Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we clude important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.A series of short terms?

What a beautiful half-year this has been! Sadly quite a few have either missed a lot of it or at least some of it. How could they not? So many of the pezzonovanti have been articulately bearish for this entire period. Most of them are smart, highly successful people who could well be proven right later. But that is NOT going to give you the profits you lost so far by listening to them.

That is the lesson of a time series – that the long term, medium term & even the short term are all made of a succession of daily terms. The past six months have taught the veracity of this simple fact. Why go that far? Just look at our own article dated June 25th for the trading week (June 19 – June 25). Smart views about the economy, markets from very smart people all about what will eventually come.

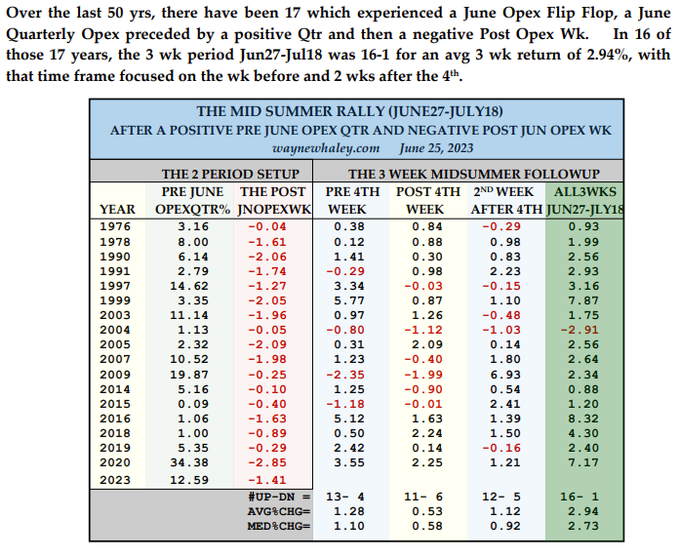

However the same article also gave a signal for here & now – a 16:1 probability of making money last week & over the next two weeks. Let us reproduce it below:

- Wayne Whaley@WayneWhaley1136 – Jun 24 – A 16-1 Mid Summer Rally Courtesy of the June Opex Flip Flop

“He told you so” as @WalterDeemer tweeted in appreciation of the above terrific call. The SPX rallied 2.3% last week alone in a torrid week:

- Dow up 2%; SPX up 2.3%; RSP (equal-weighted SPX) up 3.2%; NDX up 1.9%; SMH up 3.1%; RUT up 3.7%; DJT up 6.1%; with VIX only down 52 bps;

If you watch CNBC et al, ask yourselves or better ask them why they can’t show these ideas? If you watched CNBC Half Time on Friday, you would have seen how thrilled they sounded on Friday after last week’s great rally. But where were they last Monday morning? Ask them!

This is why we make it a point to search the Twitter-sphere to look for smart points like the above. Despite that, we miss some including even the ones that intrigued us like the one below on June 20:

