Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we clude important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.”birth of the new“?

Is the Fed about signal an end its rate hiking campaign? If it does, will it mean the “birth of the new” analogous to the end of the 1994 aggressive rate hiking campaign and the renaissance of 1995-1998? Such a “birth of the new” was laid out by Jay Pelosky on Bloomberg Open on Wednesday:

- “… currently every volatility index across all assets are at one-year lows; we believe we were thru COVID, we are thru, as of next week, the rate-tightening cycle led by the Fed & we are approaching … the birth of the new & the new is consistent with the Biden de-risking; it consists of a new inflation target regime at 3% type inflation; the end of yield-curve control in Japan which is super-bullish & the shift of domestic demand driven growth in China from export & fixed-asset growth … there is a lot going on & much of it is quite positive …. “

- “… when there is smoke, there is fire …. the cyclical sectors are already starting to move in the US; they are sniffing out the fact next week not only will the Fed go on hold or pause but we believe Fed is at the end of the rate-hiking cycle given where we expect inflation to be at sub-4% with the June report in July; more importantly the Fed is going to update their economic forecast & what that is going to do is … increase their GDP estimates for this year & next year and that is going to signal the end of recession risk …. that takes us over 4,300; we have $6 trillion in money market funds; so much ash on the sidelines, rotation is already underway; transports just broke above their 2–day mv; cyclical sectors starting to work ; markets are forward looking mechanisms .. its already under way“

No recession in second half of 2023 or 2024; end to Fed rate hiking and increase GDP estimates for late 2023 & 2024. That is what late 1994-1995 was like & it was a beautiful time.

On the other hand, Barry Knapp said on CNBC Exchange on Tuesday that “the probability of recession is much higher in mid-2023 that it was in 1994 because the yield curve is now 100 bps inverted ; the banking system is in a much more tenuous situation...”. In addition, Knapp said “we are going to have another extreme liquidity climate change storm… we are about to have one of these violent storms; we will probably have a risk-off episode“.

And this liquidity climate change will be the result of the Debt Ceiling passed already. He explained “the pressure on the banking system is going to build … I suspect by the fall, bank reserves will fall from their current reserves of $3.2 trillion to about $2.7 trillion; that will lead the Fed to potentially stop QT… “.

How do investors hedge against this liquidity shock? Knapp suggested going long equal-weighted S&P vs. Cap-weighted S&P.

We confess to being upset with Kelly Evans. It is clear that she really didn’t understand what Barry Knapp was saying & instead of letting him continue, she felt the need to show her presence with some inane comments that just revealed her lack of knowledge. It also stopped Barry Knapp from explaining what he called the Fed’s trilemma.

Barry Knapp didn’t discuss whether he expects a recession or not. In contrast, Lakshman Achuthan didn’t mince any words while retaining his usual gentle manner on Yahoo Finance. He pointed out that “services & consumer spending typically are OK as a recession starts and it only slows down to around zero inside a recession “.

Achuthan reminded viewers that “it was July 2008 – 3 quarters inside of the great recession – when there was a negative GDP print“. So what is his prediction?

- “our expectation is we are still looking at a hard landing scenario; it is still coming; …. we may have slipped into a recession at the end of last year or at the beginning of this year …. we just have to see jobs start to go; first we are seeing work-week going; lets see what happens with jobs… ”

Is there any one in investing who has not heard of Druckenmiller? We recall there was a time when he used to pride himself in not saying much on TV and especially not giving away much of what he was doing. Today’s version seems more lucidly expressive about what he thinks. Of course, all he said to BTV’s Sonali Basak was that he really doesn’t see any fat pitches. He did say however that “I am more worried about growth than I am of inflation“. What he said about the possibility of hard landing should be heard or at least read by all:

- ” … the fact that it hasn’t happened yet doesn’t change the probability of it happening or if it does happen about the depth of it … I would actually argue since it has taken so long the Fed has ended up with a higher terminal rate & in fact, inflation gets stickier the longer it stays in the system; … it increases not decreases the probability of a hard landing … “

