Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Asinine arrogance of the unelected

No! We are not speaking of the Fed. We are alluding to the arrogant stupidity of European Institutions. No, we are not only speaking today about the unelected EU. We are alluding to what Christine Laggard of ECB did on Thursday morning.

When CNBC’s Steve Liesman & the gang were focused on a pivot by the Fed,

- Holger Zschaepitz@Schuldensuehner – – WHAT? #ECB‘s Lagarde: We’re not wavering, we’re not pivoting. Euro investors are also somewhat confused.

Hello 2008 was the first reaction in Germany:

- Holger Zschaepitz@Schuldensuehner – – OOPS! #ECB‘s Lagarde: Expect to raise rates at a 0.5% pace for a period of time. 2y yields jump to 2.4%, the highest level since 2008.

Germans should stop being crybabies & look at Italians:

The word was that Girogia Meloni, Italy’s PM, left without saying a word to Laggard. With all this breaking, no CNBC anchor thought of asking CNBC’s two Italian-Americans, smart market guys & Sants to boot, about what’s going on. Actually no CNBC anchor even had a clue that something big was going on in Europe. That became visible the next morning on Friday, December 16:

Remember what Gundlach said to Wapner post Powell presser on Wednesday:

- “The Dollar has peaked & that peak is quite convincing .. Dollar reversal has tremendous legs … “

That was a whole evening & night before the Lagarde arrogance. Look what happened to the Dollar post Thursday morning’s adventure of the Old Christine:

The rally in stocks had been based on the Dollar getting weaker & long duration rates going down. One asininely stupid declaration by Old Christine changed everything & made Powell a mere bystander. Fortunately CNBC does have access to one independent mind which spoke up on Thursday morning:

- “bears got a little help this morning from Christine Lagarde when she announced that ECB had raised rates saying “market is clearly underestimating how high we are going to raise rates to cut inflation” – that scared the heck of everybody in Europe & yields on European rates spiked … we already had weak data here (in USA) & spike in European rates led to these lows (in US stocks); ”

Then Art Cashin added a kind of could be so bad it might be good thought:

- “… perversely what you could get if God scares the Europeans, you could get an accidental flight to safety; in other words, people in Europe say – holy smokes, we are in bigger trouble; we have lot more to go than America – then they would start to buy US currency & US bonds; that would bring our yields down & probably put a bid under stocks; its all interconnected here … “

It would take a heck of a flood in to US Treasuries to offset the shock of European long duration yields going up sharply as they did on Thursday & Friday morning. Remember how overbought TLT, & ZROZ were on Wednesday. Now look:

And this is despite Gundlach, Hartnett, Minerd & just about every U.S. luminary saying buy 30-year Treasury bonds. The chart shows the shock of what Old (& arrogantly stupid) Christine did to Treasury markets on Thursday morning.

Sadly, Christine & Jay might have a reason to worry about inflation next year. We counted three different smart people come on TV and say Oil is going to 3-digits with Sankey saying $120. Clearly there is nothing either of them could do about inflation coming from another 20%+ move in energy prices but they can raise rates, in a joint Chris Quixota & Jay Quixote move, enough to damage US-European economies.

Ms. Quixota can do what she likes but we don’t think Jay would be able to match that. Because as Robert Heller said to CNBC’s Sullivan:

- “the FOMC split between 1/3 hawks led by Powell, 1/3 doves led by Brainard; 1/3 chickens who can’t decide, mostly Fed Bank Presidents”

Powell knows that by the time FOMC meets again, there will be a new House & a new House Finance Committee run by a different group. Last thing they would want on their record is a sharp drop in the US economy because of wanton tightening by the Fed, especially when Brainard sits in the wings. Hopefully Powell remembers how his hero, Volcker, met his demise – members of the FOMC voted against him in FOMC meetings. He should notice what the Treasury curve did this week:

- “30-yr yield down 2 bps; 20-yr down 8 bps; 10-yr down 9 bps; 7-yr down 11 bps; 5-yr down 14 bps; 3-yr down 18 bps; 2-yr down 15 bps; 1-yr down 11 bps”

And Jay should remember (or look up) the track record of his predecessors:

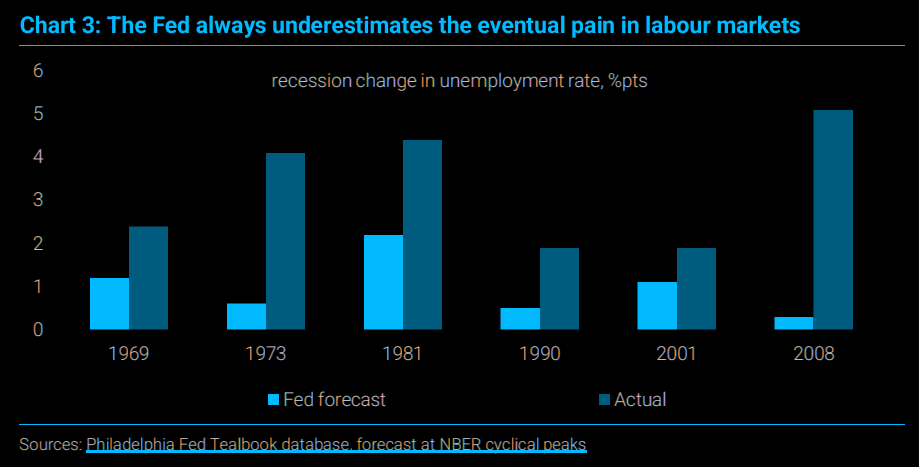

- Via The Market Ear – Fed always underestimates – Central banks are doing something we have never seen them do, warn of recessions. According to TS Lombard, the bad news is they actually do a decent job at spotting cyclical peaks, but the more worrying news is that they always underestimate the severity of recessions.

And look what the economy delivered in the two days after Jay’s stubborn presser – Retail sales awful, Empire & Philly Fed bad; Mfg & Services PMI recessionary. Don’t we all hope that this time Fed is not going to underestimate the recessionary risk? But he is not alone this time, not with the asininely arrogant ECB beside him.

Kudos to the wisdom & humility of those who put In God We Trust on the U.S. Dollar. Bet they were not central bankers!

2. Powell & “this market wants to rip… “

Look at the conditions of the invested as Powell began speaking:

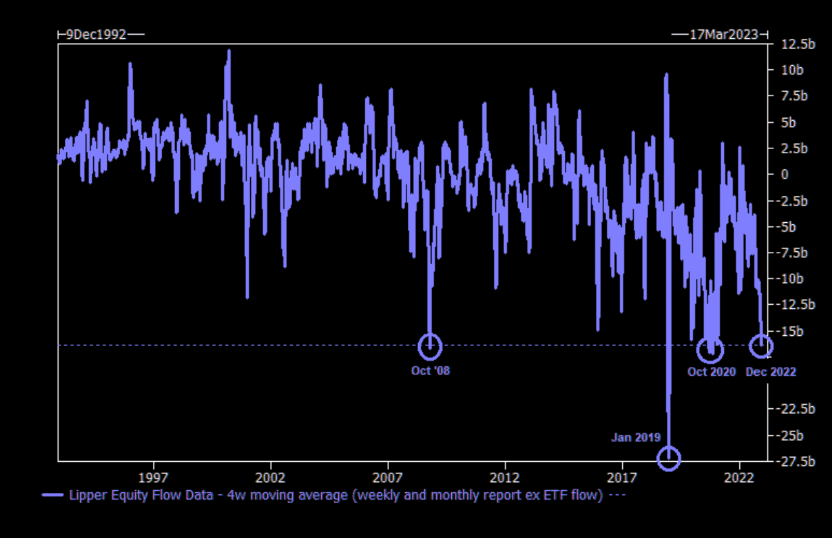

- Via The Market Ear – Tuesday December 13 – Outflows are huge – According to Lipper data we have seen equity mutual fund outflows 39 out of the past 40 weeks. Momentum has gained lately as well. Goldman’s Garrett writes: “…this pace is rivaled only by Oct 2008 (financial crisis), Dec 2018 (trade wars + Fed hike into slowing economy leading to worst December since 1931), and Oct 2020 (Trump/Biden election).”

So we pretended to be Algos & watched the S&P react tick by tick as Jay kept answering questions. So many questions were asked to get a sense of when/how Fed might pause. But Jay refused to oblige. We got the distinct sense that the set up was to move up. Then we heard @lisaabramowicz1 say “ … this market wants to rip … “. That precisely was our feeling. But Powell seemed resolute until:

Watch just before 3 pm move above when Powell couldn’t resist answering a basic question. The Dow moved up 300 points vertically on that one slip up by Powell. Later Tom Keene referred to this 300 point vertical & said it was due to the answer to the question by Bloomberg’s McKee. Then Powell adjusted and much of the bounce was given up. But by the afternoon, those who stupidly expected a sell off were exasperated & the S&P did what it has done for the past 3 months – gone nowhere.

The next morning brought the big sell-off on ECB stupidity & some seriously weak data. But we saw some dim light on Friday mid-day, the kind that is often seen around 1 pm on Op Ex Fridays. So we sent a tweet to a big shot anchor & his elite panel just before stepping out:

- Editor Viewpoint@MacroViewpoints – – @HalftimeReport – interesting juncture now; empirics suggest that a rally can occur post-noon when market is was down in OpEx Friday morning; VIX fell at noon; dollar fell a bit; do we get a rally this afternoon? Question for your smart panel; don’t expect one but response be nice

Look what we found out on return after the close – a saucer like pattern with a 200 point type move from the end of the CNBC Half Time show:

We are simple folks & we know we don’t have a clue. But we have seen empirical observations work. Not ours but clearly of those who have spent more than half-century doing so. Of course we refer to Art Cashin who said the following on Thursday morning in the turmoil of that sell-off:

- ” … couple of things … there is a cycle in here indicated that we might see in an interim low between December 13 & December 21 and this might be that test; … key here is the 3,900 level … you have to be a bit careful to see if it (selloff) extends into Monday & Tuesday … right now it is all about the market taking its own pulse; taking its own temperature – its almost all internal … ”

It seems so arrogantly stupid to say this given the enormous disparity between Mr. Cashin & us in every aspect but we do feel the same way.

