Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we clude important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.What a Setup?

By now virtually every one knows that we entered 2023 with negative expectations for the stock market which were crystallized into massive short positions of the big guys. Now many of them do recognize that this large concentration on one side of the boat was a major catalyst for the stock market rally despite so-called earnings recession risks.

But how many realized two weeks ago or even a week ago that the conditions at the start of 2023 were being replicated & perhaps amplified as we enter the heart of July? Look what we found on Monday:

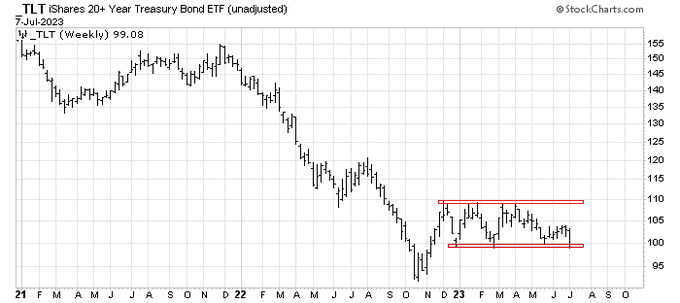

- Mark Ungewitter@mark_ungewitter – U.S. long bond is testing 7-month-old support.

Then on Monday afternoon, we heard Barry Knapp speak with Kelly Evans on CNBC Exchange:

- This is an exceptionally deep inversion, right? There were inversions of greater than 1% on a monthly basis in October 73 right before that giant recession from 73 to 75; … an inversion of almost 200 bps in December 1979 ; & another one in December 80; we have never had anything greater than even 50 bps (using 3months – 10 yrs) ; so this level of inversion is extreme & it was followed by very bad outcomes, very deep recessions & in the case of 79 & 80, it set off a chain of events that led to the S&L industry ultimately collapsing; & at that time, that was 80% of mortgage credit supply; .. so we are playing with fire here … when I look thru the data, I see credit growth continuing to deteriorate; commercial loans, industrial loans from small banks is down to zero percent growth & likely headed more negative; I saw a lot of evidence in that payroll data last week in small business employment is deteriorating as well; That’s the most opaque but largest portion of the employment market and it will be one of those things that sneaks up on the Fed and hits them across the bridge of their nose with a hammer or something; … I am a little PTSD around financial crises as well having been a senior managing director of Lehman Brothers; I readily admit to seeing financial crisis at every turn… but listen the banking system – this isn’t about mismanagement; the hedge for interest risk for banks is cheap deposits; As I said before, having curve inversions last for more than a month or two is extremely rare; they don’t hedge interest rate risk; they get cheap deposits, curve carries positively and they are able to lend money ; if we do truly have higher for longer & keep the yield curve inverted for a year or more, the banking system would not be able to supply any credit and therein lies the real problem … ; its not just the rate hikes, its the fact that the Fed owns a 1/3rd of the Treasury, mortgage & TIPS market & it is suppressing long term rates; so its not even allowing the banks to earn their way out of the 1/3rd of the assets they hold in govt securities; furthermore the inflation argument strikes me as kinda silly at this point ; we are going to be at 3 on Wednesday headline & the core is going to decline between now & the first quarter of 24 regardless of what happens … I don’t even understand the discussion about inflation; its gonna go to 3; its gonna stay there for awhile and we wont know until the second quarter of next year whether they have any chance of getting it to 2; I don’t think they do but I don’t think that is important either … it could stay at 3 that’s more than sufficient; … we are in recession; we have had two quarters in a row of negative GDI ; income is what matters not the Govt’s feeble attempts to add up all the widgets in services we produce; … the net operating surplus of the private sector has been negative 3 quarters in a row; govt spending has been positive 3 quarters in a row 4-5% so this to me is not a good mix;

Then on Tuesday morning we saw:

