Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.”a lot crescended this week“

Thus sprach Gundlach on Friday on CNBC Half Time show. We would have used “crescendoed” but barring that, we think Mr. Gundlach was on the mark. Of course, no one can call the top of a crescendo but we do think we are near the top if not at the top.

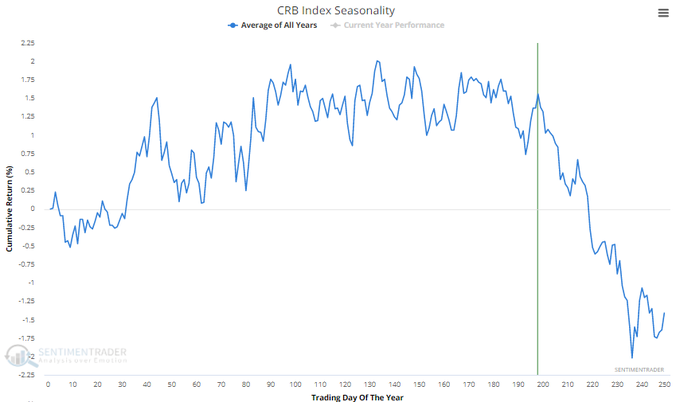

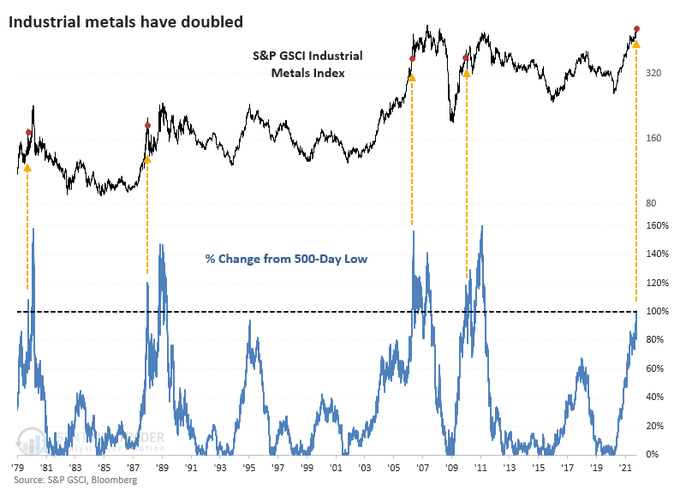

Mr. Gundlach said that while the cycle of commodities is very long, this is not the best trade location for commodities. He pointed out that bitcoin, rates and commodities had crescendoed this week including oil and said it was time to fade oil. Seasonality seems to support Mr. Gundlach’s suggestion of fading commodities.

Mr. Gundlach said Bitcoin had made a double top this week. And he pointed out that stocks are not overvalued vs. Govt. Bonds. Then he made a bold statement, one that is very different from what he has been saying all year:

- “Long term Bonds do make sense with 30-year Treasury at 2%+; with all the debt, be alert to debt deflation; 30-yr at 2% can give you a 30% return because the yield can fall to 1% as it did in Covid.”

During his conversation, he put down the “tapering is not tightening” bull**** that the Fed and their heralds are trumpeting again. The Fed and their TV heralds don’t understand that we remember the same nonsense that was bandied about during the previous taper. Mr. Gundlach referred to a study by the Atlanta Fed that QE had affected rates by 200 bps. That means if the Fed ends the taper by 1st half of 2022, then they would actually be tightening monetary policy by 200 bps.

The Treasury market is saying this already. Last week the 30-3 year spread flattened by 22.6 bps and this week it flattened further by additional 6 bps. Is there any one who doesn’t understand that this action is screaming tightening? The week before, it was the 3-year yield that rose by 11 bps, the highest rate rise that week. This week it was the 3-year yield again that rose by 8.9 bps, a higher rise than any other maturity. And the smallest rise in yield was in the 30-year yield which only rose by 2.8 bps. Is this why Nancy Davis of Quadratic Capital has launched a Bond-deflation based ETF as she said on CNBC Half Time this week?

Priya Misra of TD Securities told the Fed what to do on BTV on Wednesday morning,

- … I think the bond market here is so nervous about inflation & thinks the Fed will be forced in; all the bond markets in the front end are calling the Central Banks’ bluff; Now I think the ball is is back in the Central Banks court; they have to push back ….

