Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we clude important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.To “Coach Daly, Bob Michele, Jim Cramer & Carley Garner” add the following ….

Last week we wrote:

- “Remember how the Chuck Daly dictum suggested buying Treasuries in June-July! Cramer said, according to Ms. Garner, that Treasuries rally hard in July & August. Could Coach Daly, Bob Michele, Jim Cramer & Carley Garner be all wrong? Perhaps but we would still bet on them”.

Not only will we still bet on them, but we also found others who agree with our above list of mahaa-jan. But before we get to them, allow us to make it clear that we are NOT making a call on recession later this year or early next year as a basis for buying TLT or similar Treasuries. We do think and have always feared a 2007 type second half of this year BUT we also remember a nearly 10% TLT rally in July 2006 which ended in November-December 2006.

Now look at the 10% TLT rally from July 2007 to November 2007 and recall that NBER recession began in November 2007:

The two TLT rallies took place in different economic environments & were mainly based on extreme anti-Treasuries positioning. That is the case now as we pointed out last week in discussing our rationale.

Now to the other mahaa-jan beginning with Meghan Swiber, Director of US Rates at BofA and Tony Crescenzi, the wise sage of Pimco, on Bloomberg Real Yield on Friday 1:00 pm:

- Meghan Swiber – what we see borne out in history is that you really want to be buying the last hike of the cycle, particularly further out of the curve; So we do think going long tens, as we nearing the Fed’s final hike, makes a lot of sense. You usually see the 10- year rate rally around 100 bps or so in the 12 months after the Fed has delivered that final hike. Markets right now are only pricing about a 10 bps rally or so. So we think that those long positions are well served, but important to be putting them further out of the curve; … re front end, there are a lot of question marks around how long the Fed is going to stay on hold. But the market is pricing a full 25 bps cut by the first quarter of next year. So we do think that there’s more room for the curve to invert further. We like being long, further out, but we do think that ultimately the cuts priced in right now are largely overstated.

Note that her case for buying 10-yr Treasuries (equivalent IEF) is NOT based on Fed cutting rates in 2024 as the market is pricing now. So why buy now when 6-month rates are so tempting, tempting even for CNBC’s illustrious stock hedge fund manager Karen Finerman?

- Tony Crescenzi – we would agree with Meghan; …. blink and you may “miss the next big bond rally“. So the time is now for total return style of investing to get the gains that Meghan suggested could occur because of the move of 70 – 80 bps in the 10-year instrument means a lot in terms of price gains. You never know when that might happen & for what reason. Now is the time and history has suggested when the Fed is about to be done with its rate hike cycle; That is the time to be investing in longer maturities

This is the message Gary Shilling drilled into every bond investor for the last 20 years or so – don’t buy long maturity Treasuries (TLT/EDV/ZROZ) for the yield but buy them for the capital gains these Treasuries deliver. Just look at the two charts above. Getting 10% capital gains (plus the interest) in five months from July to November is attractive, isn’t it?

Just for the record, those who bought 25-year Treasury zero coupon bonds in July 2006 & held them until selling them in December 2008 (after the payroll report) made 60% capital gains & those who bought the same Treasury zeros in July 2007 and sold them in December 2008 made 40% capital gains. That is why we keep reminding CNBC’s Scott Wapner to recall what Gundlach told him after the last FOMC Powell-presser – that Treasury zero coupons could deliver 40% returns.

A big difference between 2006 & 2007 was that corporate credit began falling fast in July 2007 causing Cramer’s “they know nothing” rant in August 2007. But corporate credit is doing fine right, despite all the crying about the inverted yield curve? Clearly we are going to get a soft landing, right? And who cares about credit in a soft landing?

Someone like Amanda Lyman, Head of Credit Macro research at BlackRock, who said the following on Bloomberg Surveillance on Wednesday, July 19 beginning at minute 1:33:40:

- ” … companies are saying they will need these reserves even if there is a soft landing; reserves even if we get a kind of OK outcome; that is true for areas like leveraged loans, like commercial real estate – we are in the early innings of that distress cycle ; what’s really challenging is that there is going to be a new sense of price discovery … … we don’t see recession as a necessary ingredient for an uptick in defaults; so similar to how these banks are talking about will be these commercial real estate reserves even in a soft landing … I think enough damage has been done in the cost of capital environment… that we will see an uptick in defaults regardless; ”

Ahh! “cost of capital environment”!!! Meaning 500 bps of rate hikes, massively inverted yield curve or both? If you want to experience a real chill even in the current heat wave, listen to Ms. Lyman talk about Class B properties becoming Class C properties & Class A properties becoming Class B properties. Listen to her and see if you hark back to when A tranches of CLOs were downgraded followed by AA tranches getting downgraded & finally AAA tranches getting downgraded leading price of destruction of AAA-rated CLOs.

