Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Week that switched but for how long?

Broad Indices:

- VIX down 4.9%; Dow up 34 bps; SPX up 1.9%; RSP (equal-weight S&P) up 8 bps; NDX up 3.2%; SMH up 3.9%; RUT unchanged; IWC (micro-cap) down 53 bps; DJT down 25 bps;

Sectors & Stocks – sharp & hard reversal from the week before:

- BAC down 4.6%; C down 3.5%; JPM down 1.9%; KRE down 3.1%; GS down 2.3%; AAPL up 2.8%; AMZN up 6.2%; GOOGL up 5.1%; MSFT up 5.6%; META up 6.2%; NFLX up 3.8%; NVDA up 11.3%;

Dollar nearly flat:

- Gold flat; Silver down 28 bps; Copper down 1.6%; CLF down 3.5%; FCX down 1.3%; Oil down 1.5%; Brent down 47 bps; Nat Gas up 16.6%; OIH down 4.4%; XLE down 2.6%;

International Stocks:

- EWG up 1%; EEM down 66 bps; EWZ down 52 bps; EWY down 2.6%; FXI down 2.3%; KWEB down 2.2%; INDA up 75 bps; INDY up 1.1%; EPI up 1.7%; SMIN up 82 bps;

Below was one big difference between the week before & this past week.

- 30-yr yield down 1.6 bps; 20-yr down 6.1 bps; 10-yr down 10.2 bps; 7-yr down 14.2 bps; 5-yr down 17.2 bps; 3-yr down 23.2 bps; 2-yr down 23.6 bps; 1-yr flat; TLT up 40 bps; EDV down 32 bps; ZROZ flat 81.45; HYG up 1.3%; JNK up 1.3%; EMB up 1.5%;

Don’t you think BofA’s Savita Subramaniam was right at least for this past week with her quote below?

- “A rout in big tech plus a broadening of market leadership is becoming consensus. January pain trade = higher TMT/Mega-caps“

How does that look in a chart?

- Liz Ann Sonders@LizAnnSonders – Jan 11 – Back to an all-time high for Magnificent 7 (as tracked by @Bloomberg) [Past performance is no guarantee of future results]

And, unlike many, Ms. Sonders linked it to a key operating statistic:

- Liz Ann Sonders@LizAnnSonders – Jan 11 – Another roundtrip completed for S&P 500 Tech sector’s forward 12m operating margin … % near another all-time high after a considerable drop in 2022

How right was the BofA strategist in describing this as a “pain trade“? Your answer would be “very” if you watched CNBC’s Scott Wapner express his chagrin to a guest asking what happened to small-caps & the broadening of the leadership they discussed the week before?

Another big change this past week was the layoff announcements:

- GOOGL was up 5% this past week despite announcing it had laid off “hundreds of employees working on its hardware, voice assistance and engineering teams as part of cost-cutting measures.”

- AMZN was up 6.2% on the week despite having “laid off hundreds of employees in its Prime Video and studios units. It also will lay off about 500 employees who work on its livestreaming platform Twitch.”

- That is after announcement of 17% job cuts at Spotify, 15% at Xerox, 25% at Unity Software.

Do these large layoffs actually improve “forward 12m operating margins in the S&P tech sector” as highlighted above in the chart from Ms. Sonders? That has actually been the history of GOOGL, AMZN etc.

Think back to what Ms. Sonders pointed out in her post-NFP tweet of January 5:

- Liz Ann Sonders@LizAnnSonders – 8:47 am – Fri Jan 5 – December household employment fell by 683k, largest drop since April 2020 … reminder that ‘household survey’ generates unemployment rate, and is different from ‘establishment survey’ which generates headline nonfarm payrolls

The layoffs of hundreds of employees by these giant firms will probably show up in the “household employment” report. But will they show up in the “headline nonfarm payrolls“? Or will they be absorbed into another birth-death estimate of jobs created? Even if the latter is the case, we wonder if public news of these large layoffs at Alphabet, Amazon prompt other medium-sized firms to follow suit? We ask because we keep reading about “employers holding on to employees” as a reason for the high nonfarm payrolls reports. What if that changes & employers start following Mag 7 and letting their own “held” employees go?

