Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Deja Vu Plus after 2 weeks

After the close on Friday, CNBC’s Sara Eisen asked ECRI’s Lakshman Achuthan – Lakshman, you say they should already have been cutting? His simple, one-line response was

- “Yes; we are way past the due date“

He was probably referring to his presentation in April 2019 at the 28th Annual Hyman P. Minsky Conference and his tweet we featured two weeks ago on June 1, 2019:

- Lakshman AchuthanVerified account@businesscycle – Plunging yields pressuring Fed to ease, going beyond consensus that Dec. hike was a mistake. But this ECRI finding, based on inflation cycles, says Fed rate cut cycle needed to start LAST Sep. See details on page 16 here: http://bit.ly/2GzHoDo

One key message of his presentation was that there can be more than one inflation cycle within a business cycle. How should the Fed manage these local peaks & bottoms of inflation within a business cycle? Via “preemptive rate cut & rate hikes cycles“, he argues. The current inflation down cycle began in his opinion in July 2018 & therefore he argued the Fed should have started cutting rates in September 2018 instead of raising rates in Q4 2018.

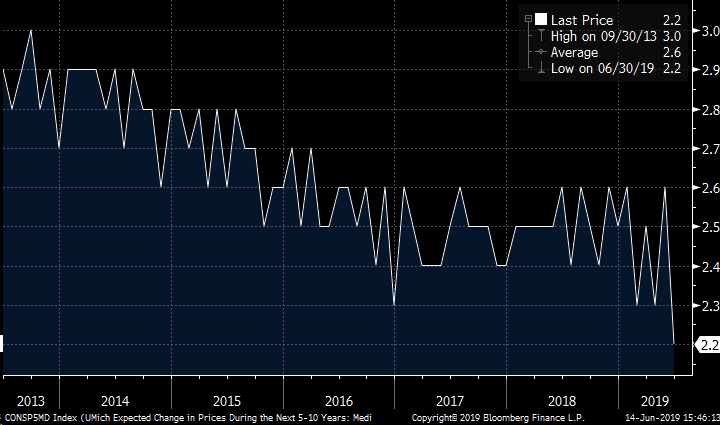

He pointed out on CNBC Closing Bell that during the last 6-7 weeks, inflation expectations have “really made a move down“. This was a gentle remonstration from the erudite Mr. Achuthan unlike the direct candid description of Friday’s inflation expectations from the actionable team at Real Vision Research:

- Real Vision Research @RVAnalysis – Massive drop in University of Michigan 5-10 yr inflation expectations to its lowest reading ever. The last vestiges of reflation are wiped out in one fell swoop

Kudos to David Rosenberg who had tweeted the “d-word” about the PPI three days prior to the above Michigan number.

- David Rosenberg @EconguyRosie – The key in today’s PPI data were the deflationary impulses in the core pipeline price measures. The Fed is way behind the curve. Yield on 10-year T-note down to, or through, 1% in the coming twelve months. Lots of money to be made on ‘dem bonds!

What did he say the next day after the CPI numbers? He used the d-word again:

- David Rosenberg @EconguyRosie – The deflation label was all over the May slate of producer, consumer and import prices. The Cleveland Fed’s 10-year inflation expectation measure has melted to 1.68% from 2.05% a year ago…just shy of the Great Recession lows. Imagine where it goes in the coming downturn.

So what, according to Lakshman Achuthan, was the danger in the Fed’s handling of inflation cycles?

- page 19 – “… the inability to execute preemptive rate-hike and rate-cut cycles is the real danger.

Lakshman Achuthan was not the only one to suggest a pragmatic cut rates now & take it back later tactic. Rick Santelli made this suggestion two weeks ago which was quickly ridiculed by his colleague Steve Liesman in that debate.

Not surprising because Mr. Liesman seems to have become the voice of the highly paid, let them eat cake economist fraternity. In fact, his buddies were not even sure that rate cuts were necessary by September. Not even Ed Hyman’s conviction about a July rate cut swayed this complacent crowd.