Think what gains your TLT (or better ZROZ/EDV) positions will deliver if we get a repeat of even 25% of the downgrades we saw in that never-again CLO crisis. A little bit more than Karen Finerman’s 6-month T-bill we think.

But that’s hogwash, right? We just saw JPMorgan and the banks deliver gung-ho performance, enough for Mr. Detrick:

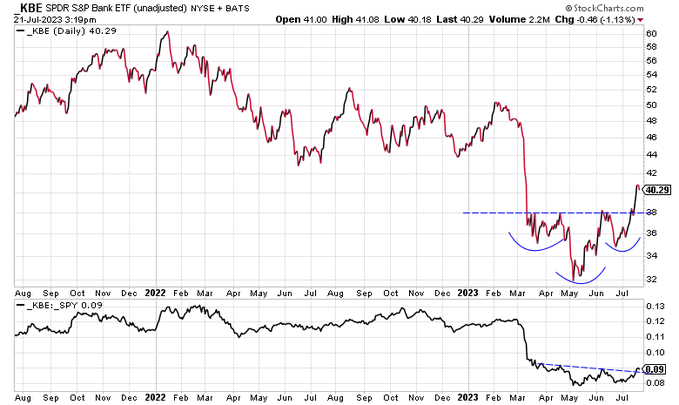

- Ryan Detrick, CMT@RyanDetrick – What is your favorite chart this week? – I’ve gotta say banks breaking out and making new relative strength highs is up there for me.

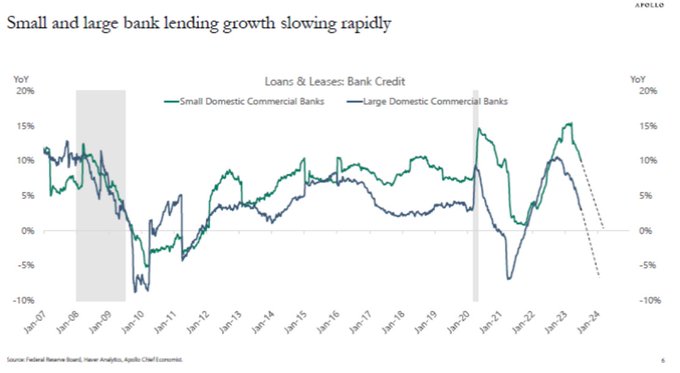

Do the banks not need or not want loan growth, especially given the inverted yield curve? That’s the one way the following could be deemed positive for banks:

- Lisa Abramowicz@lisaabramowicz1 – Jul 19 – Loan growth is slowing rapidly at both large and small banks, Apollo’s Slok notes. He expects loan books to keep shrinking.

Now a question that we would like an answer to:

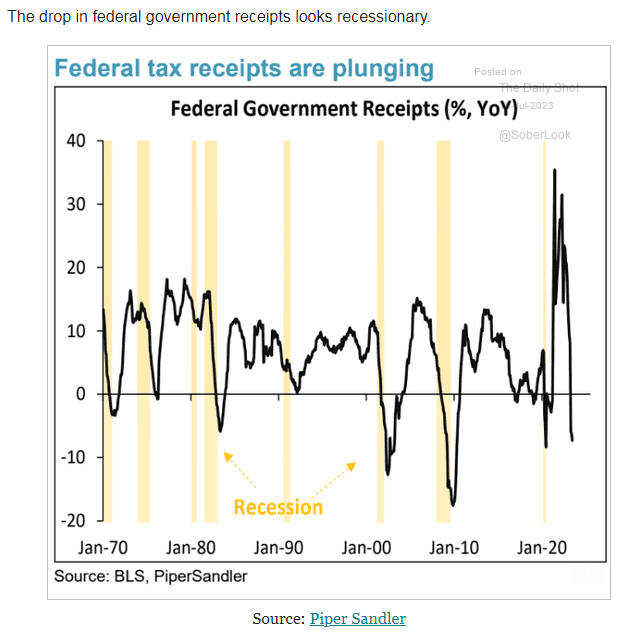

- Gary Haubold@GaryHaubold – Anyone know why Federal tax receipts are in free fall mode? Not a sign of economic strength, I don’t believe. From @SoberLook & Piper Sandler:

Does the following provide an answer?

