Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Targeted! Return to 60-40 again?

Tuesday was a negative with Walmart surprising on the downside. But what Target reported & said on Wednesday was utterly stunning. Because Target is not Walmart. We never see Walmart shopping bags in Manhattan (not sure if they even make one) but Target bags are everywhere. Walmart sells lots of groceries and Target sells higher priced stuff to more affluent customers. That may be why Target’s guidance was received so badly by investors.

Interest rates of course fell hard & actually kept falling into Friday’s close. Once again, it was like old times. Dow, S&P and NDX down 3% and TLT up 2% on the week laughing at those who keep saying old 60-40 is for the history books.

Or is it really 100 & -40 meaning 100% in Treasuries & 40% in short stocks? Meaning the R-word?

- David Rosenberg@EconguyRosie – May 19 – Yesterday was a watershed. The key with Target and Walmart is that consumer spending shift – trading down always comes first, then the actual budget downsizing. Recession is this year’s story; next year will be the rebirth. Raise cash now & put it to work later.

Jim Bianco is not sure. He wonders what will Treasury yields do when stocks do see a bounce. His guess is that Treasury yields go up again. If so, then we know it is back to old 60-40. Bianco says the Fed is now actively shooting against employment & wages. Their put is going to be based on how much unemployment they see rising & how much wages are falling. Their “target are the people who have to live on fixed-income“, to quote Jim Bianco. This may be why macro folks like Frances Donald said on BTV Real Yield that “every indicator we have says it is going to get worse“. What makes you money in that environment?

- 30-yr yield down 10 bps; 20-yr yield down 15 bps; 10-yr yield down 15 bps; 7-yr yield down 13 bps; 5-yr down 8 bps; 3-yr down 5 bps. TLT & EDV up 2.1%.

And something else changed this week. The U.S. Dollar fell 1.5% on the week. What a change did this small fall create? Brazil rose 6% on the week; EEM rose 1.6% vs. S&P down 3.1%; Even Germany was up 94 bps. And Gold, Silver, Copper flew with energy.

Is that a signal of sorts from the Fed?

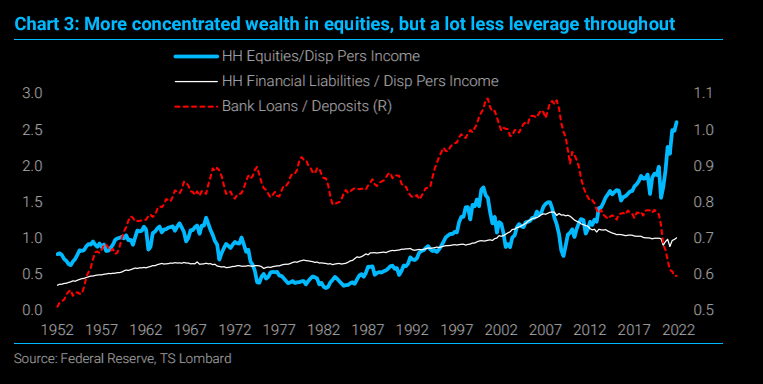

- TS Lombard via The Market Ear – Not what the bulls want to hear but that is what TS Lombard’s Blitz writes. He explains the situation: “the Fed has yet to raise rates sufficiently to turn growth into recession and the equity market is far from having dropped enough to crash spending.” Equities can drop further, but the “Fed is s sending out a soft-put signal by suggesting they are close to being done“. Expect less aggressive pace of tightening after the summer. Regarding the recession he writes: “In the end, recession is not created until the Fed drives short rates into real territory and they are far from there – betting still on inflation being transitory“.