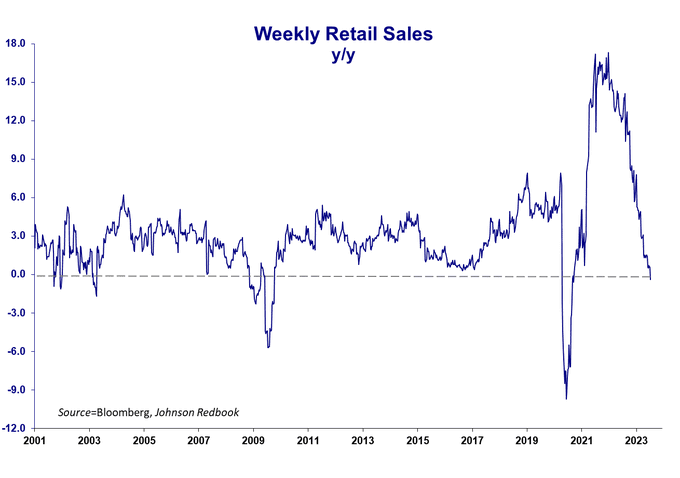

- steph pomboy@spomboy – Here’s your “indefatigable” consumer…Weekly Same Store Sales just entered contraction. And that’s BEFORE accounting for inflation.🤫

Remember the exhortation of Raoul Pal a few years ago – Buy Bonds, Wear Diamonds! We did because we saw the following on Tuesday morning:

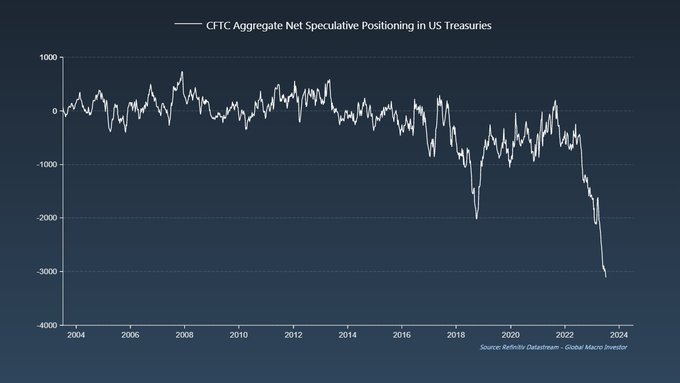

- Raoul Pal@RaoulGMI – Well, the short interest in bonds still keeps rising. Probably 5 standard deviations from the mean

“You know what to do” is what Tom Brady said to his team before the 3rd offensive possession in Super Bowl 55. After that they scored 4 touchdowns in 5 possessions.

Frankly, what we had to do was far easier & far far more obvious. And, as often happens, fortune favors the prepared brave, in this case brave being those who didn’t wait for Wednesday’s CPI numbers.

Babababoom went the Treasury market during the next two days:

- 30-yr yield down 7 bps on Wednesday & down 5 bps on Thursday; 20-yr yield down 8 bps on Wednesday & down 7 bps on Thursday; 10-yr down 12 bps on Wednesday & down 10 bps on Thursday; 7-yr down 15 bps on Wednesday & down 12 bps on Thursday; 5-yr down 16 bps on Wednesday & down 14 bps on Thursday; 3-yr yield down 17 bps on Wednesday & down 15 bps on Thursday; 2-yr down 15 bps on Wednesday & down 13 bps on Thursday;

This is better gauged via the chart posted by BTV’s Lisa Abramowicz:

For those who like to listen to economists, we reproduce the below:

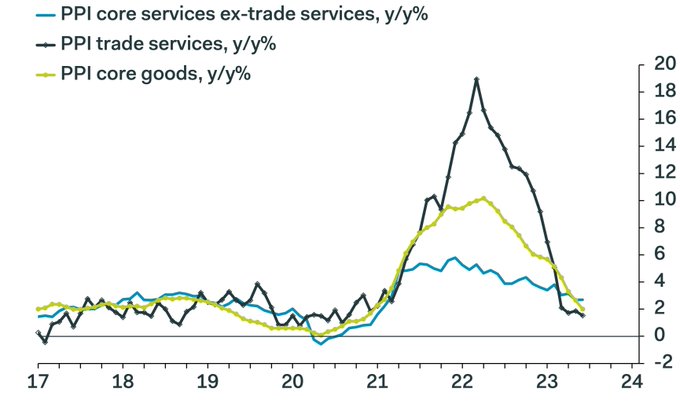

- Ian Shepherdson@IanShepherdson – The *entire* Covid inflation shock in the US PPI has now reversed. Remember the US PPI is a whole-economy measure, not just goods prices. The data scream that further rate hikes are unnecessary.

And,

- Ian Shepherdson@IanShepherdson – Even more good news for the Fed: The Atlanta Fed wage tracker is finally breaking to the downside; y/y down to 5.6% in June from 6.0% in May.