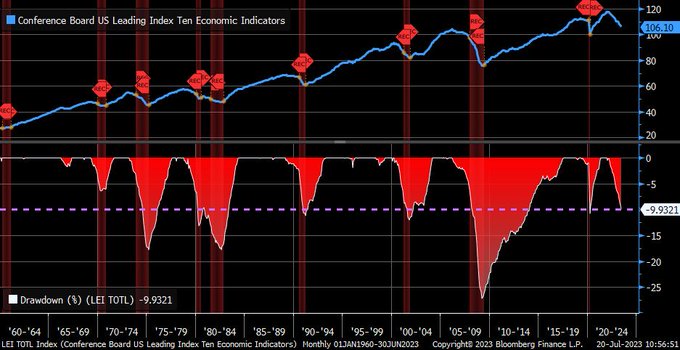

- Liz Ann Sonders@LizAnnSonders – Decline for @Conferenceboard Leading Economic Index (LEI) in June brought max drawdown to -9.9% … going back to 1960, index has never seen this magnitude of decline without already being in recession

If we are “already in a recession”, then we all must run into ZROZ/EDV/TLT right? But even if we are NOT in a recession & the LEIs are old & antiquated stuff, isn’t it a basic investment dictum to, at least for a trade, fade the overly embraced & try out the utterly discarded?

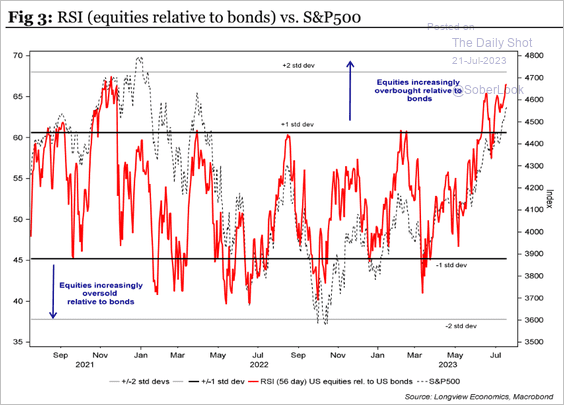

- Jesse Felder@jessefelder – ‘Stocks are very overbought relative to bonds.’ https://thedailyshot.com/2023/07/21/us-economy-will-expand-well-below-its-growth-potential/ via @SoberLook @Lvieweconomics

Going back to Ms. Meghan Swiber on Bloomberg Real Yield, note that she is NOT depending on “a material downturn in growth” for her call to buy long maturity Treasuries:

- “so the curve inversion is really telling us this message about this expectation for the Fed to be cutting. … The Fed could be cutting this time, the market is actually reflecting along side inflation moderating very quickly. … the market is pricing not only this perfect storm of inflation falling right now but that continuing over time and the Fed operating at a policy rate as will be cutting alongside moderating inflation not these cuts alongside a material growth downturn“

Kudos to Ms. Katie Greifeld of Bloomberg for managing this conversation so well.

PS: Since Mr. Detrick likes “banks breaking out”, we thought he might like to take a look at the below:

- Joe Kunkle@OptionsHawk – Jul 19 – ICICI Bank $IBN hot late with 4450 January $24 calls bought $1.55 to $1.70, big weekly breakout

2. Stocks

No one can question the tremendous momentum behind stocks & that momentum does suggest that all time highs might be ahead. If this year is like 1999, then we will know it soon. If so, forget everything we have written and go way long the high flyers after this dip is over.

Now look at 2006.

Watch out for a higher mid-August low than a mid-late July low. Sell any TLT you bought by November & enjoy. No recession here by definition. Remember Greenspan did begin raising rates in 2004 and continued into 2006.

Now look at 2007:

Credit started weakening in July & the economy did slow down. Then the S&P rallied because you always buy stocks after the Fed realizes its mistake? We do recall the 10% + S&P rally to a new all-time high in October 2007.

Even if the recession has already begun as Liz-Ann Sonders wrote (see above), the realization that the Fed gets it WILL, we expect, lead to a strong rally to a new all time high. The big question is what follows that? It was easy for us in October 2007 because Mr. Larry Fink came on CNBC & told Maria Bartiromo that we were in a bubble.

