Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.”economies have momentum “; “that is just shocking“

Many called Friday’s NFP report as a Goldilocks report, a bullish report that made stocks rally. “No” said Frances Donald of Manulife Investments “this was a bad enough jobs report that it means … the Fed is done & we can celebrate that; so let me be clear, even though we see a recession ahead, there is still some juice behind those risk trades; ” and added near the end of her clip that this jobs report “is consistent with a Fed that can take a break & stocks can enjoy a little bit of relief for the time being“.

Holy September, was our first reaction. Seriously what Ms. Donald said is kinda what we have been suggesting – a seriously slowing economy will cool the Fed’s ardor & get us a Semis-FANG-Tech rally into mid-late September & perhaps even beyond into October.

But what did she see in Friday’s jobs report that makes her see a recession ahead?

- “Look at this jobs report – we got jump in the unemployment rate; a jump in the under-employment rate; temporary help is falling, a great leading jobs indicator for the jobs market & we have massive downward revisions, 110,000 fewer jobs that we previously believed; we have had a downward revisions to every single month of this entire year; this is a labor market softening consistent with a recession early in 2024“

At this point, we must hark back to what Barry Knapp of Ironsides Macroeconomics told CNBC’s Joe Kernen two weeks ago:

- “it turns out that all the jobs, that the birth-death model was supposed to approximate business employment created last year, never existed; it was originally estimated that 1.3 million small business jobs were created in 2022; turns out that was like 60,000; So we are going to have a big massive downward revision to last year’s employment;”

Is that what we have been seeing all year? Did the BLS or the folks that control them, decide to make monthly revisions to employment instead of one massive downward revision that Barry Knapp expects? This is a big deal. Look at every bullish write up about our economy this year. The central thesis has been a strong jobs market. That has been used to pooh-pooh all negative news like fall in leading indicators for 12-months in a row & such. Now ask what if the advertised strength in the labor market has been manufactured via forecasts of job “approximated“ by the birth-deaths model?

Ms. Donald went on to remind CNBC’s Steve Liesman that:

- “we are talking about one of the fastest & most aggressive rate hikes in history; senior loan officer surveys telling us that credit is contracting by some of the most in history; a housing market that is completely frozen outside of new home sales – the context is that almost every single leading indicator tells us that things are going to get worse; I can’t look at a jobs report like this and say it is inconsistent with the idea of a material slowdown”

Richard Bernstein & his team (RBA) have not been on the side of a “material slowdown” idea based on their tweets we have seen. That is why we were stunned to hear Dan Suzuki of RBA say on Tuesday on CNBC Fast Money that “every indicator of liquidity is rolling over“.

Finally Ms. Donald reminded all us that “economies have momentum & it is very difficult to slow this train once we get to that level“.

The above brings us back to the fear that gnaws at us when we look at the charts of America’s big money-center banks, especially Citibank.

No one on Fin TV seems to have focused on these huge money center banks that have theoretically passed the stringent stress tests conducted by the Fed. No one until this week!

Look what Mary Ann Bartels said to host Katie Greifeld of Bloomberg Real Yield (at minute 9:21) on Friday:

- “lets also not forget the banks & the unrealized losses that they have; if rates continue to go up, that’s going to be problematic – something we watch called relative ratios. We take a stock price & look at it relative to the S&P. Citibank. a money center bank, just recently traded at an all-time relative new low, below where it was in 2008 & 2009. That is just shocking. So I think the banks are going to play a very key & pivotal role in where we are going in the fixed income markets eventually“.

What about Bank of America, we wondered! It has actually performed worse than even Citibank, this year!

So if banks continue to perform as above, what role might that play in fixed income markets eventually? We are simple folks with simple minds and, try as hard as we might, we have not been able to find a single period when big money center banks were acting as above & the Fed not caring even a bit. And what did that do to Treasury rates? They fell hard across the curve until the danger had passed & the Fed again had rescued risk markets.

Remember what Barry Knapp told Joe Kernen two weeks ago:

- ” … will eat away at the foundation of the recovery & the expansion probably; does it need to turn into a deep broad-based recession? No as long as the Fed gets us to this dis-inversion of this curve right away which at least means reversing those last 3 rate hikes …. “

That was before Friday’s NFP number. What should the Fed do now? It is simple, in our opinion!

