Back in May 2008, we noticed & wrote that Candidate Obama was essentially a mirror image of Candidate George W. Bush. A mirror image changes right side into left side & vice versa. But the change is in the orientation & not in the essence. This concept has served us well in analyzing the Obama term – in November 2012, it served to express the similarity between the re-election of President Obama & the re-election of President Bush in 2004; in December 2013 it served to point out the similarities between the Obamacare fiasco & the Iraq war; then in November 2014, the astonishing similarity between the debacle in November 2014 election & the November 2006 election.

Now for the first time since 2008 we can definitively say that President Obama is breaking the pattern of acting as a mirror image of President Bush.

First think back to September 2008 and imagine what the world would have looked like had President Bush been actively engaged as a Republican politician. Had he cared about his legacy, had he cared about keeping the White House in the Republican party, would he acted so decisively in America’s interests instead of his party’s self-interests?

It was relatively easy for President Bush to save Lehman Brothers, not save that company for ever but for the remaining 3 months. All it needed was $20 billion or so with a public show of commitment. He had an able Treasury Secretary in Hank Paulson who could have saved Lehman for another 3-5 months. What would have happened? The huge bust in credit could have been postponed until the next President took over & President Bush was out of the White House.

That is how an engaged politician would have behaved & that selfish political act might have changed the course of the world. Because John McCain was leading in polls at that time and candidate Obama was having trouble in being accepted by the broad majority. The Lehman bankruptcy and the ensuing near collapse of financial institutions petrified the American people and they turned to an articulate Obama.

No one knows this better than President Obama and he showed it late this week.

There is another financial bubble in the world today and this is larger than the 2008 bubble. But today America’s banks are the strongest in the world, thanks mainly to the quick decisive actions of Secretary Hank Paulson & Fed Chair Ben Bernanke in 2008 and of Secretary Tim Geithner in March 2009, The epicenter of this financial bubble is Europe, specifically Germany. And the epicenter of this epicenter is a giant bank named Deutsche Bank.

Those who don’t follow this cannot fathom the scale of utter insanity, total mismanagement involved here. Deutsche Bank’s book of derivative positions was $46 trillion at the end of last year and its balance sheet is 50% of the size of Germany’s GDP. Yet, the market cap or value of this huge bank, one of the hugest in the world, is a mere $18 billion, less than Twitter.

Look at it another way – JP Morgan is worth $241 billion in market value; Wells Fargo, yes the bad bank that is embroiled in a major scandal, is worth $224 billion, Bank of America is worth $160 billion and Citibank, the worst bank of 2008, is now worth $138 billion. And Deutsche Bank is ONLY worth $18 billion, meaning 8 Deutsche Banks would be needed to equal the value of one Citibank.

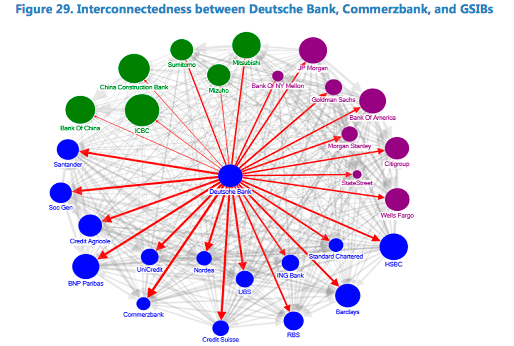

So why do we care? Let Germany worry about Deutsche Bank, right? Wrong. Just look the scary picture below from Fortune Magazine:

That is why a banking problem is the most deadly contagion there is. Nothing can destroy the world economy like a viral banking contagion. Lehman wasn’t even a bank and remember what the Lehman bankruptcy did.

The stock market has been warning about Deutsche Bank for almost 3 years. Just look at the chart below:

The stock of DB kept falling & falling from December 2014 and nobody bothered – not President Obama, not Germany’s Chancellor Merkel, not the US Federal reserve & not the European Central Bank. Actually all these august people contributed to Deutsche Bank’s problem and kept making it worse. The European Central Bank introduced negative interest rates. That destroyed the last chance Deutsche Bank had to make profits on their huge deposit base.

But the coup de grace was delivered by President Obama’s Justice Department. They imposed a humongous $14 billion fine on Deutsche Bank for their mortgage behavior back in the US financial crisis. Imagine, a $14 billion fine on a bank that is only worth $18 billion in market cap. Were they nuts? No; they were appallingly arrogant and uncaring about what they were unleashing.

You know Deutsche Bank cannot pay that humongous fine. So what would you do if you were a hedge fund and had your monies deposited in Deutsche Bank? Take it out, right? After all you remember what happened to hedge funds who kept their money at Lehman till the very end.

Do you see the huge vertical spike in DB’s volume in the chart above? That happened because several large hedge funds pulled their monies from Deutsche Bank according to Bloomberg. When that story hit the tape on Thursday afternoon, the stock market simply fell down hard and panic spread around the world. Because every one remembers how Bear Stearns fell apart in 2008 once hedge funds pulled their monies out.

What is different now than 2008? One word Trump, yes Donald Trump. There is only thing that matters to President Obama at this juncture – to make sure Donald Trump doesn’t become President. The race is so close that a Deutsche Bank crisis like the 2008 Lehman crisis, a market turmoil like the 2008 turmoil could tip the scales in favor of Donald Trump. And Germany’s chancellor Merkel cannot bail out Deutsche Bank because that would be political suicide for her. So it is up to President Obama.

And he seems to have stepped up to the plate on Thursday evening. There was talk about a Thursday evening conversation between Obama & Merkel. Of course, reportedly they only discussed Syria, Ukraine and possibly other topics like Yog & grandchildren but reportedly Deutsche Bank never came up in that conversation.

But look what happened on Friday morning. Talk began circulating that a deal was in the works in the Obama Justice Department to reduce the fine on Deutsche Bank from $14 billion to a manageable $5.4 billion. One solitary news organization reported this as a settlement around 10:50 am and stock markets exploded in a rally. The DB stock closed up 14% on Friday.

Now nothing has been sealed, signed & delivered yet. But a reduction of $9 billion in the fine on Deutsche Bank is the same as the Obama Administration bailing out Deutsche Bank with $9 billion. That is how you spell Rolaids for global markets!

This paltry $9 billion bailout, assuming it happens, will not change anything for Deutsche Bank. It is merely a band-aid. It is purely a political act to prevent a political windfall for Donald Trump and to protect Obama’s legacy. He is making sure that a global financial bubble doesn’t burst while he is in office. What happens in 2017 under a Hillary Clinton administration is not Obama’s worry.

How realistic is the worry about another global financial bust? Just look at the chart* below:

Before you blame President Obama, remember President Clinton did the same in 2000 and let the dotcom bubble burst on President Bush’s watch. What if Bush had acted similarly in September 2008 and saved Lehman for another few months? How different would the world be today?

Look at the chart above and see what the US Federal Reserve, the European Central Bank & the Bank of Japan have wrought on our world – the biggest & baddest financial bubble in history. When does this bubble burst and who will have to manage that bust? We will know on November 8, 2016.

*This chart has been so widely circulated that we don’t know who its original creator is.

Send your feedback to [email protected] Or @MacroViewpoints on Twitter