Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.”that little outfit”

How could you not be a fan of the utterances of Mr. Biden? After all the overt expressions of respect from everyone, how refreshing to hear a classically retail politician call it as it ideally should be:

- “I can’t guarantee it. But I bet — you betcha — those rates come down more, because I bet you that that little outfit that sets interest rates, it’s going to come down,”

Wouldn’t the following tweet have been more interesting had it been published after the above comments?

- Michael Nauss, CMT, CAIA@MichaelNaussCMT – – 6:27 am – I have an order to buy bonds out for Mondays open…. This means I am officially old. $TLT

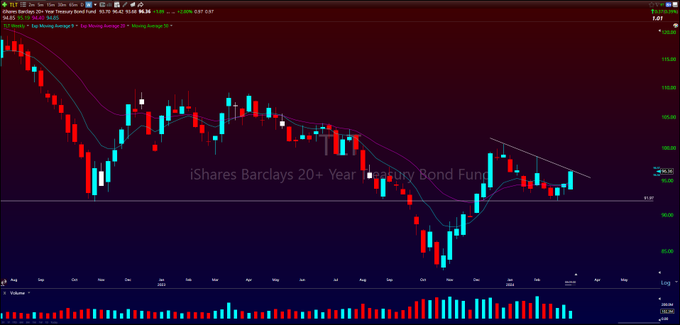

The weekly chart is positioned at an interesting place:

- Bracco

@Braczyy – Mar 7 – $TLT (Weekly)

And a price target:

- ShortSeller@ShortsellerST – Sun – $TLT possibility im watching

How did fixed-income ETFs do this past week?

- 30-yr yld down 7.4 bps; 20-yr down 10.3 bps; 10-yr down 10.5 bps; 7-yr down 12.5 bps; 5-yr down 11.2 bps; 3-yr down 7.9 bps; 2-yr down 5.1 bps; 1-yr down 1.7 bps;

- TLT up 1.3%; EDV up 2.8%; ZROZ up 1.7%; HYG up 30 bps; JNK up 30 bps; DPG up 2.8%; UTG up 2.2%; PFF up 97 bps; AGNC up 1.4%; NLY up 2%; EMB up 88 bps;

If the smart people above prove at least somewhat right and this week’s inflation data proves tame & the market believes “that little outfit” is likely to cut rates shortly, then might what happened on Friday in NVDA, Semis & large-cap tech prove to be a transient storm?

After all, SMH was last week’s best-performing index-ETF and NVDA was up 3.9% on the week beating even the market’s darling stock Citi.

2. Stock – Positive Opinions

- Helene Meisler@hmeisler – My take on the wild swings: too many up weeks leaves folks looking for a real down week. That’s it, I don’t read more into it than that.

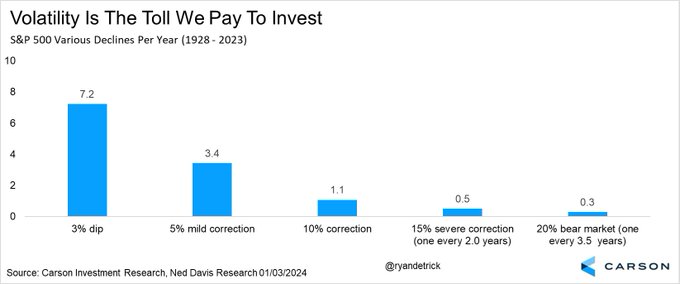

Volatility is the price, not merely a measure?

- Ryan Detrick, CMT@RyanDetrick – Sat – We are in the middle of one of the greatest 19 week rallies ever. Just remember, it usually isn’t always this easy and even the best years have moments of fear and worry. We like to say ‘Volatility is the toll we pay to invest‘ around here. This chart explains it all.

An opportunity perhaps?

- Larry Tentarelli, Blue Chip Daily@bluechipdaily – Sat – In 7 days, AMD went +31%, NVDA +26% TSM +23%, before the Friday reversals. Moves that size in mega cap stocks generally aren’t sustainable & led to a technical pullback. Might need some more reset, but I expect the pullbacks to be buyable.

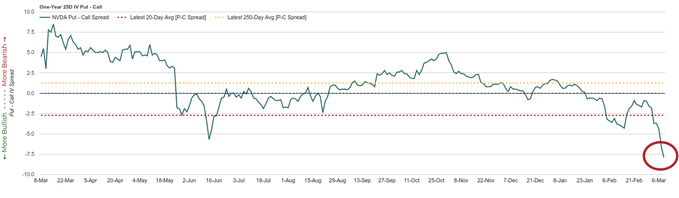

Extremes do reverse, don’t they?

