Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.FDR vs. Hoover

That could simply be the story of the next three months & three days. Since 2016, we have postulated that Trump will be in the perfect position to be this depression’s FDR & thereby win a second term. That was Trump in March-April & the stimulus he drove the Democrats to approve has been the story of the past 4 & half months.

- David Rosenberg@EconguyRosie – Was it Archie B who sang “didn’t need no welfare state…”? Second quarter wages & salaries: -$680bn. GDP: -$2.15tn. Consumer spending: -$1.528tn. But income: +$1.4 trillion. Why? Gov’t handouts: +$2.42 trillion.

Perhaps Rosenberg should have used the phrase “Governments meeting their sworn obligation to take care of the needy” instead of “Gov’t handouts“. Hardly anyone thought then that the US Economy would be in the same predicament in August as in April. But it is. So it is absolutely necessary to have another massive stimulus injected into the economy, even a bigger version but not a smaller version.

That is what FDR Trump has to champion and he seems to want to. But to our intense chagrin & near disgust, Senate Republicans seem stupidly & insanely committed to pre-FDR type plan, otherwise known as Hoover II. These are the same yahoos who didn’t believe Trump was going to win in 2016 and they don’t believe Trump will win in November. So they are responding with blind obedience to traditional Republican donors.

Even a man who dislikes Mr. Trump gets it. As Rosie wrote in his Financial Post article,

- The risks of a fiscal cliff, big or small, are coming our way as the Senate Republicans pull off their version of (U.S. President) Herbert Hoover. No doubt we will see something, but apparently nothing close to the House bill that calls for US$3.5 trillion of “stimulus” — the Senate seems set for something closer to US$1 trillion.

- In a world of second derivatives, “reduced stimulus” is the same thing as “fiscal drag.” As an example, the GOP senators want to limit the coronavirus boost to unemployment benefits to US$100 per week, from US$600 per week currently. Let’s do the math. There are about 30 million Americans receiving jobless benefits — so the reduction in fiscal assistance would amount to a total cut in aid of US$60 billion per month. That isn’t small.

- Eliminating the US$600 supplement could result in large spending cuts. It also says something that it’s the people who got displaced from their jobs during this pandemic who were keeping the economy afloat.

- Amid this backdrop, a Democratic sweep could well happen in November. The polls are leaning that way, for what that’s worth. And history also says the odds are very close to a toss-up. The impact on the markets would be negative and the real question is how much.

This fiscal drag is what President Obama delivered in 2013 after winning his second term. That took down the trajectory of that recovery but at least Obama did it after he won re-election. These caricatures of the old fat cat country club Republicans seem intent on doing this before the November election. Being born & bred big city urban, we have never even seen a pitchfork but we want a couple to go show them to McConnell & company.

And where is MW* Kudlow we ask? If he can whisper to markets, why can’t he whisper to McConnell & company? Didn’t he hear Jay Powell literally beg for a big fiscal stimulus on Wednesday?

*MW clearly stands for Market Whisperer a la Bob Rubin in Q4 1998

2. Hapless Powell?

This Wednesday we wrote down prices & levels at about 1:50 pm, 10 minutes before the release of FOMC statement. And we compared those prices/levels to Friday’s close as we do on all FOMC weeks. It provides an overview of what FOMC statement & Powell presser impacted.

So what market or sector did Powell impact with his statement & presser? Nothing. Rates continued to fall hard, Dollar did nothing, Gold kept rallying and stocks rallied small except the FAA trio & QQQ. McConnell didn’t even hear his plea for fiscal relief.

But did the total lack of market response in itself suggest something to some participants, at least tactically if not strategically?

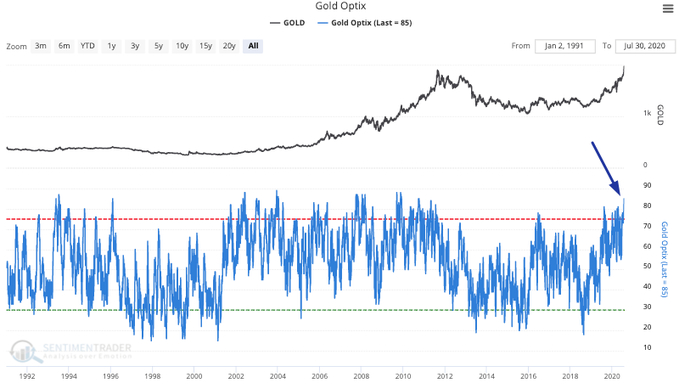

- SentimenTrader@sentimentrader – Gold’s Optimism Index has now reached one of the *highest* levels ever. In the past this was bearish for gold and bullish for the USD.

