Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Screaming Eagles!

No; we are not talking about the famous 101st Airborne. We are speaking of the take-off of the legendary F-15 Eagle:

Now look at a lift-off that puts the F-15 take-off to shame. Even when the 2-year yield was up 14 bps on Friday morning (after the theoretically strong NFP number), the 30-yr yield was unchanged. Then ZROZ slowly taxied into the take-off position in the morning & went nearly vertical in Friday’s final hour. We thought about the screaming eagle phrase when we watched the close on Friday of ZROZ, the Pimco 25 yr+ Zero Coupon Treasury ETF.

And that was not a one-day wonder. ZROZ was up 8.3% from Tuesday’s close to Friday’s close. But even that seems puny when you realize that ZROZ is up 22% since Powell’s temper tantrum in his FOMC presser on Friday November 4.

This is neither a small cap stock nor a Chinese ETF. It is neither a call option nor a leveraged ETF. And it represents the largest & deepest bond market in the world. What a stunning rally in a Treasury ETF!

But is it done now? No, if you believe that man who has recommended long duration Treasuries for months & faced ridicule for it. Look what David Rosenberg said on Bloomberg Surveillance on Tuesday, November 29, the day before the 3-day takeoff seen above?

- “… my strongest conviction call is the long bond for the next 12 months; …. you will get returns you won’t get in other asset classes… (minute 1:17:40)“

Also look what Mike Wilson said on Bloomberg on Thursday morning about his ranking of asset classes:

- ” … Cash 1st; long duration Treasuries second; credit third & then equities …”

Two days before that, Melissa Lee asked Mike Wilson on CNBC Fast Money about his “rates expectations backdrop” for his 3,600 bear case-3,900 base case & 4,200 bull case S&P 500 targets for 2023:

- “2.75%-3% if recession to 4.25% if re-acceleration; split the difference & say 3.25%“

Wow! Remember last week when we thought 3.25% would be ways off? Heck, the 10-year closed below 3.5% on Friday at 3.48% to be precise. And the 30-yr yield fell 22 bps last week. Another week like that & we could get to Wilson’s 3.25% level next Friday!

You know what is really surprising about this Treasury rally? It is happening while the Fed is selling Treasury bonds as a part of their QT:

- Holger Zschaepitz@Schuldensuehner – Dec 2- #Fed deleveraging continues as balance sheet keeps shrinking. Total assets dropped by $37bn in the past week to $8,584.6bn, the lowest level since Nov 2021. Fed balance sheet equates to 33.4% vs #ECB’s 78%, BoJ’s 128%.

So why did Treasury bonds rally on Friday afternoon? Perhaps, they read the epic un-rosy tweet:

- David Rosenberg@EconguyRosie – Dec 2– Oh, and as for that hot U.S. wage number. If not for the slide in hours worked (the denominator!), average hourly earnings would actually have come in below expected, at +0.26% MoM. Quick, Mortimer — buy those bonds back!

And the above followed the one below:

- David Rosenberg@EconguyRosie – Dec 2 – Adding to the insanity of this payroll report, the birth-death model added 110k jobs. Sure thing. So net this out and adjust for the shrinking workweek, and the real NFP number was -227K — and aligned with the recession message from the Household survey.

While you enjoy the screaming takeoff of ZROZ (then of EDV & finally by TLT), be shocked at the “big shock” forecast by T. Rowe Price guru Sebastian Page on BTV Surveillance on Friday. Why be shocked? Because Paige is warning starkly about rising illiquidity in the Treasury market:

- ” … I am looking at Bloomberg index of illiquidity & it is getting less & less liquid; … that’s almost at a level to which it went during COVIS; … saw it happen during Gilts market in the UK; … swaps spreads are showing illiquidity; other markets like on-the-run, off-the-run showing lower liquidity … that’s the risk that keep brewing in the background; …. it makes monetary policy really complicated because the Fed would have to do something to fix the plumbing … “

Just imagine if the Fed is now forced to come in to add liquidity to the Treasury market in the next 2-3 weeks! Wouldn’t that make 30-year Treasury yield really plunge? OMG! Where would ZROZ fly to?

Might all this be the result of the nutsy hawkish verbal rampage of Powell & company over the past couple of months? Three months have barely elapsed since Powell’s arrogantly destructive diatribe at Jackson Hole and now they may have to run in with a liquidity injection?