- Markets & Mayhem@Mayhem4Markets – Sun – Incredible. Call skew in $NVDA is the most extreme that I’ve ever seen it! This is pure euphoria mode as demand for calls has hit a level never seen before in the stock. Meanwhile, there’s no real concern about downside risk as put demand remains comparatively quite low.

OptionStrategist.com says the VIX “Spike Buy” indicator is still in place. But,

- Trader Z@angrybear168 – Fri – $VIX weekly RSI trending up, pullback will eventually come, not shorting this market but should manage your risk accordingly.

Now for some straight talk:

- Larry Tentarelli, Blue Chip Daily@bluechipdaily – Sat- $MDY breaking out to new highs, over the top of a 3-year range.

- Larry Tentarelli, Blue Chip Daily@bluechipdaily – Sat – $NDX Weekly uptrend intact.

- Trader Z@angrybear168 – Sat – $SPY weekly tension closed bullish.

Similar to October 25, 23?

- Bespoke@bespokeinvest – Mar 5 – The Nasdaq 100 $QQQ is currently on pace for its biggest drop since it fell 2.47% on 10/25/23.

Hmm! What happened after 10/25/23?

But some one else says this time might be pointing to a different direction.

3. W.C. says

That is our complimentary nickname (borrowed from W.C.Fields) for the team of Larry Williams & Jim Cramer when they team up for Cramer’s Off-the-Charts segments. Cramer highlighted the comments of Williams on Monday, March 5 in which Williams said S&P is likely to peak around Match 7 (last Thursday) & go down until around mid-late May and that the Nasdaq would peak around March 12 (day before the sermon at peak by NVDA CEO on March 13) and head down until mid-May. This is based on the cycle forecast of Williams as the clip below explains:

4. Markets last week

The highlight of last week was a positive AI chart:

- Bespoke@bespokeinvest – Sat – Gold AI?

Guess we begin there:

- UUP down 1.1%; DXY down 93 bps; Gold up 4.3%; GDX up 8.9%; NEM up 6.5%; Silver up 4.8%; SLV up 5.1%; Copper up 83 bps; FCX up 5.2%; Oil down 2.4%; Brent down 1.7%; Nat Gas down 2%; OIH up 1.4%; XLE up 1.4%;

Non-US stock indices:

- ACWX up 1.4%; EEM up 82 bps; FXI down 2%; KWEB down 4.2%; EWZ down 2.2%; EWY up 1.8%; EWG up 75 bps; INDA up 64 bps; INDY up 84 bps; EPI up 63 bps; SMIN down 1.7%;

US Stock Indices:

- VIX up 12.6%; Dow down 80 bps; SPX down 25 bps; RSP up 96 bps; ; COMPX down 1.2%; NDX down 1.6%; SMH up 1.2%; RUT up 34 bps; DJT down 73 bps;

Winners & Losers:

- BAC up 3.7%; C up 3.5%; GS down 6 bps; SCHW up 1.1%; KRE up 4.3%; AAPL down 4.9%; AMZN down 1.8%; GOOGL down 1.2%; META up 15 bps; MSFT down 2.2%; NFLX down 2.1%; NVDA up 3.9%;

5. From “Full Disengagement” to “Greater Re-deployment” – China-India border plus Precious Hair Trade

Remember our report two weeks ago about China’s foreign minister Wang Yi walking down a few steps to meet India’s foreign minister JaiShankar & how the two militaries held direct talks within a day of that brief chat! Those talks were about a “full disengagement along the line of control” between China & India.

Within 2 weeks of those talks, the discussion has shifted to a fuller re-deployment of additional 10,000 Indian troops to a different part of Chinese held Tibet & two Indian states. This comes after a new Armored Corps was created by India for this specific region. As Bloomberg reported,

- A 10,000-strong unit of soldiers previously assigned to the country’s western border has now been set aside to guard a stretch of its frontier with China, said senior Indian officials …

In addition, an existing contingent of 9,000 soldiers, already designated to the disputed Chinese border, will be brought under the newly created fighting command. The combined force will guard a 532 km (330.57 miles) stretch of border that separates China’s Tibet region with India’s northern states of Uttarakhand and Himachal Pradesh. The area, nestled in the Himalayas, is home to some of Hinduism’s holiest shrines. - The unprecedented assignment of troops — backed by their own dedicated artillery and air support — to this stretch of the border highlights both the region’s strategic importance and its growing sensitivity in the eyes of India’s leaders.

