Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Gundlach’s sense & Treasury Inversion

Remember the stunning call by Jeffrey Gundlach on CNBC Half Time on Friday, October 22:

- “Long term Bonds do make sense with 30-year Treasury at 2%+; with all the debt, be alert to debt deflation; 30-yr at 2% can give you a 30% return because the yield can fall to 1% as it did in Covid.”

Stunning as it might sound, for the entire week CNBC Half Time Show & its “investment committee” completely ignored this totally out of consensus call made on their air time.

But the Treasury market listened. And Treasury rates acted:

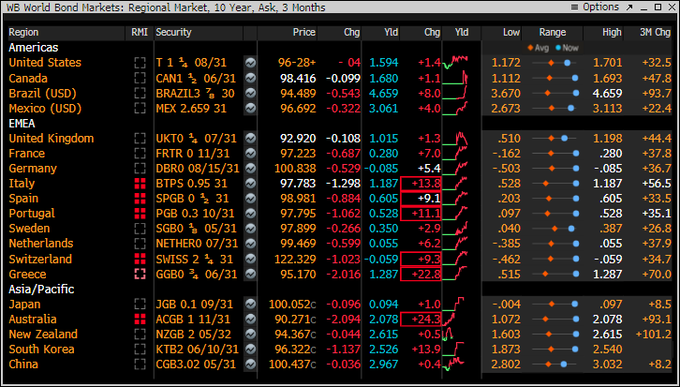

- 30-yr yield fell by 13.6 bps on the week; 20-yr yield fell by 7.6 bps; 10-yr yld fell 8.5 bps. In contrast, the 7-3 yr belly of the curve merely fell by 2 bps on avg. Long duration Treasury ETFs, TLT & EDV, rallied by 2% & 3% resp.

And that is not the biggest surprise of all – the 30-yr yield INVERTED vs. the 20-year yield on both Thursday & Friday. Granted, it is a mere 4 bps inversion. But still the 30-year yield is the most sensitive measure of future inflation. So when it inverts (closes lower) than the rate of a shorter maturity, it sounds an alert of not just lower inflation but lower inflation PLUS lower growth.

And that lower growth signal may not be merely a U.S. one. The German 30-year Bund yield FELL by 10 bps while the German 2-year yield ROSE by 6 bps, a 16-bps flattening on the week.

But the 6 bps rally in German 2-year was nothing compared to the explosion in 2-year yields across weaker European economies and Australia. PIGS 2011 redux?

Now look at the 3 bps rise in U.S. 2-year rates & marvel. CNBC Half Time show seemed completely oblivious to this and its host Wapner kept reiterating the crap from the huge speculators who are demanding hawkishness pronto.

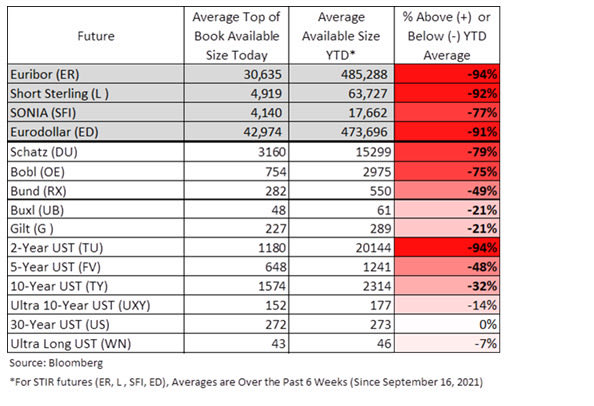

They & the Fed heralds keep telling us that tapering is NOT tightening. But even host Wapner agrees that tapering would reduce buying from the Fed even though he keeps telling viewers the Fed will still be adding liquidity for months. Guess he is satisfied with the amount of liquidity in the Treasury system. Strange given what happened to Treasury liquidity this week:

Look again – this week the liquidity of the 2-year Treasury was 94% below its YTD average, while the 5-year Treasury liquidity was 48% below its YTD average. In stark & stunning contrast, the 30-year Treasury liquidity stayed placid and calm at its YTD average.

Look again – this week the liquidity of the 2-year Treasury was 94% below its YTD average, while the 5-year Treasury liquidity was 48% below its YTD average. In stark & stunning contrast, the 30-year Treasury liquidity stayed placid and calm at its YTD average.