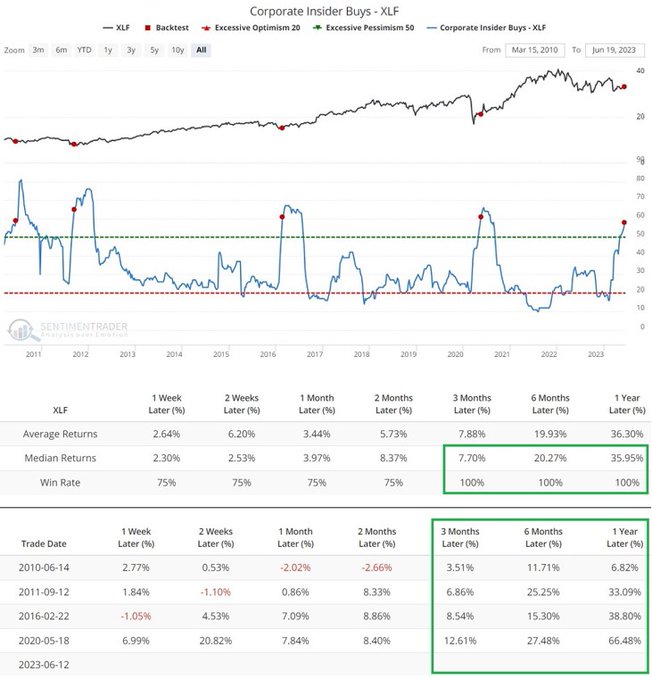

- Jay Kaeppel@jaykaeppel – Jun 20 – Broken record time: Financial sector insiders continue to INCREASE their pace of buying. Are they as “crazy” as tech insiders were 8 months ago? Red dots = Indicator crosses above 58 first time in 6 months. #sentimentrader

We kept hearing from smart technicians who kept saying they don’t like banks or “not many examples of a market going up when GS, MS, BAC are not involved“. Guess what? GS, MS, BAC got involved last week while these smart technicians missed the move.

Yes we screwed up but what were the mahaa-jan at CNBC Fast Money doing all week? We screwed up because we forgot to listen to people who do & avoid listening too much to those who only talk.

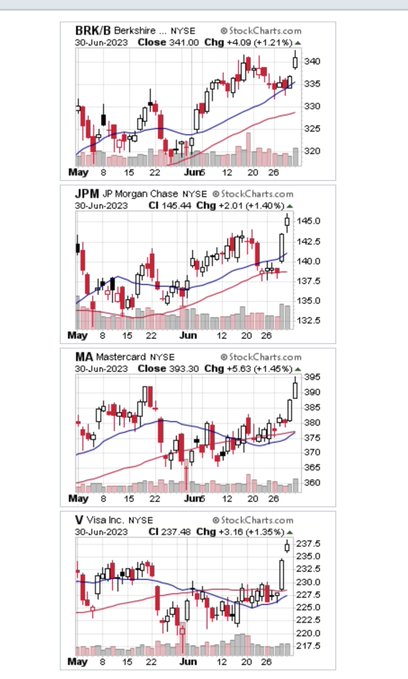

Smart doers got the above signal from insiders & went to buy. Look look what the financial sector did last week!

- Larry Tentarelli, Blue Chip Daily@LMT978 – Sat – The 4 largest market caps in the financial sector all made new 52-week highs yesterday. A bullish sign for the 3rd largest sector in $SPX

$BRK.B $JPM $MA $V

Yes, JPM was up 5% with BAC up 3.6% & GS up 2.9% last week.

Again, none of this may matter much in the long term or even the medium term. But it is nice to pocket some before looking at the supposedly bleak future. Note that even the great call by Mr. Wayne Whaley was only for 3 weeks ending by mid-July.

So we thought we might insert charts from June 1 to October 1 for two mega years – 1999 & 2007:

So even in 1999, the mega of all mega years, mid-July (around July option expiration?) was a meaningful top for S&P. What about 2007?

The two years diverged in October big time – with a steep rally beginning on October 1, 1999 and a steep fall beginning in mid-October 2007. But both the charts above showed a rally into mid-July.

Wait a minute. Both the above years were negative or turned negative fairly soon. Isn’t there another year whose template we all should consider? Yes indeed & it is our most favorite & bullish example. It is also a rare success for the Fed.

Holy you name it! Mid or late July 1995 also gave a chance to sell & rebuy prior to September. Do all these charts mean much? We don’t have a clue. That’s why we watch markets every day.

But some are bold indeed:

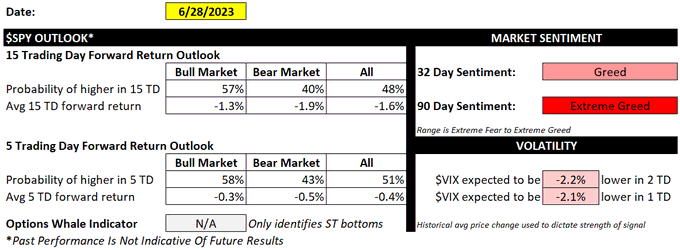

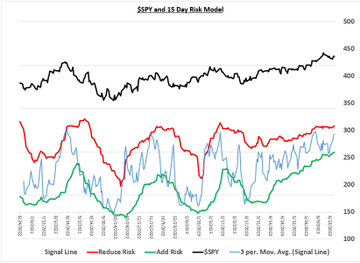

- S&P 500 Signals@SPYSTSignals – I’m going to stick my neck out here and say something crazy, I think $SPY will pullback 6-9% in the next 25 TDs. I still think bulls have the upper hand the next 2-3 days for window dressing/BOM flows ( $VIX model still bearish on vol), but post 7/4 I see a pullback, then…