So far, the Treasury market has not been damaged by the taper talk. If you don’t believe us, just look at the 10-year, 20-year & 30-year yields. They are actually under-performing. And this is despite virtually every one realizing that Powell is going to announce plans for the taper at the November 3 FOMC. In fact, David Tepper said on Friday CNBC Half Time that “Powell told you today that taper happens next month“.

And then Mr. Tepper said “if we stay at 1.60%s [10-year yield] after the taper announcement, then we could see a trading rally (in stocks) 5%-10% up till the end of the year; crap rally but I will play the game “. And this is a man who, in his own words, doesn’t love stocks, bonds, junk bonds right now.

By the way, the 10-30 year curve stared falling in yield AFTER Powell said taper announcement happens next month. By how much you ask? Well, the 30-year yield fell by 5.5 bps on Friday, 20-year by 4.6 bps & 10-year by 3.3 bps. And TLT rallied by 1.10% and the Zero-coupon EDV rallied by 1.57% on Friday.

So is it possible that inflation & taper fears have both crescendoed this week? We will know in two weeks. But if both have actually crescendoed, then November could well earn its reputation as a great month for stocks, as Mr. Tepper suggested.

And double by the way, BlackRock’s Rick Rieder expressed a similar view, again on CNBC Half Time this week:

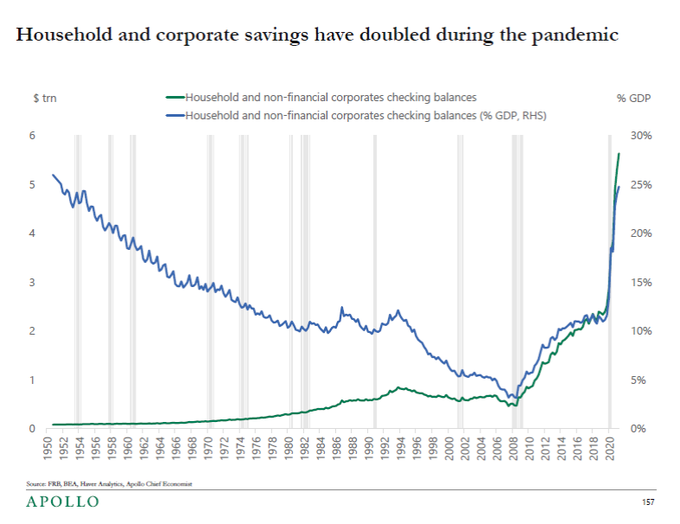

- “…. I think they [stocks] are going higher; .. interest rates have made their move, they could go a little higher but not where they affect stocks; … if you get past oil & I think you can, we could get a 5%-8% move from 4500, may be even 10% move … amount of liquidity in the system is epic …”

How epic? Below is courtesy of a Jim Bianco retweet:

2. Have Supply & Demand Crescendoed too?

By now everybody has heard of supply chain issues. Not just simple issues but intractable ones. Doesn’t that make you wonder if these concerns are being crescendoed?