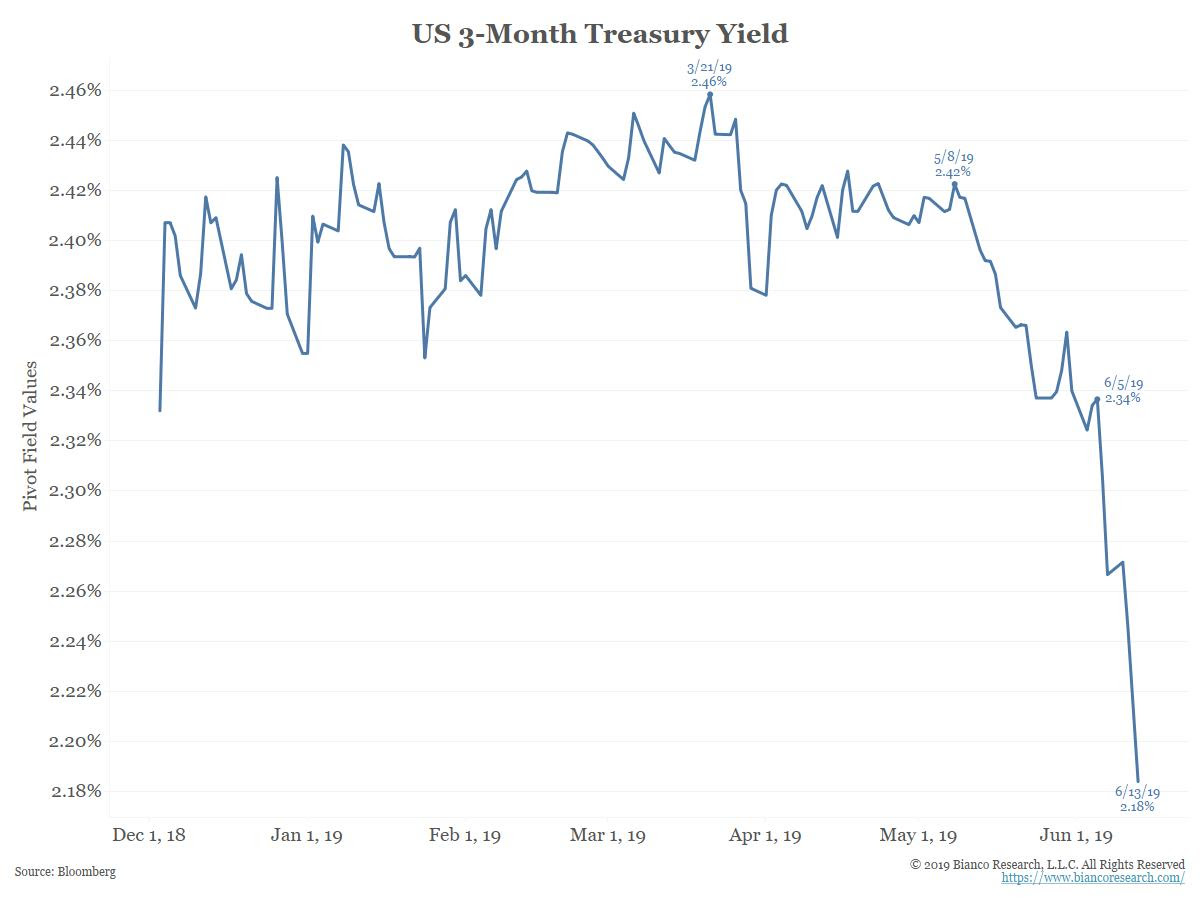

Heck, this crowd didn’t even notice the steep fall in 1-month & 3-month yields – the 1-month yield fell by 11 bps this week and the 3-month yield fell by 9.5 bps. These were the only two maturities to show this level of a fall in yields. Hmmm! What could such a large & steep fall in 1-month T-bill yield signify?

Well, one man stood up & dared to get counted on Thursday.