The tweet has two other charts that can be viewed at https://twitter.com/SPYSTSignals.

Now let us turn back to the pezzonovanti.

3. “A rolling recession turning into a rolling expansion”

It was Ed Yardeni who bravely said in late 2022 that the October 22 bottom was THE Bottom of that bear market. What a fantastic call from a true pezzonovante! He made another major call this week by stating simply to Scott Wapner that the “rolling recession is turning into a rolling expansion“.

If that surprises you, then the call below will STUN you as it stunned us. Having been so used to lower earnings ahead forecasts, we were absolutely floored by what Dan Ives of Wedbush told CNBC’s Scott Wapner on Monday June 26:

- ” … fundamentals are not just stabilizing but starting to see for the first time upticks across cloud, across enterprise & then of course you have this AI gold rush which I view as a 4th industrial revolution … tech sector will be up another 12%-15% in the second half of the year … 1st half was multiple expansion; 2nd half starting with earnings over the next month is going to be fundamentals … this is really where a lot of these companies; they ripped the band-aid off & we are seeing really across the board specially over the last 4-6 weeks a much more dramatically different IT spending environment we saw going back to January to April .. 6-10% cuts now margins … put more fuel in the rally as we go into July earnings …. this is a 95 moment, not 1999 …. this is something that is going to transform tech …this is a trillion dollars of incremental IT spend that wasn’t here 6 months ago … this is something that is going to transform tech; from a software perspective, from a chip perspective, you look at numbers – I believe as we go into 2024, we could potentially be underestimating growth by 10% & 15-20% … that’s where the rubber meets the road. … this qtr from Redmond, from Google you are going to see the signs what ultimately is going to be a massive expansion of growth that is coming in … multiple expansion was the story for 6 months; 2nd six months its not talking the talk, its walking the walk …. its a different IT spend environment we have seen for the last 4-6 weeks than we have seen for the first 4 months of the year … that’s all going to start to play thru … after this qtr, we are going to see a tidal wave of growth coming thru … “

This level of growth is stupendous to say the least & shows how pathbreaking the NVDA numbers were. Anastasia Amoroso also used a similar figure in her conversation with Scott Wapner – “... the total addressable market of AI – add all the companies that benefit in the hardware space & the software apace & that is projected to double from $450 billion to $900 billion by 2026… I am going to be rotating back into it on any pullback … ”

Does that mean?

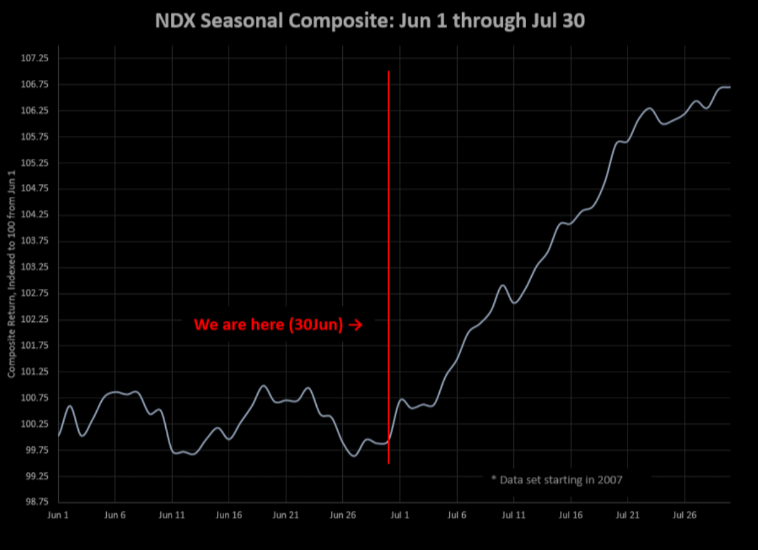

- Via The Market Ear – NDX July seasonal pattern – Enough said. Add to this that AI has consolidated nicely in June and should be ready to take the next leg higher AND that the narrow rally is starting to broaden. Source GS