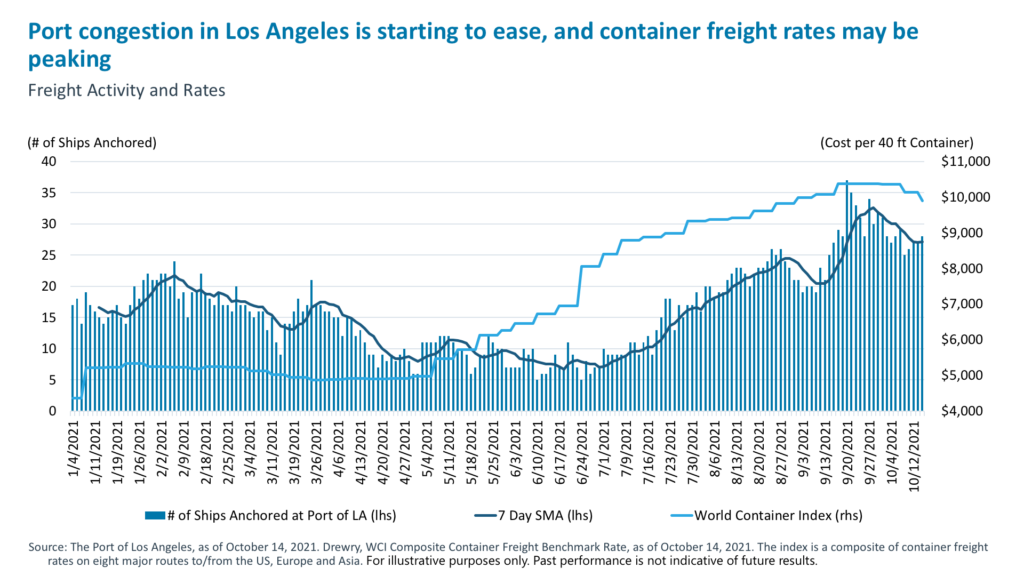

- Anastasia Amoroso@AAmoroso_1 – Wed – It’s all about the supply chain! Disruptions are everywhere but we could be at peak shortages now and they should begin to abate soon. In this week’s commentary, we take a look at 3 charts to watch for signs of bottlenecks easing. Check it out here: icapitalnetwork.com/insights/blog/

Ms. Amoroso writes in her article:

The supply challenges that businesses and consumers face could soon be abating as port congestion eases, transportation labor hiring improves, and factories in Asia reopen.

- For the first time since the end of September, the spot freight rate for a 40-foot container fell below $10,000.

- Second, wait times at sea and at ports – which could be peaking – are partly to blame for high shipping rates because they tie up containers and leave them in short supply. The latest data suggest that the number of ships at anchor is starting to decline, and the number of days at anchor, … could also be peaking,

- Factories should be reopening in Southeast Asia – Cases, however, are now coming down and vaccination rates are rising in these countries. For example, the first-dose vaccination rate in Malaysia is now close to 70%, while in Vietnam it is near 30% but ramping up quickly. With these improvements, we expect that restrictions could soon begin to ease, and with that, manufacturing shortages should too.

But supply is just one side of the coin:

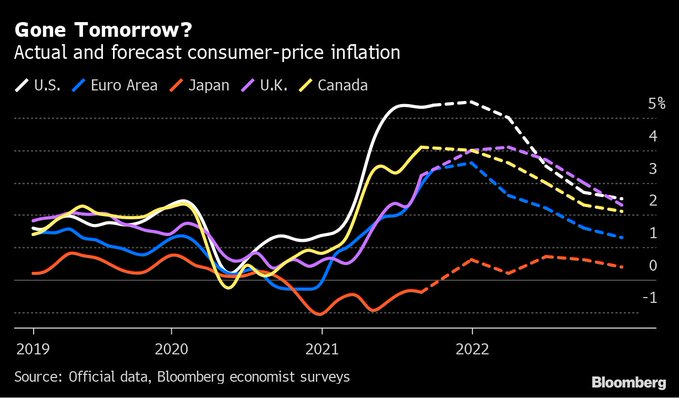

- Lisa Abramowicz@lisaabramowicz1 – – Central banks are struggling to know how to respond to inflation right now since much of it is out of their control. It’s hard to tell just how much is driven by a resurgence of demand versus supply strains & labor shortages. bloomberg.com/news/articles/

In addition to supply chain problems crescendoing, could this publicized surge in demand also be crescendoing now? Whom would you ask if you want to get a bearish opinion?

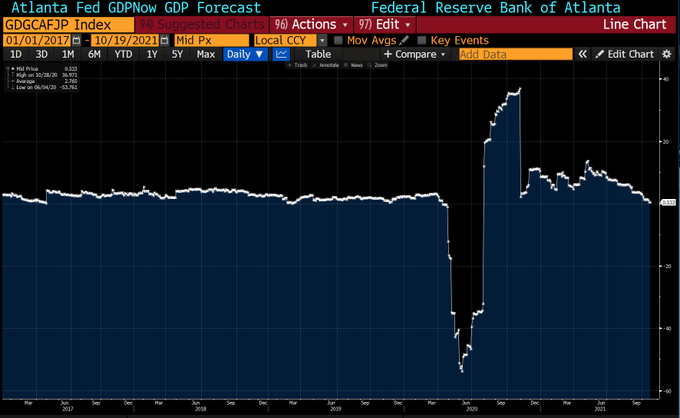

That is one statistic. What about the growth forecast for the broad economy?

