Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.”Panic”?

We have seen two weeks dominated by two “panic”s about the Coronavirus in China. The week of January 27 – January 31 was about increasing panic about the rapid spread of the virus. Friday January 31 seemed to be the culmination that week with a 603 point fall in the Dow. Treasury yields fell of the cliff that week with the 2-year yield touching 1.30%, a level that factored in 2 rate cuts by the Fed according to Rick Rieder of BlackRock. The U.S. Dollar fell hard.

Then this week opened with a raucous rally driven by optimism that the trajectory of the spread of the virus was getting lower. That created a buying panic about not missing the rebound especially among those who had been waiting for an entry to get long or longer. The fury of this week’s rally showed the buying panic. Despite the 277 point fall in the Dow on Friday, the week was up with Dow up 840 points, the S&P up 3% and Nasdaq & NDX up over 4%. And Treasury yields rose hard in the first 4 days of the week. The U.S. Dollar also rallied hard.

So which panic was greater? The answer is self-conflicting. Measured over the last 2 weeks, the buying panic in stocks was bigger with the S&P up 1% , NDX up 2.8% while Russell 2000 and Dow Transports are down 30 bps and 1.8% resp. But the safe haven panic of the first week was bigger – over two weeks, Treasury yields are lower by about 10 bps and the Dollar is up almost 1%. So same old, same old – the Treasury market & stock market are sending different messages.

So what happens next week? Everything depends on what we hear about the spread of the Coronavirus within China, especially in Guangzhou. The markets have known about the horrific conditions in northern province of Hebei. But Friday’s scare came from reports that Guangzhou is also about to be severely restricted if not quarantined. And Guangzhou is in the heart of the rich exporting region of China.

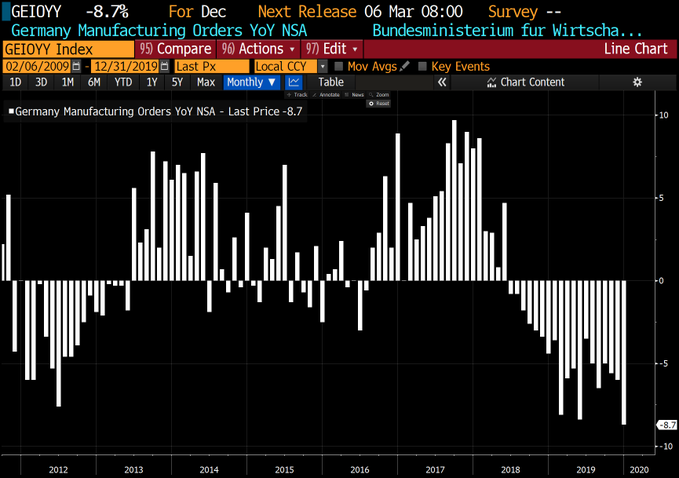

This is not the China of 2003. Today’s China supports economic growth in Europe & Latin America. And look what the engine of Europe, West Germany, released on Thursday:

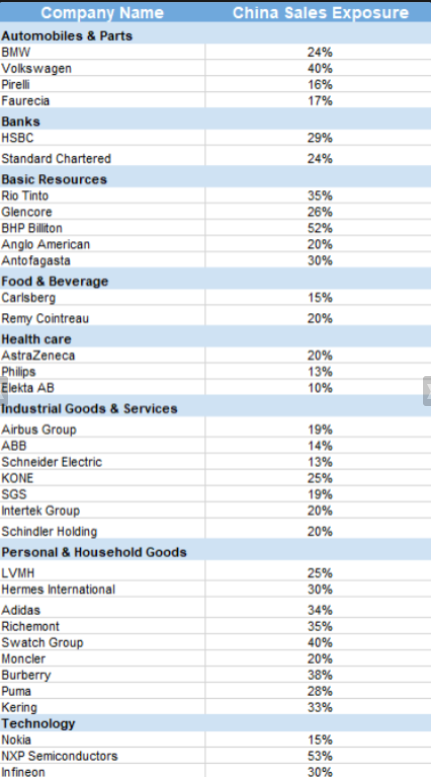

And this is before any real estimate can be made about Europe’s exposure to China’s coronavirus. But see the chart below for overall corporate exposure of Europe to Chinese spending, courtesy of The Market Ear:

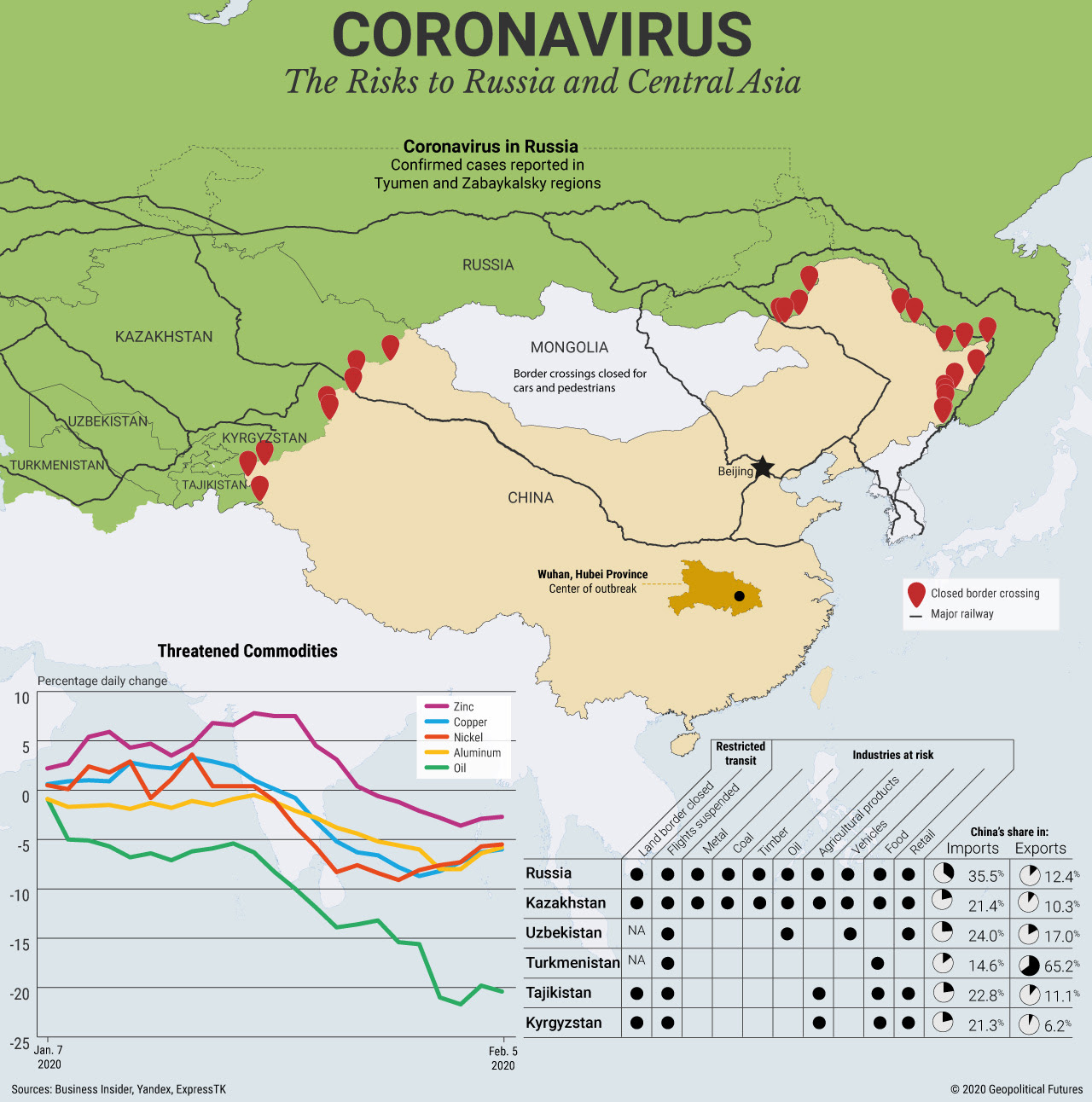

And what about exposure of Russia & Central Asia? Look at the chart below from Geopolitical Futures:

What about Latin America, you ask? Look at EWZ, the Brazil ETF, that is down over 6% in the last two weeks. Unless the world sees some daylight in this coronavirus situation, we may see all of China quarantined by the rest of the world.

Of course, there is one source of day light in this dark & gloomy scenario.

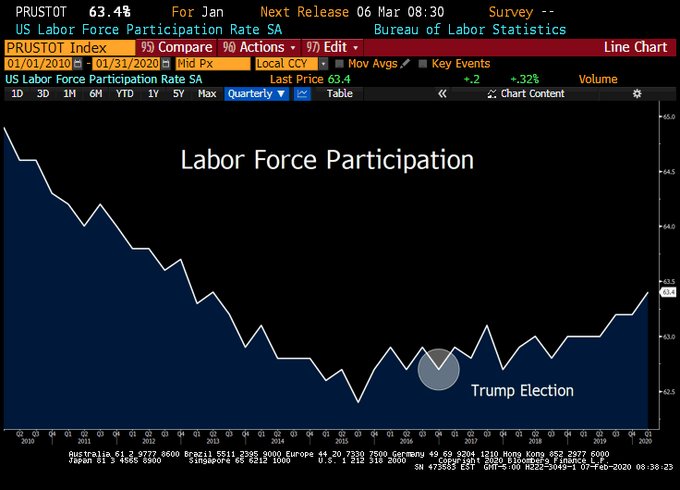

- Lawrence McDonald@Convertbond – Whether you’re a@realDonaldTrump friend or foe, there’s one undeniable fact. After years of decline – more Americans are participating in the labor force as we head toward #election2020.

But even that is not all rosy, not even in the Non-Farm Payroll report that was praised by so many:

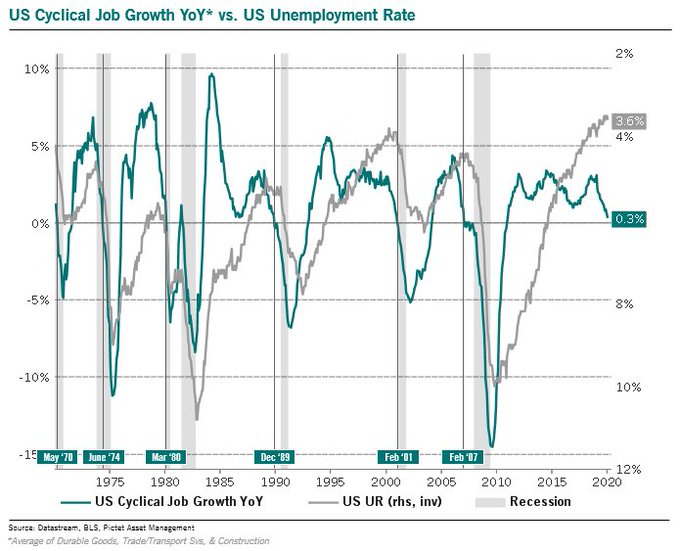

- Julien Bittel, CFA@BittelJulien –Today’s further collapse in US cyclical job growth isn’t a good look for the overall economy. We’re currently hovering just above negative territory at 0.3% growth YoY & well below ‘16 levels. Over 50Y, a negative print has always led to a cycle shift higher in unemployment.

