Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Hope of a Dawn from a labelled “Perma Bear”?

How terrible was this week? A bad year’s negative returns realized in just one week? Major averages down 10-12%, Transports down 14%, Oil down 15%. So bad & dark that even one they call a Perma Bear began thinking about a dawn.

- David Rosenberg@EconguyRosie – There’s always a risk here of catching falling knives but, on average, whenever the VIX hits 40, the S&P 500 is higher a month later.

If you are surprised to see Rosenberg turn cautiously positive about the S&P, read what a DeMarkian wrote on Friday afternoon:

- Thomas Thornton@TommyThornton – CNN Fear and Greed is at 9.

What is worse? Having your friends stop talking to you when you say one positive word about President Trump or kinda like a usually bearish DeMarkian admit to the following:

- Thomas Thornton@TommyThornton – My friends don’t like me anymore since I am net long

Then you have the non-surprising swings of sentiment from one who seems to trade on sentiment:

Yeah but, can someone point to an analogous super-fast fall & suggest an up target for a bounce?

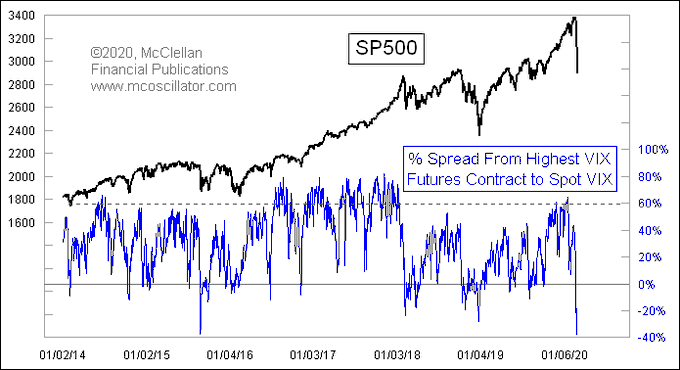

Rosenberg’s tweet was based on VIX going above 40. But VIX is not a standalone measure. Isn’t its direction linked to VIX futures?

- Tom McClellan@McClellanOsc – VIX really extended above all of its futures.

The above is fine but isn’t a trigger necessary? Will the Fed feed the beast?

Look what the mere expectation of a response on Sunday evening did to shorts during the final 15 minutes on Friday?

Is that 615 point rally in Friday’s final 15 minutes a glimpse of what might happen if Fed & other Central Banks deliver on Sunday evening? What if the central banks let Sunday evening come & go without any comment of any kind? Will the hope turn to fear on Monday morning? And what if the number of US cases of CoronaVirus rise more than expected over the 2-day weekend?

We will have to wait and see. But what would be a sensible approach?

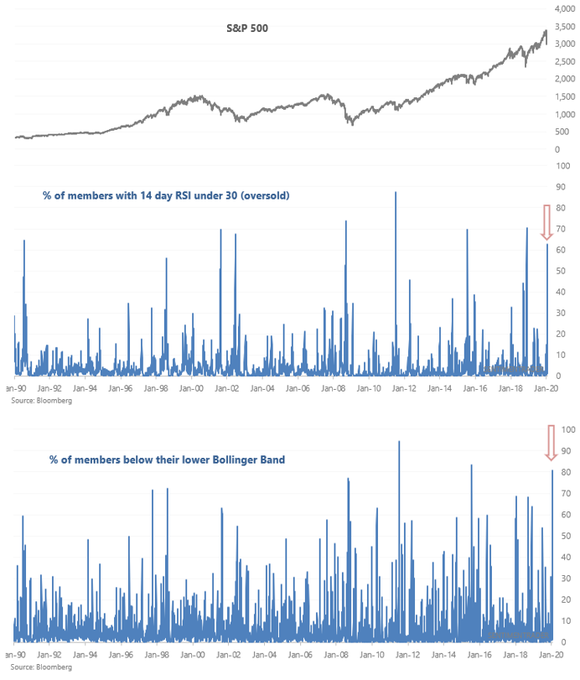

- Lawrence McMillan of Option Strategist– In summary, there is total panic in the markets right now, as technical support levels mean nothing. These massive oversold conditions will eventually lead to buy signals. The last time we had anything close to this many oversold conditions was on December 24th, 2018. The rally from there was a strong one. There has been more damage done now, and this is perhaps a medical crisis, not a financial one, so things could be different. But eventually, there will be buying. It is a matter of remaining patient and waiting for confirmed buy signals. Meanwhile, long put positions should be rolled down, but not closed out completely.

