Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we clude important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Last week

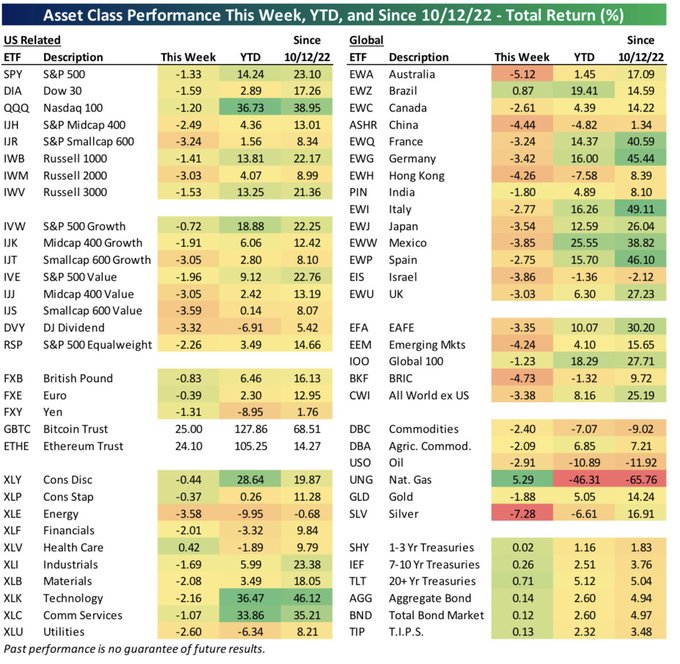

Again a Bespoke tweet tells much of the story:

- Bespoke@bespokeinvest – Sat – About the only thing up last week was natural gas and Treasuries. Read our weekly newsletter here: https://bespokepremium.com/interactive/posts/think-big-blog/the-bespoke-report-newsletter-6-23-23-who-do-you-listen-to

That brings us to what we said might lead to a rally at the end of last week’s article:

- “One reason – look what the U.S. Dollar did last week – down 1.2%“

And the U.S. Dollar is what Bespoke missed in their chart & their comments about natural gas & Treasuries. Yes it was UP 1.2% last week. If you want to see what a strong U.S. Dollar can do to global assets, look at the right hand column in the above Bespoke chart below the title Global ETF.

All the asset classes & markets recommended by well known in the “Buy overseas not in US” crowd were down hard last week – EEM, EAFE (Europe) & specifically China, Germany, UK all down hard.

She did not highlight what Bob Michele of JP Morgan had told her that ECB’s rate hike would be regarded as Trichet’s last rate hike in 2008. But she did highlight what is probably today’s most-mismanaged land east of America & west of Ukraine:

Anastasia Amoroso used the UK example to to highlight “how the Fed has actually done a good job of getting ahead of the curve finally“. This, she added on Bloomberg Open, “will give the Fed the opportunity to pause over time“. What does it mean for US equities? Ms. Amoroso said “investors seeking to allocate to global equities are going to continue to prioritize US equities“.

But are the Fed hikes going to drive the U.S. economy into a recession too? Look what smart & outspoken Francis Donald said on CNBC Exchange on Tuesday June 20:

- “ … we have 70%-80% chance of recession in the second half of the year …. even thought my models tell me that – move away from the big R-word; recession or not is not the story; the story is that we are going towards a growth slowdown; … whether we are growing at +0.1% or -0.1%, whether that triggers a recession call or not, it should not change the way you are looking at the economy – slowdown ahead, problematic fundamentals – they are not great for risk assets …. every single leading indicator is flashing red“

What does the main R-man say? Just look at his tweet below & read his memo. Especially look at his charts:

- David Rosenberg@EconguyRosie – June 20 – I keep getting asked what this current market and macro environment reminds me of. The answer is simple: the 1999-2000 period, that was followed by the 2001-2002 fundamental downtrend in equity valuations and bond yields. Read my latest memo below: https://web.rosenbergresearch.com/memo

Speaking of equities, what does the OptionStrategist say?

- “When $SPX broke out over 4300 on June 9th, a strong rally was unleashed. Perhaps that rally got carried away, as several indicators moved into overbought territory, and the Index itself traded above its +4sigma “modified Bollinger Band” (mBB). That exhausted a lot of buying power it seems, and now the Index is pulling back.

- There is still support at both 4300 and 4200 on the $SPX chart. A decline below 4200 would be quite negative and would indicate that perhaps the whole upside breakout was a false move. Otherwise, any pullback towards those support levels can be thought of as a normal pullback after a breakout.

- Equity-only put-call ratios are quite overbought, but have not yet generated sell signals. But the fact that they are so low on their charts indicates that they are overbought, and they are near the areas from which sell signals have emanated in the last couple of years. Breadth has been terrible this week. That has canceled out the previous breadth oscillator buy signals and instead generated breadth oscillator sell signals.

- In summary, we are maintaining a “core” bullish position because of the positive nature of the $SPX chart. We will trade other indicators’ signals around that core position.

We began with Bespoke. Why not end with Bespoke as well?