- Cut rates by 25 bps on September 20;

- Cut rates by 50 bps on November 1;

- Cut rates by 25 bps on December 13.

Perhaps Fed Chair P***** should recall what a great, almost legendary, American leader named P***** quoted to his team in the thick of a real battle – L’audace, L’audace, toujours L’audace!

2. Economy via Charts

First a comment on jobs:

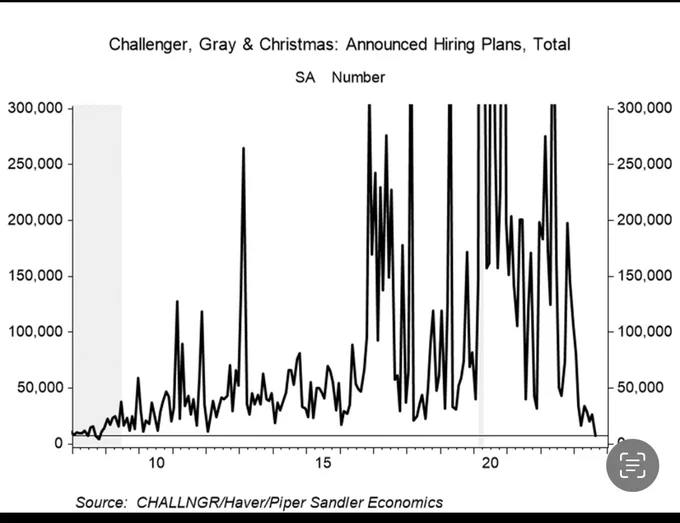

- Kantro@MichaelKantro – Fri – For hire? #hopE

Temp jobs a leading indicator?

- David Rosenberg@EconguyRosie – Sep 1 – Temp agency jobs down in each of the past 7 months by a cumulative -119k. We’ve never seen this before without the economy heading into recession. After all, when the headhunters are chopping off their own heads, what does that mean for the rest of us?

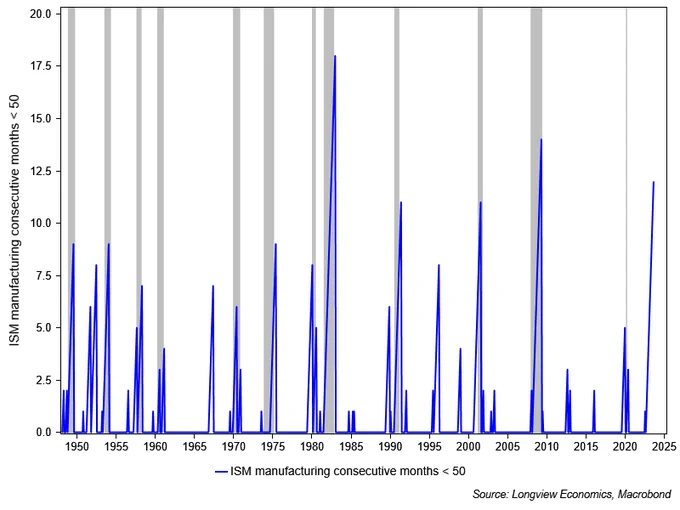

We have all heard about ISMs but a picture does tell a better story, right?

- Longview Economics@Lvieweconomics – The ISM manufacturing index has now spent 12 consecutive months below 50 (i.e. contraction territory). The only times this has been surpassed were ‘81 – ’82 & ’08 – ’09.

A comparison worthwhile only at critical economic junctures?

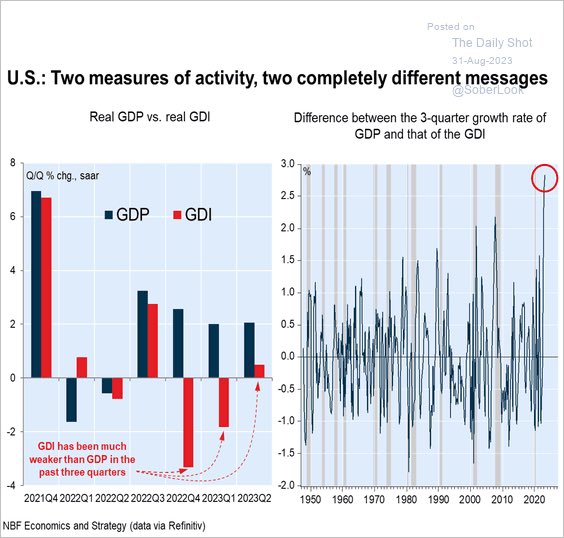

- Albert Edwards@albertedwards99 – Aug 31 – … Looking at the chart on the right you can spot how wide divergences between GDI and GDP often occur just before, or during a recession. It looks tome as if Economists have given up forecasting a hard landing just at the wrong moment!