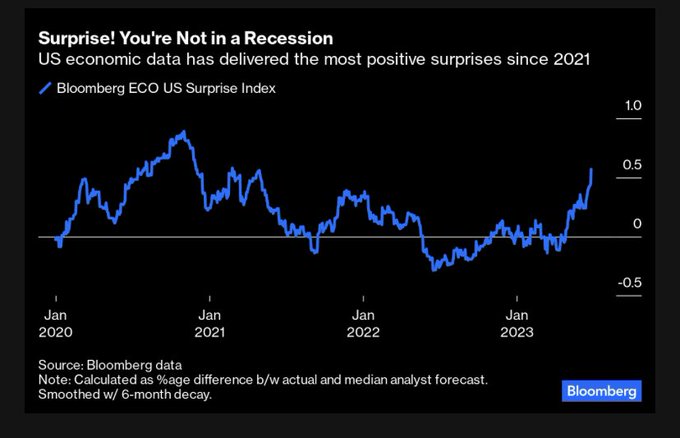

And this is showing up in the economy, as Jay Pelosky pointed out on Bloomberg Open on Thursday:

- “ .. we see the Bloomberg surprise index off the charts .. 2 year high; biggest 1-day move in a long time yesterday & the day before … “

Where do you turn to find out about a Bloomberg index?

- Lisa Abramowicz@lisaabramowicz1 – Jun 27 – The Bloomberg ECO US Surprise Index has risen to the highest since February 2021. “These just aren’t the sorts of numbers you see in an economy careering toward a recession.” https://bloomberg.com/opinion/articles/2023-06-27/recession-2023-might-be-canceled-but-economists-won-t-admit-it#xj4y7vzkg

Another indicator suggesting a rebound?

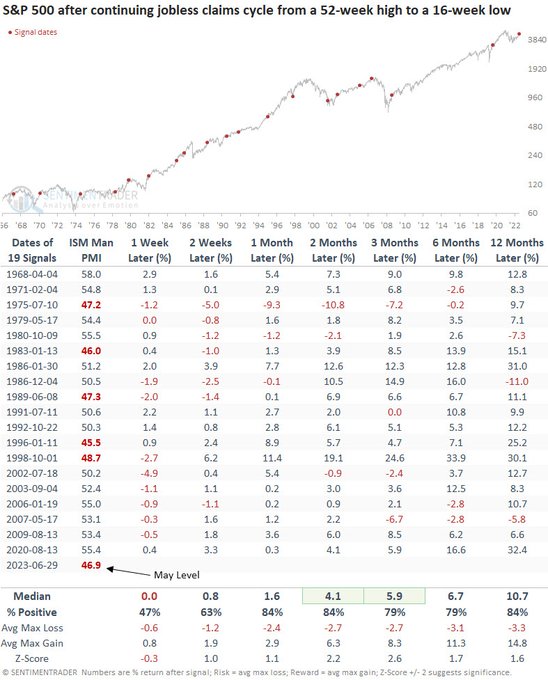

- Dean Christians, CMT@DeanChristians – Jul 1 – After steadily rising for seven months to a 52-week high in April, continuing jobless claims have now fallen to a 16-week low, triggering a bullish signal for stocks.