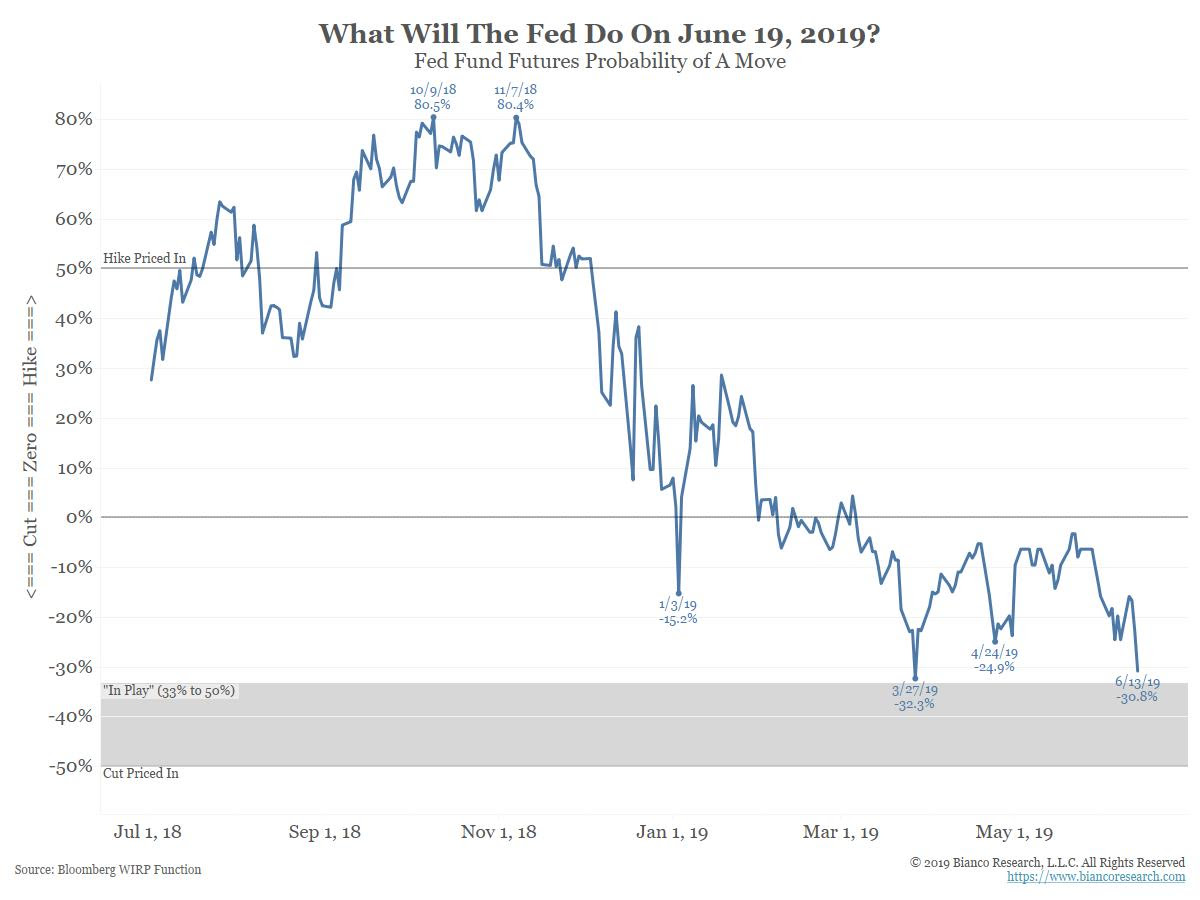

- Jim Bianco @biancoresearch – 6 days before the FOMC mtg, the June 19 cut prob is not heading toward 0% but continuing to creep toward 50%. Cut is not quite “in play” (shaded, 33%-50%). But this market refuses to give up on a potential cut next week. 3m bill yld is also acting like a cut is coming soon.

The brave Bianco did not merely tweet but he came on the Santelli Exchange on Friday to talk about what the Fed Research group was urging. What was that? Nothing short of blasphemy in that ocean-liner, supertanker size process driven institution:

The brave Bianco did not merely tweet but he came on the Santelli Exchange on Friday to talk about what the Fed Research group was urging. What was that? Nothing short of blasphemy in that ocean-liner, supertanker size process driven institution:

- ” what the Fed should do [according to the research group] with policy is come early & hard; then cut & ease a lot; and then pull out real fast [to avoid leaving bubbles] … that is the most effective was the result of their study“

So now a Fed study has concluded what Lakshman Achuthan, a fundamental cycles guy, and Rick Santelli, a bond market commentator & ex-trade, said two weeks ago. And that, we feel, was the message of this week’s 11 bps fall in 1-month T-bill yield.

What a deja vu again from a mere two weeks ago?

Listen to Jim Bianco yourselves & be amazed.