Will we know what to do in October-December of 2023 and, if so, how? Stunning as it sounded, Steve Liesman said on CNBC that he is now worried about getting a recession since no one expects it & everyone is focused on the sweet soft landing that is now the consensus.

Actually not everybody as Kathryn Rooney Vera told CNBC’s Brian Sullivan (minute 4:17):

- “the soft landing is 100% discounted in the market and I would put the probability on it not actually happening; I would prefer to be defensively positioned in a market that is trading expensive … my suggestion is to put on defensive positions, buy cheap puts – the market is exuberant; there is a high level of complacency; so protect your positions & stay long risk … “

How about buying some TLT Calls, Ms. Vera? That would protect your stocks & you would be long risk, rates risk. Just saying our bit.

Interestingly, we also saw the below:

- Helene Meisler@hmeisler – Folks started liking staples again this week. And some drugs.

Do you think the conviction about a soft landing was the basis for the broadening rally in the stock market? If you do, read the below:

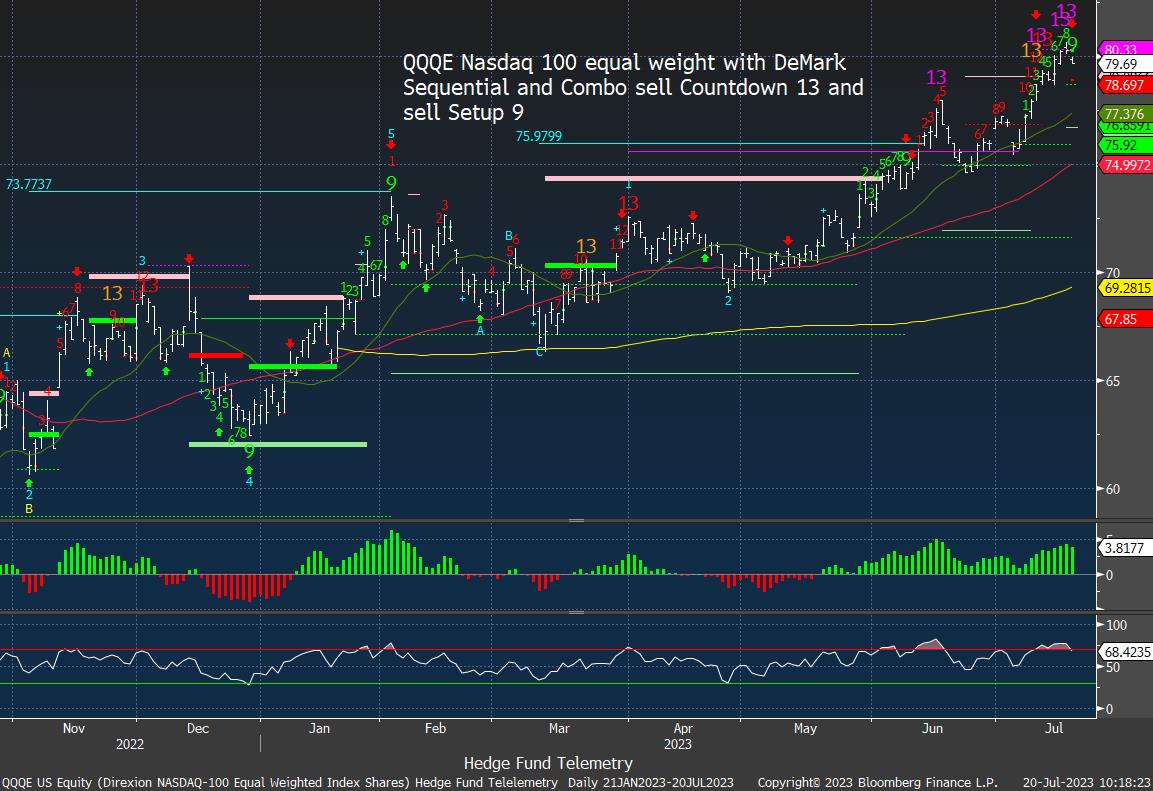

- Thomas Thornton@TommyThornton – July 20 – Broadening out might be done. $IWM (sold this yesterday in anticipation of DeMark Sequential 13) $QQQE $RSP $VTI

What if the market reduces the probability of a soft landing? Meaning raises recession odds. What stocks are likely do well in that scenario especially after a downturn into August? Stocks that almost are guaranteed to deliver free cash flow & earnings, stocks that have a strong defensive positions & fundamental growth? Microsoft, NVDA, Netflix, Meta, Google types Or CLF, CAT, FCX, Banks, Industrials? Our guess is the former! After all,

- David Rosenberg@EconguyRosie – It must be a new era when JB Hunt declares that we’re in a ‘freight recession’ at the same time as the Transports make a new high.