Dan Ives spoke of this year being like 1995 & not 1999. Jay Pelosky is not that precise but he too likens today to the 2nd half of 1990s as he said on Bloomberg Open on Thursday June 29:

- ” … our analog is 2nd half of 1990s … which was the last time US had a cap-ex boom; productivity surged … a high nominal growth period with limited inflation and a significant period of very solid performance of risk assets … “

But what about the Fed? Pelosky said:

- “We think the Fed is effectively done; if they are data dependent, the June inflation number is likely to come under 4%; the decline in inflation has been as rapid as the rise … “

With this view, Pelosky says:

- “we are really focused on 5 transitions that are really important: 1) rate hikes to rate cuts; 2) from monetary policy to fiscal policy (Bidenomics); 3) from recession to recovery; 4) from bear market to rotation; 5) from the US to the rest of the world… “

Re the 5th transition, he pointed out that

- ” … Latin American equities outperformed the Nasdaq in the 2nd quarter; Brazil & Mexico are out-performing the QQQs“

But doesn’t all this require Treasury rates to go down some or at least stay here? And isn’t stress in the corporate economy rising?

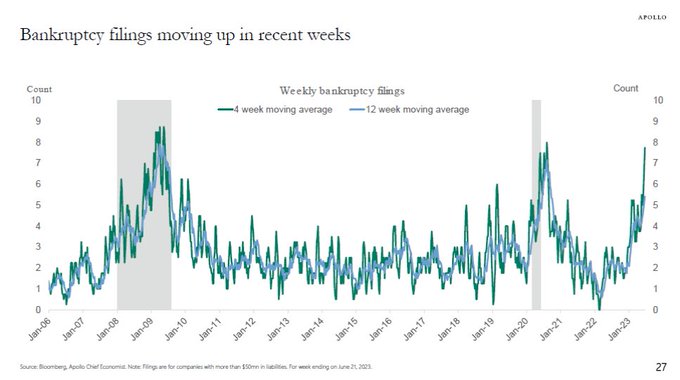

- Lisa Abramowicz@lisaabramowicz1 – Jun 28 – Weekly data for corporate bankruptcy filings has started to meaningfully deteriorate in recent weeks: Apollo’s Torsten Slok

Does that suggest that the Fed policy is already very restrictive? Yes said Kelsey Berro, JP Morgan Fixed-Income Portfolio manager (not a JPM talking head) on Bloomberg Real Yield on Friday, June 30:

- “Likely the Fed is going to hike again in July; .. But what we are really focused on is trying to determine how restrictive monetary policy really is at this juncture … what we are finding is that the policy is already very restrictive & what the Fed is doing now by continuing to hike rates as inflation is coming down & as the leading indicators are rolling over is lower growth & lower inflation in the 2nd half of this year ; that they are overtightening monetary policy; policy is already restrictive ; the Fed is going to push it a little bit more in July.. but ultimately to us the leading indicators are clear; yield curve inversion is telling you lower growth & lower inflation are ahead …”

How restrictive is Fed’s policy now? Ms. Berro said:

- “the policy restrictiveness, relative to the neutral rate using a 1-year real policy, is actually the most restrictive going back to the 1980s … another thing that caught my eye recently … the number of distressed firms is highest since 2008 = 37%; … that is starting to bubble up in corporate world & that suggests that aggregate demand is going to moderate & this tight monetary policy is going to bite … ”

When asked where the 10-year yield might go, Ms. Berro replied:

- ” Fed has hiked rates by 75 bps this year and the 10-yr yield is lower; lower by 5 bps; so as the cycle extends, the sensitivity that the 10-year has to the front-end yield is falling … ”

That is kind of characteristic of a near end to the hiking cycle, isn’t it?

Per, host Katie Griefeld, Subhadra Rajappa has a target for the 10-year yield of 3.25% for year-end 2023.

4. Stocks vs. Bonds

- Ryan Detrick, CMT@RyanDetrick – Stocks made another new all-time high versus bonds this month. How someone could be overweight bonds and underweight stocks when this happens is some major career risk. Yet another reason we remain OW stocks and UW bonds (and have since December).

Signor Detrick has been right so far this year and so many of the smart strategists have not been as right this year. Had he said the above in June 1999, he would have been gleefully right until mid-2000 & then fallen off the ladder. Had he said that in June 2007, he would have been proved awfully wrong as soon as October 2007. On the other hand, 1995 would have been the right year for Mr. Detrick’s call. From June 1995 to about June 1998, stocks clearly beat bonds.