But what about the rising projections of second quarter GDP? Lakshman Achuthan addressed it head-on in his conversation with Sara Eisen on Friday:

- “… last GDP print before the last recession in real time; guess what it was; 4.9% in Q3 2007 …“

That discussion with Lakshman Achuthan on CNBC Closing Bell is worth a direct listen, we think.

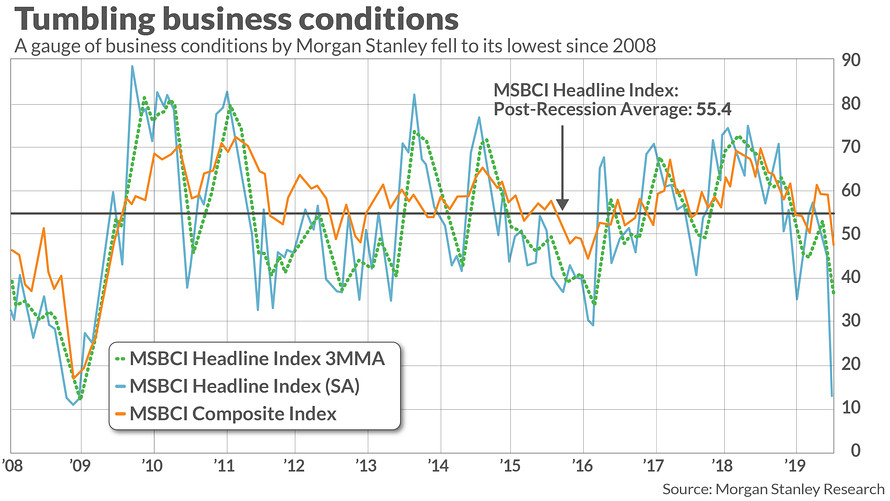

Those who find Mr. Achuthan’s comment about Q3 2007 to be more glib than reality should look at:

- Babak @TN – Morgan Stanley’s proprietary Business Conditions Index plummets 32 points to levels not seen since 2008 during GFC https://www.marketwatch.com/

story/business-conditions-are- at-their-worst-level-since- the-2008-financial-crisis- says-morgan-stanley-2019-06-14 …

Much of this could be psychology as in,

- David Rosenberg – It is important for the Fed to be pre-emptive is it’s not already too late – if expectations of a recession are rising, they feed on themselves and end up causing the downturn on their own

It is critical for Chairman Powell to change this psychology. To do so he needs to administer a shock to the monetary environment and that too next week. What do we mean by a shock? 50 bps cut next Wednesday. That would change the psychology of the markets and that is the MAIN TASK at hand.

2. Equities

Much depends on what Chairman Powell does & says on Wednesday. In the meantime,

- Thomas Thornton@TommyThornton– $SPX futures current look. Potential for downside wave 3 of 5. If the closing high in April is surpassed then the downside wave pattern is cancelled. Or in other words that’s the stop if short