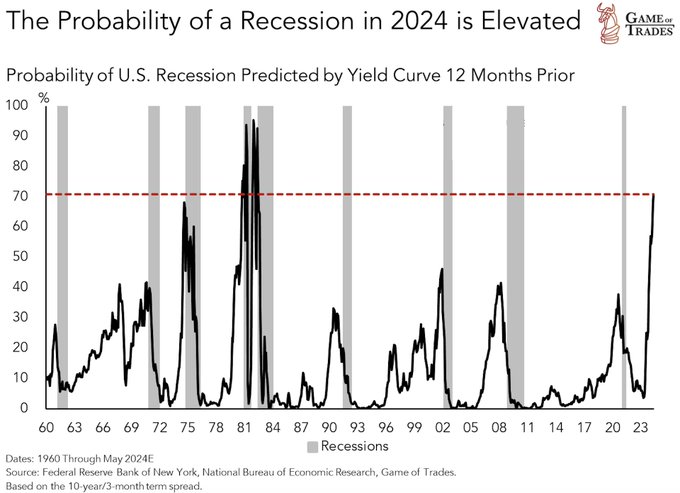

As Gundlach said this week, the “unemployment rate …. go vertical“:

- The bond guru raised the alarm on the US economy too. He said a recession looks highly probable, as the inverted yield curve is now de-inverting, leading economic indicators have been declining for a while, and employers hanging on to workers has caused a “backup” in the unemployment rate that could cause it to “go vertical” once the slowdown strikes.

- “I think 2024 will be a year of high volatility: starting with declining rates, then recession, then recession response,” he said. “DoubleLine is ready and loaded for bear.”

We focus on this because we remember how suddenly the layoff rate went semi-vertical in late 2007 & early 2008. If that even repeats by 25%, then what happens to the Treasury curve?

Look what happened this past week – 10-yr yield fell by 10.2 bps but 2-yr yield fell by 23.6 bps. Meaning the 2-10 Treasury curve de-inverted by 16 bps last week to about 20 bps (4.15% – 3.95%). So another week or two of this type will normalize or de-invert the 2-10 yr curve.

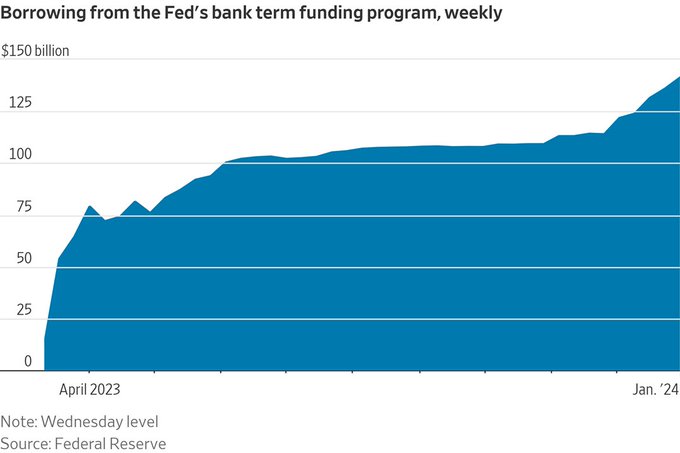

Think how the 2-yr at 4.15% is already making a mockery of Federal Funds Rate of 5.33%. Could the Fed stand by & watch the 2-yr yield go below the 10-yr yield even around 4%? Now recall the Bank Term Funding Program announced by the Fed in March 23 to save regional banks. It was smallish, right? Where is it now?

- Daily Chartbook@dailychartbook – – Borrowing from the Fed’s bank term funding program (created as an emergency response to the 2023 banking crisis) has reached new highs as banks take advantage of interest rate differentials. @DaveCBenoit @ericwallerstein

Last week’s borrowing of $147 billion was a new record high, per Daily Chartbook & others. But all you hear on-air is “Buy, Buy” for Citibank that has announced layoffs of 20,000 workers.

If you don’t think the Fed is already getting nervous, look at the number of comments in financial news about the Fed thinking about ending its infamous QT (Quantitative Tightening). As the Financial Times pointed out,

- “An end to QT would reduce the amount of debt Treasury needs to issue to private investors this year”.

- The size of the ON RRP account — an important indicator of liquidity — has fallen sharply from levels above $2tn around the middle of last year as money market funds have shifted their balances into Treasuries”.