Thankfully, it seems to be only an intra-Treasury illiquidity concern & not a credit accident!

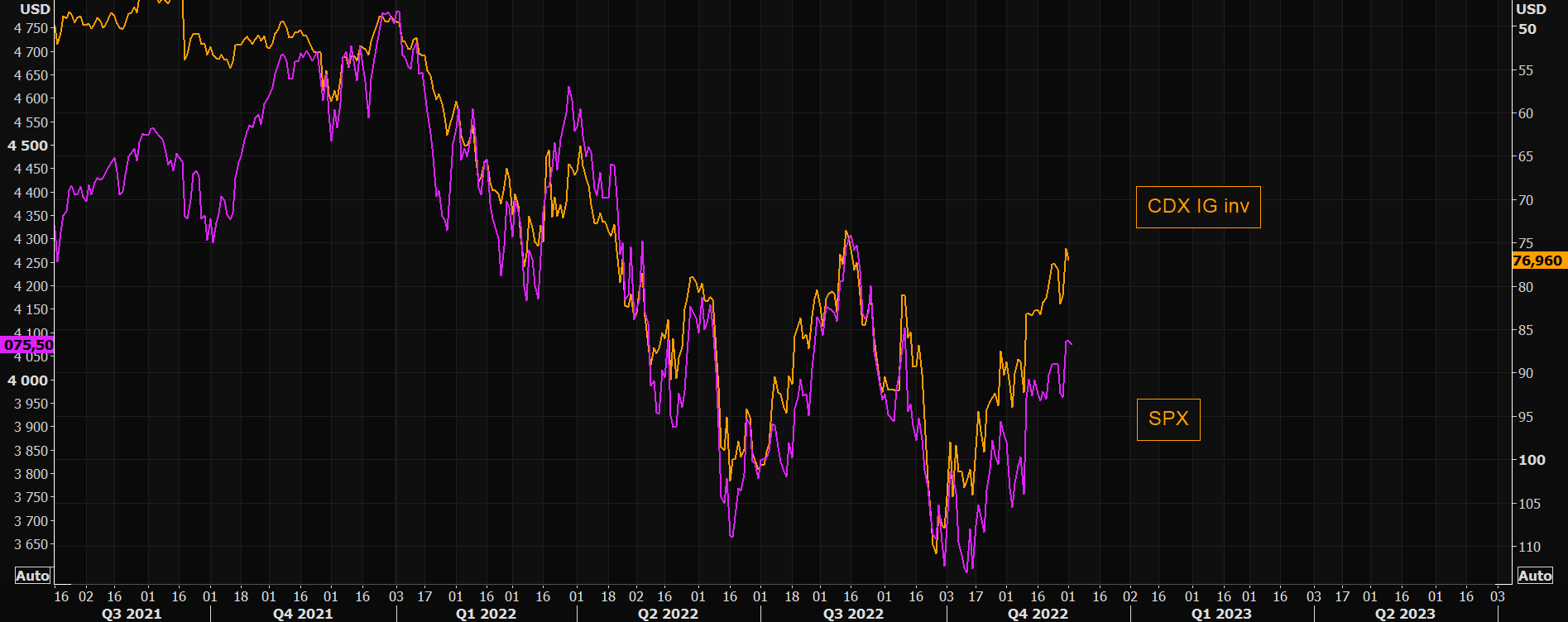

- Via The Market Ear – Dec 3 – Credit protection feeling exuberant – CDX IG has reset big since highs earlier this year (late September). We have not seen credit protection trade this “exuberant” in a long time. Note it has managed outperforming the SPX lately.

Also remember, the 30-year Treasury, TLT, EDV & ZROZ are still ways away from touching their 200-day moving averages. And remember that the real outperformance from TLT comes after it breaks out above its 200-day moving average.

Whatever happens next week & into year-end, it is important to see how terrific this week was across the maturity curve:

- 30-yr yield down 22 bps; 20-yr yield down 22 bps; 10-yr down 21 bps; 7-yr down 21 bps; 5-yr down 22 bps; 3-yr down 24 bps; 2-yr down 49 bps; 1-yr up 22 bps; TLT up 4%; EDV up 5.9%; ZROZ up 6.5%; HYG up 68 bps; JNK up 60 bps; EMB up 2.4%;

2. Stocks

Moral discourses tell us that trying times are often sent to test the resolve of the good. Assuming being long is the province of the good or at least the well-intentioned, this moral lesson has been profitable since November 2. Remember the scary meltdown in stocks after Powell’s presser on November 2; remember the 640 point sell-off on November 9; the smaller selloff on November 14 & the 498 point selloff on Monday November 28.