- Bespoke@bespokeinvest – Sat – Hard to get too bearish until support levels start to break down. As of now the August 2022 highs haven’t even been tested. Read more on the current technical setup here: https://bespokepremium.com/interactive/posts/think-big-blog/the-bespoke-report-newsletter-6-23-23-who-do-you-listen-to

2. Positive Views & Negative Views

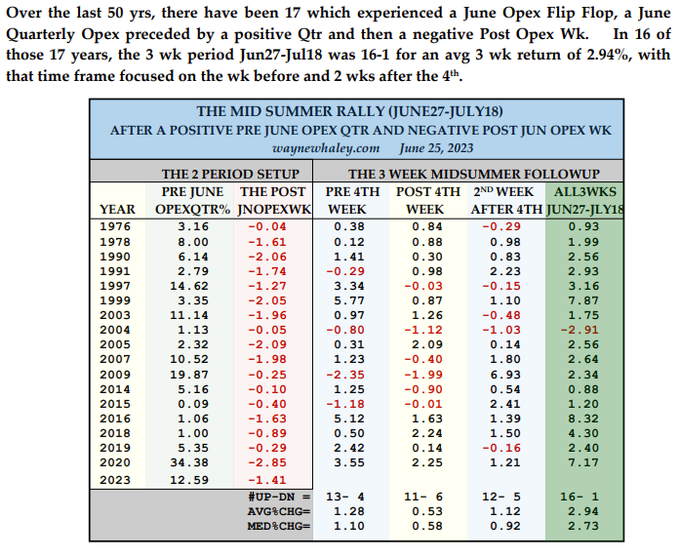

- Wayne Whaley@WayneWhaley1136 – Jun 24 – A 16-1 Mid Summer Rally Courtesy of the June Opex Flip Flop

And a fundamental view that recognizes the stock market is way overbought but feels this year will be good for investors:

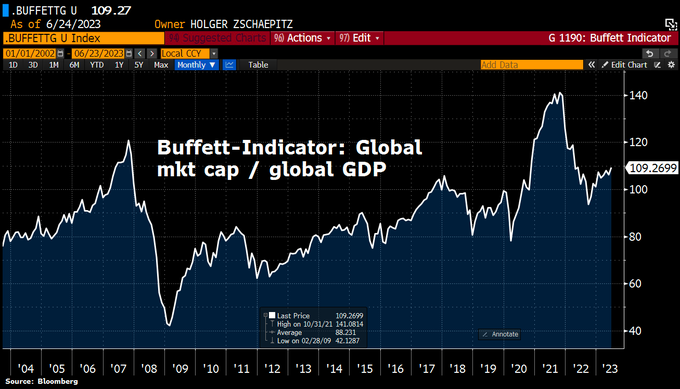

Mary Ann Bartels is a big name indeed. But even she would agree that Warren Buffet is a bigger name:

- Holger Zschaepitz@Schuldensuehner – Sat – The Buffett crash indicator is sounding the alarm again after stocks have soared too much this year. Global stocks are now worth more than the global GDP.

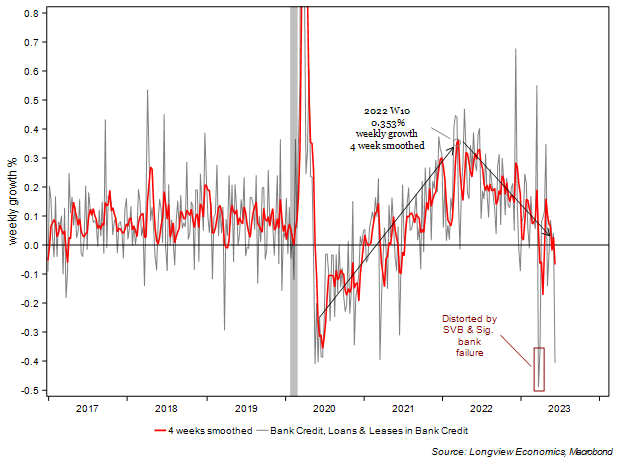

Since credit has something to do with stocks & since Longview Economics proved prescient with their QQQ sell signal,

- Longview Economics@Lvieweconomics – Sat – Last week saw the weakest weekly growth in credit in the US since SVB assets were taken out of the calculation.

Yes, but can you get negative without a volatility event?

- Otavio (Tavi) Costa@TaviCosta – Sun – Disconnected. The year-over-year change in the S&P 500 is now diverging from the ISM New Orders index. Note that the last time this happened it preceded the volatility event we had during the March 2020 crash and recession.

3. Horrible State of Reporting on India on Fin TV

What happened this week was the most substantive joint venture in US-India history. See our adjacent article The Critical & Pivotal aspect of the Biden-Modi meeting & trip for a detailed look at it including the historical issues. It might help you understand why Jeff Gundlach says India will be a great market for the next 20 years.

Now think about how CNBC US & Bloomberg Asia covered this trip. The CNBC coverage was essentially racist. They seem to imagine that an Indian heritage reporter is the right one to cover this event despite what we see as her utter & total ignorance of US-India issues. And Bloomberg Asia (Heidi + Sherry Ahn) actually exhibited bigotry against Hindus in our opinion. That, in itself, is not surprising given who runs Bloomberg.com. But why have these two discuss US-India when they do have a sensible anchor like Rishaad Salmat?

Send your feedback to [email protected] Or @MacroViewpoints on Twitter