And now back to:

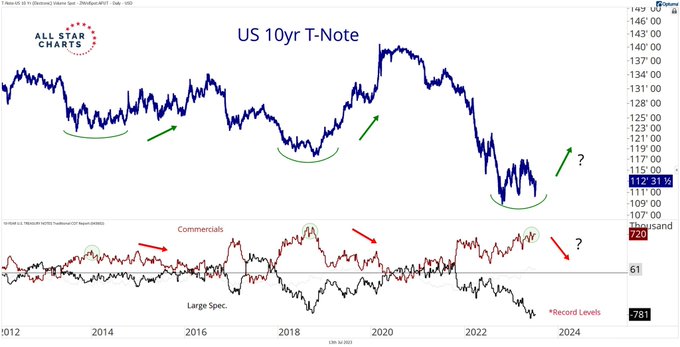

- J.C. Parets@allstarcharts – The worst investors in the world historically are at consensus that interest rates are going higher. This group has never bet so aggressively that bond prices are about to fall. How do you think this positioning will work out for them?

These charts look terrific but they don’t tell us how big is the short position in Treasuries both absolutely & relatively speaking. Fortunately for us, Jim Cramer relayed the views of his techni-pal Carley Garner on Thursday’s Mad Money show. Cramer said:

- “In 2018, the largest net short position of large speculators in 10-year Treasury contracts peaked at nearly 680,000 contracts. In contrast, large speculators are currently holding about 780,000 net short contracts, the largest net short position in history. “

Based on our hastily scribbled notes, Cramer pointed out that “in 2018 treasury short positions got annihilated“. And he added the Treasuries, especially the 30-yr Treasury bond could provide big upside in price over the next couple of years.

Bob Michele of JPM Fixed Income Asset Management has been bullish on Treasury duration for a couple of months. According to a Yahoo Finance article, he is “buying every backup in yields” and “his long duration position is now the biggest since the start of the pandemic“.

Remember how the Chuck Daly dictum suggested buying Treasuries in June-July! Cramer said, according to Ms. Garner, that Treasuries rally hard in July & August. Could Coach Daly, Bob Michele, Jim Cramer & Carley Garner be all wrong? Perhaps but we would still bet on them.

Look what we found on Saturday morning:

- Jay Kaeppel@jaykaeppel – For the record, the two primary models I use for bonds remain bearish. That said, sentiment is reaching a point that suggests something other than a continuation of the relentless bearish market since March 2020. @sentimentrader

Sadly the “intellectuals” on CNBC Fast Money are getting more & more senile in our opinion. Their resident court-jester waxed stupidly on Friday about the action in the bond market. Guess he doesn’t understand the most basic of market truths – that a massive naked short position is like a tidal wave waiting to roll. And, in many cases, it doesn’t need a big force to begin rolling. A nudge would do as it did in July 2007. The “smart” CNBC traders are so obsessed with being Fast & lazy that they don’t remember the Hare & the Tortoise tale. They won’t say it but they probably think Cramer is nuts too.

In contrast, we are simple folk & we agree with Napoleon & Bespoke:

- Bespoke@bespokeinvest – Quote of the Day: “You don’t reason with intellectuals. You shoot them.” – Napoleon Bonaparte

2. Dollar, Stocks, Bonds

When was the last time you saw the Dollar move match the SPX move? DXY & UUP were down 2.3% this week while the S&P was up 2.2%.

- J.C. Parets@allstarcharts – some people have been betting that this negative correlation would change. We have been betting aggressively that the correlation would remain. How about now moving forward? You betting things are about to change? We’re not.

And sectors behaved consistently with this correlation this week. Big tech stocks were great performers – META up 6.5%; MSFT up 2.5%; GOOGLE up 5.2%; AMZN up 3.6%. And NDX was up 3.5% as expected.

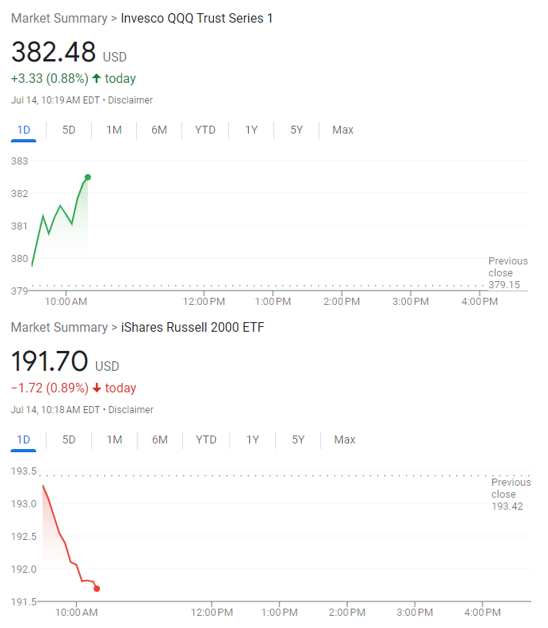

- Bespoke@bespokeinvest – July 14 – The QQQs are going one way today while small-caps are going the other... $IWM $QQQ