Then Carter Worth of CNBC Fast Money said Transports will lead the S&P down.

3. Another scenario that might keep the Fed awake

Like the consensus, we do feel that the Fed will raise rates by 25 bps this week. No less than the Divine Bernanke said that would be it. If the Fed kinda suggests that, how would the markets react? Interest rates might fall hard & the yield curve would steepen? Stocks might rally and so might Gold?

But what if the Fed actually thinks like Neil Dutta?

- “there is a lot of disinflation in the pipeline at least say next 3-4 months ….most obvious is used cars … supply chains are improving … there is some disinflation with respect to shelter …at the same time, we know labor markets are holding up … that’s going to support real incomes … & if real incomes are rising, ultimately consumers are going to go out & spend that money …. that’s sort of a linchpin why things are holding up … I would define growth recession as a situation where the gdp has a positive sign in front of it; but that growth is not strong enough to prevent the unemployment growth from rising; typically in a growth recession the unemployment rate goes up; effectively a below potential growth rate ; but that’s not what we have right now … there is more upside to the economy than not … which means whatever increase in unemployment rate we see is going to be short-lived… not a situation where we are going to see a 4%+ unemployment rate.. I am sort in the goldilocks for now camp; … I think the risks of recession has decreased dramatically …. we should probably put some more potential on the resurgence of the inflationary boom scenario ….”

As we recall, a “resurgence of the inflationary boom“ is what happened in November 2006. It killed the TLT rally & ignited a commodity-stocks, cyclicals rally that had to be eventually stopped leading to the summer of 2007 & the aftermath.

When was the last time you saw a FOMC meeting & a presser in this level of economic uncertainty & massively high exuberance?

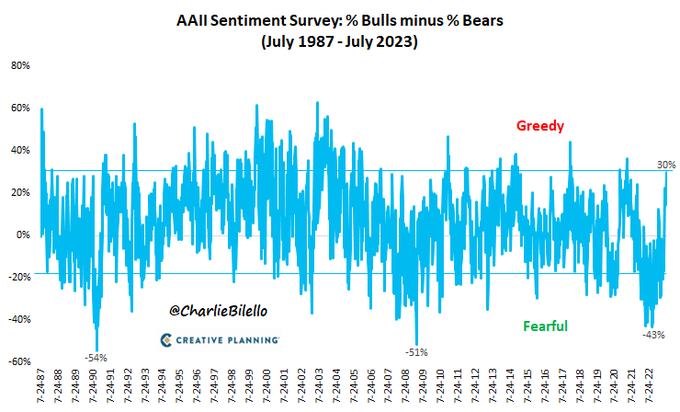

- Charlie Bilello@charliebilello – Bulls now outnumber Bears by 30% in the AAII Sentiment poll, the largest positive spread since April 2021. Last fall, Bears outnumbered Bulls by 43%. What changed? A 30% rally in the S&P 500.

That is sentiment. What about exposure?

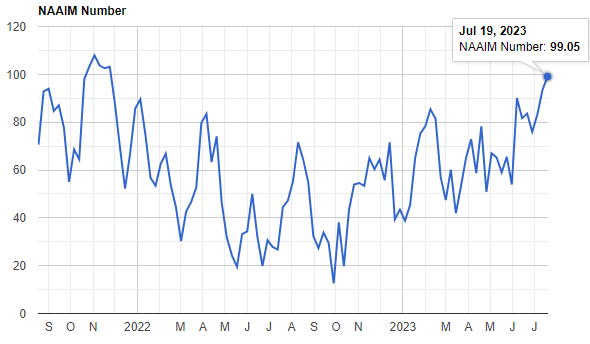

- Daily Chartbook@dailychartbook – Active managers continue adding equity exposure. NAAIM Exposure Index up to 99 from 93 last week. Highest since late 2021.

Let us see how Chairman Powell addresses that.

