Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Glory Be?

This past week started weak with first two days down as some had forecast. Then Taiwan Semi earnings hit the tape Thursday morning & BahBahBah Boom!, as the saying goes.

As Bespoke X-ed:

- Bespoke@bespokeinvest – Jan 19 – The Philly Sox Semis index was up 8% this week compared to a gain of just over 1% for the S&P 500. Strongest 4-day outperformance for the semis vs. the S&P since May 2023. All 30 Sox members were up today when the index rallied 4%. It was up 3.36% yesterday.

The message behind this action is smart & sound:

- David Keller, CMT@DKellerCMT – Semiconductors $SMH $SOXX feel like the new utilities. Backbone of the modern economy, representing products and services you’ll most likely keep using despite economic uncertainty. Good offense, potentially good defense during a rocky Q1 2024.

Looking back for a similar move:

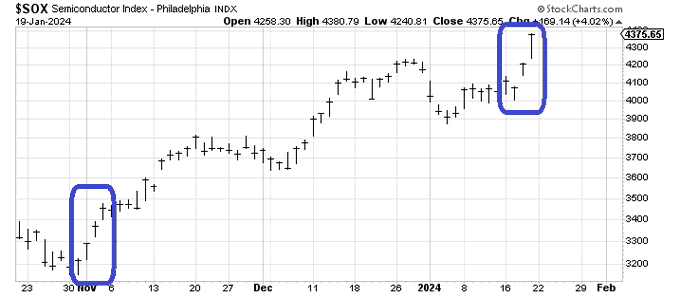

- Helene Meisler@hmeisler – Jan 20 – SOX

And with Semis rose Mag 7;

- AAPL up 3%; AMZN up 65 bps; GOOGL up 2.8%; META up 2.7%; MSFT up 2.6%; NVDA up 8.8%;

And if Mag 7 are up, what have we seen in 2024?

- BAC down 1.8%; C down 2.2%; JPM up 82 bps; GS up 1.3%; SCHW down 2.1%; IBKR down 3%

2. SPX, NDX, RUT et al

For the past week – SPX up 1.2%, NDX up 2.9% & COMPX up 2.3%.

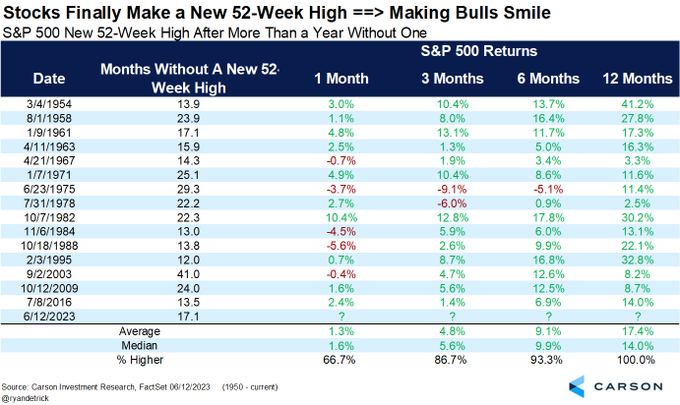

- Ryan Detrick, CMT@RyanDetrick – New 52-wk high for the S&P 500 after more than a year without one. You don’t see this happen near major peaks. Higher a yr later 15 out of 15 times and up more than 17% on avg.

And,

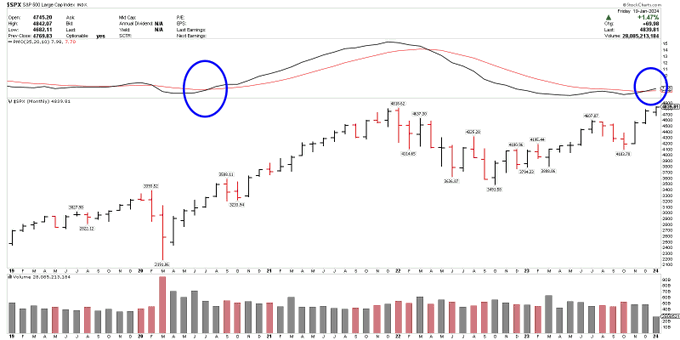

- Larry Tentarelli, Blue Chip Daily@bluechipdaily – Jan 19 – $SPX bullish monthly PMO cross + new highs. Chart is set up for higher.