Go back to the history of 2007-2008 to see that what was deemed as solved in March-April 2007 mushroomed again in March-April 2008. We are simple folk & think simply. There may be many complicated ways to argue all is panglossian-ially well. But the only “really well” that we see is that the Mag 7 sector will benefit from end of QT, Treasury yields coming down, & large layoffs that can cut their costs.

Or to put it another way,

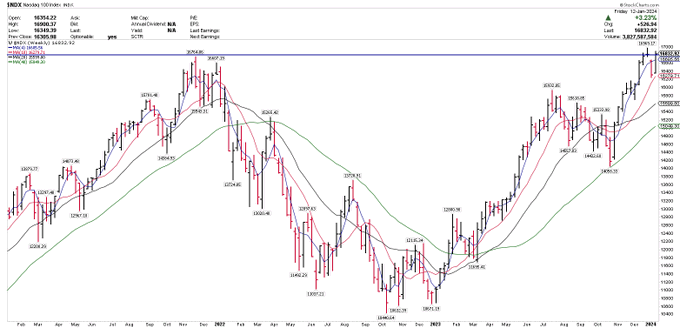

- Larry Tentarelli, Blue Chip Daily@bluechipdaily – Sat – $NDX major weekly base breakout setting up. Closed at a record weekly high yesterday.

Speaking of the “r-word,

- Game of Trades@GameofTrades_ – Jan 13 – The probability of a 2024 recession is at levels only seen 2 times since 1960. Both ended in severe recessions. This time is not different

What might prevent the onset of a recession? Priya Misra of JPM Asset Management said on Bloomberg Open on Friday:

- ” … the only way we get a soft landing is if the Fed were to start to cut rates, start normalize policy across QT as well as rate cuts. …. The reason I am in the hard landing camp is that the policy is restrictive … real rates are close to 2%; that’s putting an impact on the consumer, on the corporate sector… If the Fed doesn’t cut rates quickly enough, that’s what going to slow things down… that will force them to ultimately cut a lot more than what is priced in”.

2. Stocks – Short & long time frames

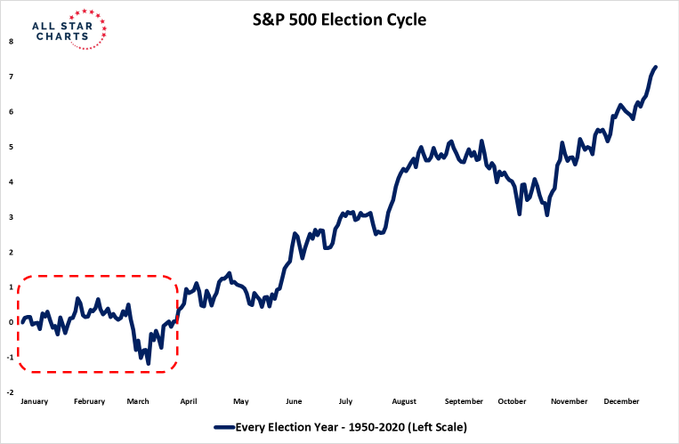

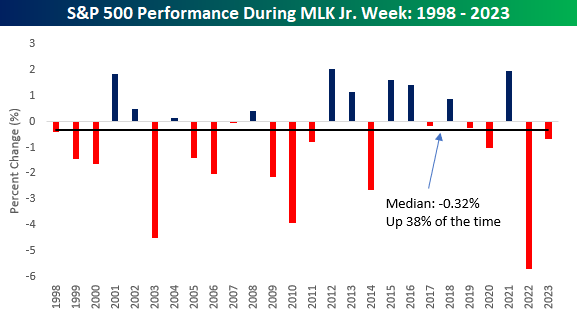

- Grant Hawkridge@granthawkridge – Just a reminder, on average, during an election year, the first three months are sideways… $SPX $SPY #stocks

More near term,

- Trader Z@angrybear168 – I expect a bigger pullback in January, possibly around opex, holding off on trade ideas until then, will still post setups but breakouts tend to fail more or face immediate reversal when pullback risk for indices is high so manage accordingly.

