Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Will history rhyme again?

Fed Chairs have a historical record of destroying market values & causing chaos simply by babbling too much & that too in the wrong tone. Others have generally understood their folly after the first chaos they created. Not our current Chair. Look at the massive open JAW he opened 2 months ago with 30-yr Treasury yield at the top lip & SPX at the bottom lip:

Look and you will notice that the Jaw began opening around July 26, the day of the FOMC meeting & Powell’s presser. And it snarled to a killing open posture on September 20, the day of Powell’s presser after the September FOMC meeting.

Last time we saw such a JAW graph was in September 1987 in the Wall Street Journal. We were just babes having invested a few bucks we earned as a techie into Fidelity Magellan. A new Fed Chair named Greenspan had raised rates in September 1987, a month after his confirmation. We all know what happened in October 1987.

Twenty years later in October 2007, an economist named Richard Hoey termed the Greenspan action a “rookie” mistake of an “overkill”. Everyone knows what happened to stocks, the lower lip of JAWs. But not many know that the 30-year Bond rallied HUGE on October 19-20, 1987.

Chair Greenspan never repeated his September 1987 mistake. That is why we can say Chair Powell is made of sterner stuff. He himself had created a smaller JAWs condition after his arrogantly stupid statements in October 2018. He had reverse that in January 2019. You think he would have learnt his lesson.

He may have but then the urge to be known as the next Volcker seems to have shooed away any semblance of reason. The result is the JAW apparition he created.

Assuming there will be a payback, we kinda hope it is the October 1987 kind. In retrospect, it wasn’t that bad. Yes the stock market fell 20% in a day but it recovered most of its losses in the weeks & months ahead. The Treasury market rallied huge & closed the open JAW shut. The economy was strong and wasn’t damaged much post-crash.

Now read the October 19, 2007 Reuters article titled Oct ’87 bond rally could replay, but more modestly in which Mr. Hoey was quoted as above. If you do, you will notice that a veteran economist like Mr. Hoey (then chief economist at Bank of New York Mellon) was blissfully unaware of the recession that was about to begin in November 2007 and the plunge it would cause in TYX (30-yr yield) & SPX. Recall also that the S&P had made a new all-time high on October 14, 2007, a couple of days before that quote.

That shows how blissfully unaware mainstream economists were about the impending downward move in the economy in 2007-2008. Are their counterparts today just as blissfully unaware of the damage already caused & where it might lead? We think so. Yes, we are simple folks and we could be totally & hopefully wrong. But the weather does smell funny, at least to us.

And a big smell is coming from the U.S. banking system, the big banks & not just the smaller regional banks. Look what badly Bank of America has done this year even when compared to Citibank that still trades near its 2008 level (adjusting for its 10:1 reverse split):

This is not merely a story of couple of banks. It is systemic:

- Holger Zschaepitz@Schuldensuehner – Sep 30 – Stress in the financial system is rising: The value of global bonds dropped another $428bn this week as the interest rate world keeps repricing for a higher for longer. In past quarter, bonds lost ~$1.8tn in value and everyone is puzzling over who has the losses on their books.

Naturally,

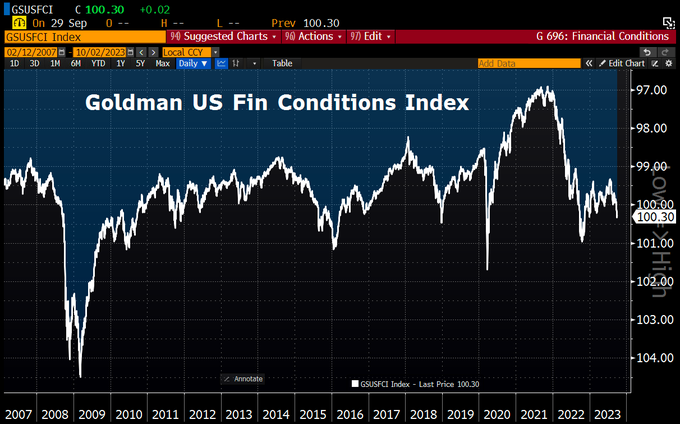

- Holger Zschaepitz@Schuldensuehner – Oct 1 – In case you missed it: The past few months have brought a very significant tightening of US financial conditions; the Goldman Sachs Financial Conditions Index is now at the most restrictive point since Nov 2022. (HT GS)

All this in a highly levered economy?