Finally a comment from someone who has been right for awhile:

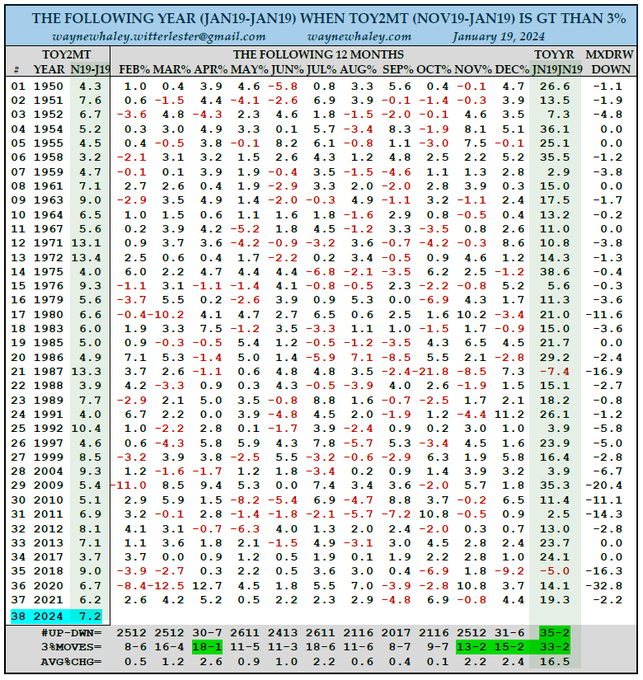

- Wayne Whaley@WayneWhaley1136 – Jan 19 – TOY is a “Turn Of the Year” Barometer based on the S&Ps Nov19-Jan19 performance. The 2024 TOY is 7.22%. Since 1950 if TOY was > 3%, the next year (Jan19-Jan19) was 35-2 for an avg 16.5% gain with 2 single digit losses. Feb-April is 32-5 for an avg 3 mt gain of 4.23%

Moving to the NDX:

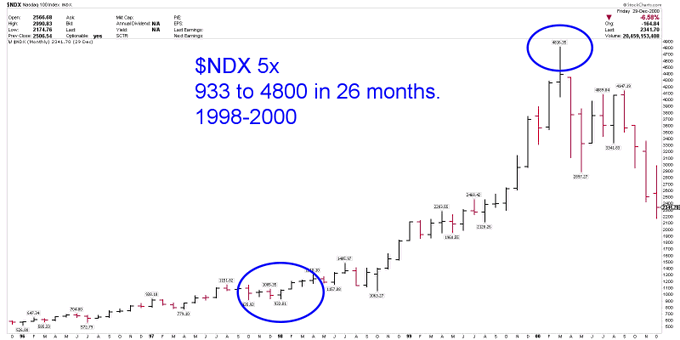

- Larry Tentarelli, Blue Chip Daily@bluechipdaily – Still not buying the “Tech Bubble 2.0” posts $NDX went 5x in 26 months, 1998-2000. I was actively trading then, so I know what it looks like. For today’s $NDX to be comparable, it would need to trade today at 52200, it closed at 17314 yest. Oct 2022 low, 10440 x 5x) = 52200

That brings us to something that has never happened before:

- Jason Goepfert@jasongoepfert – Jan 19 – The S&P 500 closed at an all-time high. The Russell 2000 is still in a bear market*, down more than 20% from its high. That’s never happened before.

