Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.First Shoe Drops; Will the Second drop too?

Our favorite indicator has been demonstrating the increasing cost of leverage in markets. For new readers, this indicator simply charts price performance of a leveraged closed end fund, like UTG, against an unleveraged ETF, like HYG, from the same asset class. Simply put, the leveraged UTG should underperform unleveraged HYG when cost of leverage is going up and conversely.

Actually this has been going on at least since the release of July payroll report on August 5, 2016. Talk about markets pointing to events before they happen. Because this did happen in a rush on this Thursday and Friday. The obvious trigger was the somewhat disappointing decision by ECB Chairman Draghi to not increase their QE as expected. We say “somewhat” to describe the reactions of FinTV folks.

You need a totally different word to describe the reaction of German interest rates. The German 30-yr yield shot up 8.6 bps on Thursday. In response the US 30-year yield jumped up 7.3 bps. The US stock market did not fall as much as the German DAX.

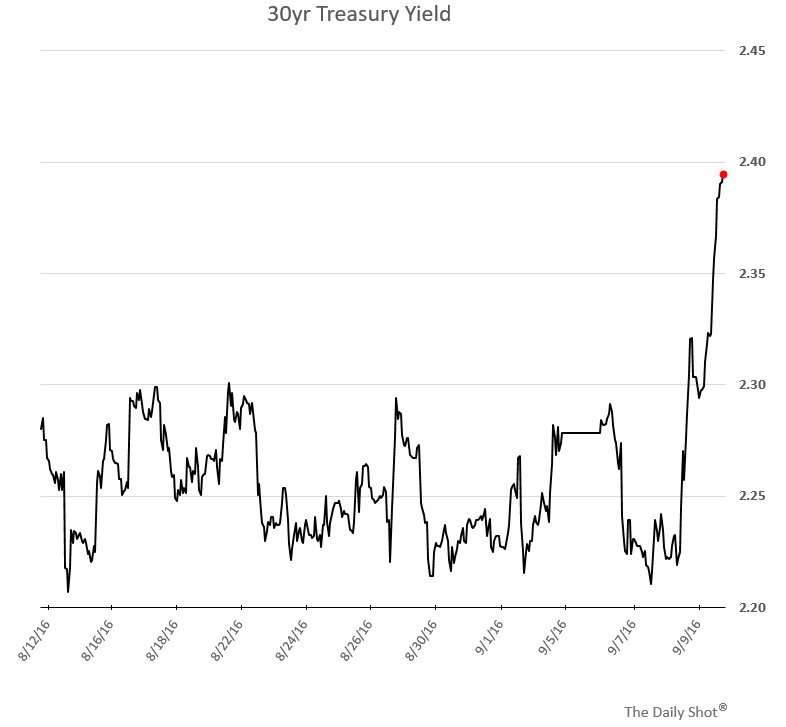

Draghi’s was the first shoe to drop on markets. But you usually need a second shoe or a 1-2 combination in boxing to stun, don’t you? The second shoe has not dropped yet. But a second punch came on Friday morning via the hawkish words of Boston Fed President Eric Rosengren. The German 30-yr yield shot up by 11.5 bps dragging the US 30-yr yield by another 7.2 bps. Mere numbers don’t tell the real tale:

- ValueWalk

@valuewalk – RBC: TWO DAY MOVE IN GERMAN 30Y BUND YIELDS A 5 STANDARD DEVIATION EVENT

And how does the move in US 30-yr yield look?

- (((SoberLook))) @SoberLook – Chart: 30y treasury yield –

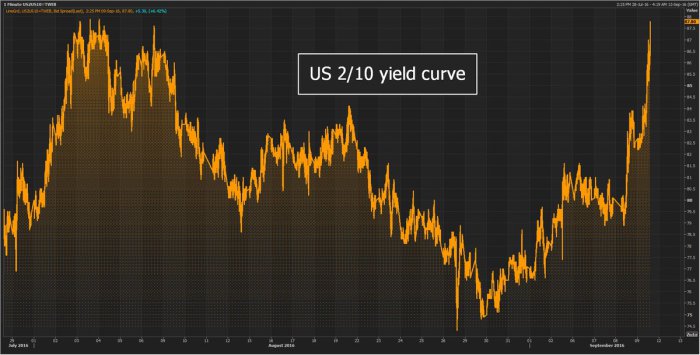

And what does the move in the US yield curve look like?

- Jamie McGeever

@ReutersJamie – This is what banks and the Fed want, right? U.S. yield curve up to 88 bps, steepest in a month.