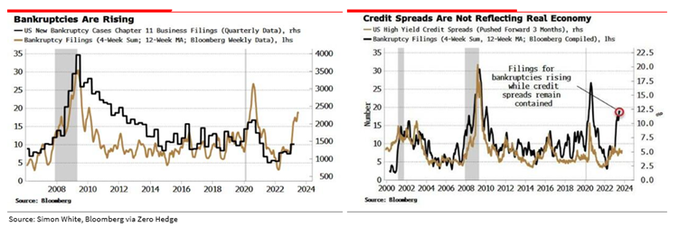

Corporate bankruptcies are reportedly up 71% yr/yr in July. But is there a difference between ordinary companies & mega-caps?

- Lance Roberts@LanceRoberts – Aug 30 – “Large- and mega-caps might be immune to higher #interest #rates, but the explosion higher in corporate bankruptcies is sending a clear message.” @albertedwards99 #Bankruptcies up 71% yoy in July.

3. Stocks

Don’t read section 2 above and think the stock market is caput! Heck, even Frances Donald said (Section 1 above) that there is still some juice behind risk trades. The deluge isn’t here yet. Treasury rates have stabilized & have actually gone down in the belly of the curve. So the Dollar went down & Stocks went up with juicy stocks leading with commodity stocks. Double heck, even the big banks went up:

- VIX down 16.5% on the week; Dow up 1.4%; SPX up 2.5%; NDX up 3.7%; SMH up 4.8%; RUT up 3.6%; IWC (micro caps) up 3.3%; DJT up 1.4%; BAC up 1.6%; C up 80 bps; GS up 2.3%; JPM down 20 bps; AAPL up 6%; AMZN up 3.5%; GOOGL up 4.3%; NFLX up 5.8%; NVDA up 5.4%;

- UUP down 38 bps; DXY down 54 bps; Gold up 1.3%; GDX up 2.7%; Silver up 2.2%; Copper up 48 bps; CLF up 5.8%; FCX up 8.5%; Oil up 4.4%; Brent up 2.5%; Nat Gas up 8.6%; USO up 6.6%; UNG up 3.4%; BNO up 5.9%; OIH up 5.7%; XLE up 3.7%;

- EEM up 2.2%; EWY up 2.6%; EPI up 2.5%; ASHR up 3.4%; FXI up 4.7%; KWEB up 8%; SMIN up 3.1%;

Magical isn’t it when treasury rates stabilize! Is this the time & place for some smart opinions, including the first one about September?

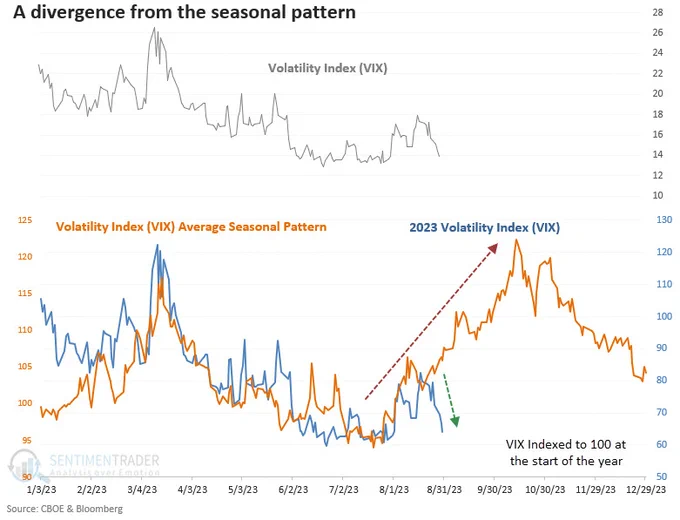

- Dean Christians, CMT@DeanChristians – Sep 1 – Stock market performance in September ranks as the worst month of the year. However, if the VIX fell below 14 in August, the S&P 500 was higher 89% of the time over the next month.

