Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Fed policy predominates

Any one who has followed markets this year knows this. The 2-month chart below shows the explosive rally in long duration Treasuries that began on November 7, after the sell-off thanks to the Powell Presser the week before.

The rally continued this week until the unwelcome rise in PPI on Friday. The 30-yr Treasury yield rose by 11 bps on Friday & ZROZ fell by 3.8% on Friday. Makes sense because inflation is the 2nd most negative factor for long duration Treasuries. The most negative factor, of course, is the Fed’s commitment to speaking threateningly about their commitment to forcing market rates higher.

Despite the action on Friday, ZROZ was only down 36 bps on the week & its coupon-equivalent TLT was only down 62 bps. That was in stark contrast to the declines in stocks & stock averages which amounted to one of the worst weeks of this year.

And the 30-yr Treasury yield completed the list of inverted Treasury curves on Thursday. The spread between the 30-yr Treasury yield & the 10-yr Treasury yields had remained positive despite all other curve segments (2-3, 3-5, 5-7, 7-10 etc.) inverting. It finally inverted on Thursday. The Treasury decline on Thursday created a 5-bps negative spread between 30-yr yield (3.44%) and the 10-yr yield (3.49%). This inversion narrowed during Friday’s decline to about 1 bps. (Kudos to Rick Santelli who was the only one on Fin TV to notice this & speak about it).

With such an inversion you shouldn’t be surprised to see long-duration Treasury rates outperform the belly of the curve (creating more inversion) this week:

- 30-yr yield up 3.1 bps on the week; 20-yr up 5.8 bps; 10-yr up 9.4 bps; 7-yr up 11 bps; 5-yr up 11 bps; 3-yr up 11 bps; 2-yr up 7 bps; 1-yr up 4 bps;

But the TLT & ZROZ combo suffered just a nick last week compared to the serious damage to stocks:

- VIX up 19.8%; Dow down 2.8%; SPX down 3.4%, RSP (equal-weight S&P) down 4.4%; NDX down 3.6%; Russell 2000 down 5%; & Dow Transports down 5.2%;

The S&P which had made investors happy by closing above its 200-day the week before is now more than 100-handles below that 200-day. Does that confirm a failed-break out for the S&P, a consummation devoutly to be fearful of? We know what will happen if the CPI comes in hotter & Powell uses that to justify a hawkish rhetoric in his presser on Wednesday?

And what happens to Treasury rates, especially to long-duration rates which depends on the CPI number (released on Tuesday Dec 14), a day before the FOMC on Wed Dec 14 &, even more importantly, on how Powell’s FOMC reacts to it on Wednesday?

But not everyone expects a stronger CPI number next week:

- Bespoke@bespokeinvest – – commodities “up in price” across ISM services and manufacturing has plummeted. This should be a crystal clear signal to the Fed that CPI is set to fall rapidly. Have they taken note? Read more: bespokepremium.com/interactive/po

What if Bespoke proves right and Powell speaks not too hawkishly in his presser and retail sales come in on Thursday morning less awful than feared? We might get a face-ripping rally from end of next week into Christmas & year-end as Steve Grasso of CNBC Fast Money said on Friday. We also recall what Goldman’s Abby Joseph Cohen said in October 2000 on CNBC- that stocks get a Santa Claus rally unless we are in a deflation.

We have also seen some smart timers & technicians suggest buying the S&P end of next week (on December 15, as some have been precise) into Christmas. If we recall correctly, Jim Cramer reported a week or two ago that Larry Williams has also made such a call. On the other hand, Jessica Inskip told Cramer, as he told his viewers this week, that the market has failed a key hurdle and that the market is hostage to the Fed. In this vein, Kudos to Mike Wilson who stepped back from his tactically bullish call & said the rally is done. One of his points, as we heard it, seems to be that such rallies have petered out around the 200-day moving average which the S&P exceeded on Friday, December 3.

One positive factor for a market rally might be the following:

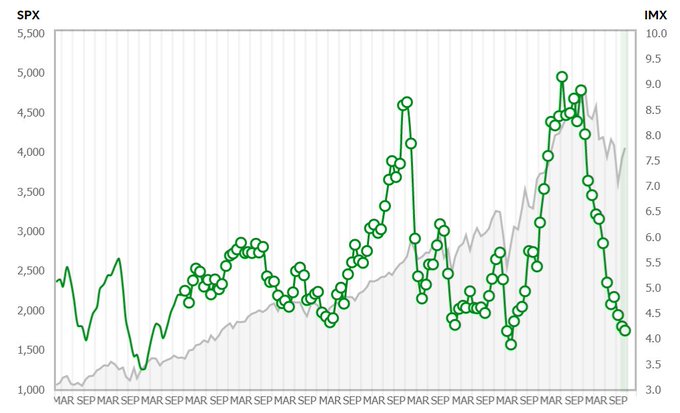

- Ryan Detrick, CMT@RyanDetrick – – The recent TD Ameritrade Investor Movement Index (IMX) was lower again in November (as stocks gained 5%). This proprietary indicator looks at sentiment of retail investors. Currently the lowest sentiment since April 2020. Another clue how dour overall sentiment is currently.

Finally an anomaly we saw this past week – SMH was only down 63 bps on the week in stark contrast to QQQ down 3.6% & S&P down 3.4%. And SMH has outperformed QQQ since November 3:

Are Semis the new “industrials”? Jessica Inskip did not mention them when she told Cramer how much she loved industrials & pointed out that XLI is breaking out.

If Semis are “new” industrials, are there any “new” banks that might be behaving better than old Banks? why do we ask? Watch the Chris Verrone clip on CNBC Fast Money about how awful the banks trade, not just the regional banks but the money center banks. If he had a “shame” chart, looks like he would put Citi on it. Because he pointed out that if you bought C right after the ferocious decline in 2009, you would still have lost money relative to the S&P at today’s price:

Once again the FOMC meeting on Wednesday and Powell’s presser will be the most eventful happening next week & for the rest of the month. Could we dare hope that 2023 will usher in times when Fed meeting days might be less eventful?

2. 2023 & 2024

Most stock folks seem united in their call for a fall in the S&P 500 in the first quarter or half of 2023 from earnings estimates coming down & then a rally in the second half of 2023.

We don’t see that level of consensus in performance of Treasuries in 2023. We all know what David Rosenberg said on November 29:

- “… my strongest conviction call is the long bond for the next 12 months; …. you will get returns you won’t get in other asset classes… (minute 1:17:40)“

This week, we saw:

In contrast, the 2023 Global Investment Outlook of BlackRock argues the opposite in the section Rethinking Bonds:

- “we remain underweight long-term government bonds in tactical and strategic portfolios”.

They explain & suggest a different bond class in their theme Living with inflation.:

- “We stay overweight inflation-linked bonds and like real assets. The old playbook principle that recession drives below-target inflation and looser monetary policy is gone. …. The market’s wishful thinking on inflation is why we have a high conviction, maximum overweight to inflation-linked bonds in strategic portfolios and maintain a tactical overweight no matter how the new regime plays out“.

Send your feedback to [email protected] Or @MacroViewpoints on Twitter