4. Manipur & selective bigotry?

What happened in Manipur to a few Kuki-Chin women is abominably disgusting. Sadly, it is not limited to Manipur. We hear such public stripping of poor women is common in political India especially in the pre-election season. It reportedly happens in every state ahead of local elections including in the most progressive of states like Maharashtra. All local politics is driven by race & community in India and public shaming of your opponents by public stripping of their women seems to have developed into an electoral practice of intimidation.

This is not a men vs. women issue per se. Women can be even more cruel to women, we hear. Witness, with sincere regrets, the tweet below & the accompanying video published on Twitter:

This is not #Manipur. This is Malda in Mamata’s #Bengal. pic.twitter.com/kgAX37sQa9

— Abhijit Majumder (@abhijitmajumder) July 21, 2023

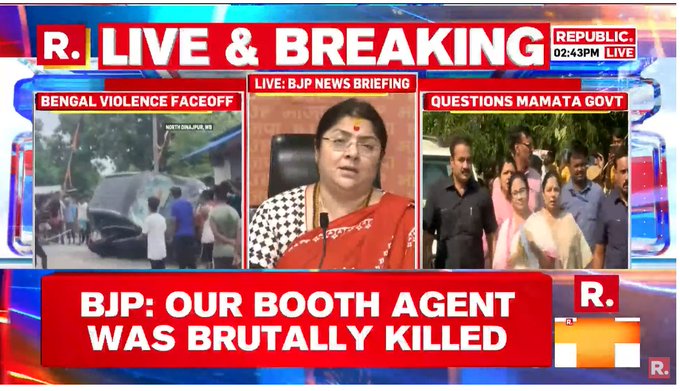

This is in West Bengal, the most anti-Modi state in India, a state with a documented record of murdering political workers of Modi’s BJP party. Notice in the above video, the woman is being shamed by a group of women. That this happens to women in West Bengal is common knowledge but totally ignored by the US & European media. Why? Is it their Nazi-like hate of Hindus or is it their intense mission to defeat PM Modi? And it is not as if killings of BJP Hindu poll workers is hidden from the public domain.

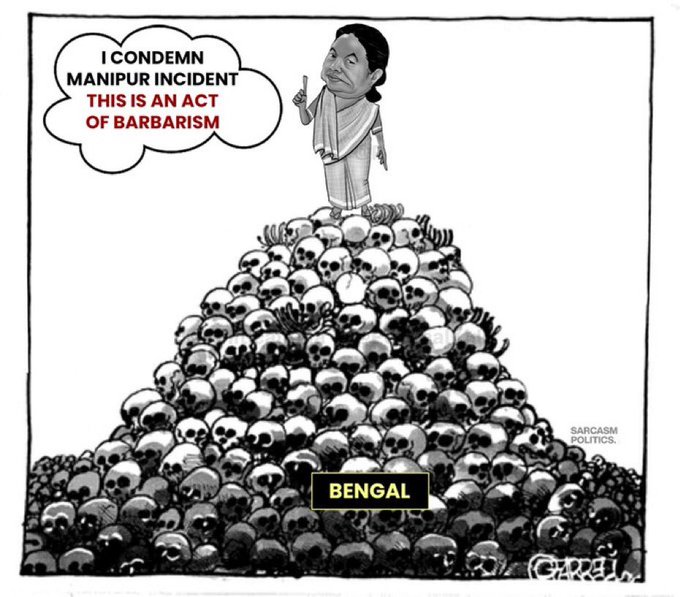

You can find the video of the above lady BJP official on Twitter under the Republic banner. Below is a tweet that shows one public perception of the Chief Minister of West Bengal.

How can this happen under Prime Minister Modi, the all-powerful anti-democrat Hindu leader as the US & UK media calls him? Simple. Violence, especially election related violence, is the province of the State & State law is in the hands of the Police in the States. And this means the state police must do the bidding of the State’s Chief Minister.

Every UK & US news organization that operates in India knows this. BBC must have copious videos of Hindu election workers being beaten up, killed & their women abused in public. Guess to all these “freedom of speech” defenders, defeating PM Modi next year is the sacred mission.

But Manipur & the rest of Northeastern states also have a bigger problem.

It looks like Manipur is evolving into a smaller version of Kashmir. Just like Kashmir was flooded by Muslim migrants from adjacent NaPakistan, just as India’s West Bengal was flooded by Muslim migrants from adjacent Bangladesh, Manipur has been flooded by non-Hindu migrants from adjacent Myanmar.

