Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we clude important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Honor the brave!

On Memorial Day we honor the brave servicemen & servicewomen of our Armed forces. But bravery is not just for the physical battlefield. What about the brave Bespoke who tweeted the below?

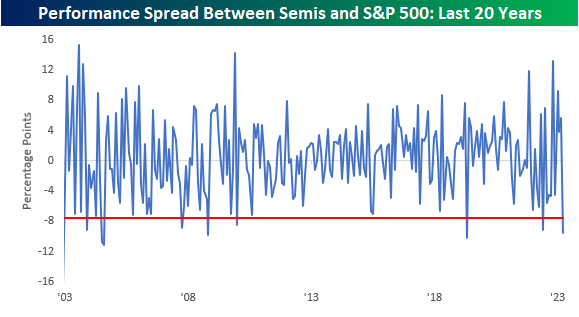

- Bespoke@bespokeinvest – Apr 28 – Semis (SOX) are underperforming the S&P 500 by 9.7 percentage points this month. The only month in the last ten year that the group underperformed by a wider margin was in May 2019.

- Bespoke@bespokeinvest – There’s only been eight other months in the last 20 years that semis have underperformed the S&P 500 by more than 7.5 percentage points in a month. #Semis

Thanks to @jaykaeppel, we can reproduce the classic quote of Walter Deemer – “When the Time Comes to Buy, You Won’t Want To“. We wonder how many people stepped up & bought the Semis, outright or vs. SPY, since the above Bespoke Tweets?

The SMH has outperformed SPY by nearly 20% since the above tweets. Of course, half of that outperformance came this week with SMH up 10.7% & S&P up 31 bps.

A great deal of credit goes to the one & only NVDIA, fundamental credit we mean:

- Via The Market Ear – Thu – NVDA superlatives – JPM’s TMT trader, Stuart Humphrey, adds some color: “NVDA defies gravity. This guide is insane. No one I spoke to had this kind of magnitude of a Q2 guide. Incredible that they can drive that much revenue in one Q…”

Marvel was up 44% this week and even Micron exploded at the end of the week. So what follows?

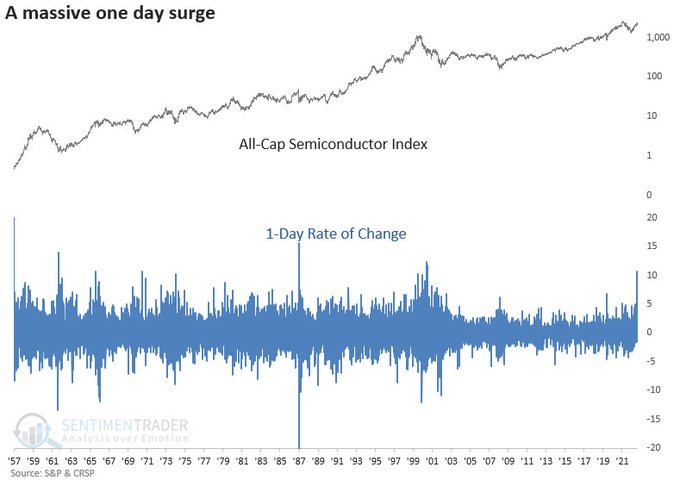

- Dean Christians, CMT@DeanChristians – For only the 24th time since 1960, a semiconductor index surged by more than 5% and closed at a 12-month high, but not a 24-month high. After similar momentum breakouts, the index was higher a year later every time.

Bespoke was so correct a month ago. Could they prove correct again?