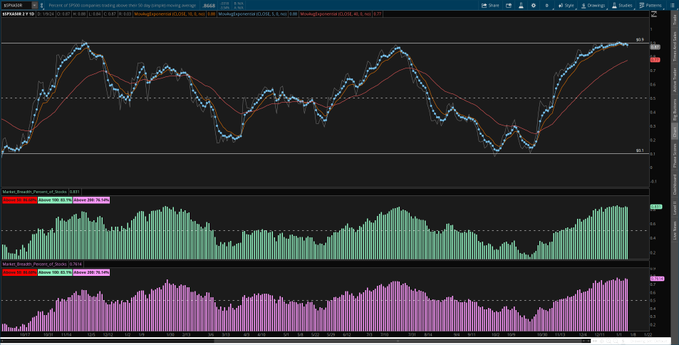

- Trader Z@angrybear168 – $SPX not a time to be super aggressive when % of stocks above 50 SMA is rolling over, definitely not shorting this market but soon market should provide a much lower risk entry for longs.

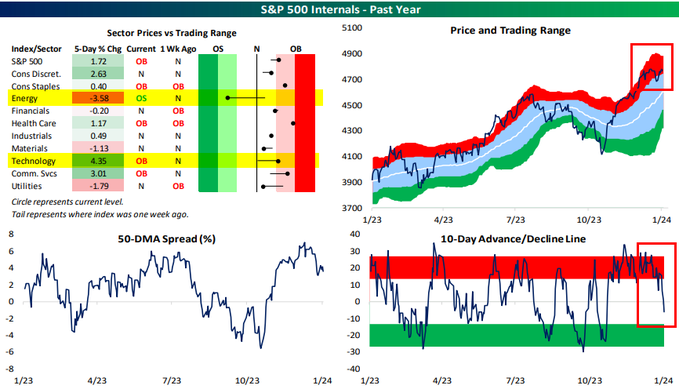

What about overbought, oversold sectors?

- Bespoke@bespokeinvest – The S&P 500’s price level remains more than 2 standard deviations above its 50-DMA, yet its 10-day advance/decline line has turned negative as things have cooled to start 2024. Energy $XLE has had a rough week, falling into oversold territory, while Tech is back to overbought.

How about next week?

Finally how about one who has a “zero” score for S&P 500; who says corporate credit spreads are very very stretched just as they are for the S&P 500; who says take some profits in long duration Treasuries; who has neutral scores for Japan & Europe; who says hold Gold but don’t buy here; and who mainly likes the Japanese Yen as well agriculture & natural gas?

Who could make this clarion call?

3. International

Don’t let the term fool you! What is more international today than NVDA? Look what Rajiv Jain of GQG said to Bloomberg TV in his clip Why GQG’s Rajiv Jain Is Bullish on Nvidia, India, Brazil:

- “… NVDA, META, GOOGL – we still feel there is a lot of runway ahead of them even NVDA; … transition to GPU is still in the early stages;… it is just 22-23 times earnings … by far our largest position … what we look for is barriers to entry … today the outlook is still getting better for companies like NVDA … we are generally pretty upbeat on Tech by the way … we entered last year very underweight tech & now we are very upbeat on tech, esp. Semiconductors … wonder why Industrials are selling at 25X earnings while META is at 17-18?”

Let us not forget that GQG & Mr. Jain were initially noticed by Bloomberg TV when they stepped in to buy Adani stocks near the height of that washout. Times of India pointed out this week that “GQG’s initial bets on Adani group have soared to $4.3 billion in value“. What did he say about India to Bloomberg TV?

- “ … we have been reasonably bullish & we continue very bullish …… if you look at the underpinning of the infrastructure side, the government is spending more; lots of privatization is happening and growth rate in India has shifted away from IT Services, Consumer Staples & even some of the Banks; .. it has shifted to infrastructure – that platform is in the early stages ; … & Adani has a lot of fuel in the tank on longer term basis… “

When asked about the standard nonsense about shift of money from China to India, Jain said:

- “that’s the interesting part; money has not come into India; in 2 years, India has seen the most outflows in 2 decades; money has not shifted into India at this point … “

When asked about Brazil, Jain said:

- “we are quite bullish on Brazil; Petrobras has been a big position for us; when we bought it, it had a 40% dividend yield; Now it still is at 20% dividend yields; that’s at $70 oil; ”

Then he said the following about the Middle East:

- “we are incrementally getting much more bullish on Middle East; in UAE, Saudi Arabia – lot of interesting things happening there … “

Notice the fresh off-the-press FT article Fund Manager Rajiv Jain takes $2.8bn bet on Middle Eastern stocks. The sub-title is “GQG cuts position in China and says state crackdowns make foreign investors ‘nervous’“. The article states:

- “GQG’s new interest in the Middle East means its funds now have more money invested there than in China, the world’s largest emerging market. That marks a major change of position from five years ago, when the world’s second-largest economy accounted for 40 per cent of the firm’s emerging markets portfolio.“

What is the trigger for Jain’s new focus on the Middle East?