Perhaps that means:

- Markets & Mayhem@Mayhem4Markets – $IWN looks quite interesting here as a swing long 🤔. Above the 200-day and 50-day moving averages what appears to be a new uptrend forming; Defending a key trendline and bouncing; Positioning and call skew are not stretched; A P/E ratio of about 10.25; A 2.04% dividend

Ok, but does anyone have an upside target?

- Jason@3PeaksTrading – …. this pullback to support and backtesting the trendline break.. inside month candle thus far. Bears getting riled up lol; $IWM will be 220+ by Spring

But what about that saying – Rates up, Russell down?

3. Treasury Yields

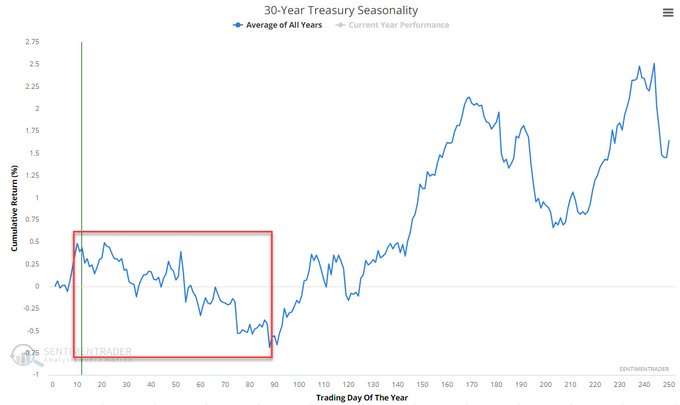

- Jay Kaeppel@jaykaeppel – Jan 18 – Seasonality is never a sure thing. That said, it presently is a negative factor for long-term treasuries. @sentimentrader

And that was the story this past week:

- 30-yr yield up 15 bps; 20-yr up 16 bps; 10-yr up 18 bps; 7-up 20 bps; 5-yr up 21 bps; 3-yr up 22 bps; 2-yr up 23 bps; with TLT down 2.5%; EDV down 2.2%; ZROZ down 5.7%; HYG down 73 bps; JNK down 78 bps;

4. Dollar up, International Down?

UUP was up 95 bps & DXY was up 80 bps. So Gold & Silver got hit. And so did International stocks & many commodity stocks:

- EEM down 2.1%; EWZ down 4%; EWY down 3.4%; FXI down 4.7%; KWEB down 6.1%; INDY down 1%; EPI down 47 bps; INDA up 18 bps;

- CLF down 4.1%; FCX down 5.1%; MOS down 2.1%; XLE down 3%; OIH down 1.4%;

5. Explosion of Hateful Anger at CNBC-NYSE – A corporate liability for both?

For some reason that we can’t fathom, there is dogged determination to abuse Indian names at many US networks and especially at CNBC. It keeps showing up at CNBC probably because no CNBC anchor-reporter has ever suffered any real censure for doing so. It is not that CNBC leadership doesn’t realize it but determined enforcement of compliance has not been a CNBC virtue at least for the past 15 years.

This week a particular anchor at CNBC-NYSE seemingly went nuts in his determined abuse of a sacred Indian name, a synonym for Bhagvaan Krushn. It is almost as if he wanted his listeners to know that he wanted to demean the name as a right. In fact, it was so nuts that his three guests on the show seemed stunned at his tone & facial expression. This is one occasion that we appreciate CNBC not putting that particular clip on its website. Because this episode goes far beyond the emotional state &, what we perceive as, inner hatred of that particular anchor.

The name that was abused was Aswath Damodaran, a linguistically elite name unlike the more familiar Ram (Raam) & Krushn, the two most important Avataar of Vishnu, the Creator component of the Divine Trinity. It is possible that the man who was given these names may not himself understand the names that were given to him by his erudite parents:

- Aswath (a horrible spelling of Ashvath) is the name of the tree under which Prince Gautam received his Divine Enlightenment & thus became Buddha, the founder of Buddhism. So it is hardly appropriate for a CNBC anchor to publicly use the “Ass” pronunciation for this name of deep meaning to Buddhists all over the World.

