Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Blackjack dealer handing out free chips?

We have focused on the two-handed stimulus as the foundation on which the magnificent stock rally rests – one hand being the monetary from the Fed and the other hand being fiscal from the Administration+Congress. But we are simple folks and our beliefs don’t mean much. So we spend much time listening to & reading from people we respect. Read, for example, what David Rosenberg said on BTV on Friday:

- “the bottom line is that this has nothing to do with the economy; the financial markets have nothing to do with the economy; what’s happened with the stock market has zero to do with anything about the V-shaped recovery; it has everything to do with the fact that the central banks globally and the Fed has endless pocketbook that has taken the risk premium to zero; this is a different Fed than anything we have seen in the past. So I would say they have totally eliminated risk premium in the marketplace; they will continue until they are comfortable with the fact that the economy is on a self-reinforcing growth track; it could be years; its like Powell is a blackjack dealer in the Casino handing out the chips for free; and as long as that’s gonna happen, volatility will be muted… & financial assets will remain completely disconnected from the real economy..”

That does not mean Powell won’t take a breather from handing out free chips from time to time. What could happen during such breathers?

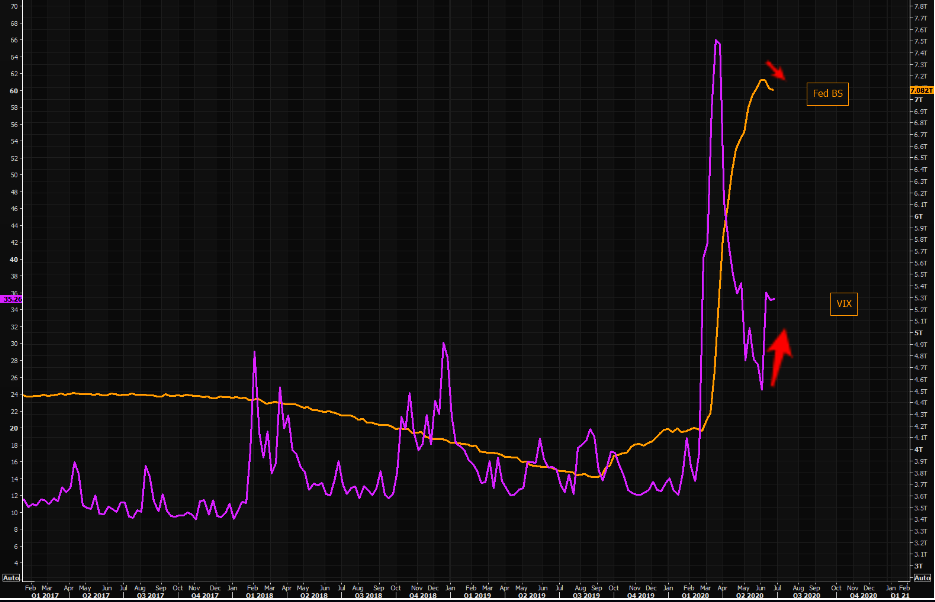

- Liz Ann Sonders@LizAnnSonders – Market has stalled since latest peak on June 8, just as @federalreserve’s balance sheet stopped expanding [Past performance is no guarantee of future results]

This chart looks about a week old with the SPX shown at 3083. This week the SPX closed at 3009, down 3% on the week. Hardly a “stall”. Looking at the Fed’s balance sheet from another angle,

- Market Ear – Fed’s BS shrank tiny and VIX exploded massively; Yes, the Fed is still busy and this was just swaps rolling off, but Fed does suppress volatility, and VIX continues to trade very stressed. What is next, Fed shorting VIX futs?

Two weeks ago, we focused on the one word the Fed doesn’t want to hear – Deflation. Guess what happened as the Fed took a breather! Short maturity Treasury yields, 3-5 year, closed virtually at new all-time lows on Friday – 3-year at 18.5 bps, 5-year at 30 bps & 7-year below 50 bps. Guess what some were looking at mid-day?

- Market Ear – US 10 year – has closed lower once since late May. Watch the huge 0.65% area.

Sorry, but the 10-year yield closed at 64 bps, 1 bp below the “huge” 65 bps level. Didn’t Komal Sri Kumar say only two weeks ago that the 10-year yield was going to fall below 50 bps? The 30-year yield closed at 1.37%, well well above David Rosenberg’s target of 50 bps. But that might be coming given that Carter Worth said Buy 10-year Treasury & TLT on Friday evening.