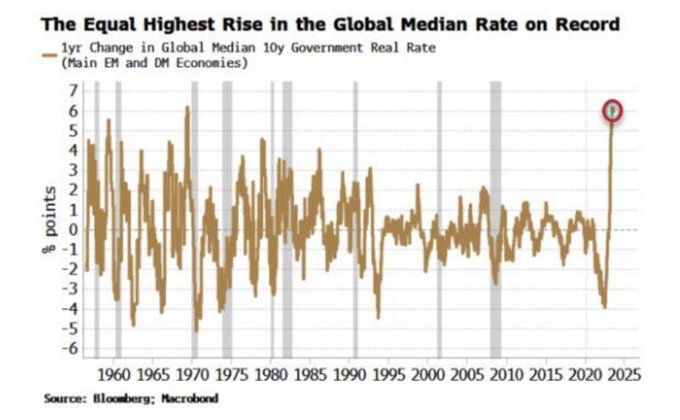

- Otavio (Tavi) Costa@TaviCosta – Oct 1 – I cannot stress this enough: The escalating risk from the global destruction in collateral value of fixed-income securities in a highly levered economy is profoundly concerning. The very individuals who previously dismissed the lagging impact of falling bond prices within the banking system are now claiming that worries about a recession are widespread.

But how much greater is the 2023 rate rise compared to the earlier recessions?

- Jesse Felder@jessefelder – “The core risk for markets and the economy is tied to the interest rate shock of the past 18 months. The current change in interest rates is about 5 times larger than the 2002-2008 increase.” https://ft.com/content/979690cc-341f-4e89-b398-f28a9e27d7bd

Any one who wants to read more should see how the US consumer is being affected by simply viewing the charts posted by David Rosenberg in his new missive – Playing with Fire.

If you are like us, you desperately need a drink or some positive views after reading a Rosie piece. So much of what follows has a bullish flavor, at least for the short term.

2. U.S. Dollar

- Sven Henrich@NorthmanTrader – 9-27 – 11 weeks of Dollar rally now pushing outside the weekly Bollinger band. $DXY

But two days later:

- Trader Z@angrybear168 – Sep 29 – $UUP USD is opening itself to a potential 80% rule backfill to 28.81 monthly value area low if bears can break the trendline and close within value in October.

And,

- Larry Tentarelli, Blue Chip Daily@LMT978 – Sep 27 – $SPX 28 daily RSI; $USD 79 daily RSI; Both near extreme ends of their RSI ranges.

That certainly made us feel better. Let’s see if we can keep this good feeling going.

3. Stocks

First the smart guys who have been right about their weekly suggestions:

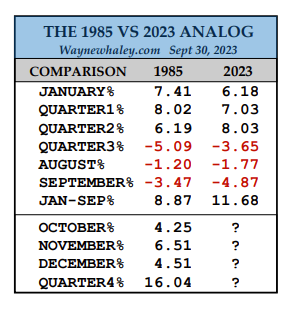

- Wayne Whaley@WayneWhaley1136 – Sep 30 – The odds of 1985 style 4th Qtr finish are extremely unlikely but the Bulls have to like setup comparisons. Both were recipients of Jan thrust as well as a late summer correction which much of our studies suggest is normally Fourth Qtr friendly. The similarities are worth noting.

Next,

- Jeffrey A. Hirsch@AlmanacTrader – Sep 27 – October: Bear-Killer, Bargain Month, Turnaround Month – Seasonally Speaking, October is time to buy stocks, especially late Oct & esp techs & small caps. October can evoke fear on Wall Street. Memories are stirred of crashes & massacres.

And,

- Jason@3PeaksTrading – Sep 28 – Covered all shorts at the open and added long calls in $SPY, $AMZN and some $TSLA all from this great view at the Baltic Sea in north Poland!