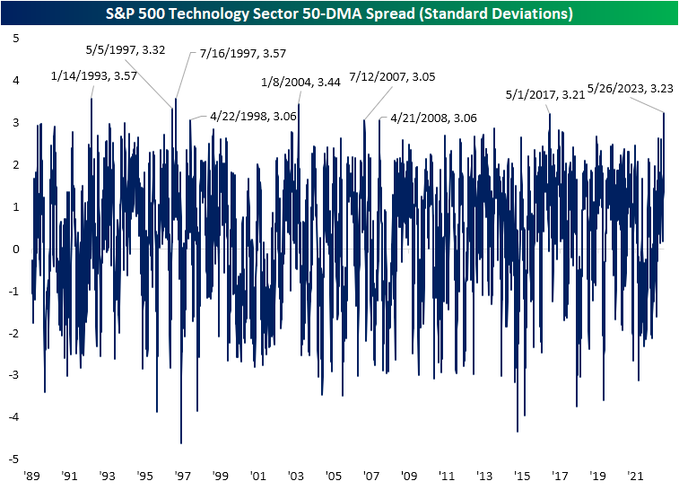

- Bespoke@bespokeinvest – May 26 – The Tech sector heads into the weekend trading 3.23 standard deviations above its 50-DMA, its most overbought reading since January 2004! https://bespokepremium.com/interactive/posts/think-big-blog/tech-in-orbit

On the other hand, look what Bespoke tweeted just a day later:

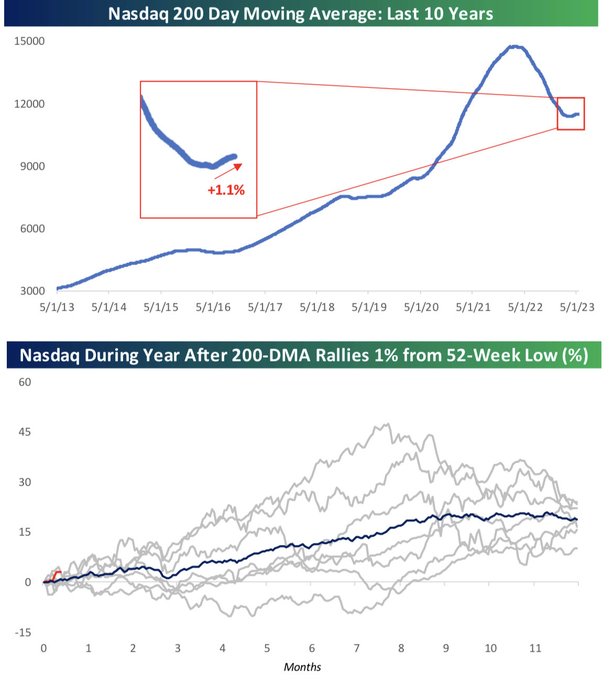

- Bespoke@bespokeinvest – May 27 – Every time the NASDAQ’s 200-DMA has rallied 1%+ off a 52-week low, the index has been higher a year later.

Is the current Semi-AI boom a repeat of the 2000 tech bubble? That was discussed this week. For those who care, below is Jessica Inskip elaborating on the differences between the tech bubble & AI:

2. The Rest?

This really was a tech week:

- Dow down 1%; SPX up 31 bps; RSP down 88 bps; NDX up 3.6%; SMH up 10.7%; RUT down 6 bps; IWC down 54 bps; DJT down 5 bps; EWG down 3%; FXI down 3.7%; Copper down 1.5%; CLF down 3.4%; FCX down 2.5%; Gold down 1.5%; GDX down 5.3%; NEM down 6.4%;

First of all, is the rally really so narrow?

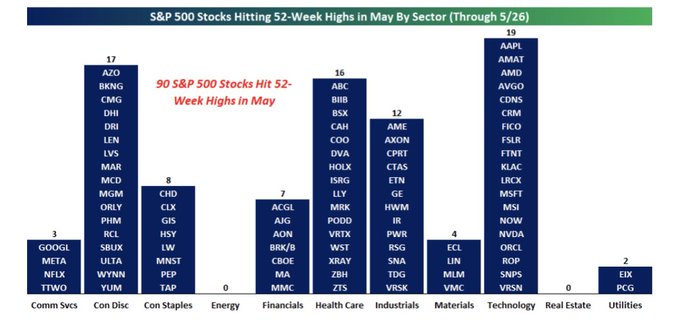

- Ryan Detrick, CMT@RyanDetrick – Awesome chart from

@bespokeinvest showing it isn’t ‘just 5 stocks’ like we’ve been saying. But also new highs are happening in various sectors.