Below worked on 13 straight occasions:

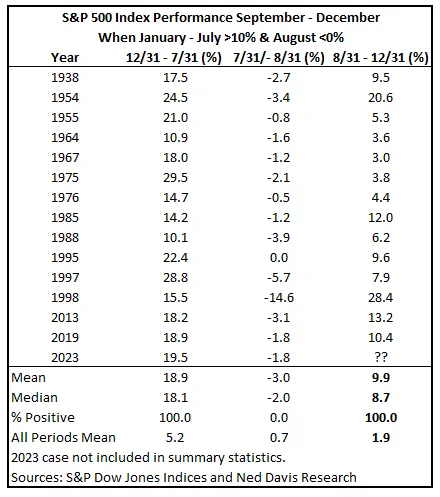

- Ed Clissold@edclissold – The $SPX fell 1.8% in Aug after surging 19.5% YTD thru July. The 13 previous times SPX +>10% thru July &⬇️in Aug, it rose every time Sept-Dec by avg of 9.9%. Just one data point, but it supports the case that the Aug decline was a pullback within an ongoing uptrend. @NDR_RESEARCH

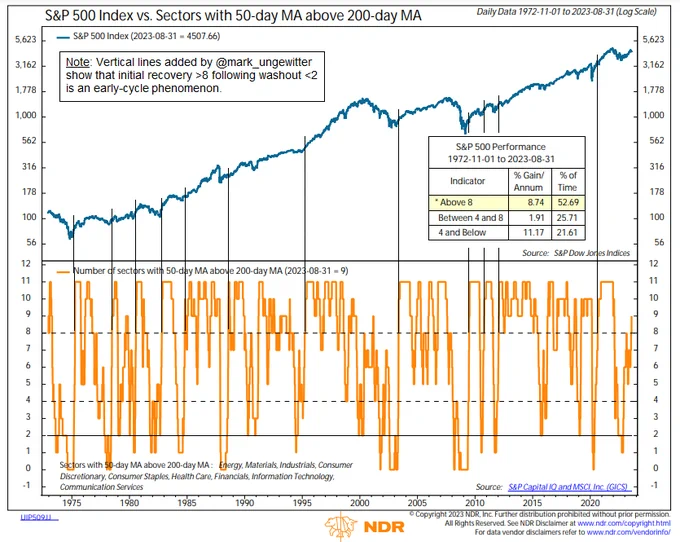

Comment about Breadth:

- Mark Ungewitter@mark_ungewitter – 2/ Comment: Breadth reversals of this nature imply further room to run, as shown by my supplemental annotations. H/t @_rob_anderson

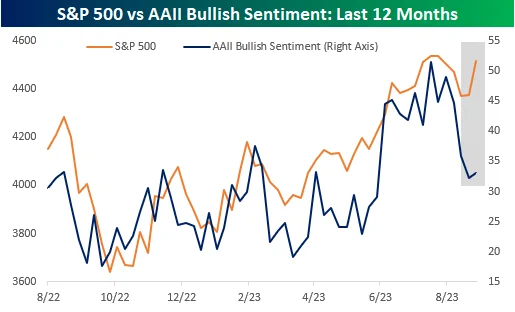

What about sentiment?

- Bespoke@bespokeinvest – Aug 31 – Despite the rebound since last Thursday’s close, individual investors still aren’t buying it. The weekly AAII poll showed little rebound in bullish sentiment.

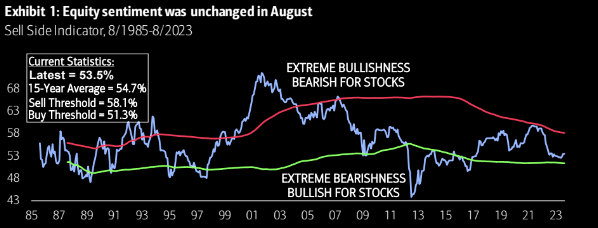

What about Quant Sentiment?