Wait a minute. This can’t be about Fed raising rates. Because when the Fed raises rates, the shortest maturity yields go up and that means a jump in the 2-year yield. That didn’t happen this week despite the two shocks. The 2-year yield fell by 0.8 bps & the 3-year yield only went up by 1.2 bps on the week. In contrast, the US 30-year yield shot up by 12 bps on the week. But the story of 30-year yields is not just limited to Germany and America:

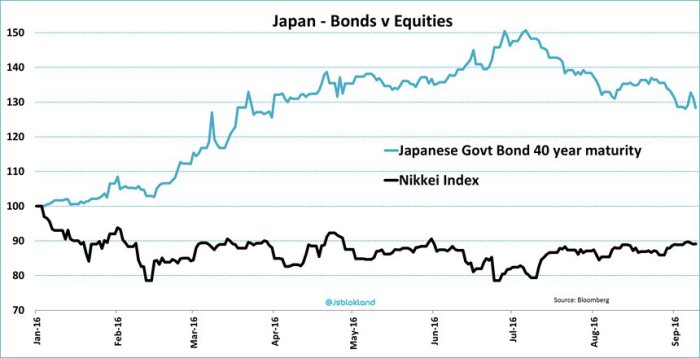

- jeroen blokland

@jsblokland – ‘Yes’,#bonds can go down too.#Japan‘s 40-year govt bond down 15% as#BoJ is running out of options.

2. Drivers of the selloff?

So what is driving a sell off in long maturity sovereigns around the developed world?

- A rising fear that the magic of central banks is wearing thin, meaning no more stimulus or at least no more increase in stimulus?

- Or a realization that the magic of central banks was merely an illusion like the proverbial emperor’s clothes?

Let us stick to the first scenario. That in itself was enough to shake up the old risk appetite, right? Yes said the global equity indices and sold off hard on Friday. The sell off was proportional to high beta & to large positioning. Where was the absolute worst positioning?

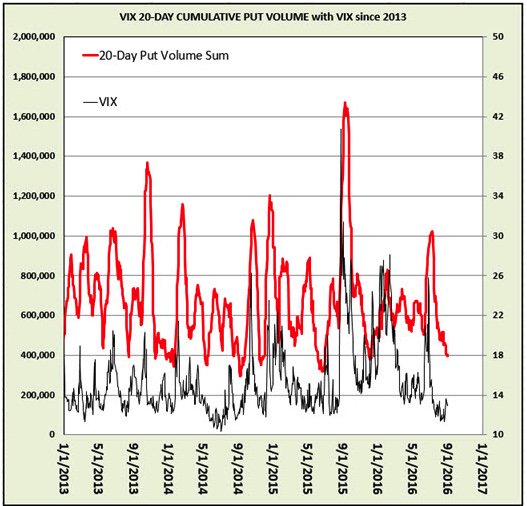

- Urban Carmel @ukarlewitz – Sep 7 – Schaeffers: low $Vix put volume (red) vs $Vix. Has preceded avg 26% jump in Vix over next month

So what did VIX do on Thursday & Friday? Up a mere 46% with VXO up 63%. What did the US stock indices do? On Friday Dow fell by 394 points and S&P by 53 handles.

- SentimenTrader

@sentimentrader – As of Tuesday, large speculators (hedge funds etc) were long an all-time record $65 bn of index futures.

As his base case, Kolanovic is expecting a 5% type sell off which would begin by first dropping below 2160-2150 (which happened on Friday) and then an additional drop of 100 handles. Then he can see a rebound from there to 2200 or new highs by the end of the year.

But is there a possibility for a bear market? Kolanovic said yes but only if central banks make a mistake of policy. And if they do, then the second scenario we outlined above will play out. Meaning the markets will conclude that the magic of central banks was an illusion and that these emperors never had any clothes. Whew! God forbid ! Or more correctly Yellen forbid.

That’s not just us saying so. The man himself said it on Friday.

Art Cashin is so right. Chair Yellen would be amazingly & arrogantly adventurous to raise rates on September 21, 2016. Especially so given the weak ISMs & ho-hum payroll report. What would happen to the Fed’s credibility if they raise rates in September and the payroll report comes in weak in the first week of October?

But before September 21 comes Monday, September 12.

3. Brainard on Deck

What made Friday dicey was a dove named Rosengren putting on hawk’s feathers. But Brainard is in another tier of dovishness. Not just because she is naturally so but because her international experience makes her aware of the fragility of the global economy.

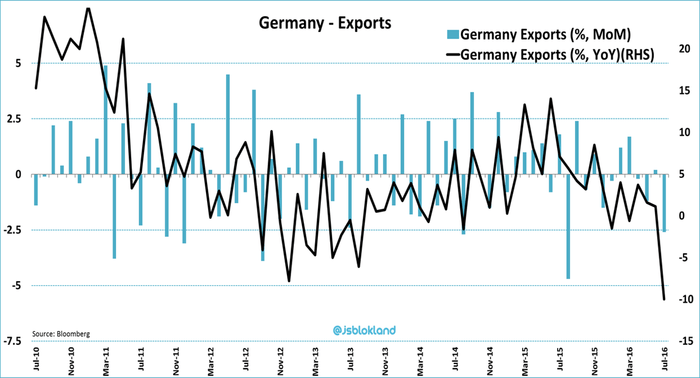

Look what happened to German exports on Friday:

- jeroen blokland

@jsblokland – ‘Ouch!’ German exports fell a whopping 10% YoY in July, most since 2009!