2. Treasury Rates & the Fed

With all the above, wasn’t it rational for the Treasury market to ignore the 225,000 strong Non Farm Payroll report on Friday? And it did so almost right after the report. After all, as Bob Michele of JPMorgan Fixed Income Asset Management, said on Bloomberg Real Yield on Friday – “everywhere [Europe, US] clients have too much cash & they are trying to get into bond markets“. And he himself is “all in”. He doesn’t see any risk of losing money unless there is a recession coming and he is convinced the Central Banks will do everything possible to prevent a recession.

Rick Rieder of BlackRock said on BTV on Friday that the long end of the Treasury market is interesting while, unless the Fed eases, the short end can’t rally much more. That brings us to the Fed and Chairman Powell’s testimony to the Congress on Tuesday & Wednesday.

3. Stocks

A sensible comment came from J.C.Parets on Wednesday:

- J.C. Parets@allstarcharts –– I don’t know about the rest of you, but I keep seeing more reasons to be much smaller, not bigger, in the current market environment. There is a time to make money and a time to keep money. I think now is the latter

Even sensible people can get whipsawed in this environment unless they right-size their portfolio:

- Lawrence McMillan of Option Strategist – So, the indicators remain somewhat mixed. I still feel that some caution is warranted before jumping completely on the bullish bandwagon. But we would be forced to turn bullish if $SPX can close above 3337 again and $VIX can close below 15 again.

But that is merely 9 handles away in the S&P and less than half a point in VIX.

One group of shareholders doesn’t seem to be in much doubt:

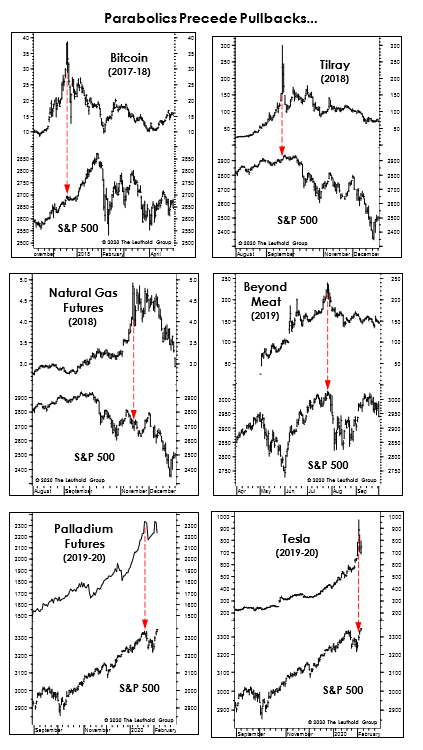

But what about the parabolic moves in Tesla & semi-parabolic moves in stocks like IBM?

- Michael Santoli@michaelsantoli – Been some discussion here of how isolated parabolic price moves seem to occur near the start of broad-market pullbacks. These charts from@LeutholdGroup identify some instances.

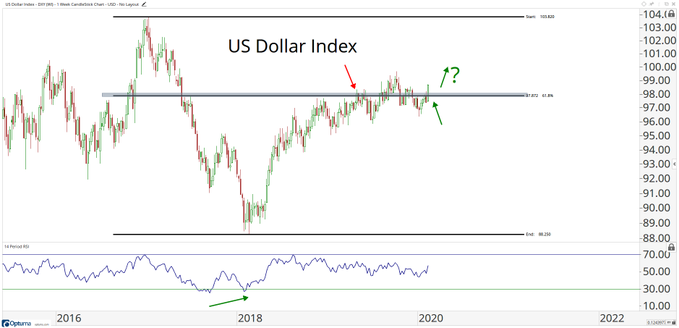

So what to do? We would watch the U.S. Dollar. The Fed wants it lower but the global panic might drive it higher. And as one chartist puts it:

- J.C. Parets@allstarcharts –is it like this? I think it is $DXY $UUP

Send your feedback to [email protected] Or @MacroViewpoints on Twitter.