And looking out a distance,

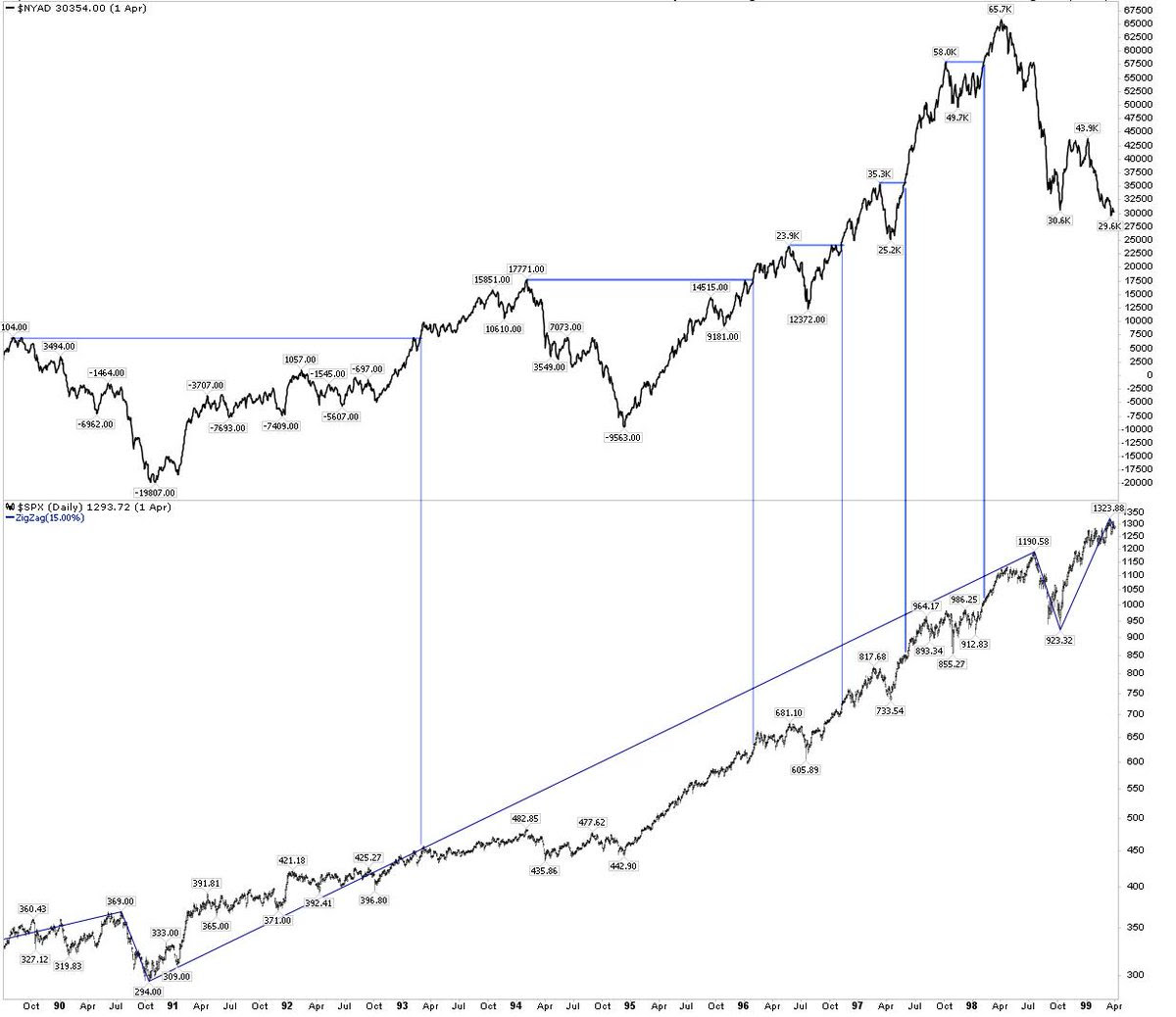

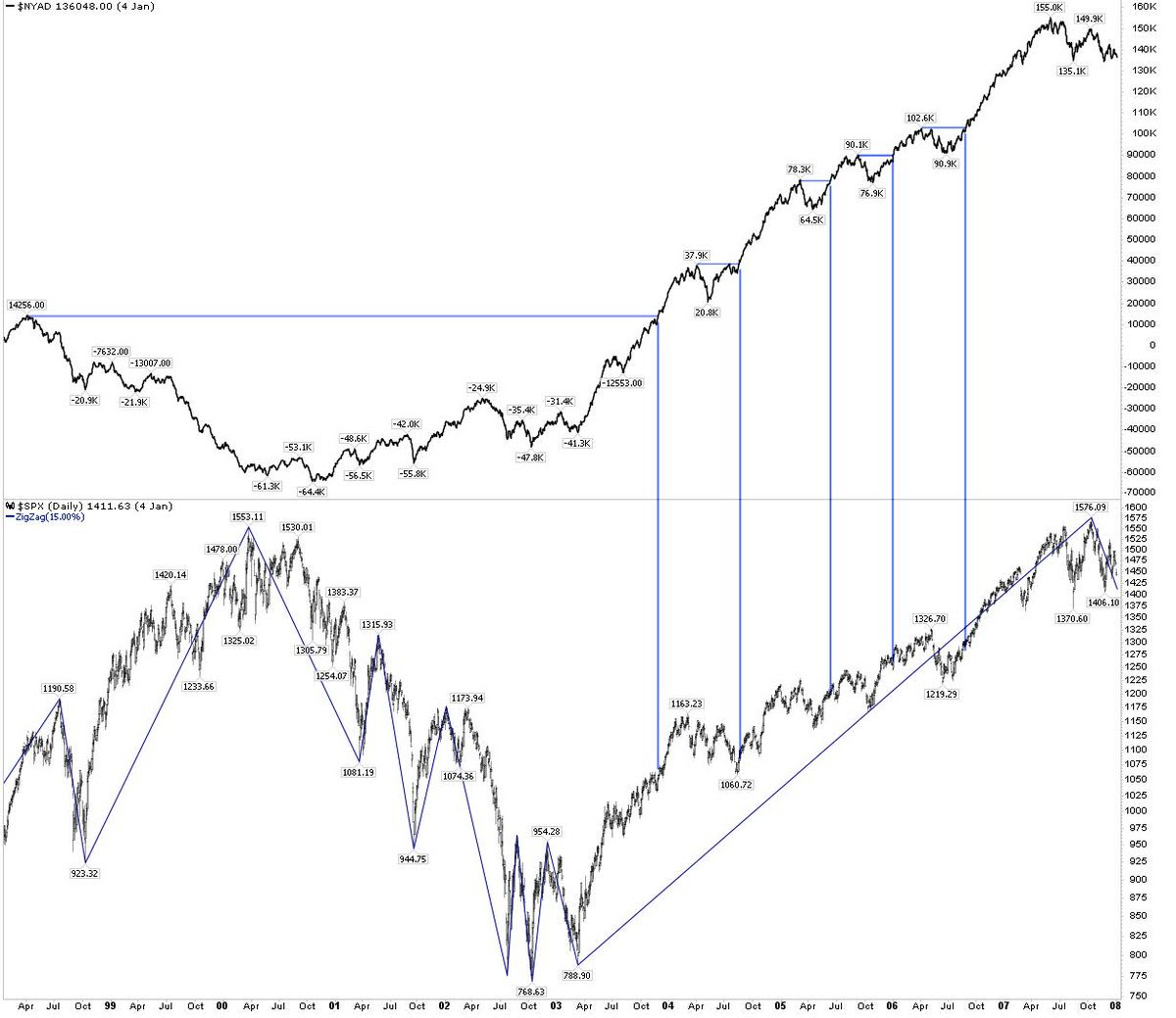

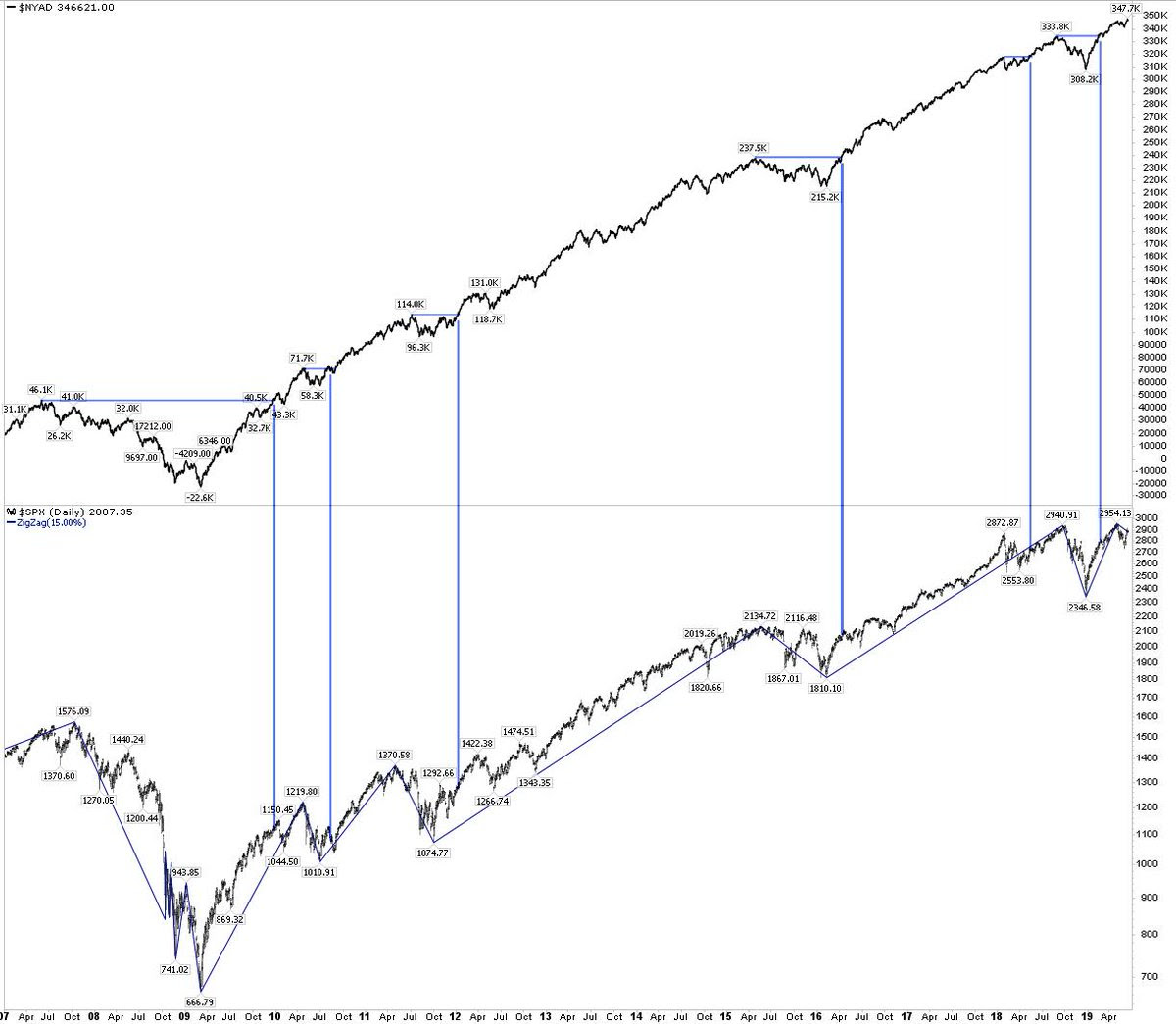