On the other hand,

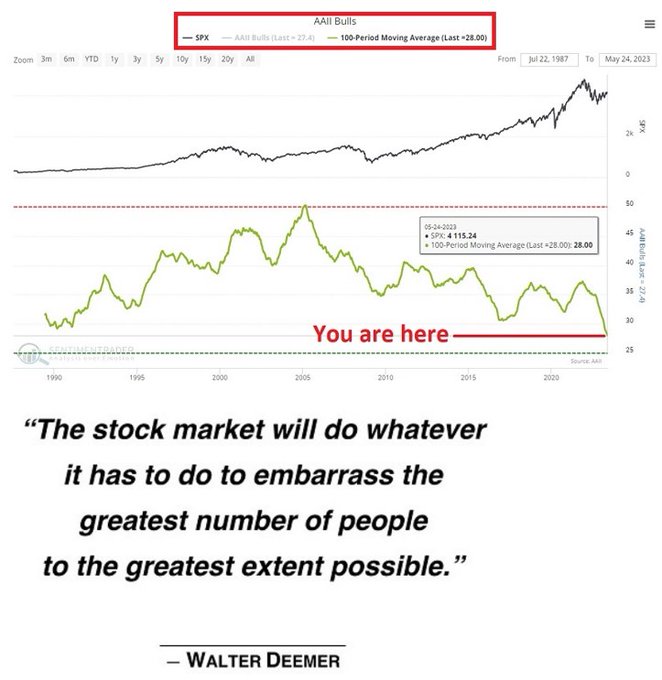

- Jay Kaeppel@jaykaeppel – May 27 – As SPX and NDX breakout while the 100-week MA of AAII Bulls plunges to a new all-time low, it seems like a good time to take a page out of

@WalterDeemer classic book “When the Time Comes to Buy, You Won’t Want To.”

And now to the Presidential cycle

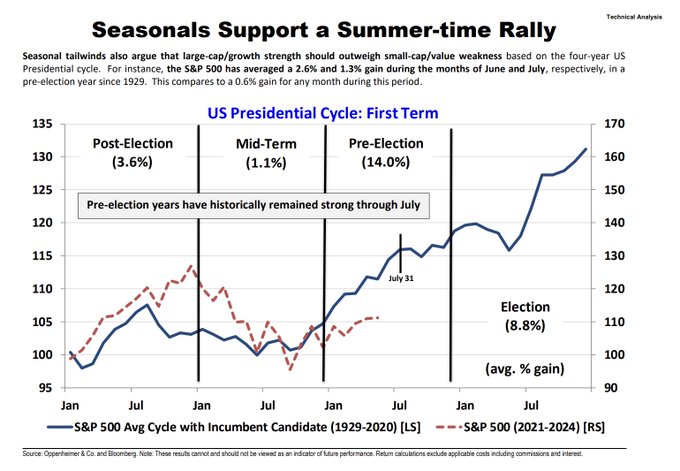

- J.C. Parets@allstarcharts – You can sell in May and go away if you want, but during Pre-election years stocks historically do really well in both June and July. h/t @AriWald

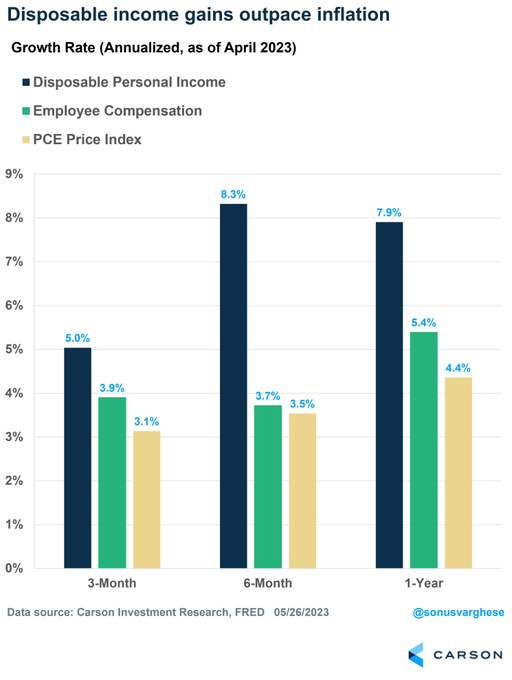

But is there a basis for a broad stock rally? Inflation is not one but could income be one, income over inflation that is? A good nominals beating bad nominals world?