Seriously Jay, isn’t it time to wake up from your siesta?

2. The other hand or “forget about the rally altogether“

Remember last week’s “when risk premium appears, you have to grab it” directive of Mike Wilson of Morgan Stanley? He had raised his S&P target from 3,000 to 3,300 last week, as we recall. He sounded a different note this week on CNBC:

- “… fiscal stimulus not coming through is the biggest risk to markets; …. if we don’t get a trillion dollars , which means extending PPP & unemployment benefits through year-end, you can forget about this rally altogether“

Why wouldn’t there be an extension of the fiscal stimulus? Mike Wilson added,

- “… we think it will pass but there is a case that we snatch defeat from the jaws of victory & Congress is good at that“

What might happen, besides end of the rally, if the stimulus is not extended? Wilson said,

- “you are probably going to have a double-dip in the economy“

Yes, but whom would it hurt more? Perhaps if confident Democrats think a double-dip in the economy would hurt President Trump and a recovery with a fiscal stimulus might actually rescue President Trump from a certain defeat in November 2016. But are they really that confident?

- ian bremmer@ianbremmer – Actual point: It’s very early. Way too many Dems I know are confident (privately very confident) that this is a slam dunk Biden win. That is not the attitude you want to have in June.

A little bit of history,

- ian bremmer@ianbremmer – Mike Dukakis was up 17 points over George Bush Sr after the Democratic Convention in 1988.

You would think that the new wave of coronavirus in Texas & Arizona would make the Congress hurry & extend the fiscal stimulus. But confident Democrats could well decide that this new wave increases their chances of winning at least one of these red states.

But all may not be lost given what is already in the bank, according to this week’s article from Rick Rieder & friends at BlackRock:

- “Moreover, the Congressional Budget Office estimates a $3.8 trillion federal deficit for fiscal year 2020, ending September 30, leaving another roughly $2 trillion to spend over the next 3.5 months. To wit, the Treasury currently holds $1.5 trillion in cash, shattering the previous record high, representing demonstrable real-economy policy “dry powder.” The impact of such massive Main Street targeted programs could be the equivalent of almost 37% higher household income over these crisis months, than was the case pre-crisis.”

But they also warn:

- “Yet perhaps investors still need just a little bit of “Patience” (Guns ‘N Roses), as the coming U.S. election, increased social unrest, and ongoing coronavirus headlines all risk creating more volatility in markets.”

3. Stocks’n Stuff

Speaking of volatility, Lawrence McMillan of Option Strategist writes in his Friday summary:

- “From a longer-term perspective, the picture is still one of caution, as the bulls won’t fully be in charge until $VIX closes below its 200-day moving average. In fact, if $SPX should fall below 2920 and the equity-only put-call ratio should roll over to sell signals, the bears would be back in charge.”

This was one bad week with Dow down 3.3%, the S&P down 2.9%, Russell 2000 down 2.8% but the NDX only down 1.6%. High yield ETFs, HYG & JNK, were down 1.6% while their leveraged counterparts DPG & UTG were down 5.8% & 9.8% resp. Even “safer” Utilities (XLU) and Staples (XLP) were down 4% on the week. Does this suggest a whiff of panic?

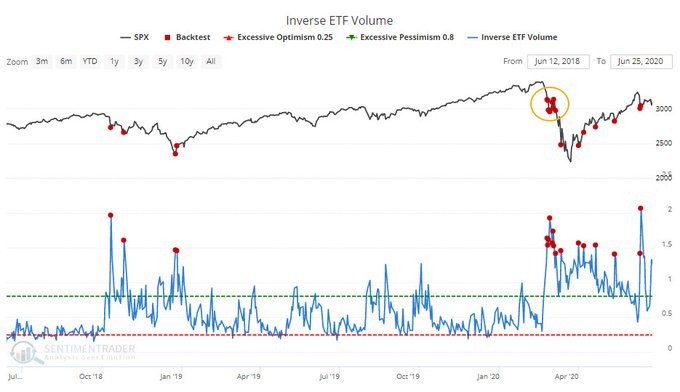

- SentimenTrader@sentimentrader – Panic in the air. Inverse ETFs like QID and SH are seeing a jump in volume, accounting for more than 1.5% of total volume. That has been a pretty much perfect sign of a short-term pessimistic extreme, except for that nasty bit in late Feb – early Mar.

