Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Is it just this simple?

First,

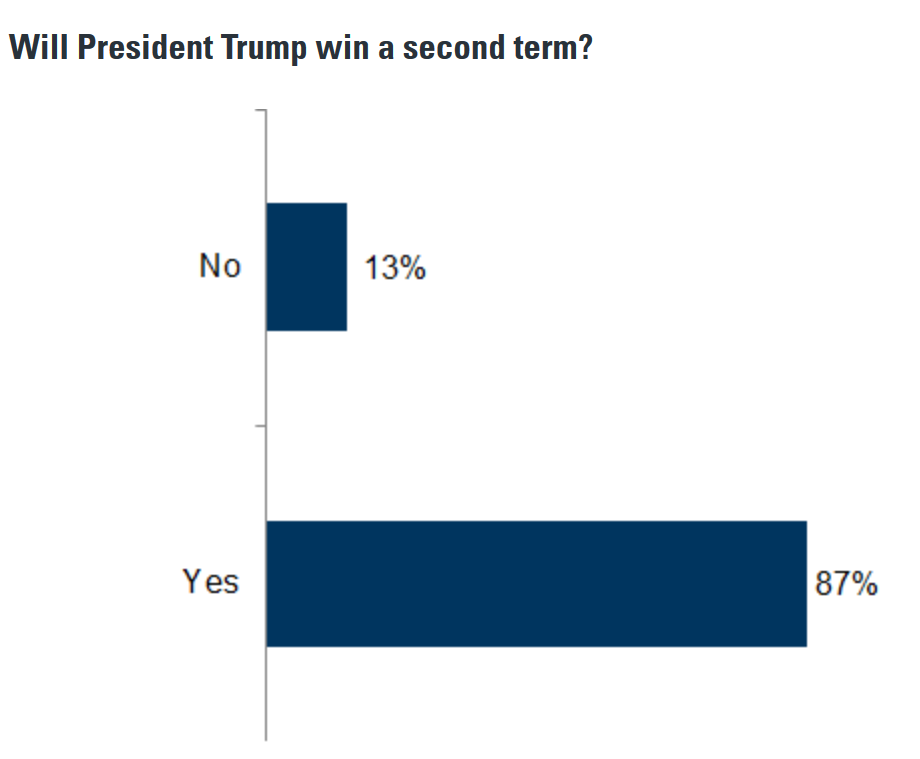

- Via Market Ear – 87% of investors think Trump will win – Survey of 250 investors at Goldman’s strategy conference this week.

We think this week’s rally had a lot to do with the win in China trade & the realization, emphasized by Steve Bannon, that it was President Trump who drove the Chinese to accept this Phase I deal. But more on President Trump & the events of this month later.

Secondly about the R-word:

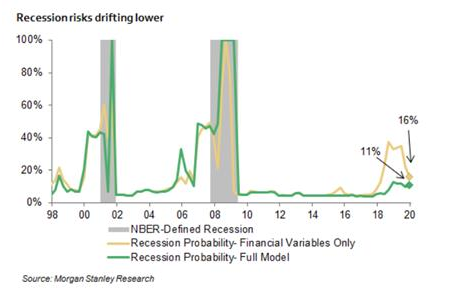

- Via Market Ear – MS US Economist Ellen Zentner points out that recession risk continues to drift lower, driven by robust labor market conditions and supportive financial conditions in recent weeks. The risk of recession computed from financial variables only has fallen to its lowest level since June 2018 at just 16%, down from close to 22% in the fourth quarter of last year and down from a high near 40% as of August 2019

Third the Fed has indicated that they will step in if US growth falters & also react if global growth remains week. We are convinced that they will not allow the specter of Recession to rear its head mid-year.