What is going on in Myanmar? Under the sanctions imposed by US & EU on the Myanmar junta, about 40% of Myanmar youth are unemployed. What have they been doing? Thousands of people have moved across the 400 mile + plus border with India and settled in Manipur & other north-eastern states. As in Kashmir & West Bengal, no one in the Manipur state government did anything.

It has become much worse in recent years, per an article in the Diplomat,

- “… what has happened over the past few years is an explosion in poppy cultivation in Manipur’s Kuki-dominated districts backed by drug cartels and insurgent groups with a cross-border network, resulting in huge loss of forest cover” … A section of these illegal immigrants is being used by the drug and weapon cartels in Manipur,”

And don’t forget about the Human Rights of the Kuki-Chin migrants who argue that poppy cultivation in Manipur is their right regardless of Indian laws.

I promised and here it is. #Manipur is India's Colombia.

This is a drug war and everything else is a distraction.

Kuki lady openly says we want to grow our poppy and harvest them. Poppy is main ingredient for Cocaine & many drugs.

Then Kuki group in the Drug cartel fatigues… pic.twitter.com/KZyWjTIUFD

— Arun Pudur (@arunpudur) July 22, 2023

Why doesn’t this happen in Chinese districts bordering Myanmar? Those, as we understand, are manned by the Chinese army & brutally so. The Chinese army has its own insurgents fighting against the Myanmar junta to keep pressure on the Myanmar government. India can’t do any of that because state law is the province of the local administration & not the Central Modi government and also because having good relations with the Myanmar government is important for India’s Look East foreign policy.

At least this is not a religious conflict like the Hindu-Muslim migrants issues in Kashmir & West Bengal. That may be changing too.

Ask why is the EU & now some MPs from the British Parliament getting involved in this issue on freedom of beliefs basis? Yes, they hate the Myanmar junta & any one fighting the Junta is presumably their ally.

Also, perhaps coincidentally, EU & US Christian Missionaries are at work in border areas of Myanmar converting various groups to Christianity. Their lobbies are now stepping into Indian border states trying to turn this into Kuki-Chin Christian vs. Indian Hindu conflict.

The role of white Christian missionaries in Myanmar is now so well known that there is a Rambo movie about a group of them going into border areas of Myanmar to convert locals. Rambo, working as a local boat charter guy, is requested by a US diplomat to help this group of Christian missionaries arrested by brutal Myanmar soldiers. Rambo does so in the usual manner & hundreds of Myanmar soldiers & local poor are killed in the process.

Below is a 13-minute recap of this Rambo film, a watchable film we might add. Yet, Washington Post, NYT, BBC, CNN & other “media” don’t bother to report on any of this:

Getting back to the media coverage of the public shaming of the Kuki women in Manipur, the bottom line is that, while the abuse of women in Manipur is utterly disgusting, to focus only on that one incident without covering other worse crimes (unless you think killing of male poll workers is far less of a crime than public stripping of women) is heinous or driven by a different purpose.

What can that different purpose be? Remember the Adani tempest? While Hindenburg did all investors a favor by eradicating the crazy overvaluation of Adani shares, the reality is the Adani furor in India was launched & fueled for the express purpose of attacking PM Modi. We think the abuse of a group of women in Manipur is similarly made into an anti-Modi issue even though his central administration in Delhi had nothing to do with the stripping. Both sets of media coverage were funded to try & defeat Modi in the 2024 election.

Why does this continue? Simply because the nationwide Hindu community is just not interested in atrocities on Hindus outside their own state or community. But things are changing, actually thanks to Twitter & other easy forms of access to news Global Television refuses to cover. So far, attacks of this nature on PM Modi have actually united nationwide Hindus to rally around his re-election. And so far, heavily funded political attacks have backfired, including the attack on PM Modi via the Adani group of companies.

The real negative for US-India relations is the virulent anger we see in India about US media like Washington Post, CNN & others about their blatantly false coverage of such stories. Sadly, the US media is viewed as virulently anti-India & specifically anti-Hindu. And India is not unique in this. Just witness the popularity of Putin in Asia, Africa & even Latin America. Yes, he is even considered to be more moral in his stance than the Biden administration. Who would have thunk it?

Send your feedback to editor.macroviewpoints@gmail.com Or @MacroViewpoints on Twitter