They were simply sent to test our resolve, as we can argue now. We can rest on this morality but Paul Hickey of Bespoke cannot. So he put it more intelligently & in smarter terms in his conversation on Friday afternoon with Mike Santoli:

- ” … the market had plenty of overbought levels that had led to selloffs every other time this year ; this week we have actually seen the market continue to rally ; that’s an encouraging sign for us … “

When asked by Santoli about the recessionary message of the markets, Hickey said:

- ” … these internals are diametrically opposed to what’s been very weak economic data; .. it doesn’t look good but whenever you see this situation where things don’t look good but the market is telling you a different message, market usually ends up being right … “

The next day Bespoke put up two tweets with charts to perhaps explain why the market may be right:

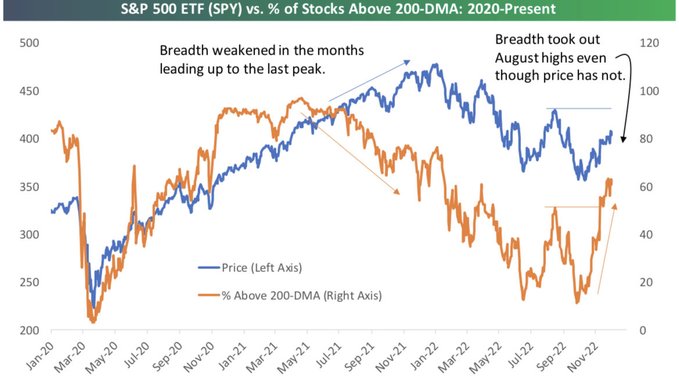

- Bespoke@bespokeinvest – Dec 3 – The % of stocks above their 200-DMAs continues to show positive breadth divergence. Head over to https://bespokepremium.com for more in-depth analysis.

Then a message that even simple folks like us can understand:

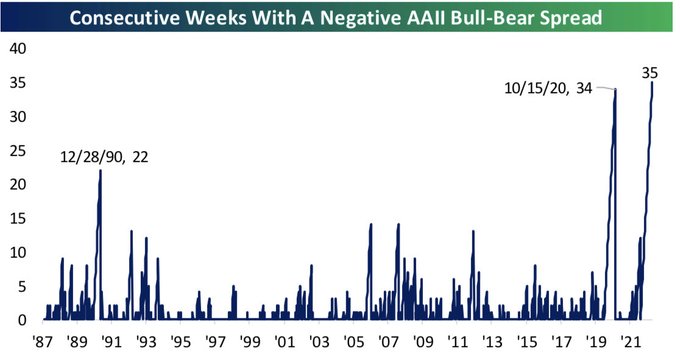

- Bespoke@bespokeinvest – Dec 3 – AAII’s weekly investor sentiment reading has had more bears than bulls for a record 35 weeks in a row. @AAIISentiment https://bespokepremium.com