For a smart investor’s preference for bonds over stocks, we refer folks to the comments of Richard Saperstein below on Tuesday June 27.

Who is right? It really depends on whether Dan Ives above, Bloomberg Eco surprises are right & the economy is now catching a tail wind as we go forward (a la 1995) Or whether Saperstein, Kelsey Berro & others are right about the economy slowing down from here (a la 2007).

As usual, CNBC cut short what Saperstein was saying. He made it clear that he owns the best performing AI-tech stocks in addition to bonds. So, as he said, his performance is doing well. And he does have 2/3 years (1995 & 2007) on his side in his “doubling down” on Bonds.

Also Wapner tends to treat his discussions as “talktime” & doesn’t even remember what some of his guests have told him. For example, he seems to have forgotten that Gundlach said “long bond” could deliver a 40% performance in price in addition to the coupon. Of course, that would require a 2007-2008 type economy. But even 1995 would do fine for the long bond.

This is not a very negative comment re Mr. Wapner. He does a very good job in getting excellent, informed & opinionated guests on his two shows. And they tend to like speaking with him and that, we think, makes them say more. But we would like his performance more if he tried to remember what his guests have told him, especially guests with a great track record of performance.

5. “India definitively darling of investors“

That was how Haslinda Amin, a Bloomberg Anchor, described India on Friday morning India time. Perhaps more meaningful because she has not been a fan of India in the past.