But the Fed can only try to restrain a fall. They cannot put money in the pockets of the people. To this end, Larry Kudlow himself announced this week what we have been suspecting. That a middle class tax cut is being planned to be announced in the later stages of the campaign. Read what Dr. Kudlow said on CNBC this week:

- “I am still running a process of Tax Cuts 2.0. We’re many months away – it’ll come out sometime later during the campaign, … Tax Cuts 2.0 to help middle-class economic growth: That’s still our goal.” … We want to see middle-income taxpayers get the lowest possible rates.” … Whether we get to 15% on a middle-class tax rate — I don’t know. Sounds like a pretty good idea to me.”

With these four legs, aren’t stocks on a strong foundation? Of course if one of these weakens, then the rally might stumble. And one of these legs might be tested on Wednesday, January 29 if the Fed gets cold feet & starts sounding hawkish.

2. What does stats history say about the full year 2020?

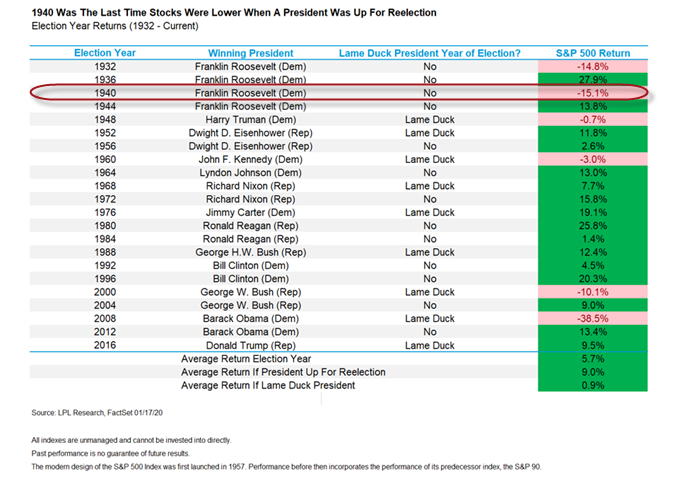

- Ryan Detrick, CMT@RyanDetrick – The S&P 500 hasn’t been lower during an election year when a president was up for reelection since 1940. We discuss why this is here. lplresearch.com/2020/01/17/a-c

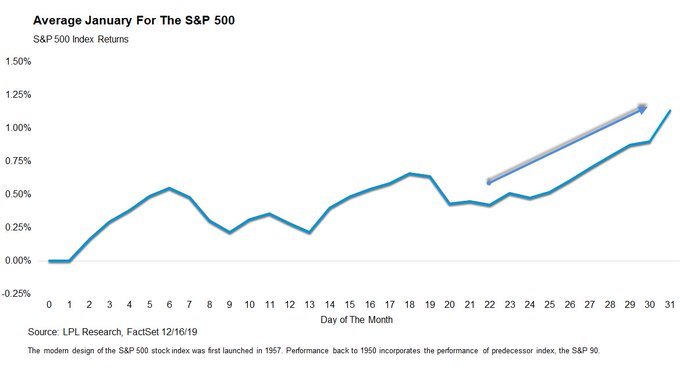

January has already been a stellar month with the Dow up 800 points, up 2.8% in just about 2.5 weeks. What typically happens late in the month?

- Ryan Detrick, CMT@RyanDetrick – Here’s what the average January looks like for the S&P 500. Tends to rally late in the month.

So the smart tactic has been to stay the course until clear signals emerge.

- Lawrence McMillan of Option Strategist – In summary, the trend of the stock market is higher, and we do not have any confirmed sell signals at this time. Hence, we remain bullish. But the overbought conditions are worrisome and so are the comparisons to January 2018.

But the above doesn’t mean the year will not see corrections:

- Jeff York, PPT@Pivotal_Pivots – Replying to @biancoresearch and @WalterDeemer – fwiw- there is an 80% chance the $SPX will go below 3k sometime in 2020. The Annual pivot is at 2974. It gets tested 80% of all years since 1950.