- “There are massive privatization hopes which by definition will open up the economy,” said Jain, whose firm manages $105bn in assets and is well known for a large contrarian bet it took last year on Indian conglomerate Adani. “There’s a real intention to open up and transition away from oil.”

Go back to Section 1 above & notice that Indian ETFs were up strong on Friday in comparison with other ETFs. That, we understand, is due to strong earnings reported by Indian tech firms like INFY, TCS. The INFY ADR was up 4.40% on Friday. These stocks had been trading listlessly because of concerns about their earnings.

Going back to Mr. Jain’s comments about infrastructure in India, take a look at the 3–minute clip below about the new Atal Setu: The Mumbai Trans Harbour Link – the “longest sea bridge” in the world that has used “17 times as much steel as in the Eiffel tower, “six times as much concrete as in the Statue of Liberty” and “wiring that is twice the size of the earth’s diameter“.

How does this infrastructure buildup benefit companies in Europe & America? Look at the 4-minute clip titled “Never sold as many … ” about orders for Airbus from India:

That brings us to the upcoming elections in India & the continuously disgusting Anti-Hindu Brit-Nazi coverage in UK-led US media like the Economist-outsourced Bloomberg.com opinion section. Who appoints these old tired Brit-servile idiotically ignorant people to their editorial board, we have no clue. Thankfully, Bloomberg TV seems mostly untainted by the Economist-Bloomberg.com Nazi-type hatred.

Since his first election, PM Modi has assiduously tried to improve conditions for a very large section of India – women, especially wives. Already Indian wives are his most dedicated & loyal constituency. And now look the 2:45 minute clip below to see what Muslim wives are saying about PM Modi – “PM Modi is our ‘Bhaijaan’…” – “Modiji is like our respected elder brother“

Since India’s Independence, Indian Muslim women have been left at the mercy of Muslim Religious Authorities for fear of losing the Muslim vote. Reforms that have benefited Indian women of other religions have not been made available to Indian Muslim women. For example, a Muslim husband in India can simply divorce his wife (either single or one of 4 wives allowed) by simply saying “Talaaq” 3 times. Their rights within their household are miniscule & entirely dependent on the local religious board.

PM Modi has promised to introduce a Uniform Civil Code for all religions that will grant rights to Muslim women/wives that are available to all others. Also every Muslim knows the terrible state of neighboring Na-Pakistan & has heard what several youths there said during the G-20 in India – “I wish my grandfather had NOT migrated to Pakistan from India in 1947. Had he not, I would be in India today & not in this ****-hole of Pakistan“.

How widespread & deep is this support we don’t know but it is a step in the right direction. And it is backed by Saudi & UAE governments who have a large stake in orienting Muslim youth toward business, education & prosperity.

4. This day back in 1761 – unleashing a global re-orientation

When faced with two enemies, which one should a wise leader defeat first? On this question, rests the future of nations & even groups of nations. The Great FDR faced this question after Pearl Harbor. Thanks to Hitler’s utterly vain arrogance, he declared War on America. Very few realize today that FDR would NOT have been able to declare war on Hitler’s Germany even after Pearl Harbor. He would have been impeached by the US Congress. Hitler bailed FDR out and the world changed.

FDR was a rare leader who understood that Hitler’s Germany & its conquest of Western Europe was an existential risk to America. He knew that, despite Pearl Harbor, America would eventually win single-handedly against Japan. So he ignored pleas to focus on Japan &, instead, focused on Germany.

After Russia’s victory at Stalingrad, it became clear that Germany was a nearly defeated power & Stalin’s Russia would emerge a much stronger country. At that time, FDR kept being asked to stop supporting & arming the Russian war machine. But FDR realized that the Allies would NOT be able to land in Europe without the majority of German armies fighting Russia in the East. And FDR understood that Stalin’s Russia was a smaller future enemy than Hitler’s Germany. Despite its appearances, the USSR never became the enemy that Hitler’s Germany was & could have been.