- Urban Carmel @ukarlewitz – In the past 30 years, after a dip, a new high in A-D (blue lines) has been followed by a new cyclical high in $SPX. Doesn’t preclude interim drawdowns (see above) but it’s reasonable to expect price to rise, probably to a new ATH

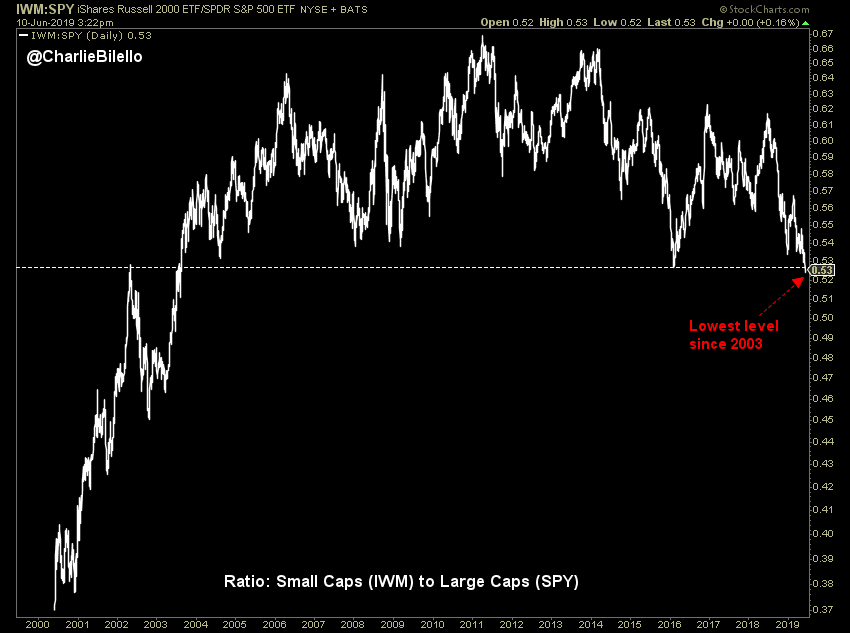

What does the chart below say? Problem with liquidity or opportunity?