And the valuation doesn’t seem to suggest an uneventful year:

- The Bear Traps Report@BearTrapsReport – The Price to Sales Ratio in the S&P 500 (2.4x) is the highest in Bloomberg data history (1990).

Perhaps that suggests a decline in the middle of the year followed by a strong year-end rally after the election. And that is consistent with statistical pattern:

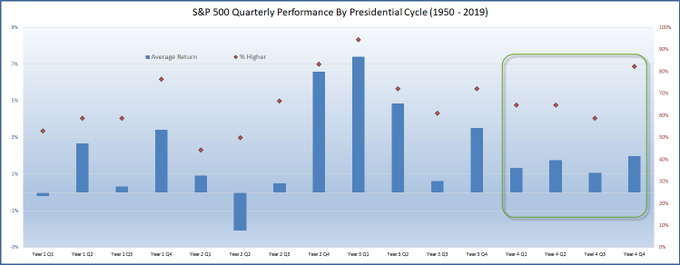

- Ryan Detrick, CMT@RyanDetrick – Stocks tend to do pretty well Q1 and Q2 of a Presidential election yr, then little weaker in Q3. What really stands out though is Q4 (aka the Presidential election) is higher more than 80% of time, making it one of the most likely quarters out of the 4 year cycle to be higher.

3. Near Term?

Despite some unsuccessful DeMark signals of last week, US stocks were strong all week with over 520 points on the Dow & all major indices up 2%+ on the week. It tells us the basic tenet that overbought can stay overbought.

And Nasdaq is back to its trend channel high:

Doug Kass described this another way:

- Douglas Kass@DougKass – S&P Index is now at the largest % above its 200 day moving average since the third week on Jan., 2018. $SPY

How will the markets react to earnings in this overbought state? And what will Chairman Powell say in 7 trading days? And how will the Treasury market react to that? Remember the December call by Charlie McElligott of Nomura to bet in January on Treasury rates falling and on Staples? The 10-year Treasury yield is down 10 bps so far in 2020 despite the raucous stock rally and Staples have been on a tear. And when Treasury rates are falling, where do you expect the Global Hedge Funds to concentrate? Momentum!!!

On the other hand,

- Jesse Felder@jessefelder – ‘The number of SPY shares outstanding is above its upper 50-1 Bollinger Band, and continuing to rise. Other instances were associated with meaningful tops leading to noticeable corrections.’ mcoscillator.com/learning_cente by @McClellanOsc