Holy Canoli! Is it possible that supply chain problems & consumer demand might both be crescendoing around now? Are bond investors positioned for this?

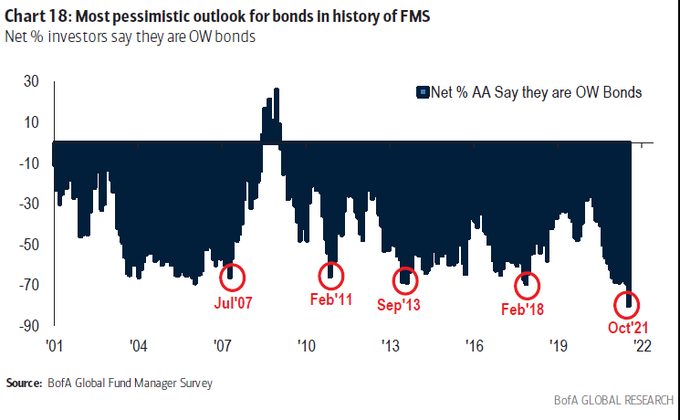

- Lisa Abramowicz@lisaabramowicz1 – – Fund managers’ allocation to bonds fell to the lowest level ever in the latest BofA fund manager survey as inflation woes drove expectations for higher rates, via@theterminal

Double Holy Canoli!! Imagine what might happen if fund managers actually realize that inflation expectations are crescendoing?

Double Holy Canoli!! Imagine what might happen if fund managers actually realize that inflation expectations are crescendoing?

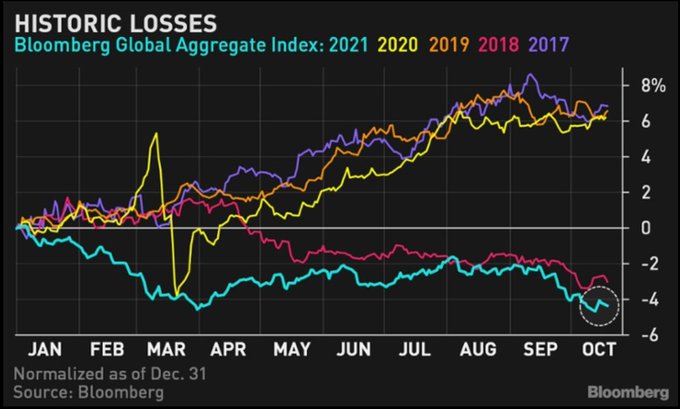

And bond allocations have collapsed as above because, as in the previous cases, global bonds have suffered mega losses:

Wowser! What if all the crescondoings we discussed above actually start being realized and accepted by big players? Wouldn’t Mr. Gundlach be spectacularly right about 30-year Treasury bonds making sense at 2% + yield?

But there is a reason Mr. Tepper is waiting to see how Treasury bonds react to the taper announcement. Chairman Powell could first screw up as he did in October 2018 & then capitulate. In that case, stocks & bonds could first fall hard in early November and then rally hard after his capitulation.

But will it be Chairman Powell who capitulates or Chairwoman Brainard? Jim Bianco said on BTV on Friday morning that Powell reappointment is being held as a bargaining chip in the intra-Democrat fight and that Powell would be given up as a final appeasement of anti-Fed Democrats.

Which means uncertainty is one factor that is not crescendoing yet?

3. Stocks

The above discussion was all intra-US, meaning what stocks might rally if Treasury rates fall instead of rising. What might happen if you add German Bunds to the picture? Tom McClellan painted a disturbing picture in his article Treasury-Bund Yield Spread Shows Troubling Divergence:

- The yield on German bunds is rising (becoming less negative) faster than the U.S. 10-year T-Notes, and that means the spread shown in this week’s chart is falling. Normally this spread moves in step with the stock market, and so this behavior creates a bearish divergence relative to the DJIA.

- For now, however, this is a warning of trouble for the stock market, much like the warning that this spread gave us before the Covid Crash…. it did show that the financial markets were in a vulnerable state, poised to react more strongly to the appearance of outside stimuli.

- Now we are seeing a divergence again. …. For now, the message is that the market is vulnerable to the type of pullback that we saw in 2000, 2007-08, and 2012, when similar divergences appeared.