2. Rates – fast & bullish?

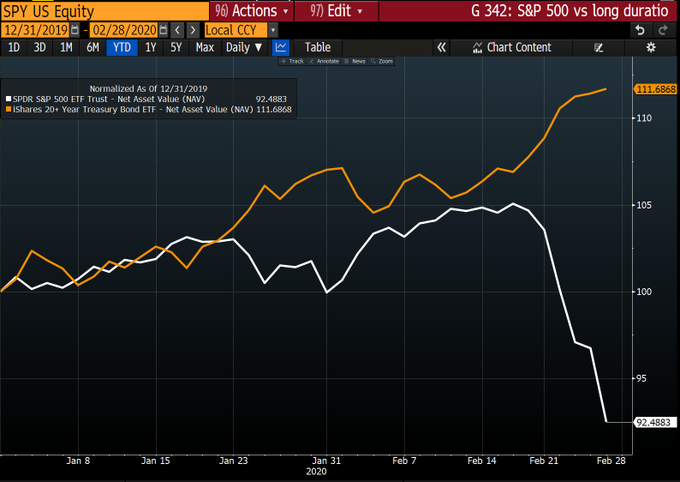

Speed was not merely the characteristic of the fall in stocks.

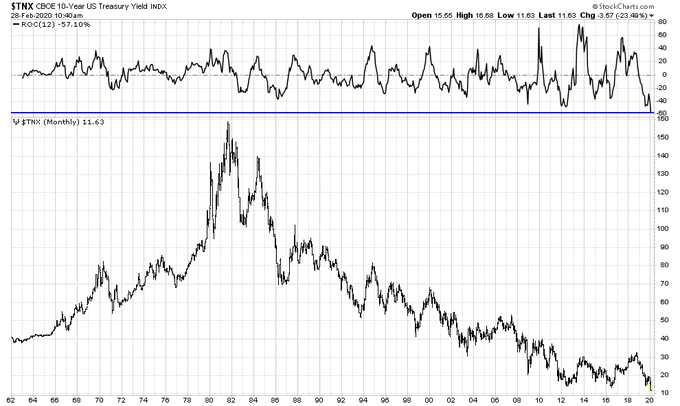

- Jesse Felder@jessefelder – Not only is this the lowest yield for the 10-year note in history, it’s also the fastest year-over-year decline in percentage terms

Friday’s closing levels of the Treasury curve should be documented at least until they get broken to the downside to even lower all-time lows:

- 30-yr 1.668% ; 10-yr 1.145% ; 7-yr 1.059% ; 5-yr 92.4 bps; 3-yr 88.4 bps; 2-yr 89.7 bps

Kudos to Subadra Rajappa of SocGen & Priya Misra of TD securities for predicting (on BTV Real Yield) a 1.25% 10-year yield. They both have been calling for rate cuts by the Fed in 2020. Now they have the yield curve on their side.

But what might be a sure indicator based on Fed Funds? Subadra Rajappa provided one on Bloomberg Real Yield on Friday:

- “one measure we track closely is the 1st Fed Funds contract vs. the 4th Fed Funds contract. That has inverted. … any time it inverts beyond 25 bps, the Fed has followed through & delivered a rate cut. Now that curve is close to negative 50 bps. ”

So why did Fed’s James Bullard say on Friday that he is open to a Fed rate cut but leaning against it? Jim Bianco described it colorfully – “they are hiding under their desks in shock“. He added “doing nothing is tightening“.

We did acknowledge 1.25% 10-yr yield prediction by Subadra Rajappa of SocGen & Priya Misra of TD Securities. But, in reality, they have been pikers, haven’t they? In contrast, David Rosenberg said he expects the 30-year yield to go below 1% this year. That should help the 30-year bond deliver a 20% return from here. And that is after the phenomenal performance year-to-date.

3. Real Risk

We have no idea how fast & how intractable the CoronaVirus will prove. We do believe that the Chinese economy will be in severe trouble despite what the PBOC does. And that will lead to a slowdown in the global economy. Rosenberg says the Chinese slowdown will affect Europe & that will finally affect the US economy.

The Fed will have to cut rates & do whatever they can to protect the US economy. As Bianco says, their doing nothing (or even doing little, we might add) is tightening. Frankly, all that they can do is to prolong the positive growth until the Administration can deliver a middle income tax cut & a stimulus program in 2021.

Speaking of China & Covid-19, we remembered a Holy Whatever (in the interest of being secular & non-denominational) level statement about the globalized supply chain from the 14th century:

- “China functioned as the manufacturing center of the Mongol World System, and as the goods poured out of China, the disease followed, seemingly spreading in all directions at once.”

Man! The more things change, the more they stay the same!! Those interested in our reflections about China-Plague-Europe in 14th century and China-Covid19-USA in 21st century might wish to read our adjacent article – Cycle Change Reflections – US-Europe, Covid19-Plague, China 14th-21st Century.

Send your feedback to [email protected] Or @MacroViewpoints on Twitter