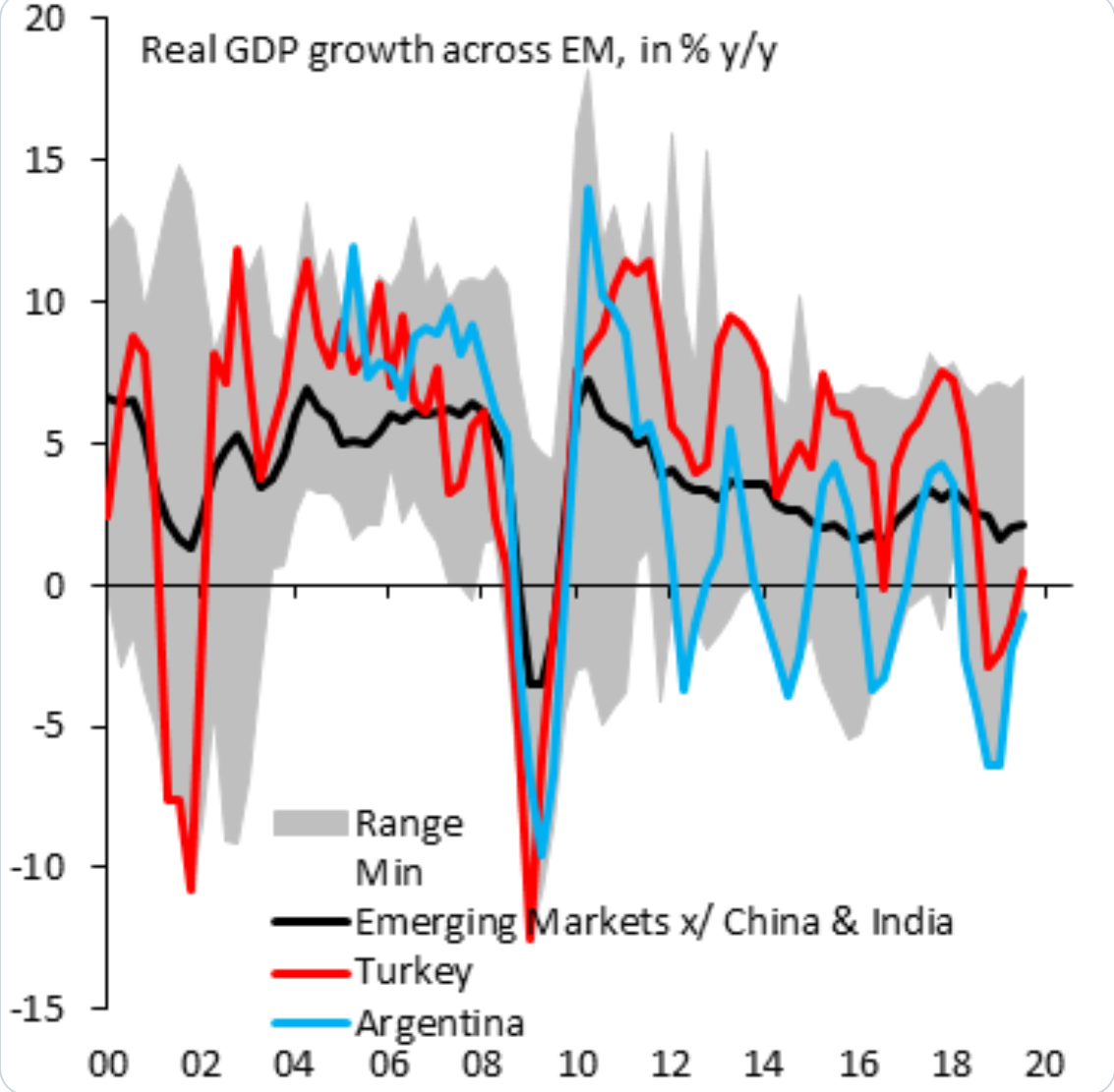

And then you have the slowdown in EM:

- Via Market Ear – Robin Brooks: “The growth slowdown across EM is an inexorable force, a sign countries need to change their growth model. Big danger is that EMs fall back on short-term solutions like credit stimulus, which only raise volatility around a falling trend, rather than more needed structural reforms”

4. Rosie & Rich in agreement

Our old rule of thumb is that when David Rosenberg & Rich Bernstein agree, it usually proves true. But they don’t agree all that often. Even now they seem to be on opposite sides of the Treasury trade. Rosenberg still like U.S. Treasuries while Bernstein not so much. Instead, Bernstein recommends TIPs or Inflation protected notes.

But they both reportedly agree now on Gold. Bernstein went as far as saying Gold could beat US stocks in performance in the next 1, 2, 5 years. And Rosenberg reportedly see $3,000 in Gold. That’s close to a double and the Dow will have to get to almost 60,000 to outperform that.

wow!

5. Beginning of the End could lead to Another Beginning?

The first part of this section title comes from Steve Bannon who described the Phase I China deal as the “Beginning of the End of the Managed Decline of America“. It is a powerful directional win for America and Donald Trump is the Judge, Jury & Executioner in his words. He also said that, with USMCA, President Trump has taken a big step to make North America a big manufacturing base that would rival East Asia.

All of this is an unadulterated positive for America & that means for U.S. Corporations. A fact that may have been behind the rise in PEs we saw in 2019.