The question is whether the Fed has also been targeted into speaking more softly. If so, then a simple indicator might be sending a signal:

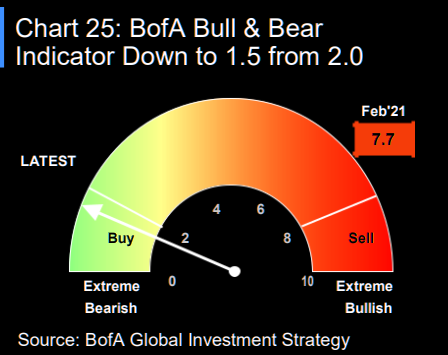

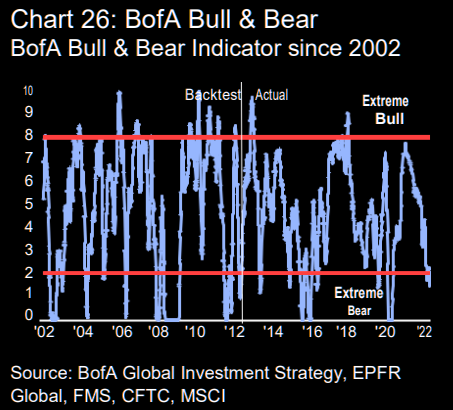

- BAML via The Market Ear – THE contrarian indicator says buy – If you have been waiting for what probably is the most accurate contrarian signal, BofA’s bull and bear indicator, it is now in buy territory. The overall tone from Hartnett remains bearish, so guess this would be a quick buy only. The investment bank writes: “…vulnerable to bear rally but we would still argue “sell-any-rips””

Then you have another extreme:

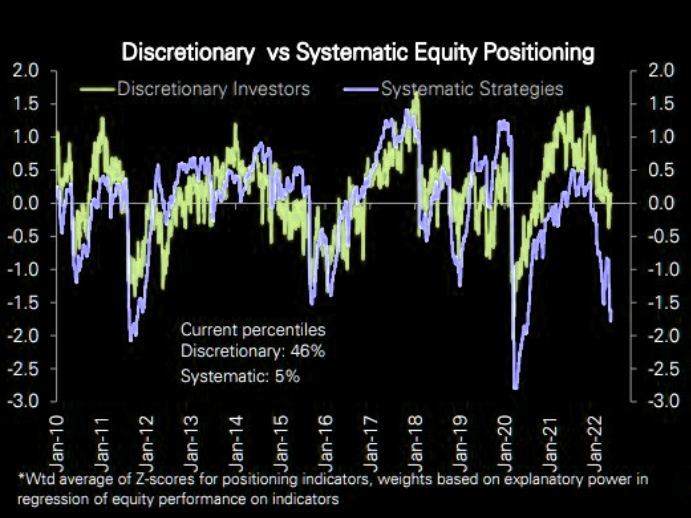

- The Market Ear – Systematic positioning at an extreme – 3rd lowest in 10 years…

But what about the G-term we keep reading about?