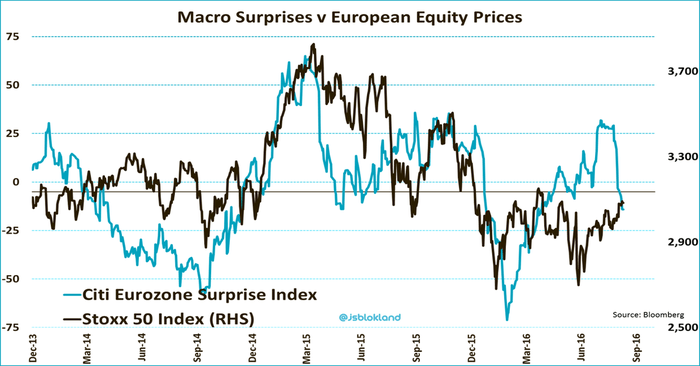

Look at the direction of European macro:

- jeroen blokland

@jsblokland – Is the party over? Eurozone macro surprises v Eurozone stock prices.

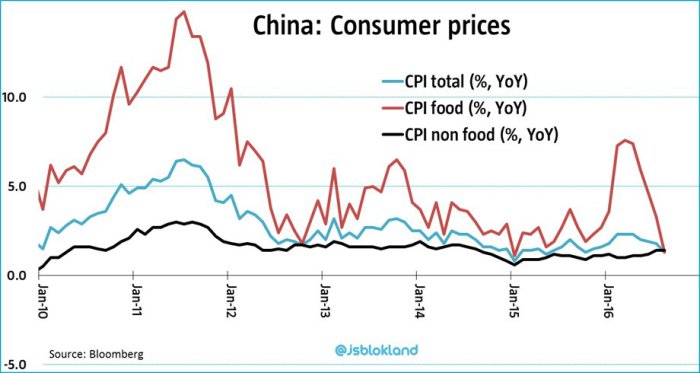

Then you have Chinese inflation data:

- jeroen blokland

@jsblokland – Good#China day! China’s August#inflation way below expectations at 1.3% as food price inflation slows massively.

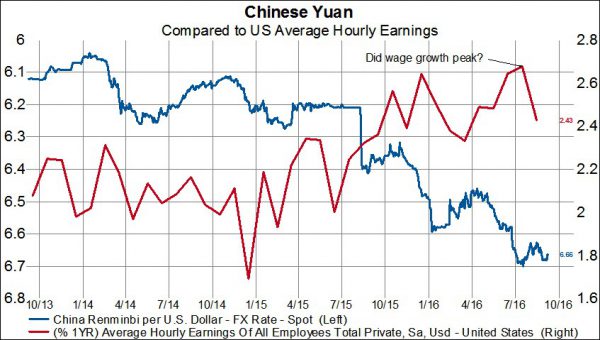

How does the weakening Yuan affect US wages? As Gavekal capital writes:

- “Have we seen a peak in US wage growth for this cycle? If the economy is slowing due to a currency devaluation by China and this leads to an increase in foreign competition thanks to a cheaper cost basis, than isn’t it possible that wage may have already peaked? This of course matters greatly to the Fed and many other economic commentators since a tighter US labor market is suppose to feed into higher wages which ultimately should drive both economic output and inflation higher. If instead US wages are constrained by foreign competition than perhaps the Fed will have to alter its monetary policy course”.

So given all this & given the brainy sagacity of Dr. Brainard, why would she give a nod to raising rates in September? Therefore if she actually does so, then the markets will price it in as a clear cut signal. Will that signal be like what Wyatt Earp bellowed that day to Ike Clanton at the train station – “… I am coming and I am bringing hell with me”.

Or as the sedate Art Cashin said on Friday afternoon – “if we are down 300 points on a hint, could we be down 1,000 points on fact?“

- Ryan Detrick, CMT

@RyanDetrick – Last 2 times S&P 500 was down 2% on Friday and the next day was a Monday were 8/21/2015 and 6/24/2016. Following Monday down 3.9% and 1.8%.

Remember Dr. Brainard speaks at 1:30 pm. Almost everyone we heard on TV seemed to expect a dovish message. If she assuages the fears, then we could see a bounce of sorts next week. If she drills in the hard message, then what? We will wait and see.

- Urban Carmel

@ukarlewitz –$SPY 60’ RSI(5) = 8 (top panel). First low should now be close. Rebound towards the 5-d (green line) might be next

- Urban Carmel

@ukarlewitz – Normally, a MDD [major distribution day] after multiple selling days marks a capitulation low. But this one came near a high; that normally leads to more downside

But later?

- Urban Carmel

@ukarlewitz – RT@JLyonsFundMgmt Tight ranges end with a bang! 3 weeks later, all but one instance were higher by median 2%$spy

5. Good news?

Football is back. Last weekend was just glorious; the best opening weekend in college football history. Thursday gave us a great Broncos-Panthers game. Hopefully this weekend is just as good. Then we can forget about the Fed, markets and all that stuff till Asia opens on Sunday evening.