- Charlie BilelloVerified account @charliebilello – Ratio of Small Caps to Large Caps at lowest level since 2003. $IWM $SPY

Tom McClellan sees an opportunity with a caveat in his article When Underperformance Reaches An Extreme:

- “When this indicator gets outside of around +/-2%, it shows an extended condition, and perhaps an opportunity. It just showed us a -2.2% reading, meaning that the underperformance of small caps was perhaps overdone. Yes, it can get more overdone, as we saw in the ugly selloff during Q4 of 2018, but most of the time a -2% reading or below is an oversold opportunity.”

And what caused the “ugly selloff during Q4 2018”? Jay Powell’s candid comments. See how everything comes down to him & what he will say/do on Wednesday, June 19?

3. Gold

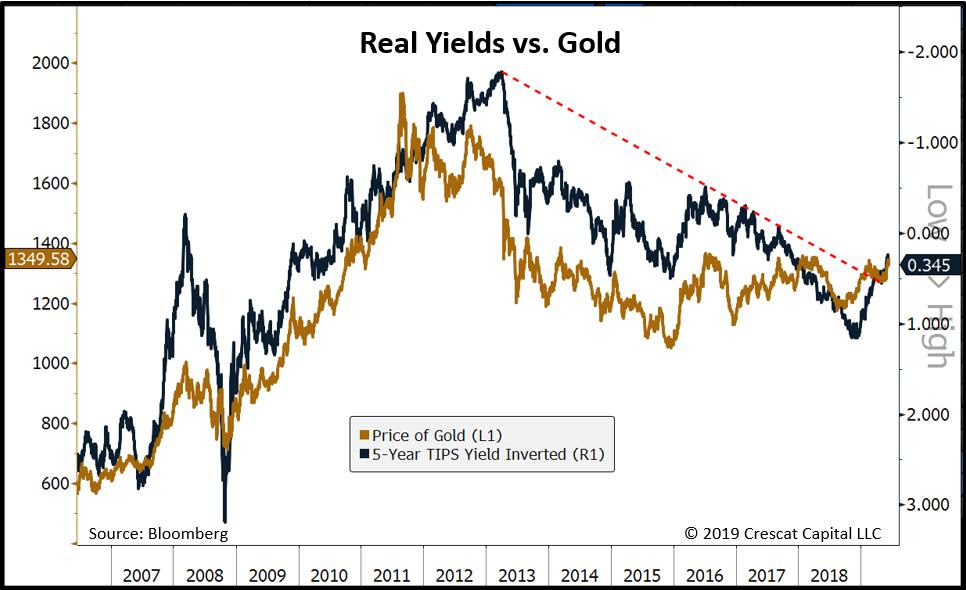

How bullish are the Mahaa-Jan on Gold? All the way from Carter Worth of CNBC Options Action to the legendary Paul Tudor Jones. And even real rates are adding fuel into the Gold up move:

- Kevin C. Smith, CFA @crescatkevin – Incredibly bullish for gold. Real yields inverted have broken out of their six-year downtrend. Confirmed by yield curve inversions and new Fed easing bias

Yet, Gold took a breather this week & Silver got shot on Friday. As Market Ear wrote on Friday afternoon:

- “Silver now minus on the day, putting in a big reversal. Down 1.6% from highs“

Silver closed down 1.2% on the week. What about Gold? As Market Ear pointed out:

- “Gold joining silver in making a huge short term reversal candle, despite the big boys talking their long gold books.”

What does a Demarkian say?

- Thomas Thornton @TommyThornton – Gold thoughts – potential for further gains with upside DeMark Countdown’s in progress

Speaking of gold, did you know about an old Indian custom of asking a beautiful woman for her hand by giving her her weight in Gold? How was it done? The woman was placed on one side of a scale & gold/ornaments added to the other side of the scale until the two sides were level:

How low have beautiful women fallen? These days they say yes when merely offered a solitary diamond ring?

Of course, being dedicated to true Gender Equality & historical mean reversion, we can’t wait until women start asking men for their hands by gifting them their weight in Gold. Sadly, such a day might be ways off.

In the meantime, rest up this weekend, folks. Wednesday & post-Wednesday could be fun.

How might we rest up? By watching an early & good film (2006) of the above pair Katrina Kaif & Akshay Kumar. In the interests of safety, we would not recommend giving a ride to a woman on your bike the way the clip below shows in the first 50 seconds.

Send your feedback to [email protected] Or @MacroViewpoints on Twitter