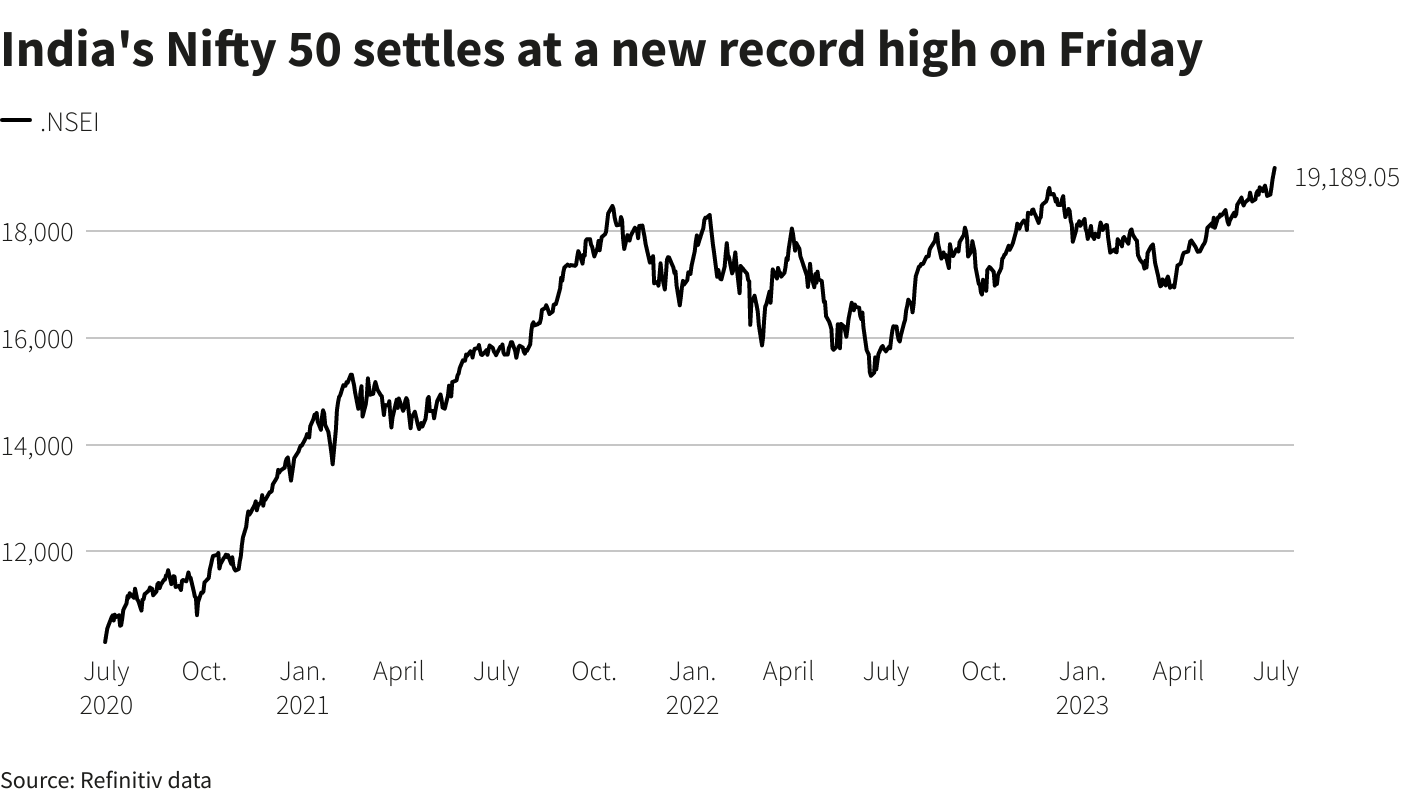

Both the Sensex & the Nifty 50 indices reached record new highs on Friday, per Reuters. INDA & INDY were up 2.7% & 3.4% resp. last week.

But Haslinda Amin was not speaking about stock investors. She was speaking about how Foreign investors are now running to India to buy low-credit bonds. Yes, this is a new trend & one that speaks highly about maturation of Rupee-based credit markets in India. As a Bloomberg.com article reported “Foreigners Flock to Snap Up 18.75% Yield on India Low-Grade Bond“, a Rupee issue worth $1.7 billion.

According to the Economic Times of India,

- “Goswami Infratech accepted bids worth Rs. 143 billion ($1.74 billion), including from Edelweiss Special Opportunities Fund, Davidson Kempner, Ares Capital Management, Varde Partners and Cerberus Capital Management. Deutsche Bank and Standard Chartered Bank also subscribed. “

The article also quoted:

- “we are seeing money coming in from global asset managers, international development financial institutions and large pension funds in Indian private credit funds, said Vineet Sukumar, founder of Vivriti Asset Management … . The momentum in this space is “exploding”, said Sukumar who put this down to improved corporate balance sheets in India that gives investors comfort to invest in low-rated, higher-yielding debt.””

The article added:

- “Goswami Infratech issued the zero-coupon bonds at a yield of 18.75% for a period of two years and 10 months. The issue has a put option at the end of December 2025 and is rated BBB-… “

The fact that Goswami Infratech belongs to the well-known Shapoorji Pallonji Group might have helped the issue placement.

Again the fact that a vibrant high-yield bond market is maturing in India is absolutely a positive & should raise the already high PE of the Indian Stock Market.

Notice this is entirely a Bloomberg reported story. Wasn’t there some network that called itself “first in business worldwide“? What happened to that network, especially regarding some of the more exciting stories that prominent US investors are “flocking to”? Perhaps they don’t have an Asian desk or their Asian desk, like their US desk, only caters to stocks.

6. Wagner “spectacle” in Russia & Belarus

Let us be clear. We have no clue what is going on in this spectacle in Russia-Belarus with Wagner head Prigozhin & President Putin. It seemed like a classic mutiny by a private warlord against his country’s leader.

What made it sound different? Simple answer Bloomberg Surveillance & specifically the conversation of the Keene-Abramowicz team with Lt. Gen.David Deptula. In case you have not heard of him, Tom Keene hailed Gen Deptula as the Hyman Rickover of the US Drone operations.