- “The possibility that we may face a similar situation that we faced in 2020 is keeping us active all the time,” said India’s Defense Secretary Giridhar Aramane,

People who have been waiting for China to relax its treatment of foreign investors should see some similarity with the above. Xi’s China can talk reasonably from time to time but it is totally obsessed with its views of Chinese security & supremacy. The clip below is a good overview:

The timing of the 2-weeks old overture by Wang Yi & the same old rejection of withdrawal to pre-2020 line of control by Chinese Military is interesting to us. PM Modi’s re-election is coming up soon & China might be tempted to engage in a new encroachment & tussle with the India at the Line of Control to embarrass PM Modi. The new re-deployment of 10,000 troops & the creation of a new self-sustained Armored Corps might be a signal to China that this time India might not be content to play defense.

It appears that China is not satisfied with trying to seize Indian territory. What else has China been trying to take? Hair of Indians, specifically Indian women. Apparently Chinese women, especially Chinese millennials, have been losing hair & they are trying to get hair of Indian women. The clip below reports that this past week India broke up a $1 billion Hair Smuggling racket. Stupid us, we have always taken hair of Indian women for granted. See you learn something new every day::

Bollywood poets have often written about what charms silken hair (zulfe) hold for men, a famous song being a hero falling for a woman singing “ye reshmi zulfe (silken hair), ye sharbati aakhein (eyes like full wine)“.

Frankly, we still don’t get it. Could those who get it please explain to us how the October 23 video song below (titled trap of black hair) could be focused on the dancer’s “kale zulfe” (black hair)?

(“trap of black hair”)

This failure of ours is probably one of many reasons we have been characterized a “nerd” so far & will continue to be!

6. A New Assertive India towards China

In the above section, we wrote:

- “The new re-deployment of 10,000 troops & the creation of a new self-sustained Armored Corps might be a signal to China that this time India might not be content to play defense“.

We stated it simply because we totally believe it be true. But we don’t have the absolute certainty given that we are first American & we don’t have access. But below we present someone who does & who has been a serving Major on the Line of Control between India & China. We urge you to listen to his words.

China has another big problem with India. Today India can focus on China with at least 80% of its military assets while China’s major military targets are in South China Sea & near Pacific. So China cannot devote a majority of its military assets towards India. Also Chinese local supremacy is in South China Sea which India does not need. While India is building a strong naval-air posture in the near Indian Ocean that Chinese ships MOST go through. Seriously check out the naval routes Chinese ships need to go through to go from South China Sea to & from the Persian Gulf and notice what Indian assets sit astride those naval routes. Also India’s military postures & assets improve in every year that passes while the Chinese postures & assets decrease.

And the world is coming closer to India while maintaining a cautious distance from China. Look what happened today – India & 4-nation bloc EFTA (Norway, Switzerland, Iceland and Liechtenstein) signed a historic trade pact.

And something else happened that had never happened before at the beginning of this past week. Those who know something about how infantry fights has heard about the Cannon on the Shoulder – the Swedish recoilless rifle Carl-Gustaf M4 that is reportedly used by about 40 militaries around the world, including the Indian military. In its long history, Saab, the Swedish manufacturer, has never manufactured the Carl-Gustaf rifle outside Sweden.

Earlier this week, Saab started construction of a new facility in India to manufacture Carl-Gustaf M4 weapons for the Indian Armed Forces. Why? The Indian Military already is a customer. Perhaps because Saab did not want to run foul of India’s new mandate for Made in India weapons. True, but we think there is a deeper aim. Saab believes in the growth of an Indo-Sphere from Saudi Arabia-Emirates to South-East Asean countries in the Indian Ocean &, as a next step into East Africa. Saab presumably has watched the rising arc of buyer interest in BrahMos missile systems. By manufacturing Carl-Gustaf M4 in India, Saab not only reduces the cost of this magnificent weapon but increases their chances to sell to other countries in the Indo-Sphere.

This is to suggest that investors consider the defense sector as a long term growth area in India, something very very few had factored in until now. We ourselves find it tricky to buy Indian stocks at these rich levels but we keep noticing how the Indian growth story is adding new arms & legs for greater support. That doesn’t mean we don’t see the attractiveness of FXI & KWEB but it is getting increasingly hard to trust China. Frankly, the UAE-Saudi area seems more attractive to us.

Send your feedback to editor.macroviewpoints@gmail.com Or @MacroViewpoints On X.