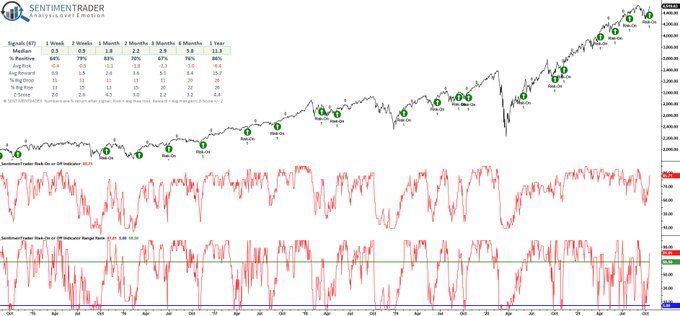

Yikes! But let us focus for now on the Tepper-Rieder view that the stock market could rally by 5%-8%-10% by year-end. Below is one opinion that describes a buy signal triggered this week, courtesy of a retweet by @sentimentrader

The next one is directly from @sentimentrader:

4. Snap to Google

Most were prepared for bad news from Facebook but very very few were worried about an ad slowdown at Snap. No wonder Snap was brutalized with a 25-26% drop in its stock price. The key line about the ad slowdown at Snap was “if you don’t have a product to sell, why advertise?”

As Dan Niles explained on CNBC Closing Bell, these signs have been coming for a couple of months & got crystalized in the Snap earnings call. That is why Mr.Niles sold all their GOOGL rather than take the earnings risk. Watch him explain his reasoning below:

That shows that the supply chain issues are now pervading the entire economy, even the most impregnable of companies like Alphabet. The big question is whether the economy-wide Snap to Google (if Google actually disappoints because of supply chain) slowdown a sign that problems are intensifying or is it a signal that about a crescendoing of the supply chain problem?

This is not idle musing. It is a dictum that a stock market correction is nearly over when the strongest stocks finally get hit. So if GOOGL does get hit next week, then you have to ask which company has not been hit by supply chain issues already?

This makes the “supply chain problems peaking already” call by Anastasia Amoroso (see section 2 above) so interesting. Think if she is right and interest rates actually stabilize after Powell’s taper announcement on November 3, then wouldn’t that combo lead to a strong NDX rally? That is why the next two weeks may be really interesting.

We are not giving ourselves the liberty of looking into early-mid 2022. We could get depressed if we did so. The problem with the Rosie-type crowd is that they start way early and get tuned out for being wrong. And that is when they turn out to be presciently right. That is why we were so intrigued by Mr. Gundlach’s “30-year Treasury makes sense at 2%+” call. Remember advantageous trade location is important to him.

That doesn’t mean the 10-yr does not get to 2% in the midst of a 10% year-end stock rally. That might only mean that the 30-year Treasury bond at 2.5% makes tons of sense into 2022.

Finally since Tom McClellan already brought up 2007 and bonds are now more under-owned than in July 2007, we thought we might share this week’s views of Mark Spitznagel of Universa:

- Jesse Felder@jessefelder – – “It’s a terrible time for equity investing. It’s the worst time for this generation. It’s very, very similar to 2007, although credit spreads and equity and bond valuations are far more stretched today; NFTs would have been laughed away in 2007.” – https://www.ft.com/content/941fa030-8135-4964-9d7a-e5274c130592″

Mr. Fitznagel’s key point seems to be:

- “He is careful not to say when a crash might happen, but insists there must come a time “when you can’t take on more debt”. He adds: “It’s a very strong view I have. What has happened in the past decades is . . . laying the groundwork for the next crash.” ”

That is precisely the point Mr. Gundlach made this Friday on CNBC Half Time Report:

- “… with all that debt, be alert to debt deflation – 30-year Treasury at 2% can give you 30% return if they fall to 1% as they did in Covid”

By the way, this big call by Mr. Gundlach was NOT included in the clip posted by CNBC about the discussion between Mr. Gundlach and Mr. Wapner, host of CNBC Half Time.

Does that show that “CNBC Anchors” are still “on a Mission Against US Treasuries” as we discussed way back on May 30, 2009?

Send your feedback to [email protected] Or @MacroViewpoints on Twitter