And in the midst of this, Fed Chairman Powell is expected to announce a taper of Fed buying (meaning reduction of market liquidity) and speak hawkishly about a rise in rates next year!

If that is not all, the Fed has consistently & silently tried to keep the Dollar down in the past. After all, to use the words of Larry McDonald, a strong Dollar is a wrecking ball for the world.

In the face of this, the Dollar rallied hard by 80 bps on UUP & 85 bps on DXY on Friday leading to a weekly Dollar rally by 52 bps & 74 bps resp.

- The Market Ear on Friday – Mighty Dollar Is Back – Wild swings in big assets continue. Dollar‘s huge down candle yesterday is replaced by a huge up candle today. Bullish or bearish the DXY, the swings are huge and continue confusing the crowd. Huge moves in the DXY, bonds and commodities is shaking a lot of p/l, but so far equities remain “unimpressed” and do not care...

Normally with all this and a 91% drop in Eurodollar liquidity this week, we would argue that Chairman Powell is likely to surprise with a less hawkish statement. But a couple of things make us wary of assuming common sense & focus on market stability:

- Chairman Powell is fighting a rear-guard campaign to keep his job,

- The left of center market billionaires & erudite commentators are demanding Powell immediately cut taper & raise rates to slay the inflation demon they see …

- And we remember the Powell who torched financial markets in October 2018 only to reverse at the end of December & early January the following year.

So all we are going to do today is merely point out what a big week we face next week:

- Tuesday – Nov 2 – Virginia Gubernatorial Election

- Wednesday – Nov 3 – FOMC meeting & presser

- Friday – Nov 5 – Non-farm payroll report

So pick your favorite philosopher before next week begins – Yabaa Dabaa Doo Fred Or Holy Cr** Frank (Barone).

2. Don’t Worry Be Merry

Remember how the elites were thinking at the beginning of October 1? Read what Andrew Ross Sorkin, the elite of CNBC elites, said on October 1 to strategist Anastasia Amoroso:

- “… we were just talking to the head of TPG actually 2 days ago and he said you know put your seat belts on; you are putting your seat belts on?”

Look at the S&P chart since October 1 and be amazed at the arrogant stupidity of Sorkin’s question cum put-down:

Remember what Ms. Amoroso said on October 1:

- “I expect that may be a little more tactical technical downside to this market but that could reverse to the upside over the course of Q4 … seasonality is now coming over to be on our side … if you look at the put pricing right now & the volatility that has blown out so much on the put pricing, you can sell that put, you can monetize that volatility & you can buy the call option which is very cheap relatively speaking;

What did VIX do over the month of October?

Kudos to Ms. Amoroso for that call. Any one who followed her gutsy call presumably did very well with the collapse of the VIX & the rally in S&P in October.

This final week was a merry one indeed for the big indices with Dow up 40 bps, S&P up 1.3% and NDX up 3.2%. Wait a minute. How could the NDX be up 3.2% & beat the S&P so badly this week given FinTV’s trumpeting of Götterdämmerung or Twilight of the Big tech Gods on Friday?

That gets cleared up when you notice that Apple & Amazon were both UP for the week, Apple up 88 bps and Amazon up 1.2%. The only way this is twilight of AA Gods is in comparison to the brilliant noon of MA Gods with Microsoft up 7.4% & Alphabet up 7.1% on the week. Add 6.5% for Netflix and you got to admit this all looks like MANAA from stock market heaven to simple folks who have believed.

What might lie ahead for true believers in seasonality?

- From Goldman via The Market Ear – Super Strong Seasonals: Hard To Find A Better Hit Rate – Consigliere to most macro hedge fund titans, Tony Pasquariello looks at his tactical dashboard and cannot help but being bullish. Tony P: “Systematic funds are adding back length, the buyback switches are being thrown back on and the retail investor isn’t backing down, if anything they’re going up-in-quality … such that there could be upwards of $15bn of daily demand just from those three cohorts … call it an elegant version of animal spirits. of course there are some countervailing force (e.g. month end), but it strikes me that flow-of-funds still skew to the positive side, amidst a discretionary investor base that is running light of right tail protection. with respect to seasonals, note the following from GS sales & trading colleague Scott Rubner … it’s less the hit rate and more the 2-month return that stuck out to me: “there have been 15 times since 1928 that the S&P was up 20% or more through October. The median return for the rest of the year was +5.92%, with an 80% hit rate.” (Tony P, Goldman)

Aren’t we taught that true believers are the ones who get to heaven? And markets provide true believers something that no theosophical religion provides – Puts. Or a marriage of puts with stocks to protect the downside while believing in the upside. And puts seem to be cheap with VIX around 16.