A weekly close of DXY below 100 would be terrific for Treasuries according to Carley Garner as reported by Cramer in his clip on Thursday. Does the close of 99.96 count as definitely below 100? Or will the Dollar rally back above 100 next week?

The above fall of the Dollar this week seems too precipitous to us. We confess the violence of the Dollar move & the corresponding action in stock sectors worries us a bit. Especially since cross-asset positioning & performance seems to have reached some sort of local peak.

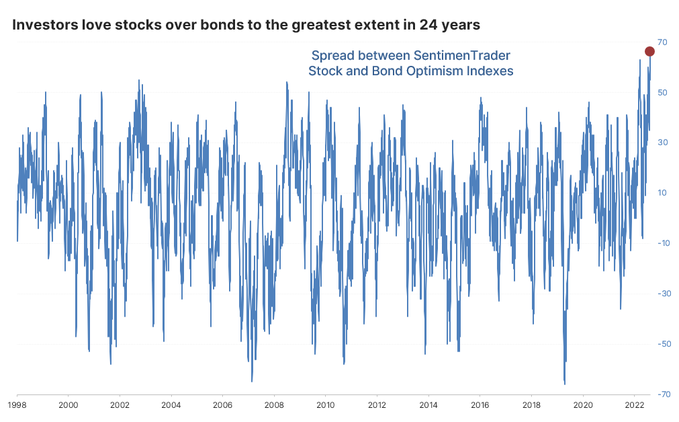

- Jason Goepfert@jasongoepfert – Thu – Optimism in the stock market is 65 points higher than in the bond market. Investors have never (well, in 24 years) had a more disparate view of the two markets.

How violent is the action beneath the indices?

- Thomas Thornton@TommyThornton – Friday – From Mizuho – today’s $NVDA intraday swing was bigger than the mkt cap of 400 companies in the $SPX

Since we all now know that this year’s SPX rally began with short covering of the massive short position, does the below suggest a peak or sorts?

- Thomas Thornton@TommyThornton – Fri – GS Most Shorted Basket just topped with DeMark Sequential sell Countdown 13 and GS confirms what we already knew.

The ratio chart below is from the article from Michael Gayed titled The Coming VIX Spike And The Flight To Safety Trade.

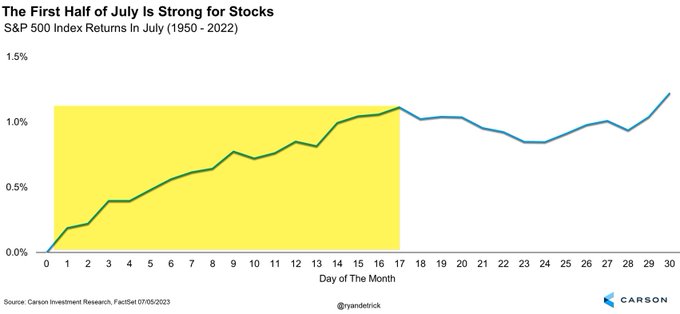

Seriously, isn’t the above a chart that just screams for at least a short term reversal, meaning TLT to outperform SPY at least for a bounce? Especially since the patron saint of S&P bulls, Ryan Detrick, posted his permission for a short decline in the S&P in the second half of July:

3. US Economy – R-word?

Nothing above had anything to do with whether the US economy will fall into or swerve by a recession later this year. Everything above had to do with massive & exposed positions that could shake a bit. So what do we read & hear about our sweetly wonderful economy?