Yes, we know that some CNBC anchors mocked all those who still expect a Santa Claus rally, but we can’t resist pointing out some straws in the negative blowing wind:

- SentimenTrader@sentimentrader – Dec 15 – Investors are running for the hills. – According to Lipper, investors pulled more than $27 billion from equity mutual funds and ETFs last week. It’s the 10th-largest one-week outflow in 21 years and the largest December outflow ever, exceeding Xmas week 2018.

We have never seen them but we keep hearing about those things called “deltas”. Are they suggesting something? The Market Ear reported a couple of points from Goldman’s options guru Garrett:

- “$billions of client long calls struck between 4050 and 4200 for year-end…the opposite of this is that dealers are short these options…so a move higher would result in dealers having to chase deltas to the upside as short gamma makes them shorter and shorter deltas on the way up…”

- “Garrett points out that the dynamics are opposite to the downside “…significant open interest ($20bn) in the year-end 3835 strike with the assumption that the market is long”…this would dampen a possible move lower in markets“

We don’t know about Goldman’s Garrett but we do know what Myles Garrett would do in such a case – a bull rush towards his target.

Looking at it another way, the S&P is where it was on May 22. So why not … ?

- Via The Market Ear – From 200 day to 50 day…why not 200 day again? – Why not a frustrating bounce having washed out a few people over past 24 hours? This market remains in “fat and flat” territory.

To understand the frustration that might ensue, think of the frustration of the Rams who controlled the entire game until Brady became Brady again in the last 59 seconds of the game. Also think of the frustration of the New Orleans Saints who were up 16-3 in a dominating fashion until Brady scored 2 touchdowns in the final 5 minutes.

Look where we are today. This week was awful, down across the board. CNBC mocked those who dared speak of a Santa Claus rally & filled their slate with people talking Sell, Sell, Sell. Just imagine if you get a washout in the first couple of days of this week ahead & you get to say, just before Christmas, “Buy’em” just as the two below did at minute 1:01 of the clip:

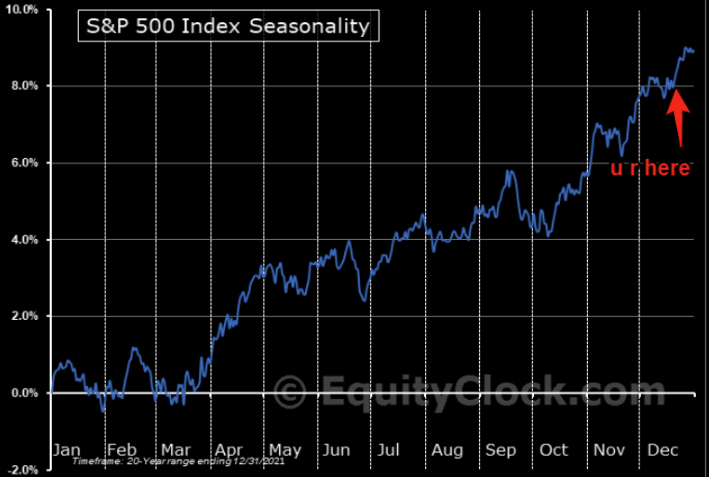

Do realize that there is nothing to depend on for this bet except the seasonality chart below from The Market Ear & the comment by Art Cashin about an interim low ahead on or before Tuesday December 21:

Below are the two clips we referenced above. Worth listening in full, in our opinion:

And

3. Trifecta in Energy

Mark Fisher of MBF Trading imparted a very valuable lesson to Scott Wapner last Monday when he said ” markets don’t move on what people focus on; markets move on what people don’t focus on“. Fisher was explaining why they “bought everything today on the close – crude, heating oil, natural gas “. He added “today was too irresistible… the setup was too good“.

A day later on Tuesday, December 13, Jim Cramer relayed the views of his techni-pal Carley Garner about energy. The “speculators have their lowest net long position in at least 5 years“; also based on her work, the support is between $65 & $70 and the resistance is at $95. Cramer does a good job of explaining the charts & the logic behind Garner’s call.

Then on Wednesday December 14, Paul Sankey came on & said he expects Brent to go to $120 by net driving season (May 2023) with WTI getting to $115. With that he gave his pair trade of Long HAL (Halliburton) & Short WLK (Westlake Petrochemical on weakening demand & high input costs).

We can’t recall another time when we saw three buy calls by three smart experts on the same asset on three consecutive days. So either this will be a great trade (our bet) or a horrible trade.

Send your feedback to [email protected] Or @MacroViewpoints on Twitter