- Ryan Detrick, CMT@RyanDetrick – Love this one from @sonusvarghese. Disposable personal income is outpacing inflation. I’m not sure many are pointing this out. Yes, inflation is higher than we’d all like, but when incomes are outpacing it, that isn’t a bad thing.

Is that why defensive sectors are being tossed aside?

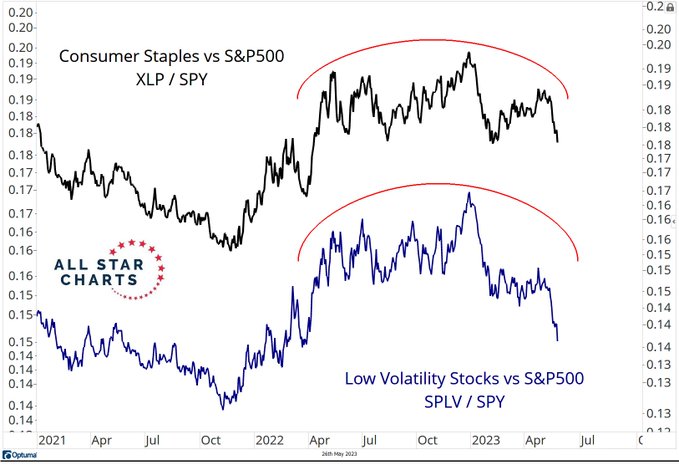

- J.C. Parets@allstarcharts – May 26 – New 52-week lows across the board for the most defensive stocks relative to the market: Utilities, Healthcare, Consumer Staples, Low Volatility all new relative lows today

On the other hand, should these sectors be bought right now, at least vs. the S&P? Probably if a recession is about to arrive or is already here!

3. An Un-Rosy view about today

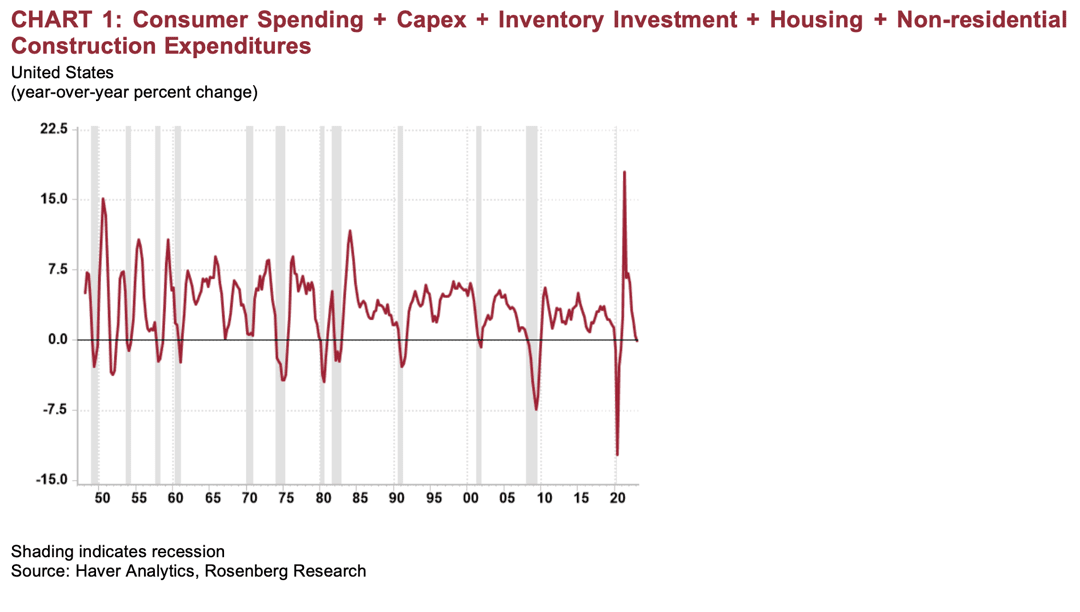

Who but one man would say such a thing? Yup, it was David Rosenberg & he wrote on Friday – WHAT IF THE RECESSION HAS ARRIVED… WITH NOBODY NOTICING??