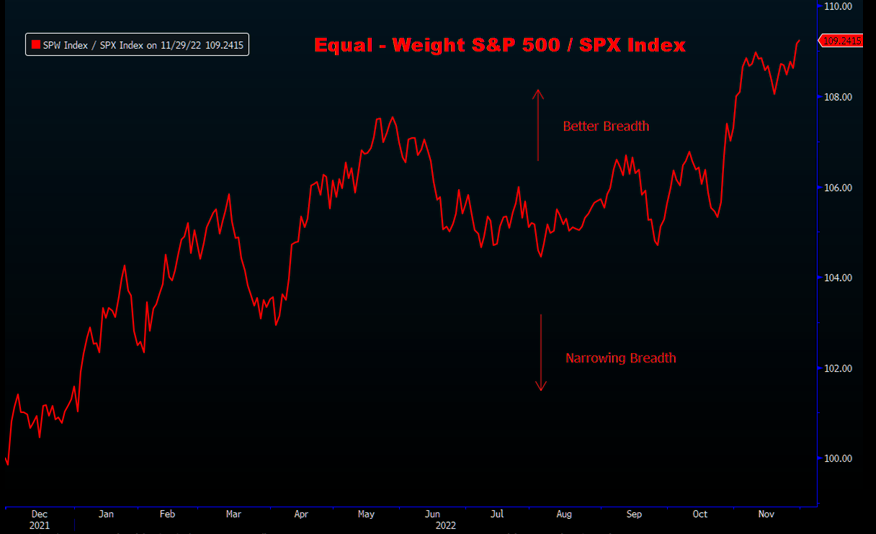

Speaking of breadth, look what we saw mid-week, Via The Market Ear – Equal-Weight S&P 500 vs SPX continues to make new YTD highs

- 66% of SPX stocks have outperformed the index since mid-October. More than 90% of members are positive.

- 6 weeks ago, just 20% of stocks were trading above their 200d Moving Average. Now it is about 44%. (LT avg is 54%)

- In November an average 54% of stocks in SPX outperformed the index on a daily basis. That’s slightly above October’s 53% average and September’s 51% average.

What about the famous term “hedge fund positioning”?

- Via The Market Ear – Nov 30 – 13-year extreme equity positioning – Hedge Funds beta to equities at 13-year lows seen during GFC.

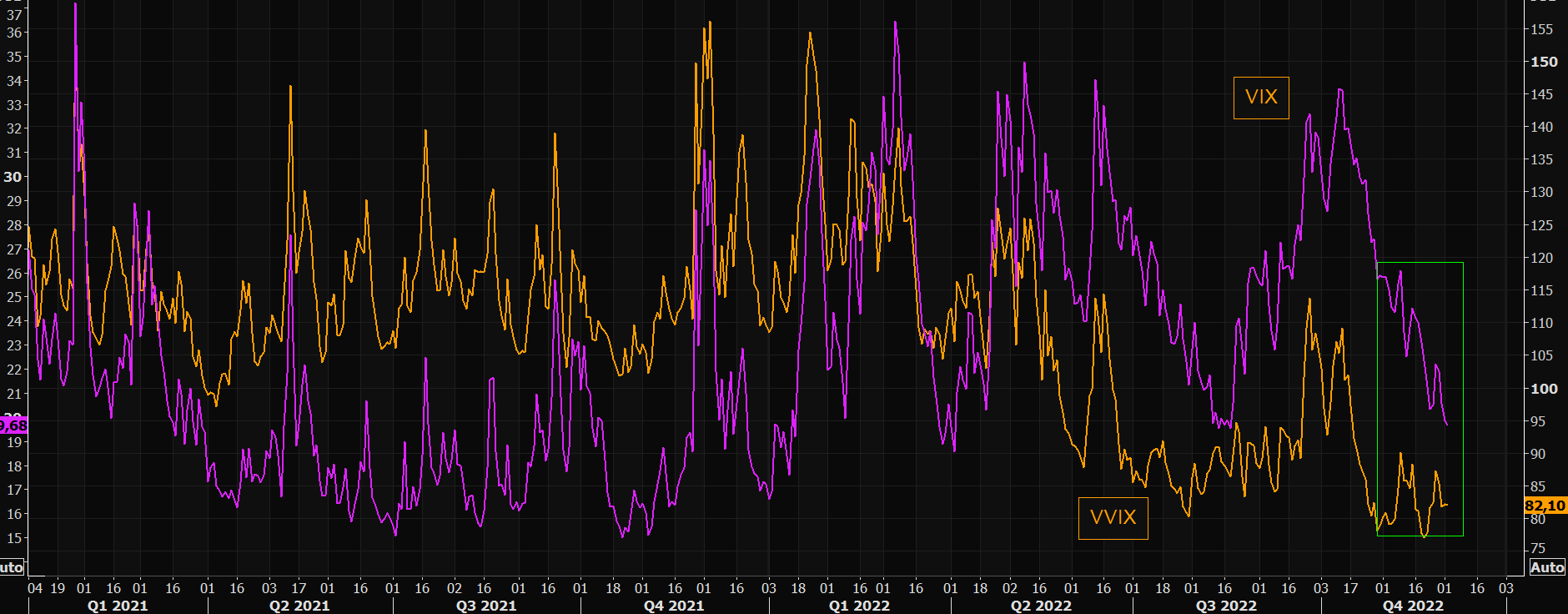

Seriously even we can’t end this section without at least one bearish note. Art Cashin said on Friday that VIX below 20 bothers him. In that vein,

- Via The Market Ear – Dec 2 – VVIX refuses buying the inverse panic – VVIX is up from recent lows, while VIX has continued printing new recent lows. The gap between the two is becoming very wide.