- Via The Market Ear – Sat – Sentiment says relax – The BofA Quant team sentiment model is actually closer to a “bullish for stocks” level than anything else. Sit still in the boat. Source BofA Quant

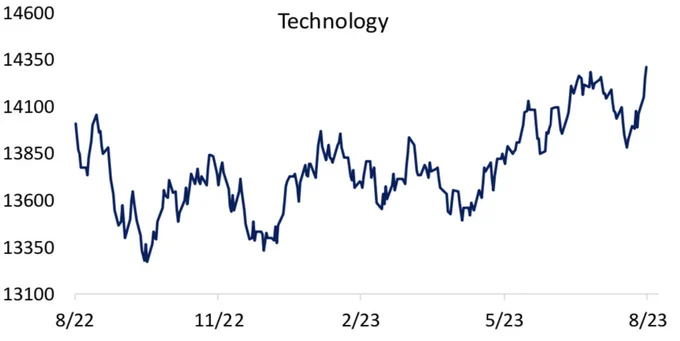

Does the advance-decline in our favorite sector look good or perhaps too good?

- Bespoke@bespokeinvest – Aug 31 – Tech’s cumulative advance/decline line made a new high yesterday:

Be aware that the man with the best record on turning points, Ed Yardeni, refused this week to raise his year-end target above his current of 4,600. This is despite his view that “We’re seeing the soft landing that the market’s been looking for“. He also said that the “bond market calling the shots for the stock market.”

Moving to AI, Dan Ives of Wedbush has been the leading voice for technology, especially AI. His basic thesis is that this is 1995 & we have 18-24 months to participate in the move. And Apple is the table pounder for him. For what will drive Apple & when might we start hearing about how & what Apple does to & with AI, watch his 7-8 minute appearance on Bloomberg Surveillance on Thursday, August 31 morning (minutes 2:19:20 to 2:26:38).

Now a couple of charts looking forward:

- Larry Tentarelli, Blue Chip Daily@LMT978 – Sat – $SMH set up well. Just below a 162.50 breakout level.

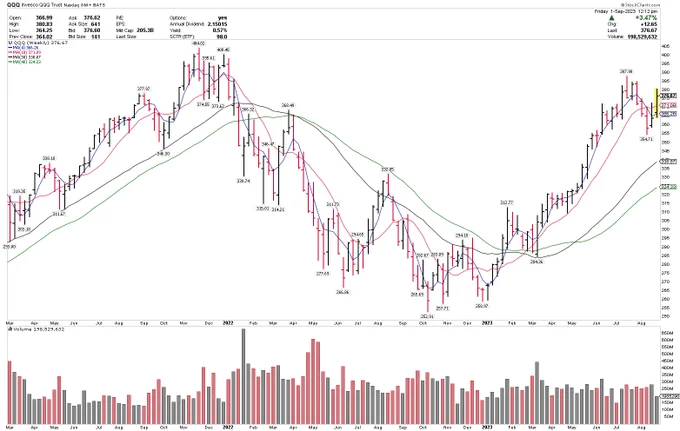

- Larry Tentarelli, Blue Chip Daily@LMT978 – Sep 1 – Strong week for $QQQ so far.

Reclaimed the 20 & 50-sma, a few other trend buy signals earlier in the week.

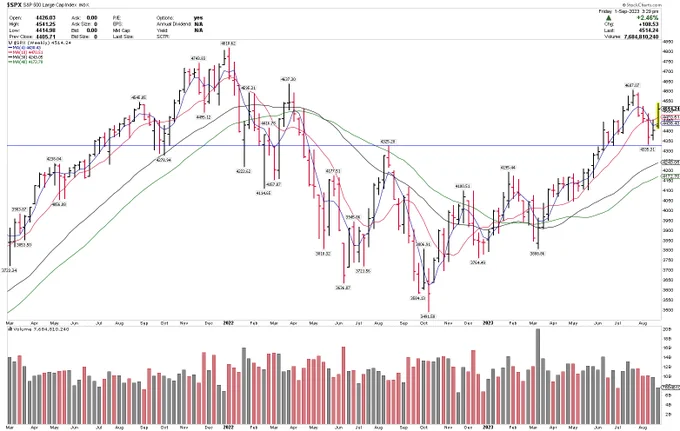

- Larry Tentarelli, Blue Chip Daily@LMT978 – Sep 1 – $SPX has held > the 4325 support/base breakout line twice on recent pullbacks. A key support level.

4. Dollar & Commodities

Despite the BRICS hype & opportunity, nothing matters to the global economy as the U.S. Dollar. You add weakness in the Dollar to Treasury rates stabilizing & you send buy triggers through commodities & emerging markets.