Everyone knows about the year 1776, the year when America won its war of Independence against the British. Very few know what happened to British Generals like Cornwallis after 1776. Also shouldn’t the British have gone down in global importance & wealth after losing an entire continent like America? After England was not much stronger, richer or most advanced than France or the rest of Europe.

Actually, the reverse happened. Track England from 1776 onwards vs. America & the rest of the world. Actually, let us track England from 1820, some 8 years after the 2nd war Anglo-American war of 1812. It was the period that began America’s ascendancy over Britain, right? Wasn’t it the century that let America expand westwards to get California, to expand south-westwards to get Texas & the West?

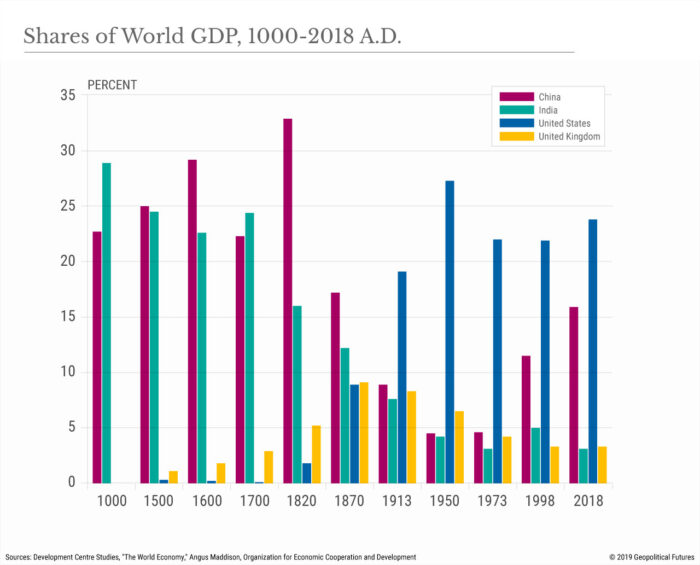

Look at the share of World GDP in the OECD chart below & focus on the section from 1820 to 1913, just before WWI :

Wait a minute! Wouldn’t you say the UK fell behind USA fairly quickly? If you do, then you would be missing on what UK had gained almost simultaneously as it lost USA! The answer is India. Cornwallis & other English commanders moved to India in size after 1776 & by 1820, the UK owned virtually all of India, including India’s wealth & economy.

Look at the 1913 bar in the chart above and ADD UK to India to get a bar as tall as USA. This is why, even after WWI, America drew up plans to defend USA from the British Navy. And why America worked very hard to destroy the British Empire after WW II. Seriously, it was FDR’s America that, in the end, bankrupted the British Empire & reduced Britain to a 2nd-rate power.

Also look at India’s height reduced by 50% between 1820 to 1913 to illustrate how much UK stole from India. Why did it happen to India, you ask?

The lesson we began with. The grievous & utterly disastrous mistake of not understanding who the GREATER Enemy was & focusing on the SMALLER enemy.

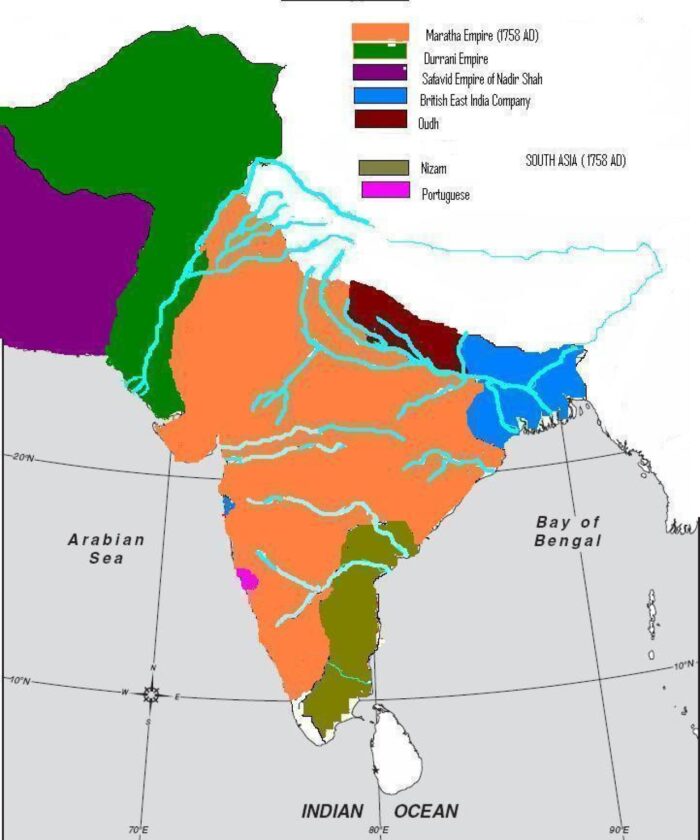

Look at the Indian region in 1758:

It is crucial to point out the Maratha Empire was headquartered near the small blue area highlighted on the western coast above. That western coastal region below the small blue & the pink area had been occupied-dominated by the Portuguese. In 1739, the Maratha leadership wiped out the Portuguese Navy & Army from India’s coast & relegated them to tiny Goa. That ended Portuguese conquest & reduced it to an inconsequential power.

The Maratha regime in 1760 had every intention of wiping out the English from India. But look how far the English were – in the far north-eastern corner of India’s western coast in a region called Bengal that was NOT central to the Maratha Empire. In 1761, North India faced an invasion from Ahmed Shah, the Durrani-Afghan leader of Afghanistan. That was nothing new. Afghan invasions of Delhi & the North had been a regular affair every 2-3 decades or so. These were NOT existential risks to India.

But, out of sheer arrogance & a disastrous lack of judgement, the Maratha ruler in 1761, Nana Peshva, decided to send a 50,000 strong army north to fight the Ahmed Shah’s invading army of about 55,000. In doing so, Nana postponed his planned attack on Bengal to wipe out the British presence there & throw them out of India as Nana’s uncle had thrown out the Portuguese. This was not new. Three-four generations before Nana had realized the long term danger posed by the English presence on India’s coasts.

But Nana, unlike FDR & so many great leaders, decided to fight an unnecessary war against a non-existential enemy instead on focusing on the long-term existential enemy. Then his chosen commander continued to make tactical mistake after another in the long fight against Ahmed Shah. Finally the two armies met on January 14, 1761 at Panipat, northwest of Delhi. The Marathi army had nearly won the battle in early afternoon when Ahmed Shah threw in his reserves into the battle. The Marathi commander had not kept any reserves.

The result was as disastrous as the result at Waterloo in 1815 when Prussian reserves arrived in early evening to rout Napoleon’s army. Actually, the Marathi empire recovered & recaptured North India a few years later when a worse disaster fell that regime – Nana’s brilliant young son, MadhavRao, died of TB in 1772 just as the Marathi Empire under him was poised to win the North. Subsequent vicious infighting led to the demise of the Maratha Empire.

Look at the map above. Both the green Durrani Afghan empire & the orange Maratha Empire got mortally wounded by that disastrous war & opened the door to the blue English to move in eastwards into North India & eventually control all of India.

What did the English gain? An India that was the richest & most economically advanced economy in the world in 1750:

- “In the first half of the 18th century,….the Indian subcontinent was then the workshop of the world, accounting for almost a quarter of global manufacturing output in 1750, compared with just 1.9% for Britain.”

As fund manager Nick Robins pointed out in his must-read book, the plunder of Bengal gave England a huge reservoir of money that was not available to its European rivals like France. He also estimates that Britain gained about 25 years lead in launching its industrial revolution ahead of French & other European countries.

To quote Nick Robins,

- “the British East India Company simply considered India as a vast estate or plantation, the profits of which were to be withdrawn from India and deposited in Europe.”

It took the first decade of the 20th century for British Viceroy Curzon to admit:

- “As long as we rule India, we are the greatest Power in the world. If we lose it, we shall drop straight away to a third-rate Power“.

Imagine all of this just because one arrogant ruler named Nana Peshva made the fateful decision to fight the wrong battle with a strong enemy who did not pose an existential danger. We remember this futile battle on every January 14 and we regret that very few Indians today understand the ramifications of that stupidity.

We use Curzon’ quote often because we see that PM Modi & his team remember it and the lesson. Unfortunately, the current US foreign policy apparatus is still wedded to the Brit-Nazi thinking about India. Sadly, that may be why the US-India relationship has never managed to become anything more than a tactical accommodation.

Send your feedback to [email protected] Or @MacroViewpoints on X.