Guess what Gen. Deptula said (from minute 1:30 to minute 1:36) on Bloomberg Surveillance on Monday June 26:

- “… there is also the possibility that this so-called Wagner revolt was a ruse to open up a northern front from Belarus into Ukraine ; so one need to understand that deception is a fundamental element of Russian operations; so there is a lot of speculation but few facts yet …”

Ahh – maskirovka as we recalled from the Fist of God by Frederick Forsyth (the excellent book about Saddam Hussein’s annexation of Kuwait). Or as Wikipedia describes it:

- Russian military deception, sometimes known as maskirovka is a military doctrine developed from the start of the 20th century. The doctrine covers a broad range of measures for military deception, from camouflage to denial and deception.

Guess what we saw two days later on Wednesday March 28 – Wagner Chief’s Belarus Exile Spooks NATO; ‘Ready To Face Moscow Or Minsk,’ Says Stoltenberg:

- “NATO admitted that deployment of Wagner Troops in Belarus is a “Greater Danger” … The NATO meeting comes amid speculations of Wagner Mutiny being an excuse for Russia to redeploy their troops in Belarus in the midst of Ukraine War“

Then we saw another headline from Mr. Lukashenko, head of Belarus, saying – “We want Wagner’s war experience in our army“.

Simple as we are, we couldn’t help but wonder what would the reaction have been had Mr. Prigozhin himself flown to Belarus on his own to manage his troops in Belarus. That would have created a mini panic about Putin’s plan to invade Kyiv through Belarus, right? Now, with this mutiny like mess, Prigozhin has an alibi to be in Belarus, right?

But how many soldiers would go to Belarus from Ukraine? Might Prigozhin actually run the Russian troops already there? Mr. Lukashenko did say that “Prigozhin and his troops bring a lot to the table for Belarus“. Though Belarus says that Wagner will have nothing to do with tactical nukes sent by Russia, this clip says “several analysts predict Wagner will guard Russia-provided nuclear weapons“.

A real question is whether this Putin-Prigozhin fight gives Putin a plausible deniability if Wagner does enter Ukraine through Belarus & even threatens use of tactical nuclear weapons that they somehow get control of? Scary stuff. Add to this the report that Wagner is heavily recruiting Gurkha fighters from Nepal to fight in Ukraine. The clip below says Wagner is paying 2700 Euros a month to Gurkha volunteers & Russia promises Russian citizenship after one year of service. That is a princely salary in Nepal.

Then we saw the clip titled Wagner Out Of Ukraine War? Prigozhin Refuses Russia’s Deal, Belarus Builds Huge Base For Mercenaries. Below are a couple of key statements from this clip:

- “The base is about 80 miles from the Belarusian capital Minsk and about 13 miles northwest of the military town of Asopovichy” …

- “Belarus will have world’s most combat-ready unit”

Now fast forward to minute 3:28 of this clip to see & hear a Wagner mercenary talk about their plans.

Yes, the two situations are utterly & totally different but we can’t help remembering how Chief of Staff Eisenhower benched Gen. Patton for slapping a soldier & kept him in London without an assignment. They built a fake army around Patton to persuade Hitler that the real landing in Europe was going to be in Calais & commanded by Patton. Hitler bought it and kept a reserve of several Panzer divisions in Calais instead of sending them to Normandy to fight the Allied Landing.

President Putin for his part seems to have moved away from the Wagner mess to praise Indian PM Modi & his “Make in India” initiative. It seems Putin thinks a similar Make in Russia initiative might make sense for Russia. From what we read, it is not farfetched to imagine that PM Modi might be asked to help bring about a deal between NATO & Russia to suspend the Ukraine war if not actually stop it. He may be the only world leader with good relations with both President Biden & President Putin.

7. The “progress” of India viewed via a different medium!

In Section 5 above, we looked at the progress India has made in stock & bond markets. The reality is most people in the world know of India via Bollywood films & songs. So we thought we would show the “progress” of India via Bollywood songs.

The first below is a popular song from 1970 when young men & women could not easily meet & express their feelings. It was an era of suggestion, gentle expressions & avoidance of physical contact.

Now look at today’s era represented by Jacqueline Fernandez & Hrithik Roshan in the Ad film below:

What might the “progress” of the next decade bring to Bollywood & its fans?

Send your feedback to [email protected] Or @MacroViewpoints on Twitter