Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.”… hope rational minds prevail … “

So said a guest on CNBC Half Time show about the tariff fight that erupted on Friday. Virtually all have heard of the old saying “consistency is the virtue of asses” and it’s even more famous restatement by Keynes “when facts change, I change my opinion; what do you do?”

If they are asses, what adjective should we use for those who talk of “rational minds”, “rationality” or “reason”? Not having been taught negative words, we can’t think of the appropriate derogatory term for these rationalistas. They usually fall back on Kant & his nonsense on “reason”. Sadly, they have never studied Gauss nor do they know what Kurt Godel did in 1931.

For the most part, “rational minds” turn out to be stupid because their rationality is derived from their narrow frame of mindview. Like those who still say the sum of all three angles of a triangle is 180 degrees. Little do they know, as Riemann showed”, the sum of all three angles of a triangle is > or < 180 degrees depending on direction of convexity of the curve. Only on the flat tangential plane of a single point on a curve is the sum of all three angles Equal To 180 degrees.

Idiots who ask for rational minds to prevail in this US-China trade fight wouldn’t recognize true rationality even if it hits them in the head. These are the same yahoos who keep saying on CNBC Fast Money that Trump has to fight an election whereas Xi does not. Little do they realize Xi could be sent to a re-education camp if he is replaced by China’s Central Committee in 2021 or earlier while Trump would simply return to his lavish style on Fifth Avenue. So the pressure is far greater on President Xi than on President Trump.

Also these “rational mind” aficionados don’t read anything except the bilge produced by their brokerage firms. Clearly they have not read what Nikkei Asian Review has been saying for about 2 weeks that China’s power struggle lies behind global market turmoil.

- “To many, Trump and his many flip-flops on policy are the primary cause of the global market turmoil. But this reading misses the forest for the trees. … Most people do not understand the true nature of this phenomenon,” a Chinese source involved in economic policy said. “What is happening now is based on the tug of war in Chinese politics that has continued for the past year and a half.”

We don’t know whether CNBC’s Sara Eisen is aligned with the rationalistas but she did deliver three of the best clips of this week including the best one on China-US by Ian Bremmer of Eurasia Group:

- “I really do think the next few months have the potential to be pretty severe in terms of geopolitics of the world’s most important relationship impacting the markets & you will hear a lot more of the R-word as a consequence”

For a more detailed discussion of the China-US issue with insightful comments from Stratfor, GZERO Media, John Burbank of Passport Capital, & Ian Bremmer, see our adjacent article titled A Tipping Point of Recognition Now? – China-USA.

We just can’t resist featuring one tweet that actually mentions the symbolism of the finger, a tweet from a usually sedate & gently spoken analyst:

- Jim Bianco@biancoresearch – How does Trump give the Chinese the finger? — Trump said existing 25% tariffs on some $250 billion in imports from China would rise to 30% come Oct. 1, the 70th anniversary of the founding of the People’s Republic of China. bloomberg.com/news/articles/2019-08-23/trump-hikes-china-duties-again-as-frustration-grows-ahead-of-g-7?srnd=premium

2. Enemy on the inside?

Neither were we around during the Japan-US war in the 1930s-1940s nor have we read about what the Federal Reserve did during that war. We couldn’t even tell you who the Fed Chairman was during Pearl Harbor. Perhaps some anchor on FinTV will bring in Jim Grant to provide that historical perspective.

The best point about this Powell Fed was made by David Rosenberg & Jeremy Siegel to CNBC’s Sara Eisen:

- Rosenberg – most divided Fed in 30+ years

- Siegel – battle royale going on at the Fed; I have never seen a dichotomy like that;

And now hear why John Burbank of Passport Capital describes today’s fight as “a fracturing of the world” and asks if globalization was good for growth, why isn’t the end of globalization bad for growth?

- Real VisionVerified account @realvision 19 hours ago– Today’s tweet storm didn’t surprise John Burbank of Passport Capital. Watch him predict the fracturing of globalization and the rift between the US & China- There’s no turning back…

#Deflationcometh@realdonaldtrump https://rvtv.io/2HjJmaX

No wonder Burbank says “this is as big a thing as there exists“. And the Fed heads keep fighting with each other as if they were combating factions in China’s Central Committee. This is an institution on its way to serious reform or possibly extinction. And the fight has begun:

- Maria BartiromoVerified account @MariaBartiromo– The Fed had the Democrats’ back for years: Rep. Gohmert http://ow.ly/kJjo30ppczZ

@MorningsMaria@FoxBusiness

Thanks to the 8 bps fall on Friday, the Treasury curve almost closed the week unchanged. That was not true of stocks, though. What is one view of where interest rates go?

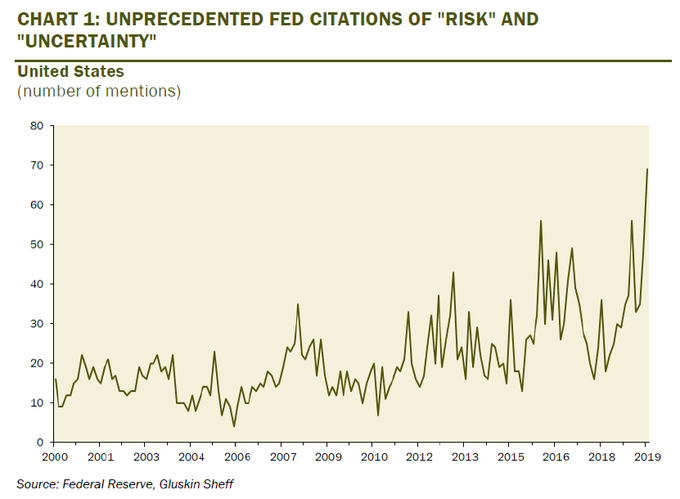

- David Rosenberg @EconguyRosie – Risk and Uncertainty – those two frightening words were used 23 times today in Powell’s speech in his last sermon, there were only 4 citations. Before that at his Congressional testimony, just 6. Whether the Fed goes 25 or 50 bps at the next meeting, the final destination is zero

3. Stocks

No one knows what we will see on Sunday night on Twitter or in markets? So we can offer nothing except repeat the basic from Option Strategist:

- In summary, the big picture still seems negative, although the short-term oversold buy signals did have their say. The $SPX chart will remain negative unless it can close above 2950, and that is the most important indicator.

4. Dollar

This is the most critical variable & no one has a clue what President Trump might do. So, keep an eye on the following as Larry McDonald tweeted:

- The Bear Traps Report @BearTrapsReport – Offshore – Onshore Yuan spread widening fast CNH just off its lows at 7.13

Send your feedback to [email protected] Or @MacroViewpoints on Twitter