After the references to 1994-1995, 2008 and so on, how about a reference to what we saw in 1991-1993 – a hard default cycle without much impact on the GDP. She didn’t specifically allude to that but look what Dawn Fitzpatrick, CEO of Soros Asset Management said at the Bloomberg special:

- “you could have a really big default cycle without GDP rolling over“

She explained:

- “credit contraction is invariably coming; banks will be able to loan less; 70% of leveraged loans have been bought recently by CLOs; CLO issuance right now is at 2020 levels; typically CLOs have a reset where they can expand duration; …. now with higher rates those resets don’t make sense … ; you are going to see a default cycle that is about to emerge the magnitude & more interestingly the duration of which is going to surprise people; … this is going to take a really long time to play through; …. you could have a really big default cycle without GDP rolling over ”

2. A Cycle view of Stocks

Jim Cramer did discuss some of the points of Larry Williams in his Off the Charts segment on Tuesday, June 6. We could discuss that or we could go straight to a more detailed discussion by Larry Williams himself. We urge all to watch the 28-minute clip below titled Market Correction is Coming. The chart work is necessary to understand the discussion & Mr. Williams is articulate about what he sees & expects:

Both his long term & short term cycles make his say “right now, I don’t want to buy stocks like crazy because the most significant move should be down – rally into the middle of June & then a pullback; intermediate term traders might want to take profits in this rally “. He says a better buying opportunity might come around end of July & first part of August. At the end of the clip, he discusses his views on TSLA, Moody’s, Apple & Microsoft.

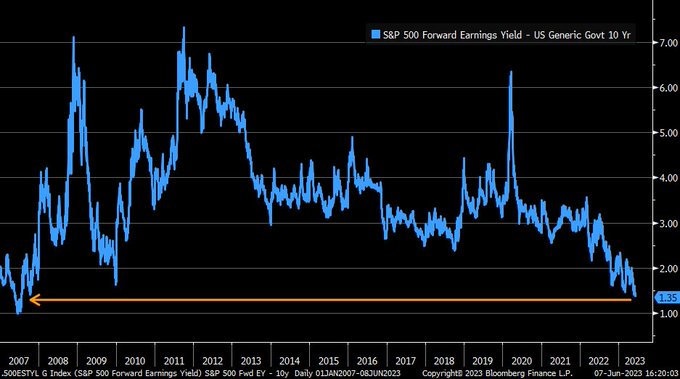

We get that the term “cycle” is a technical term and we are not smart enough to understand it the way the gurus do. Remember how David Tepper used the S&P forward earnings yield vs. the 2-year Treasury yield to call for stocks to go up several years ago. He called it an indicator or signal. Whether this comparison is a “cycle” or not, below shows where we are today. Could some one ask Signor Tepper whether the below should be deemed as bearish for stocks?

- Liz Ann Sonders@LizAnnSonders – June 8 – Spread between S&P 500’s forward earnings yield and 10y U.S. Treasury yield has fallen to lowest since mid-2007

Individual investors have turned bullish. Just look at:

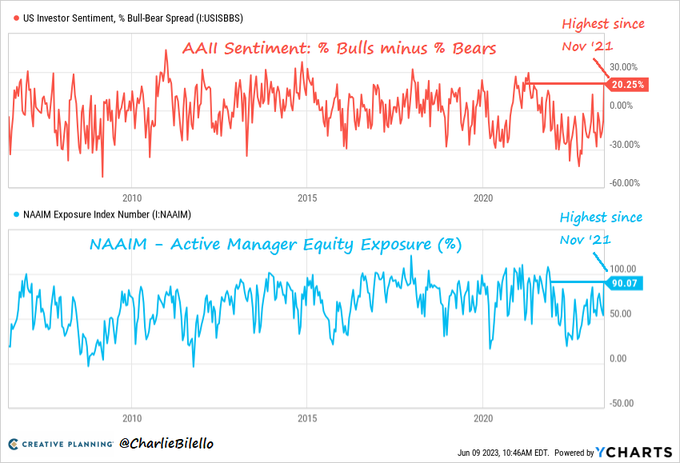

- Charlie Bilello@charliebilello – After a 24% S&P 500 rally off the October lows, US equity investors are finally getting bullish again: -AAII Sentiment Poll: Bulls exceed Bears by 20%, most since Nov 2021. -NAAIM Active Manager Exposure: 90% net long, highest since Nov 2021. $SPX

But the charts above are of bulls only. Any chart of bulls vs. bears?