3. 200-day & a charm offensive

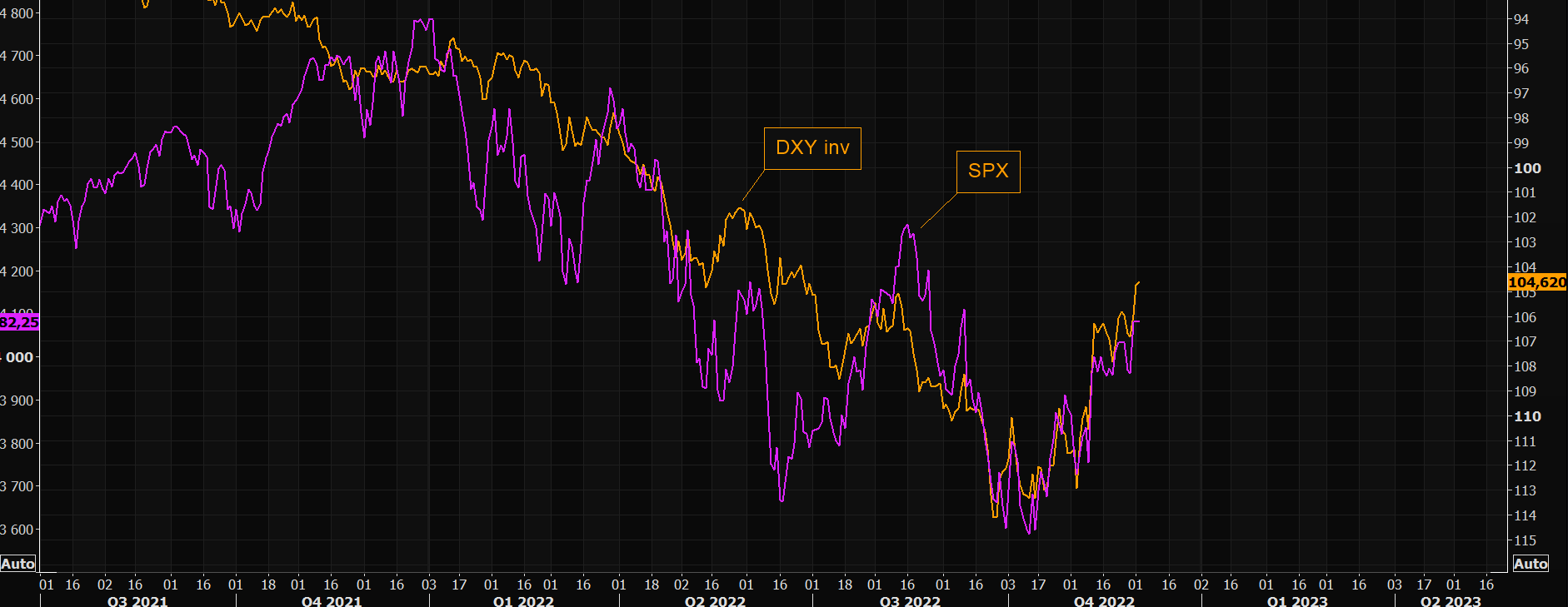

Remember Gundlach saying earlier that he will NOT invest in emerging markets until DXY breaks the 200-day moving average! It did so this week.

But is this a real break that sticks or will it get faded? It is a big question because,

- Via The Market Ear – Dec 2 – Just a dollar thing? Bullish or bearish, but the most recent squeeze has got a lot of support from the falling dollar. The dollar is a huge part of the current macro narrative.

Assuming the Dollar stays weak and below its 200-day moving average, diversifying into emerging markets might add real value. And that might include a huge market that might make 2023 the year of its charm offensive.

Leland Miller, CEO of the China Beige Book & an astute China observer, said on Thursday on Bloomberg Surveillance that “China is about to reopen” and added that “2023 will be the year of Charm Offensive by China“.

Send your feedback to [email protected] Or @MacroViewpoints on Twitter