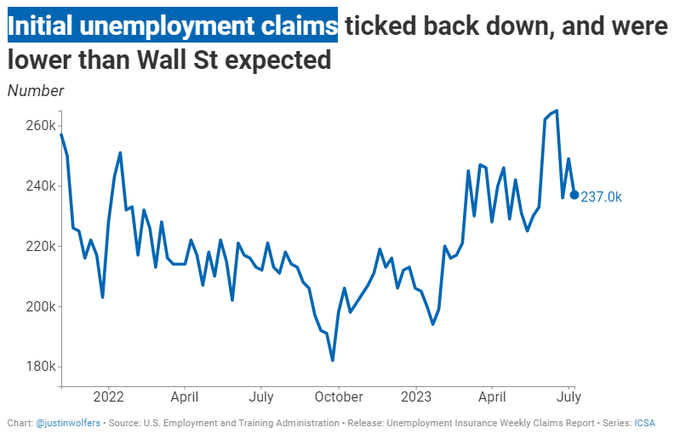

- Justin Wolfers@JustinWolfers – Thu – Initial unemployment claims are one of our most important indicators, because they’re timely (last week!), broad-based (anyone who files!), and based on a counting of all applications rather than a survey (no measurement error!). And this week’s number looks very healthy.

Neil Dutta of RenMac has always said that as long as incomes hold up better than price inflation, the consumer is fine & so will the economy be. And that just got better with the decline in CPI. Watch his interaction with CNBC’s Kelly Evans in the clip below:

There was an interesting moment at the end around minute 3:18 when Kelly said to Neil “final question because you are a very very good sparring partner“. We heard this & saw Neil appreciatingly smile at the unexpected compliment and instantly thought of a similar moment when, in a Rules of Engagement episode, a WNBA player says something in a similar tone to Timmy.

Reverting to the stock market, Anastasia Amoroso told Kelly Evans on Thursday that “real wage-growth for the consumer is up 1.2% & so we went from a negative wage growth to positive wage growth .. that supports the economy & that supports stocks“. In a bit longer conversation with BTV’s Jon Ferro, Ms. Amoroso said:

- ” I think you stick with tech; I am a fan of AI; it is a huge trend that is adding to companies starting today … earnings for 2024 have been de-risked a lot; … it gets you closer to 4,800 on the S&P:

She feels comfortable that we are on track for a soft landing & she doesn’t see a recession. We must add what Bob Michele of JPM Fixed Income said in his ending comment:

- ““Based on all the stress we’re seeing in the system, we’re pretty confident we’re going to see that sharp rise in unemployment,” …. “It’s going to feel like a soft landing until you actually hit recession.”

4. Floods not Tidal Waves

Himaalaya is a compound word “Him” (snow) + “Aalaya” (storage reservoir). Appropriate name because that mountain range is the largest, youngest & hence the most unstable reservoir of snow in the world.

People who lived next to that mountain range used to know how to live, where to build & how to respect the enormous power of the rivers that come down from the mountains. Several years ago, while white-water rafting in the Teesta river, we were awestruck with the remains of the damage a flooding Teesta had done including a bridge broken into large pieces & thrown to the side.

This week it was the time for exquisite Manali, a major link town on the highway to Leh in Ladhak.

Now look what a furious Beas river did to Manali:

We had been reading about the haphazard way rivers were being pushed in to make way for apartments, hotels & such to benefit from the tourist trade. Finally the rivers struck back this week & caused enormous damage. But even in this flood, structures that were built a few hundred years ago, presumably by people who understood the rivers, remained standing while the newer bridges etc. were swept aside.

Wait Wait Wait..

The Panchvaktra Temple, Mandi is at least 3 centuries old (some say much older).

We’ve seen it in Kedarnath too.

What did those architects do to survive nature’s massive onslaught, that we are just NOT able to put in practice.pic.twitter.com/EyrWm9Saca

— Shekhar Dutt (@DuttShekhar) July 10, 2023

The state of New Dehli, the capital of India, was far more pathetic. It was pure human arrogance, assuming politicians are human. The system is just like in America where Washington DC is managed by the local administration despite being the capital of USA.

Similarly New Dehli is “governed” by the founder of the Common Man (Aam Aadmi) Party who came to power promising free for ever electricity, water & other amenities to the majority of common people. Literally free. So how does the local government fund itself? By leasing scenic areas along the Yamuna River to construction companies who built whatever they liked, wherever they liked. The people paid the price for it this week.

The Yamuna River got its vengeance this week. It ran through much of the new construction & reclaimed its natural room to flow.

5. Modi-Macron summit for Bastille Day

Ordinarily this summit would have been celebrated. But it paled into insignificance given the floods ravaging Himalayan states. That doesn’t take anything away from the success of both the summit & the proven India-French relationship:

France was instrumental in fitting India’s Mirage 2000 aircraft with modifications to fit laser-guided bombs. They did it in record time, a feat that enabled Indian Air Force to drop pinpoint bombs on Himalayan Peaks that had been occupied by Napaki Special Forces in the 1999 Kargil conflict.