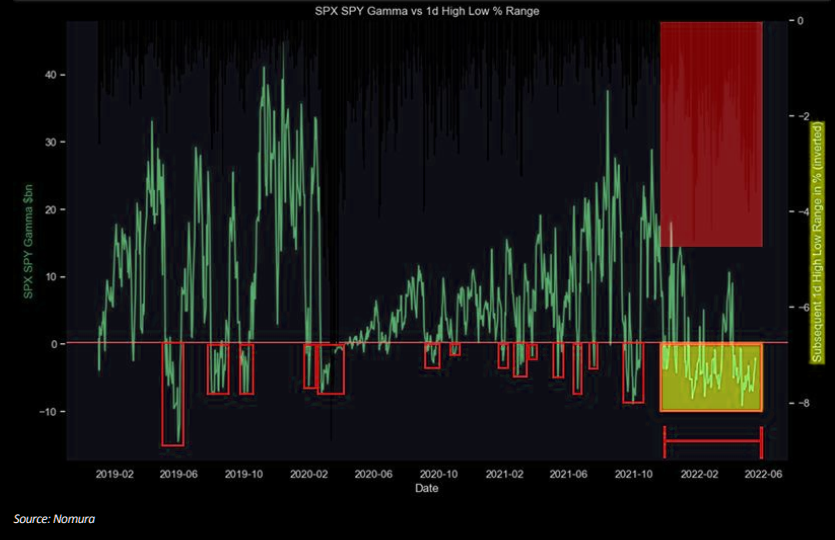

- Nomura via The Market Ear – Short gamma dealers waiting for Monday – We have been mentioning the pillars of the “erratic market over past weeks: short gamma and poor liquidity (this one stays intact for now). A lot of gamma is rolling off today (more here). The chart is showing the most recent buy high sell low frustration well. As Nomura’s McElligott writes this has been the longest period of dealer short gamma seen in years (in case you still wonder about the wild swings…)

Is there a timing event that might create buying? It is the old-fashioned Month End. What is expected at May’s month-end? The Market Ear reported a few estimates of “month-end flows” from “various banks”:

- JPM: “We estimate the potential equity buying by the end of May due to monthly rebalancing by balanced mutual funds to be between $34bn and $56bn“

- Morgan Stanley: “With month-end rebalances quickly approaching, though, something to keep in mind given how ‘positioning-driven’ this tape’s become. MS’ QDS Team now estimates that these month-end pension rebalances may bring with them ~$35B of domestic equity inflows – which if realized, would mark an 89th percentile reading on actuals going back to 2005“

- GS model estimates $11bn of US equities to BUY for month end

But what might make better buys? Barry Knapp pointed out this week that Tech is now at same valuation as Staples and, in that case, he would take Tech every time. Within tech, he specifically likes Semiconductors.

What about commodities you ask?

- David Rosenberg@EconguyRosie – I spent this week attending and speaking at one of the most prestigious mining conferences in Vancouver. I counted hundreds of smiling faces in the audience which reminded me of the tech conferences I spoke at in 1999. Must be a sign of a peak here in the commodity cycle.

That is an indicator we can accept. We recall a standing room only conference in Manhattan in 2000 about Telecom stocks with focus on fiber changing the world for good. And we also remember a huge ballroom filled with investors in Delhi in February 1994 listening to great potential of Indian stocks. This was after a glorious 1993 in which Pfizer India, Glaxo India etc. were up 100% plus & selling at crazy multiples.

2. Chinese Debt, a Default & a little Himalayan Flood

Sri Lanka was declared in default this past week. Among the years of mismanagement was the Chinese One Belt & One Road debt piled on by Sri Lanka for Chinese investment projects using Chinese companies & Chinese labor.

What country was even a larger recipient of such Chinese economic aid? The utter mess of a so-called state whose currency blew past the psychological barrier of Rs. 200/- vs. the $ this week. If that was not enough, look what happened a few days ago to one of the more important projects of the China Na-Pakistan Economic Corridor.

And it wasn’t even a mega flood, just one solitary flooding of one glacier lake, one lake out of some 7,000 such glacier lakes in the Himalayan section of NaPak-occupied Kashmir.

As a local article reported:

- “Although major outbursts in the Shisper Lake are not uncommon, this outburst caused exceptional damage. The Hassanabad bridge is particularly important to Pakistan’s economy because it connects Pakistan with an important trade and political partner: China. The Nation reported that the bridge’s collapse disconnects key routes between Pakistan and China, as there is no alternate route for large vehicles.

The construction of the bridge was reportedly not the problem but the position where the bridge was constructed was the real problem, “the position that exposed it to glacier lake outburst floods“.

Apparently governments of states like Sri Lanka & Na-Pakistan viewed Chinese investment as semi-free money & never really planned for repaying it. That may be why so much of its ended up being mal-invested. Now these states are in a debt bind. Would (EU-US majority) IMF really loan large sums of money that would probably used for repayment of Chinese debt? Or would China agree to forgive or re-schedule its debt to give these states room to recover?

Send your feedback to [email protected] Or @MacroViewpoints on Twitter