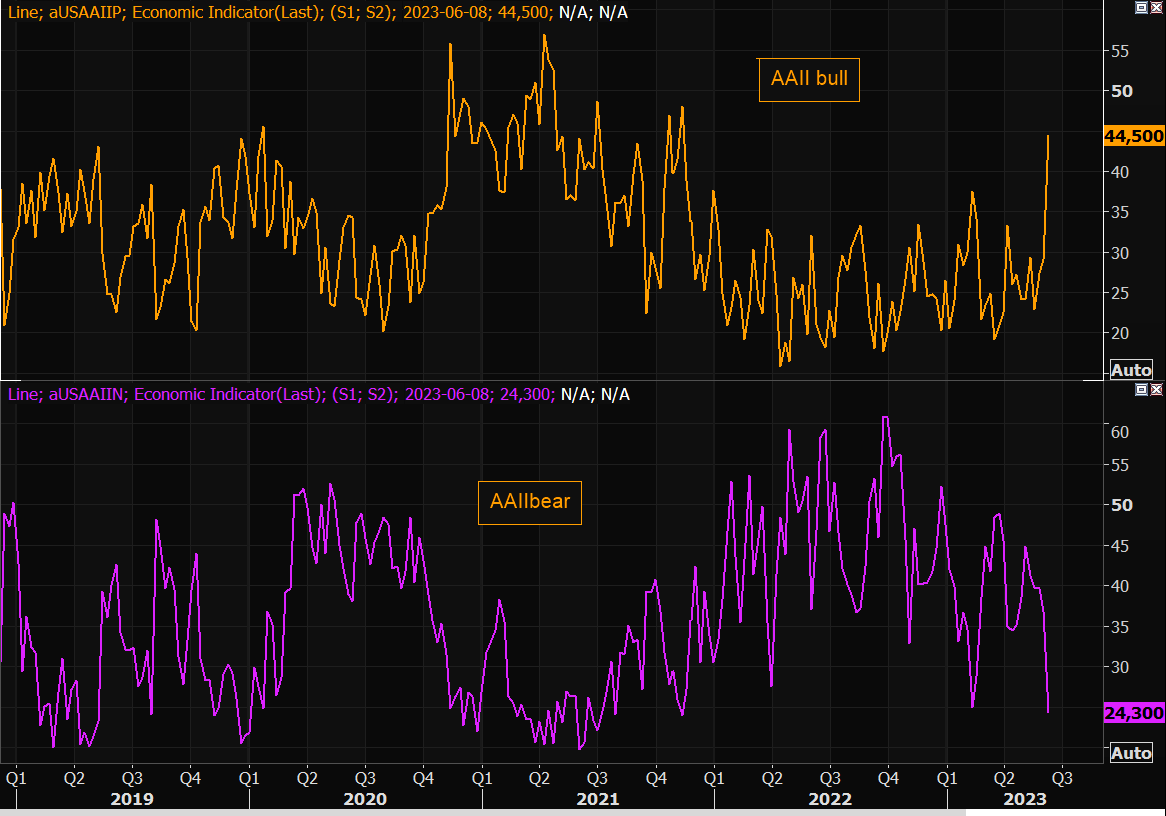

- Via The Market Ear – Sat June 10– Massively bullish bulls and evaporating bears – We have been waiting for this exuberance to kick in and here it is. Latest AAII bulls showing a huge spike, and bears throwing in the towel. Source: Refinitiv