This summit solidified France’s military relationship with India acquiring 26 Rafael-M fighters for India’s aircraft carriers. India has been looking to replace the MIG-29s used on the aircraft carriers. The Naval Rafaels will complement the Rafaels used by the Indian Air force. India also ordered 3 more French Scorpene submarines to be built in India’s Mazagaon Docks.

But the real breakout deal from this visit is the long-term deal between France’s Safran & India’s DRDO:

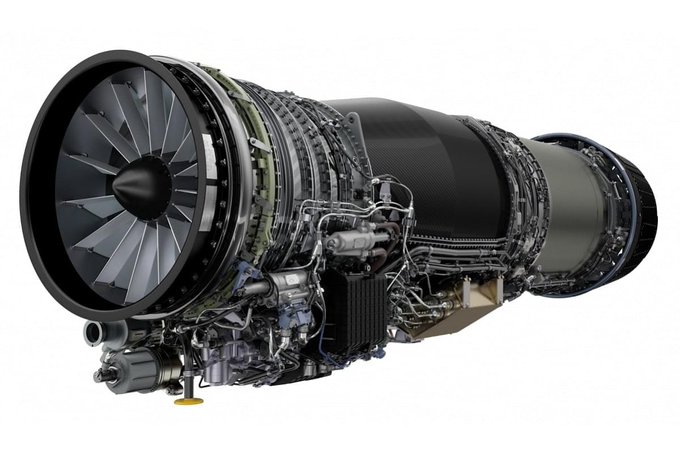

- Nitin A. Gokhale@nitingokhale – As @PMOIndia sits down for dinner with President Macron, there will be satisfied faces on both sides on conclusion of truly pathbreaking outcomes. For me the announcement that Safran and DRDO will jointly develop a military jet engine in India for the AMCA is truly significant

Understand the significance of this:

Remember the pathbreaking deal between USA & India for GE to manufacture its F-414 engine in India. That GE engine will power the Tejas MK2 aircraft of the Indian Air Force. GE will also transfer 80% of the technology to India in that deal.

This Indo-France deal is more ambitious. Unlike the GE engine, Safran will, with India’s DRDO, design, develop & then manufacture the next generation engine for India’s next generation Advanced Medium Combat Aircraft. And Safran will transfer 100% of the technology to DRDO under this deal.

Think ahead to 10 years from now. Between manufacture plus 80% of GE F-414 engine technology and Safran’s 100% design+manufacturing with 100% of technology transfer, the Indian capability to build their own military aircraft industry will be significantly enhanced. This by itself will substantially reduce India’s dependence on Russia.

And it will add an export of weapons muscle to India’s forays into ASEAN & the South China Sea?

- RAND Corporation@RANDCorporation – India’s recent moves in Southeast Asia “raise the tantalizing possibility that it will increasingly complement the U.S. Indo-Pacific strategy to counter China,” says RAND‘s @DerekJGrossman

India’s Defence Minister Rajnath Singh (L) and Vietnam’s Defence Minister General Phan Van Giang (R) – June 2023

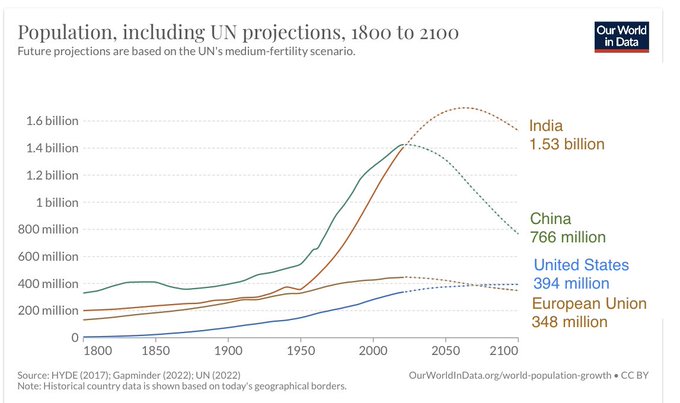

This is one reason why Jeffrey Gundlach keeps advising investing in India for the next 20 years. And all this is also backed by the fundamental 77-year projections vs. China.

Send your feedback to [email protected] Or @Macroviewpoints on Twitter