And look what Jim Cramer featured on his show the day before the Fed – a bearish view of Gold from his colleague Carley Garner. She thinks that there might be one last gasp rally in Gold before it rolls over & perhaps not even that if Dollar stabilizes. Listen to Cramer explain her views & charts:

Then on Friday, Carter Worth of CNBC Options Action, the man who coined the “rates to zero & gold to infinity” line suggested, tactically speaking, that gold is “getting a bit crowded“.

But if gold is taking a detour from its road to infinity, what about rates, gold’s fellow traveler in the “zero-infinity” journey? Mr. Worth did not say but someone else drew a picture that does seem worth lots of words:

- Market Ear – Gold and TLT – imagine TLT does NOT take out new ATHs…. ..right when everybody loves precious metals.

TLT did not get to a new all-time high but the 10-year yield did reach a new all-time low on Friday. Is that because, as JPM’s Bob Michele told CNBC’s Kelly Evans, that money is pouring into Treasuries from the rest of the world or is the reason something more malignant?

- Lawrence McDonald@Convertbond – It’s NOT about current inflation, it’s a about the certainty (plunge) of long term deflation. That’s the game-changer in July 2020.

Wasn’t that Hoover’s contribution to America? Who will explain that to McConnell? Not only did the new 20-year Treasury close below 1% at 98 bps but the German 30-year yield closed below zero at minus 11 bps.

And remember what deflation of 1930s did to banks? That history seems to be rhyming in the UK today:

- Raoul Pal@RaoulGMI – Another reminder to not loose sight of the big picture… The UK banks are about to break the only support since the start of the index in 1986.

3. Pandemic Shpandemic?

Look at Ian Bremmer’s table of pre-pandemic & pandemic-afflicted Big Tech revenues:

- 2019 – Amazon $123bn Apple $112bn Alphabet $75bn Microsoft $64bn Facebook $32bn

- 2020 – Amazon $164bn Apple $118bn Alphabet $80bn Microsoft $73bn Facebook $36bn

Is this a Pandemic or Shpandemic? Goldman, JP Morgan can reach & exceed trading revenue targets with traders working from home. Pandemic or Shpandemic? Only place it is a pandemic is among people who will turn out to vote en masse. That is why the fiscal stimulus is needed now & in bulk.

Morgan Stanley’s Mike Wilson said on BTV that the current consolidation in the stock market will end with the passage of the fiscal stimulus bill. With that he thinks next year will take the curtain off the leverage being built in operating margins of companies. That is why he thinks a new economic expansion will be begin as it did in 2009, 2003 & 1990-1991 and then the equal-weight S&P will outperform the S&P 500.

Lawrence McMillan of Option Strategist wrote in his Friday summary:

- Currently both breadth oscillators are on sell signals after another day of poor breadth yesterday.

- Implied volatility has fallen — just not as fast as realized. Even so, $VIX is below its 200-day moving average, and now the 20-day moving average of $VIX has crossed below the 200-day as well (orange circle in Figure 4). This is bullish for stocks. In the short term, the $VIX “spike peak” buy signal of July 14th remains in place.

- In summary, the market seems a bit tired, but $SPX continues to hold above support. So the bulls remain in charge unless $SPX breaks down below support at 3130.

They were in charge this week with the S&P up 1.7% or up by 55 handles. But was it really? Didn’t 45 of those 55 handles come in the last 90 minutes on month-end Friday?

So was that move real or was it merely month-end? Perhaps we don’t see it because the above are bars & not candles.

- Bob Lang@aztecs99 – VERY BULLISH and powerful candle today on the daily charts of spx, dia, qqq. follow through monday would be very impressive.

Send your feedback to [email protected] Or @MacroViewpoints on Twitter