A new voice with a cool handle:

- hedgopia@hedgopia – Sep 29 – Non-commercials cut net shorts in e-mini $SPX futures to lowest since early Jun last year. At this rate, wouldn’t be long before they switch to net long. Cash (4288) down 4 weeks in a row. Wed’s low 4239 came just above 200-day (4199). Rally odds growing. 4320s first hurdle. $SPY

Now to one who has remained bullish for the last couple of weeks:

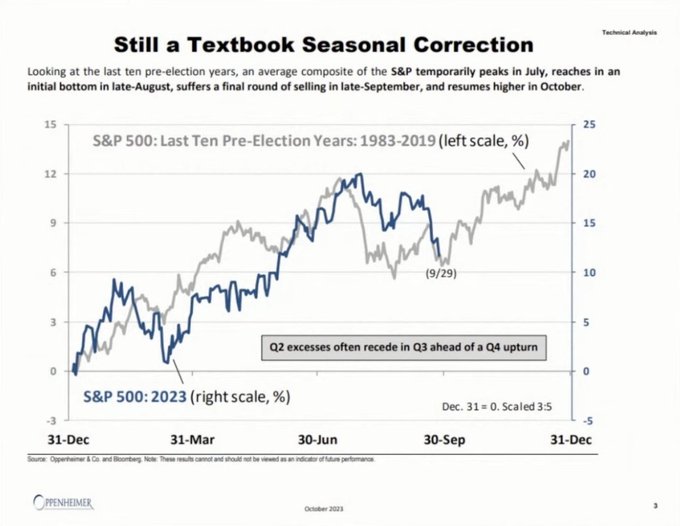

- Seth Golden@SethCL – Friggin’ perfect… Updated: Last 10 Pre-Election years. Nothing anomalistic in price action, following typical seasonal pattern. $SPX $SPY $QQQ $DIA (Ari Wald of Oppenheimer)

Now for simple stuff that even we can understand. Before that, how did the major indices do last week? In order of performance – SMH up 2.2%; QQQ up 5 bps; SPX down 74 bps; Dow down 1.30%;

First a solitary comment:

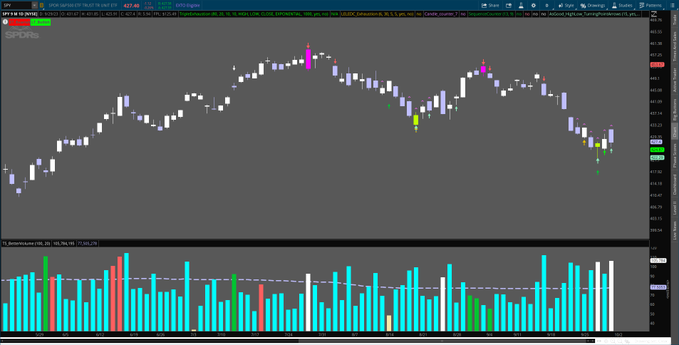

- Trader Z@angrybear168 – Sep 29 – $SPY a cluster of buy signals are showing up on the swing system, should be fun.

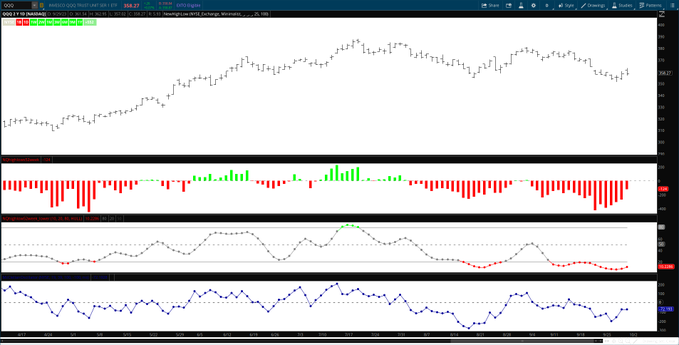

Now to QQQ:

- Helene Meisler@hmeisler – Sep 30 – At 146 new lows that was the fewest for Naz since 9/1

- Helene Meisler@hmeisler – Sep 30 – Naz was green 4 days last week.