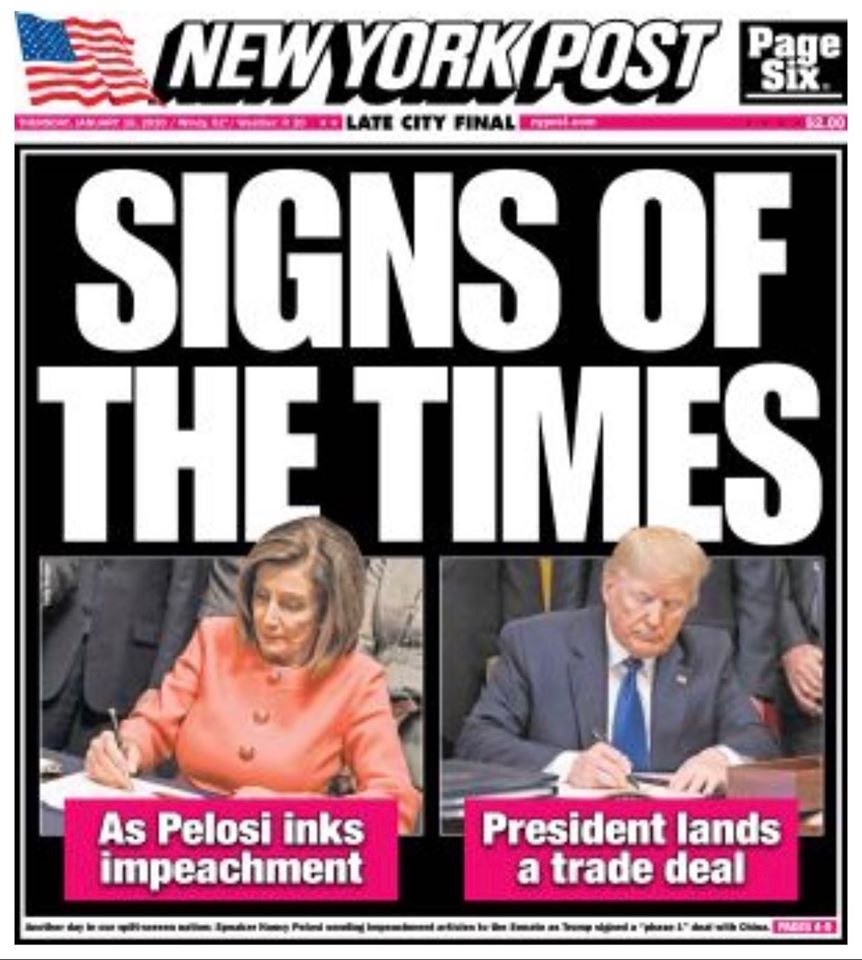

Also we all saw the contrast this week:

Voters are smart, much smarter than the millionaire media thinks they are. They see which party is working for them & which party is committed to damaging this economy & country. That is why it would be smart for the administration to launch their middle income tax cut as the Trump commitment to making middle America even more secure financially.

But it may be the time to recognize one real risk to U.S. economic growth into 2021 & beyond. We are already seeing that U.S. corporations are unable to find skilled workers in the numbers needed. President Trump recognizes this & has always recognized the need for getting talented people into the American labor pool.

So, assuming the GOP wins back the House in November 2020, we think President Trump will address Immigration Reform in his second term & make Talent Immigration a key part of his reform. That, we think, will begin to drive CapEx & the U.S. economy in 2021 & beyond.

All this tells us that the biggest factor behind the January rally is the increasing conviction about President Trump winning his reelection & the possibility of the GOP winning the House. If that happens, the GOP will work hard with President Trump to pass key legislation, economy-friendly, business-friendly legislation in 2021 & 2022.

There is a lot of supposition & hope in the above but isn’t hope is the biggest factor in driving up the market’s multiple?

Send your feedback to [email protected] Or @MacroViewpoints on Twitter