3. On more earthly ground

Does that require a positive sounding comment that is actually signaling negativism?

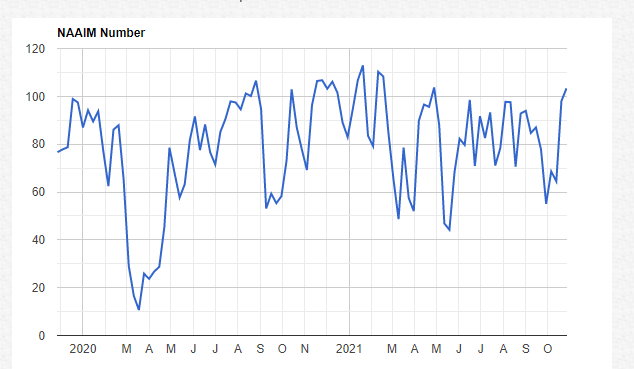

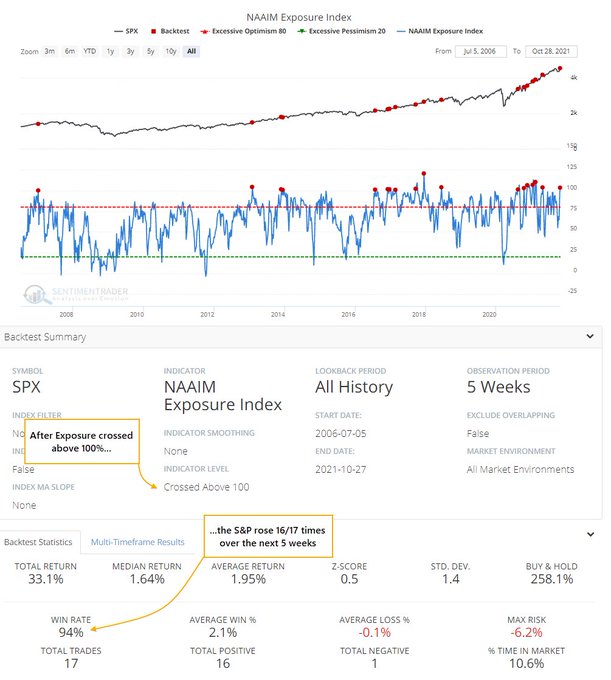

- Helene Meisler@hmeisler – Oct 28 – NAAIM Exposure 103. First time over 100 since the spring. Yep, folks feeling good.

But does history suggest that crossing 100 is actually a bullish sign? According to the below, the S&P rose 16/17 times over the next 5 weeks after that sign:

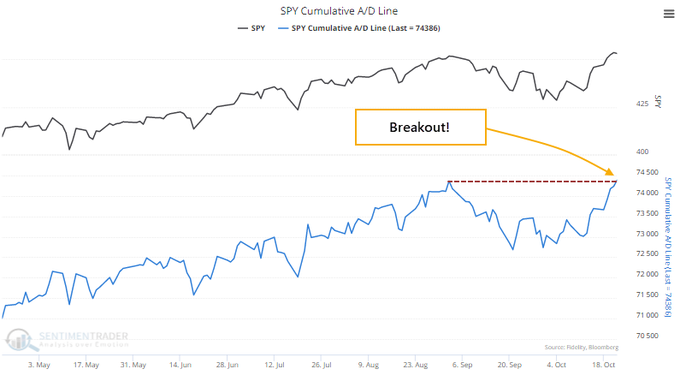

This week wasn’t merely sweet for indices. The S&P 500 Advance/Decline line hit a new high this past week. What does that suggest for true believers?

- SentimenTrader@sentimentrader – Oct 26 – The chances of an imminent correction just cratered. Thanks to a new high in the S&P 500’s Advance/Decline Line, the probability of a 10% drawdown w/in 3 months plunged from 15.9% to 4.6%.

But probability is not certainty, especially with a wounded Chairman Powell on deck and with

Send your feedback to [email protected] Or @MacroViewpoints on Twitter