Plus,

- Trader Z@angrybear168 – Sep 29 – $QQQ huge improvement on new lows today, not positive yet but a higher low indeed

And now to Semis:

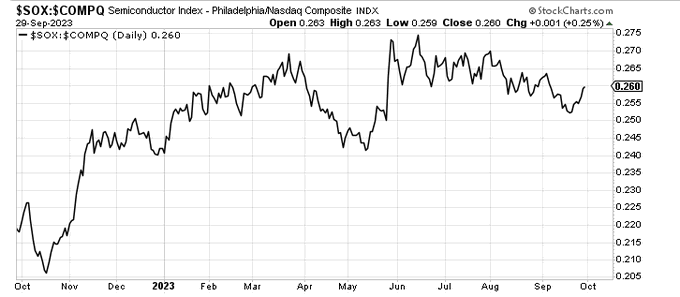

- Helene Meisler@hmeisler – Sep 30 – SOX to Naz

Now about an interesting reversal in performance:

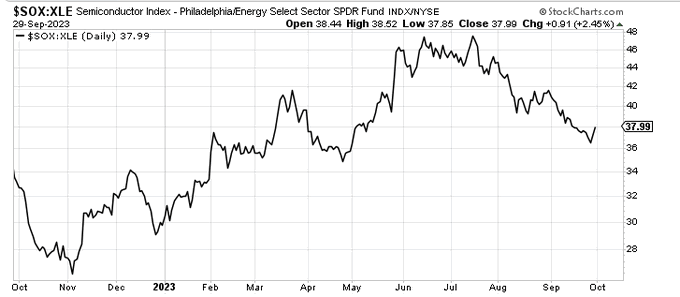

- Helene Meisler@hmeisler – Sep 30 – SOX to XLE. Interesting move in the final week of the quarter.

Finally, an year/year comparison:

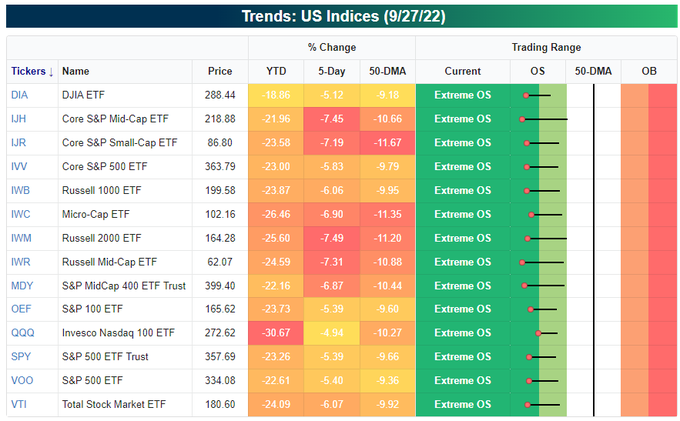

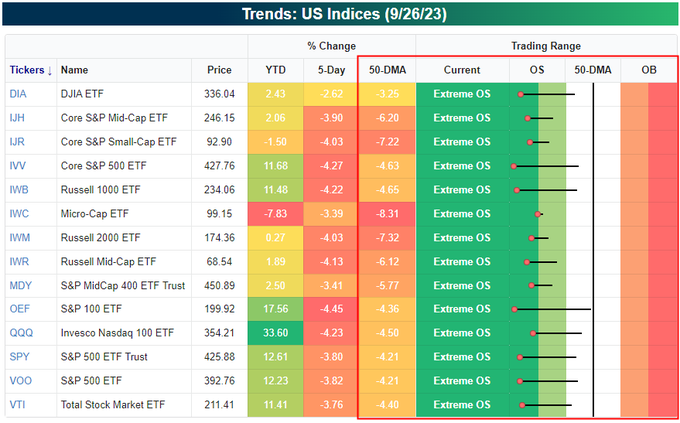

- Bespoke@bespokeinvest – 9-27 – There’s something about late September… Every major US index ETF in our Trend Analyzer is now in extreme oversold territory. The last time every single US index ETF in our Trend Analyzer was in extreme oversold territory was exactly a year ago on 9/27/22.