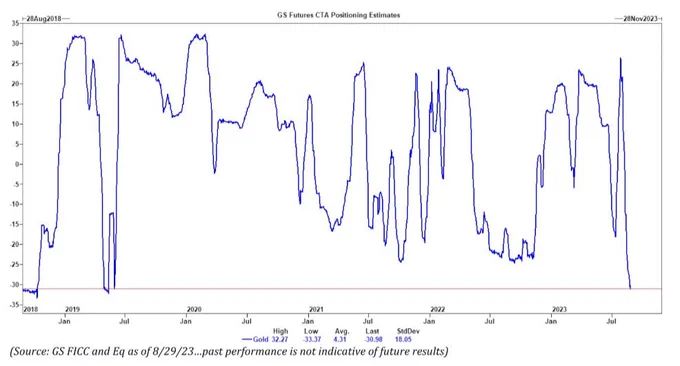

- Barchart@Barchart – Aug 30 – CTAs are currently short $30 billion worth of Gold, the largest short Gold position in more than 4 years and one of the largest ever according to Goldman Sachs

Naturally, one asks:

- Jason@3PeaksTrading – 2024 could be the year for… gold? 🤔

Moving to oil:

- Bespoke@bespokeinvest – Crude cup and handle? $USO

- Via The Market Ear – Oil – zooming out – Is this a massive golden cross to “care about”? Source Refinitiv

That brings us to:

- Larry Tentarelli, Blue Chip Daily@LMT978 – Sep 1 – $XLE strong week so far, testing > 90. Over 92 soon could open up the chart.

5. From There in 1998 to Here Now in September 2023 – US & India

For those who don’t know, the United States led by President Clinton was vehemently opposed to India going nuclear. US Satellites used to monitor the Pokhran test ground to check if India was preparing for its first nuclear test. CIA was active near Pokhran with NaPakistani spies to do the same on the ground.

The newly elected first BJP Government wanted to go nuclear. So they assembled a team at Pokhran staffed to prepare India’s first nuclear test. They worked during the periods US satellites were not over India & shut everything down before US Satellites would approach. India also created a mock scare of a conflict with NaPakistan to pull most of US Satellites to monitor Kashmir instead of Pokhran.

And while the US Ambassador was conducting feverish negotiations with the Indian Prime Minister about avoiding a Kashmir accident, the Indian nuclear team exploded 3 nuclear bombs at the underground testing facility in Pokhran. The team leader called the First Secretary to India’s Prime Minister while the PM was in a meeting with the US Ambassador with the code message “Sir, the White House has collapsed. Congratulations”.

This story is told in a film titled Parmanu (the atom) – the Story of Pokhran from Zee TV. The film also shows the actual footage of CIA Director George Tenet speaking publicly on US TV about this test saying:

- “We have been following the Indian Nuclear Program for many years but there is no getting around the fact that in this instance we missed & did not predict the particular test involved. Simply stated, we did not get it right.”

Watch at least the last 20 minutes of this film from 1 hour & 43 minutes onwards. An angry President Clinton slapped sanctions on India in 1998 that the Indian Airforce has not yet forgotten. Simultaneously it was a wake up call for President Clinton to upgrade India in the US foreign policy calculus. President Clinton made his first trip to India in 2000 & since then every US President has made a progressively warmer & more successful visit to India.

Fast forward to September 1, 2023 and witness a path-breaking decision by USA to launch a major partnership with the Indian Air Force. Remember the deal signed between President Biden & Prime Minister Modi during in June 23:

- “GE F414 Engine Co-Production: The United States and India welcome a groundbreaking proposal by General Electric (GE) to jointly produce the F414 Jet Engine in India. GE and Hindustan Aeronautics Limited have signed a MoU, and a manufacturing license agreement has been submitted for Congressional Notification. This trailblazing initiative to manufacture F-414 engines in India—the first of its kind—will enable greater transfer of U.S. jet engine technology than ever before.

This week the US Congress cleared this deal marking a new era in military technology cooperation between USA & India.

Furthermore, the Indian aerospace & military complex is increasingly taking a smarter & a US-type look with smaller companies & start ups supporting the larger scientific & technological entities. Reportedly HAL (Hindustan Aeronautics) has begun training 600 of its trusted subcontractor firms to begin work on this high level of GE-engine technology.