As he explained,

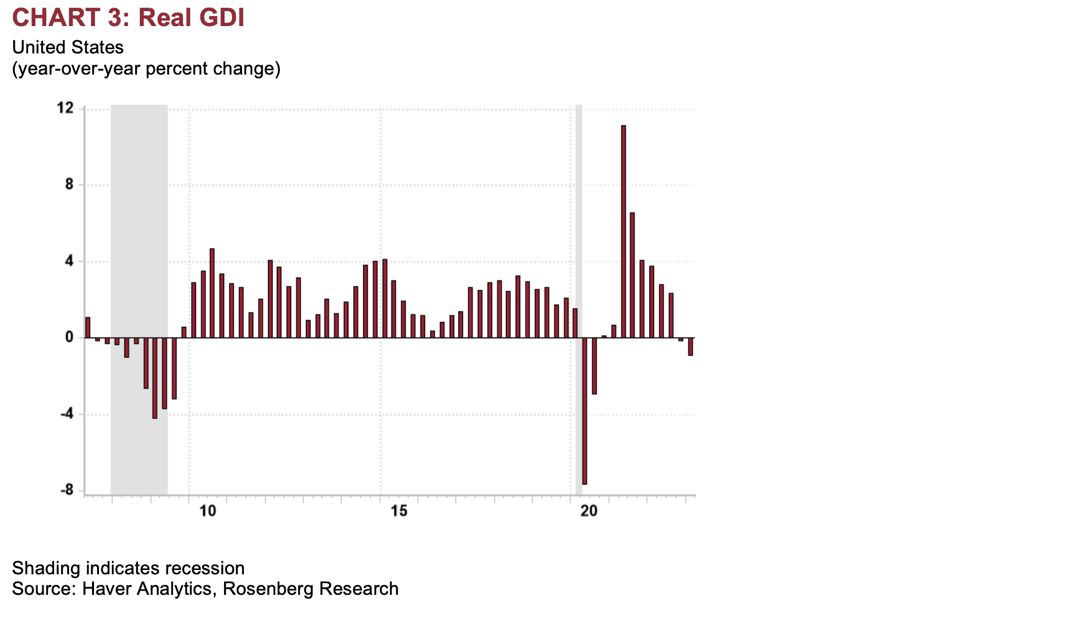

- This is something else that nobody talked about yesterday: real Gross Domestic Income (GDI) contracted at a 2.3% annual rate in the first quarter. That followed a 3.3% retreat in Q4 of last year. Not once back to 1950 have we ever failed to experience an NBER-defined recession with such back-to-back declines.

- Tack on the fact that real GDI is also down in three of the past four quarters and now running -0.9% on a YoY basis. What is very interesting is that last year, when we did have successive quarters of negative real GDP prints, everyone was saying “never mind, real GDI is still positive!”

- Nary a word yesterday on the back-to-back contractions in real GDI. When you average out both real GDP and GDI, this metric came in at a -0.5% annual rate in Q1 on top of -0.4% in 2022Q4 — not to mention slipping in four of the past five quarters. Once again, never before have we failed to see a recession with such a dynamic. Will it really be different this time?

One market that should notice this is the Treasury market. But they are busy selling off every day, especially in the belly of the curve.

- TLT down 27 bps on the week, EDV plus 4 bps; ZROZ flat; 30-yr yield up 3.1 bps; 20-yr up 7.8 bps; 10-yr up 11.6 bps; 7-yr up 14.7 bps; 5-yr up 18.5 bps; 3-yr up 27.1 bps; 2-yr yld up 27.7 bps; 1-yr up 22.6 bps;

Now that the Debt Ceiling issue is seemingly behind us, Treasuries might start moving higher in price especially if the economic data keeps coming in not-so-hot. Recall Treasuries began moving lower in yield in June 2007 after being torched in the first 5 months of that year. Is there any market indicator that might be hinting at this?