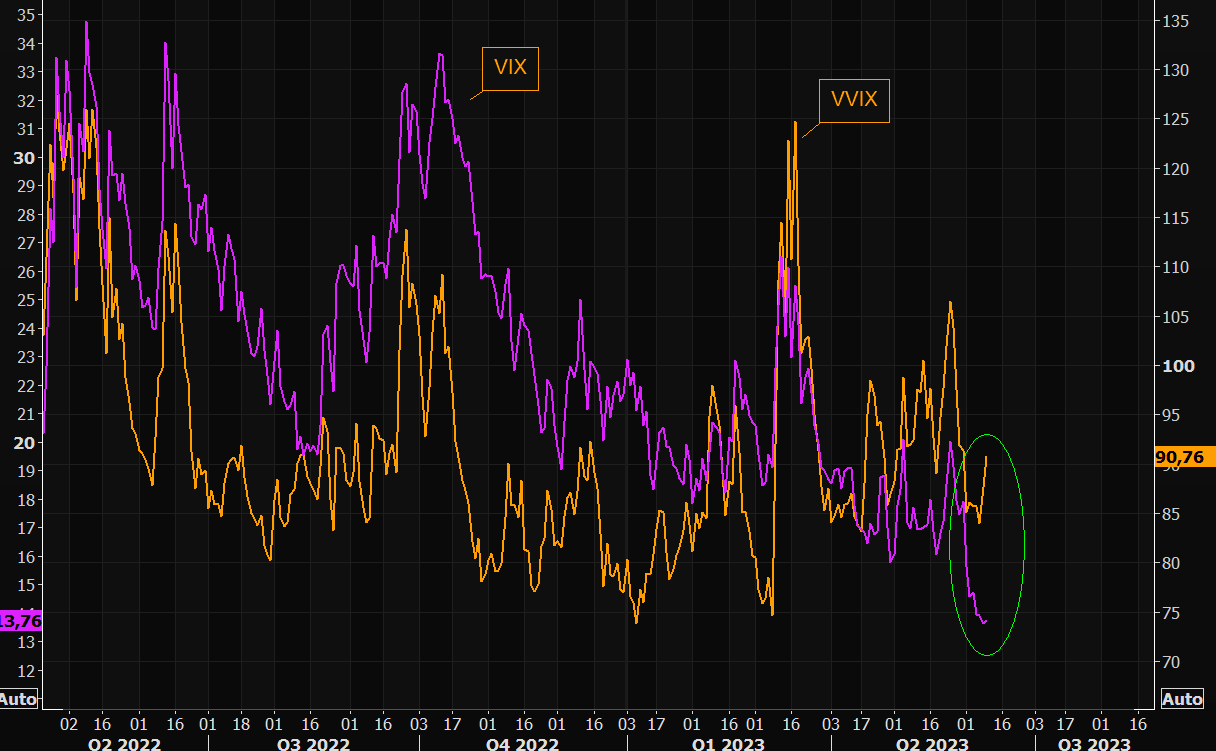

OK but is there a quant-type signal that might be pointing to a trade?

- Via The Market Ear – Friday June 9 – Widening further – The VVIX vs VIX gap getting wider today again…Pay close attention. Source Refinitiv

Double OK but does any one actually say Sell?

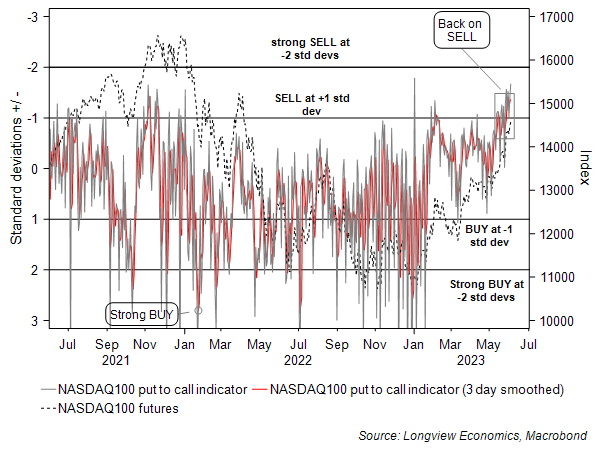

- Longview Economics@Lvieweconomics – Tue June 6 – Low levels of put protection for the NASDAQ 100 at the moment…a pretty accurate short-term SELL signal over the past few months!