Kudos to BAML’s Michael Hartnett who said “Sell the 3250 rip” in S&P 500. What is saying now, per Market Ear?

- “buy the 2950 dip“

Speaking of stuff, Gold miners flew this week, up 4-5% with both Gold & Silver up 1.6%. Carter Worth, the technician who said Buy Bonds on Friday evening clarified and said he would prefer Gold to Bonds.

4. “Holy Grail of Equity Investing“

- The Bear Traps Report@BearTrapsReport – Jun 23 – Significant bearish RSI divergence in the Nasdaq 100

Before going towards the holy, shouldn’t we take a look at what BlackRock might deride as outmoded if not outright unholy?

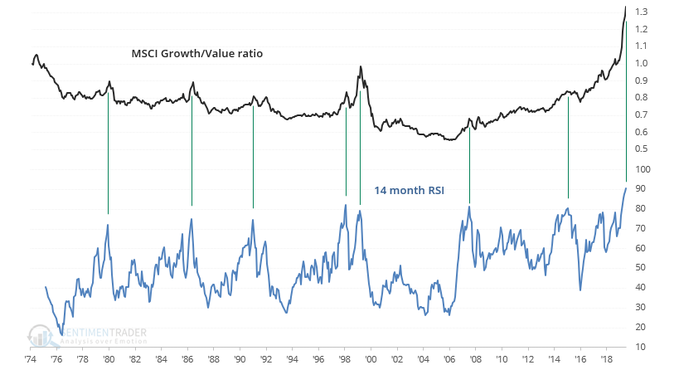

- SentimenTrader@sentimentrader – Traders are throwing caution to the wind amidst the mad scramble for everything GROWTH: The MSCI World Growth/Value ratio’s 14 month RSI is at its *highest level* ever! (higher than in 2000 and 2007) Growth & tech seems at risk of a big shakeout here – remain on high alert.

How does Rick Rieder & team look at this metric in their BlackRock article?

- “The same is true for equities, where we choose to eschew the conventional debate about the relative merits of factors such as growth vs. value. Today, identifying durable cash flow generation is the holy grail of equity investing. The wedge between growth vs. no-growth entities, cash flow generators vs. cash burners, those who make ongoing research and development (R&D) investment vs. those who don’t, etc., is widening. The market is rewarding those who are investing in the instruments of the future, while the relics of the past stagnate.”

Are they spelling Amazon? How has that stock performed since Bezos told investors to take a seat because of the money he was investing in the business?

Analyzing portfolio construction in this new world, Rieder & Co. writes:

- “Relatedly, we are passionate about analysis around leverage, liquidity, and cash flow. We see the hyperbolic narrative of excessive leverage in the U.S. corporate sector as missing critically important free cash flow trends. In fact, balance sheets are broadly quite healthy and companies’ ability to service low yielding debt has arguably never been better. Similarly, the common refrain that equity PE ratios are too high vs. history misses the more relevant metric of free cash flow yield. The obvious and persistent outperformance of companies that generate large cash flows renders traditional valuation metrics less useful and provides a much cleaner comparison to fixed income yields. Through that apples-to-apples lens, free cash flow yields for much of the U.S. equity market offer compelling relative value versus depressed fixed-income yields.”

They also see Europe as increasingly interesting:

- “We are witnessing a historic time for Europe and a potential investment game-changer for markets there. Few incentives have existed over recent years to drive investment toward Europe, but with European asset valuations relatively attractive today, and potentially efficacious economic policy now in place, a low geopolitical risk profile, and U.S. investors increasingly nervous about the upcoming election, Europe may be the beneficiary of incremental capital flows. … Europe has put into place a historic evolution of fiscal policy that radically changes an investment climate that was heretofore relying solely on overly aggressive interest rate policy.”

Needless to say, we urge all to read this article by Rieder & Co. despite its needlessly long title – Today’s portfolios “Can’t get no satisfaction” from yesterday’s instruments.

Send your feedback to [email protected] Or @MacroViewpoints on Twitter