Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we clude important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.FOMC Statement – a Bollywood fight?

Today it might be somewhat different but classically Bollywood films used to featured confrontations that began with big-dare type rhetoric and dramatic threats that never actually resulted in serious violence. That’s what we sensed on FOMC Wednesday.

No question the rhetoric in the FOMC statement was fighting tough with intensely dramatic threats to hike & hike. No wonder the stock market fell hard, down 428 points at the low. Then came the Powell presser. And almost right away, the S&P touched a lower pivot & began bouncing back. The stock market instinctively realized that all Powell was dishing out was rhetoric, possibly to hide the reality of their becoming more cautious on the economy.

And stocks went baboom! Just look at the SPX lift off above. The real message about the Fed is – who cares? If the economy keeps slowing down gently as it has been doing, then they would stay on pause; if the economy re-accelerates, then they can tighten more. The real message of the market was that the Fed is no longer in charge, the economy is.

Kelsey Berro of JP Morgan said the “Fed can perhaps pause for longer than the Fed is currently projecting“. So why the rhetoric? The 3rd & most important reason Ms. Berro gave was “their forecast is inflation can come down; but they don’t trust their forecast“. Watch this clip if for nothing else than the amazing surprise – Andrew Ross Sorkin showed that he can speak less & listen more!!!

2. “Recession that never comes” or “market doing a repeat of that“?

As Mr. Sorkin was being less arrogant, Ms. Melissa Lee adopted the “contemptuous you” air. She looked directly into the camera & scoffed at the “recession” that never comes. Just a gentle suggestion; she needs to study how Sorkin speaks more closely. He does project a centuries-old hereditary intellectual Brahminist aura that Ms. Lee might want to emulate.

In contrast when asked “do you think a soft landing is actually possible?“, Ed Hyman said “No“. He cited 3 reasons – yield curve is inverted; money supply is contracting – the most its done since 1930s and, in addition to aggressive rate increases, they have QT going.

But the most interesting part of Mr. Hyman’s comments was his statement “the market is basically doing a repeat of that“. What is this “that”? Watch the clip below of course. A quick summary is below:

- “.. it takes a long time for monetary policy to work, like 1-2 years; …. the Fed paused in summer of 2006; recession started in 2008, 18 months later; … the S&P rallied 20% during 16 months out of the 18 months & the economy in 4th quarter of 2007 GDP growth was 2.5% just before going into the next recession & employment was pretty good; … the market is basically doing a repeat of that “

He says “employment is the linchpin“. And note that Kelsey Berro said above that “other aspects of employment are already weakening“.

3. “what to like?“

Jeffrey Gundlach asked & answered the question is his regular “post-Presser” conversations with CNBC’s Scott Wapner. We urge all to watch & listen to the entire clip below. A few excerpts below:

- “Fixed Income Market is very cheap; … systematic upgrade in fixed income portfolios ; “

- “long bond could give 40% in return plus coupon ; .. 20% stocks; 60% bonds; 20% real assets; we are in 2012 or so”

- “EM not China; Asia, Latin America & India of course – has a very very bright future over 2 decades“

Who seems to tie the above all together? Mike Wilson of Morgan Stanley. Watch the clip below. A few excerpts:

- ” our view is that inflation is going to come down; potentially that is very good for bonds; its not going to be good for stocks because that is where the earnings pressure has been coming from… now as inflation comes down, you are going to have a profits recession“

- “most people think the earnings recession is over in the 2nd half of the year; we think earnings recession is going to come .. last year earnings recession was a cost issue.. now what we are going to get is a top line disappointment … your pricing is going to evaporate … “

- we see the near term risk reward is lousy but if we look out to 2024, 2025 .. capital expenditure boom for things like reshoring, green energy, traditional energy, retrofitting buildings etc. & now AI”

- “median multiple for S&P 500 today is the same as the market-cap weighted multiple; its close to 18.5 -19 times… its a very broad overvaluation“

- “we can buy stock market right here 12 months from now“

4. then & now?

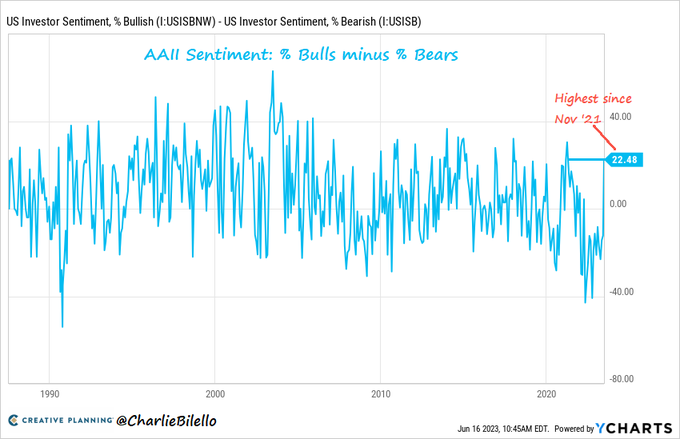

- Charlie Bilello@charliebilello – June 16 – October 2022 lows: S&P 500 below 3,500 & Bears outnumbered Bulls by 36% (AAII Sentiment Poll). Today: S&P 500 above 4,400 & Bulls outnumber Bears by 22% (highest spread since Nov ’21). It’s counterintuitive, but investors get more excited as prices rise, the opposite of how… Show more

And

- Via The Market Ear – GS goes bearish….? 1. “We see a much higher-than-average chance of a 5% SPX down-move over the next month. 2. Continued weak ISM new orders suggest a weak outlook among US manufacturing managers. Also, the decline in FCF yield of S&P 500 companies shows that they are in a weaker position to weather a slow economy in the context of higher interest rates. These variables have statistically proven to be significant indicators of elevated downside asymmetry for equities. 3. While our estimate of the probability of downside asymmetry over the next month is in its 99th percentile vs the past 27 years, put prices are only in their 20th percentile. Result: The gap between our expected probability of downside and put prices is in its 100th percentile vs the past 27 years“. (GS derivs)

Naturally, with the tone of this article so bearish, you have to be ready for a bull thrust towards 4,500, at least 4,450. One reason – look what the U.S. Dollar did last week – down 1.2%.

5. Father’s Day

A a truly heartfelt sentiment that honors that amazing species called Fathers:

- Ryan Detrick, CMT@RyanDetrick – This is the sixth #FathersDay without my Dad. If you are lucky and still have your Dad, enjoy it and don’t take it for granted. Love you, Orvie!

Send your feedback to [email protected] Or @MacroViewpoints on Twitter