3. Go Straight or Turn About?

Next week is mucho big with CPI, FOMC + Powell presser and then Jobless claims. Each is important but together they can say drive on or change direction. We have no clue which one it would be. So we are content to wait.

4.”Will of God” or “a faster gun“?

A couple of weeks ago, we wrote about the unique 7-iron shot from the top of a nuclear submarine onto the green on land from the film Down Periscope. Today we point to a classic film unveiled in YouTube’s new “free with ads” list of films. There are many like CNBC’s Phil Griffeth who say that The Magnificent Seven was Yul Brynner’s best role. We disagree.

But before we get to that, we want to highlight a trait of men that every woman considers as nuts, at least every woman we know. This trait was also the standard practice in the settlement of the West. Tom Chantry, the main character in North to the Rails book of Louis L’Amour, had come west to buy cattle. In a drinking establishment he rubs against a drunk cowhand & that leads to a quarrel. Chantry is unarmed & so the drunk, now totally sober, tells him to show up on the street at dawn with his gun. Chantry thinks it is nuts to put his life & his venture at risk for a stupid gunfight over a drunken brawl. So he leaves town to go his meeting to buy cows. But no one wants to deal with a man who has refused to fight. Eventually Chantry shows his “manhood” against a real opponent & then he is able to resume his purchase.

That brings us to a similar incident in Taras Bulba, a classic of all classics type film about events in the 16th century. We first read a Marathi translation as a school boy & then watched the 1962 film Taras Bulba starring Yul Brynner as Taras & Tony Curtis as his son Andrei.

In a wild drunken party that signals the invitation to go to war, Andrei starts debating the wisdom to siding with the Poles in the war. In that debate, a old & respected Cossack says to Taras “it looks like you raised a coward“. The atmosphere chills instantly when Andrei coldly replies “that can only be proven by the will of God“. His younger brother says to Andrei “Its only a word. You can’t die over a word“. Their mother goes to Taras Bulba & begs him to stop this. Taras replies “There are words men must die for. We will ride to the gorge at down“.

Unlike the American west, such disputes were NOT settled mano-a-mano. They were settled by what they deemed as the will of God. The two men had to jump over a deep gorge in both directions until one with his horse misses the jump and falls into the gorge. Watch this from minute 56:00 to minute 1:01:38 in the Taras Bulba film on YouTube. Seriously watch this scene if only to watch the emotions of Taras & his wife as they watch their son jump over the gorge 4 consecutive times.

Later on, Andrei falls in love with a Polish girl of noble class & she with him. To protect her from a siege by his father & the Cossacks, Andrei joins the Poles & comes out with the Polish army to fight his father’s men. After the initial shock, Taras asks his soldiers to isolate Andrei & bring him face to face with Taras. The dialog is as ancient as the tale of father vs. son in cause vs. love:

- Taras – My son. Why? Why?

- Andrei- I did what I had to do.

- Taras – From the day I plunged you in the river to give you life, I loved you as I loved the Steppes. You were my pride. I gave you life. It is on me to take it away from you.

Watch a 1:37 minute clip of this scene in French below – Magnifique , as a comment says:

Taras shoots his son in the heart. And then goes on to lead a massacre of the Polish army to capture Dubno & make it a Cossack city. If you watch the film, you hear the Cossacks yell “Zaporozhtzi” as they ride. For the first time, we noticed the term and looked it up.

The term is used for Cossacks of Zaporizhia, a town on the eastern side of the Dniper river in Ukraine. Yes, the same town that has the nuclear plant that has been shelled in the current conflict. And Dubno, the city Zaporizhian Cossacks captured in the film is located in western Ukraine near the Polish border, some 370 km from Kiev. A similar battle is raging today in the same area of Ukraine with Poland hoping to march into Western Ukraine to rebuild they had in the 16th century. Sad how history seems to repeat itself.

All this apart, this is a great film, the best film of Yul Brynner. And we watched it again thanks to YouTube’s “free with ads” product.

Send your feedback to editor.macroviewpoints@gmail.com Or @MacroViewpoints on Twitter