Another piece of evidence of this new architecture came from a Bloomberg story that,

- “A New Delhi-based startup has won a 3 billion rupee ($36 million) order to make 200 long-range swarm drones as the Indian Air Force tries to add to its capabilities drawing lessons from Russia’s war in Ukraine”.

Imagine what might the Indian aerospace & military technological space look like in 10 years if not in 5 years? Now you understand why Jeffrey Gundlach stated weeks & months ago – stay invested in India for the next 20 years or so for the benefit of your grandchildren.

6. Indian Space Research

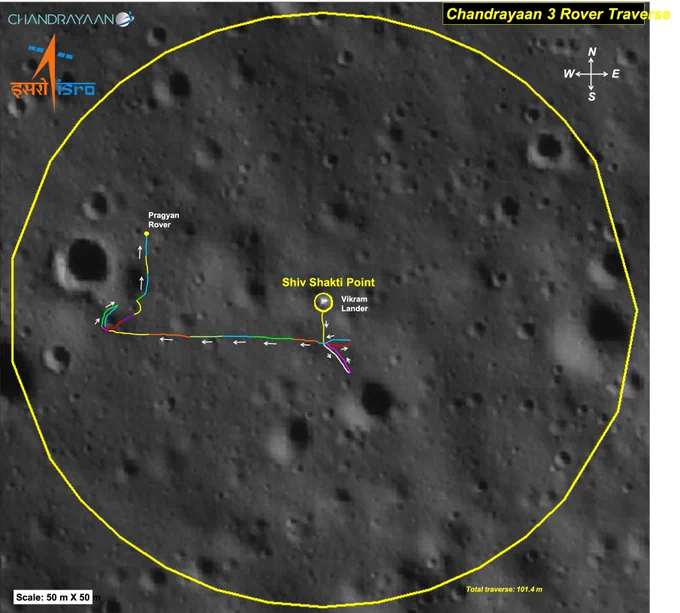

By now, everybody has heard about India’s successful mission to land on the South Pole of the Moon. A day ago, ISRO tweeted:

But now the Lunar night has begun & the Pragyan Rover has gone to sleep. Will it wake up when the next lunar day begins on September 22, 2023?

- ISRO@isro – Chandrayaan-3 Mission: The Rover completed its assignments. It is now safely parked and set into Sleep mode. APXS and LIBS payloads are turned off. Data from these payloads is transmitted to the Earth via the Lander. Currently, the battery is fully charged. The solar panel is oriented to receive the light at the next sunrise expected on September 22, 2023. The receiver is kept on. Hoping for a successful awakening for another set of assignments! Else, it will forever stay there as India’s lunar ambassador.