- The last name correctly written as Daamodaran, in contrast, is far more common. And here the man, a noted Professor of markets, is mainly at fault. He still uses the wrong spelling “Damo” instead of the phonetically correct “Daamo”. We must point out that we had communicated specifically to this CNBC anchor that the correct pronunciation is Daamo & not Damo. But he obviously doesn’t care.

Here is where we would like to move beyond the hate of one anchor to CNBC, the organization. From what we understand, each show has an Executive Producer & at least one staff member. Having watched CNBC for a long time, we feel absolutely certain that this team managing the show WOULD NOT permit such abuse of a Sacred Christian Name or a Sacred Jewish Name & absolutely not a Sacred Muslim Name. To digress a bit, we used to notice abuse of Sacred Muslim Terms in the late 1990s on News TV. That stopped right after 9/11.

So the question is whether CNBC has a written down practice for their anchors, executive producers to verify they are correctly pronouncing Sacred Names to not inadvertently insult a large number of viewers. They clearly did NOT practice such basic due diligence for the name used as “Damodaran”. Out of curiosity we wondered how hard might such due diligence have been?

So we typed “How to pronounce Damodaran?” in YouTube search bar & look what we found:

Those who prefer a written pronunciation can simply visit PronounceNames.com & watch it show what we told this CNBC anchor awhile ago – Say it as Daa & not Da:

And how important a name is Daamodaran? It is a part of a prayer that families recite every day. Listen to first 6 words of the prayer below & hear “Krushn Daamodaran” phrase:

We found the above in minutes. The CNBC Executive Producer of the show had seemingly ignored such basic due diligence & the CNBC Managing Editor presumably has NOT dictated such due diligence for all CNBC shows. They, in our opinion, can at least be criticized as negligent & derelict in their functions.

The previous such instances we have discussed took place in shows based on CNBC HQ in New Jersey. In stark contrast, the above show is televised from the New York Stock Exchange. Since this abuse, wanton deliberate abuse, of a Sacred Indian name took place at the New York Stock Exchange, wouldn’t the NYSE be liable at least partly?

We don’t know but isn’t it likely that use of NYSE facilities & the NYSE logo was granted to CNBC by the NYSE under an executed Legal Agreement? If so, wouldn’t even a basic legal agreement of this sort specifically demand standards of behavior that would not damage the reputation of NYSE?

If we recall correctly, the NYSE is extremely close to the site of 9/11 & suffered like the rest of us from the after-effects. So we find it very difficult to believe that the NYSE would permit a CNBC show based at NYSE to abuse & insult a Sacred Muslim Name. And NYSE tolerating an abuse of or insult towards Sacred Christian or Jewish names at NYSE facilities would be impossible to even imagine.

So was the above behavior towards Sacred Indian names because CNBC knows (& NYSE concurs) that Hindus are docile even pathetic creatures who greatly value being personally seen on White American TV & ignore whatever slight/insult being heaped on their religion-culture to protect their selfish interests? Fine but what do CNBC & NYSE gain by allowing this persistent denigration of Sacred Indian Names? Feeding their inner bigotry & hate?

Finally a simple question to CNBC & (to NYSE, a silent participant) – Why not simply use terms like Professor or Dean for guests who names you can’t pronounce? Unless deliberately insulting Indian religions & Sacred Texts is really a goal of CNBC!

The answer may be simple – India still has NOT produced a Bill Ackman! It might be a stretch to imagine an Indian Bill Aikman, but smart journalists in India have begun raising questions about Anti-Hindu-Hate in America:

- Anand Ranganathan@ARanganathan72 – – While Indian business houses hike their donations to universities that spread hatred against Hindus – case in point being the increase in funding of chairs and centres at universities that recently co-sponsored the virulently Hinduphobic Dismantling Global Hindutva Conference. (We find the graphic below weird given how Bill Ackman was advocating removal of the other three)

Send your feedback to editor.macroviewpoints@gmail.com Or @MacroViewpoints on X