4. Interest Rates

Guess what happened on Thursday, September 28 – Rick Santelli pronounced that an intermediate technical top had been reached in Treasury rates. And true to from, Treasury rates along the entire curve fell 2-3 bps on Friday, September 29.

There has been so much talk about who is going to buy Treasury bonds given the size of the deficit. Bob Michele of JPM Fixed Income said on Bloomberg this week that large investors who normally buy 30-yr Treasuries are waiting to avoid catching a falling knife. But the appetite & the need to buy is growing & when they choose to come in, the buying will be more than enough.

Some economists are shedding their reluctance and saying Buy now.

- Kelly Evans@KellyCNBC – MKM’s Michael Darda (the only one who was right during Covid): buy bonds. The downturn will trump the deficit.

And,

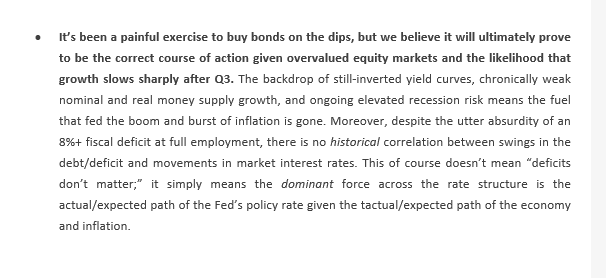

- Bespoke@bespokeinvest – The 2-year Treasury is yielding 5%+ and speculator positioning gets more and more short each week. The countertrend rip could be a big one when it comes.

What about the 30-year?

- Joe Kunkle@OptionsHawk – $TLT – 30 Year Bond Chart is Wild – Maybe get some kind of Government shutdown washout and reversal here by week end

5. “friends up north” or/and “Canada as Pakistan’ –Truth Way Way Stranger than Fiction/Allegations

In this arena, we admit we are not even babes in the woods but probably babies in cribs. We thought last week’s story was about a murder of a man some considered a leader & others a terrorist. We discovered this week that the True story actually involves a terrorist center that spans the globe from British Columbia to Pakistan to Myanmar & possibly Thailand as a port. By the end of the week, it had also involved Glasgow, Scotland.

The Nijjar episode in itself involves Canadian Intelligence, many retired Major Generals of Pakistani ISI & a drug + people trafficking network. But even that is not serious enough. Because by Saturday, September 30, the story got engulfed in a no holds barred war between two top terrorist armies inside Pakistan, one of which is Lashkar-e-Toiba & its leader Haffiz Saeed on whose head still sits the $10 million US award.

Not merely that but this Saturday’s day light shooting of Mr. Saeed’s right hand man in Karachi was filmed live as he was shot & fell and the video has been given to every media outlet that wants to showcase it.

So we request readers to read our adjacent article “The Nijjar Murder – Is Truth Way Stranger than Fiction or “Credible Allegations“? Everything in the article is from publicly available sources including the Vancouver Sun, Al Jazeera & various Indian media entities.. We would love candid feedback on the topic or our write up.

Our only factual statement is that anyone who uses words like “community leader” or “activist” for Nijjar or his fellow Khalistani extremists should be aware of the risk of getting typecast as a terrorism supporter or sympathizer. This weekend’s attack on the Indian Envoy in Glasgow has served as a wake-up call to Britain at the PM level. Hopefully Trudeau will soon see the wisdom of stepping down given what might have transpired between Canada’s Intelligence Services & himself. Read the article to see what we mean.

What feels absolutely great is how India’s External Affairs Minister described the India-US relationship during his trip to Washington. His one-liner summary is – “Today in every way this relationship has exceeded expectations, which is why today we don’t even try to define it. We actually keep raising the bar,.. “

Not many know this but Israel has been the rock on which the India-US relationship began and at every step Israel has encouraged & backed it. So it is important that we acknowledge Israel’s drive for “another pivot of history” via a “monumental change” as he told the UN General Assembly this week.

Send your feedback to [email protected] Or @MacroViewpoints on Twitter