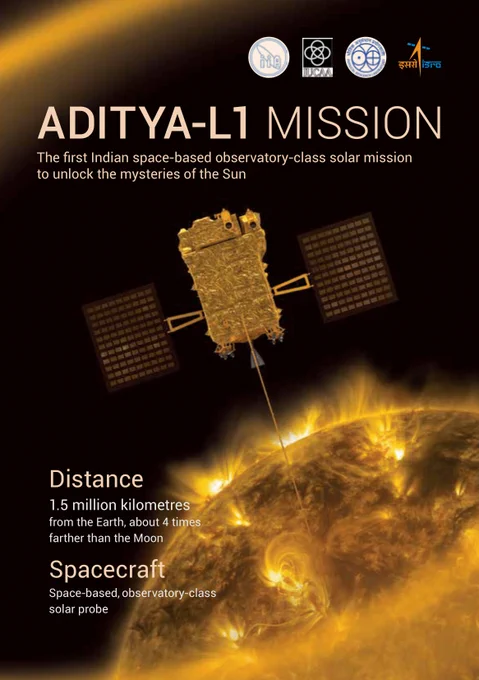

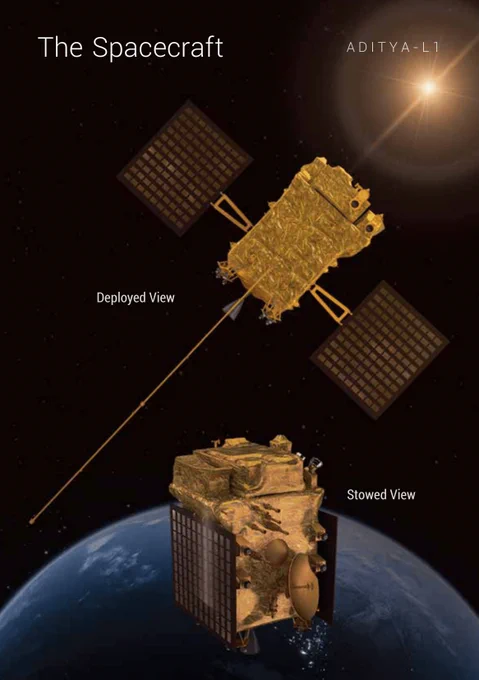

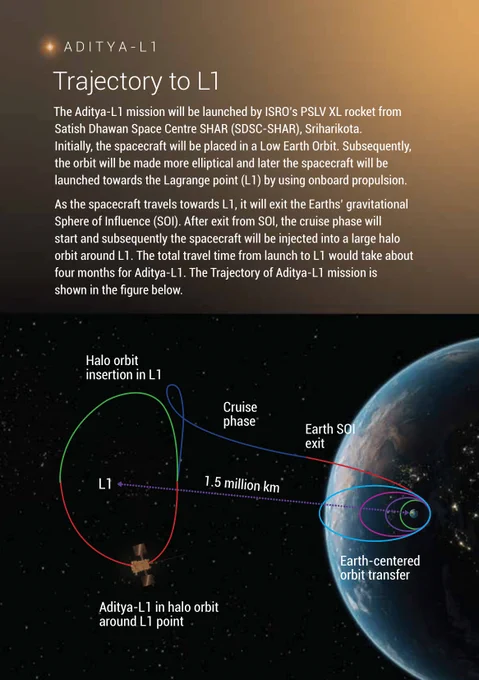

But this Chandra-Yaan stuff has almost become yesterday’s news. Because two days ago ISRO launched Aditya-L1, its first Solar Observatory, to study the Sun & its impact on earth from its chosen spot at L1 (Lagrange point 1) where the gravitational pull from the Sun & Earth are equal.

- ISRO@isro – Aditya-L1 Mission: The satellite is healthy and operating nominally. The first Earth-bound maneuvre (EBN#1) is performed successfully from ISTRAC, Bengaluru. The new orbit attained is 245km x 22459 km. The next maneuvre (EBN#2) is scheduled for September 5, 2023, around 03:00 Hrs. IST

By the way, the term Aaditya means a son of Aditi, a legendary figure in Indian history. The Aditi period, according to ancient texts, began in 6400 BCE & ended in 4700 BCE when the Orion period began. The name Aaditya is one of the many names given to Surya or the Sun.

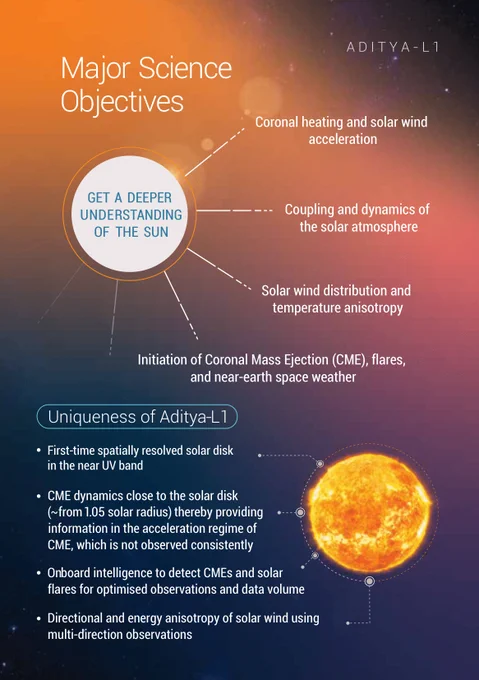

Hear the ISRO scientists explain what they plan to study about the Sun & why Aditya-L1 is different from the earlier such laboratories.

A more visual & less scientific clip that might be easier & quicker to watch:

While all the above is good & for universal good, it seems that the immediate geopolitical ramifications might not be all positive. In fact, the potential for a near-term war might now be much higher. How near-term? Before winter arrives in the Indian Subcontinent, possibly? If interested, look at our adjacent article – BRICS, G20 & Beyond – India- China as Central Competition

Send your feedback to editor.macroviewpoints@gmail.com Or @MacroViewpoints on Twitter