- Joe Kunkle@OptionsHawk – High Yield $HYG chart looks ugly and 6500 January $72 synthetic shorts open, another potential market red flag

4. China, India

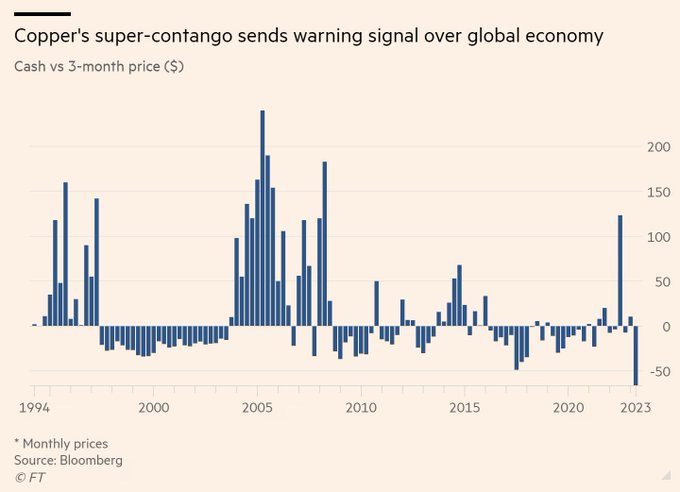

Chinese ETFs & Chinese ADRs were terrible performers this week and so was Copper.

- Jesse Felder@jessefelder – ‘The price of copper has widened to the biggest discount against its futures equivalent in almost two decades, in a warning sign of a sudden weakening in global demand as China’s economic rebound stalls.’ https://ft.com/content/479c524f-c5ea-45a2-8bc3-c66eaf4f83a5

A sensible description of China’s problems was provided by Ruchir Sharma of Rockefeller on CNBC:

Sharma said the two biggest structural headwinds facing China are demographics & debt. How long term & mega-serious is the Demographics problem?

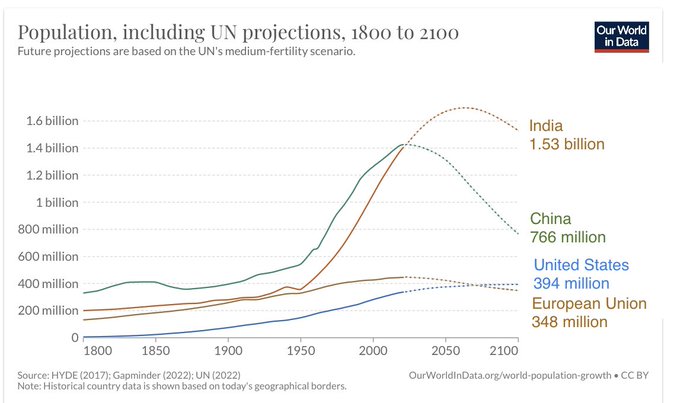

- Jeff M. Smith@Cold_Peace_ So, India may have *double* the population of China by 2100? The U.S. and China could have similar populations sometime next century?

In contrast, Indian ETFs were strong this week – INDA up 2.8%; EPI up 2.3%; SMIN up 1.8%. And wonder of all wonders, the most abused set of stocks, those of the Adani group, rallied hard this week with, Bloomberg writing:

- “Adani Ports Recoups All Stock Losses Since Hindenburg Report; Group stocks extend recent surge, flagship jumps almost 19%; Combined market cap of 10 stocks up $22 billion since Thursday“

Bloomberg also reported that GQG’s Jain has raised Adani Stake to $3.5 Billion and has said his group wants to be the largest investor in Adani after the family.

5. Memorial Day, Sport, You Tube vs. Netflix

Unlike GOOGL, Netflix is a straightforward single story. That makes You Tube a better comparison with Netflix. We have noticed that YouTube is adding lots of movies to its “free with ads” offering. We think it is smart because we are not sure how the earlier “Buy or Rent” offering was doing. As You Tube has increased its “free with ads” offerings, we find our own time on Netflix has decreased.

For example, we highlight below one of our favorite movies that we again watched recently on You Tube. It is kinda perfect for Memorial Day given that the film if about a slightly nutsy submarine commander who succeeds in a crazy war exercise. The film begins (minute 1:24 to 2:38) with a 7-iron shot, the most unique golf shot we have seen & one we would absolutely love to try ourselves. The film, of course, is Down Periscope starring Kelsey Grammer (of Frasier fame).

Now for a more traditional Memorial Day message:

Send your feedback to [email protected] Or @MacroViewpoints on Twitter